Table of Contents

State Farm homeowners insurance covers damage to your home & personal property, liability protection, additional living expenses, and more.

As a homeowner, it’s crucial to protect your investment from unexpected damages or losses. That’s where State Farm Homeowners Cover comes in. With this insurance policy, you can rest assured that your home and personal property are safeguarded against a wide range of perils, from fire and theft to natural disasters and liability claims. But what exactly does State Farm Homeowners Cover provide? Let’s take a closer look at the benefits and coverage options available to homeowners who choose State Farm as their insurance provider.

State Farm is a popular insurance provider that offers a wide range of coverage options for homeowners. The company has been in the insurance business for over 90 years and has built a reputation for providing reliable coverage and excellent customer service. If you’re considering purchasing a homeowners insurance policy from State Farm, it’s important to understand what’s covered and what’s not. In this article, we’ll explore the coverage options offered by State Farm for homeowners.

The Basics of State Farm Homeowners Insurance

State Farm offers three levels of homeowners insurance coverage: standard, expanded, and premium. Each level of coverage offers different levels of protection for your home and personal belongings. Standard coverage includes protection for your home, personal property, liability, and medical payments. Expanded coverage includes the same protections as standard coverage, as well as additional protection for your personal property, identity theft, and higher liability limits. Premium coverage includes all of the protections of standard and expanded coverage, as well as additional coverage for earthquake and water damage.

What Does State Farm Homeowners Cover?

State Farm homeowners insurance covers a wide range of perils, including:

- Fire and smoke damage

- Wind and hail damage

- Water damage from burst pipes or overflowing appliances

- Theft and vandalism

- Falling objects

- Liability for injuries or property damage

- Medical payments for injuries sustained on your property

What’s Not Covered by State Farm Homeowners Insurance?

While State Farm homeowners insurance covers a wide range of perils, there are some things that are not covered. These include:

- Flood damage

- Earthquake damage (unless you purchase premium coverage)

- Mold damage (in some cases)

- Wear and tear or maintenance issues

- Damage caused by pests or insects

- War or nuclear hazards

Personal Property Coverage

State Farm homeowners insurance also includes coverage for your personal property, such as furniture, clothing, and electronics. The amount of coverage you have will depend on the level of coverage you choose. Standard coverage typically provides up to 50% of your home’s insured value for personal property, while expanded and premium coverage may provide more.

It’s important to note that some items may have specific limits on coverage. For example, jewelry and furs may have a limit of $1,500 per item. If you have valuable items that exceed these limits, you may need to purchase additional coverage.

Liability Coverage

State Farm homeowners insurance also includes liability coverage, which can protect you in the event that someone is injured on your property or if you cause damage to someone else’s property. Liability coverage typically includes:

- Legal fees and court costs

- Settlements or judgments against you

- Medical expenses for the injured party

The amount of liability coverage you need will depend on your assets and your level of risk. It’s a good idea to speak with an insurance agent to determine the right amount of coverage for your needs.

Additional Coverage Options

In addition to standard, expanded, and premium coverage options, State Farm offers a number of additional coverage options that can provide even more protection for your home. These include:

- Identity theft protection

- Eco-friendly upgrades coverage

- Credit card coverage

- Water backup and sump pump overflow coverage

- Home business coverage

Conclusion

State Farm homeowners insurance offers a wide range of coverage options for homeowners, including protection for your home, personal property, liability, and medical payments. While there are some things that are not covered by State Farm homeowners insurance, the company offers a number of additional coverage options that can provide even more protection for your home. If you’re considering purchasing homeowners insurance from State Farm, it’s important to speak with an insurance agent to determine the right level of coverage for your needs.

State Farm Homeowners insurance is a comprehensive policy that offers protection for your home from various unexpected events. It covers personal property like furniture, electronics, and other belongings, which can be replaced in case of damage or theft. Liability coverage provides protection against legal and medical expenses if someone is hurt on your property or if you accidentally cause damage to someone else’s property. The physical structure of your home, including the walls and roof, is also covered under structure coverage, protecting it from damage caused by events like fire, wind, and hail. If your home is damaged, additional living expenses coverage can help cover some of your extra expenses until you can return to your home.Natural disasters such as floods, earthquakes, and hurricanes can cause extensive damage to your property, but with State Farm, you can have peace of mind knowing you are financially protected. Medical payments coverage can help cover someone’s medical expenses if they get hurt on your property. This coverage is especially beneficial if you are found liable for their injuries. Besides, State Farm Homeowners insurance also offers personal liability umbrella coverage, which provides additional liability protection beyond your regular policy limits. Water damage coverage can help pay for repairs to your home and personal property caused by events like burst pipes or floods. Identity restoration coverage can help you recover from identity theft and other related crimes. This coverage can help pay for expenses related to restoring your credit and identity. Home systems protection offered by State Farm Homeowners insurance can also help cover the repair or replacement of your home’s major systems, such as heating and cooling systems, plumbing, and electrical. This coverage helps you avoid costly repairs and replacements.In summary, State Farm Homeowners insurance is a comprehensive policy that offers protection for your home and personal belongings. It covers liabilities, natural disasters, water damage, and medical expenses. Additionally, it provides additional liability protection beyond the regular policy limits, identity restoration coverage, and home system protection. With State Farm, you can have peace of mind knowing that you are financially protected against unexpected events that may damage your property.

State Farm is a popular insurance company that offers various insurance policies to protect you and your property from unexpected events. One of their most popular policies is State Farm Homeowners Insurance, which covers a wide range of damages that can occur to your home and personal belongings. Below are some of the things that State Farm Homeowners Insurance covers and its importance from my point of view.

- Dwelling Coverage: This covers damages to your home’s structure, such as fire, hail, windstorm, lightning, and other natural disasters. This coverage ensures that your home can be repaired or rebuilt in case of any damage caused by these unforeseen events.

- Personal Property Coverage: This covers your personal belongings, such as furniture, appliances, clothing, electronics, and other valuable items if they are stolen, damaged, or destroyed. It gives you peace of mind knowing that your possessions are protected in case of any unfortunate event.

- Liability Coverage: This coverage protects you against lawsuits that may arise if someone gets injured on your property or if you damage someone else’s property. Liability coverage helps cover the cost of legal fees, medical bills, and other expenses that may arise from a lawsuit.

- Additional Living Expenses: If your home becomes uninhabitable due to covered damage, State Farm Homeowners Insurance provides financial assistance for temporary living arrangements. This coverage takes care of your hotel bills, meals, and other expenses you may incur while your home is being repaired or rebuilt.

As a homeowner, I believe that having State Farm Homeowners Insurance is essential. It provides me with peace of mind knowing that my home and personal belongings are protected in case of any unexpected event. In addition to the coverage mentioned above, State Farm also offers optional coverage that you can add to your policy, such as water backup and sump overflow coverage, earthquake coverage, and identity restoration coverage.

In conclusion, State Farm Homeowners Insurance is a comprehensive insurance policy that provides protection for your home and personal belongings. It covers damages caused by natural disasters, theft, and other unforeseen events. Having this insurance policy ensures that you don’t have to worry about the financial burden of repairing or rebuilding your home or replacing your personal belongings. It is a must-have policy for any homeowner who wants to protect their investment and their family’s well-being.

Thank you for taking the time to read our article on What Does State Farm Homeowners Cover. We hope that we have provided you with valuable information to help you better understand your policy and what it covers.As we discussed, State Farm homeowners insurance provides coverage for a variety of events that can occur in and around your home, such as fire, theft, and weather-related damage. It also offers liability coverage in case someone is injured on your property or if you accidentally cause damage to someone else’s property.It’s important to note that while State Farm provides comprehensive coverage, every policy is different, and coverage can vary depending on factors such as location, type of property, and individual needs. We encourage you to review your policy and speak with your State Farm agent to ensure that you have the right coverage for your specific situation.In conclusion, having a proper homeowners insurance policy in place is crucial in protecting your home and personal belongings. State Farm provides reliable and comprehensive coverage that can give you peace of mind knowing that you’re protected in the event of unexpected events. We hope you found this article informative and helpful, and we wish you the best in your journey as a homeowner..

When it comes to protecting your home and personal property, having the right insurance coverage is essential. State Farm is a popular insurance company that offers homeowners insurance policies. Here are some common questions people ask about what State Farm homeowners insurance covers:

- Does State Farm cover my house and other structures on my property?

- Will State Farm pay for my personal property if it’s stolen or damaged?

- Does State Farm provide liability coverage?

- What natural disasters does State Farm cover?

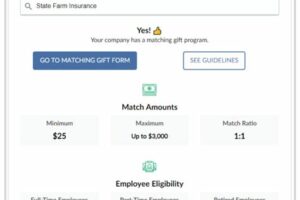

- Does State Farm offer any discounts on homeowners insurance?

Yes, State Farm’s homeowners insurance covers your home and any other structures on your property, such as a garage or shed.

Yes, State Farm’s homeowners insurance includes coverage for your personal property, including furniture, electronics, and clothing, if it’s stolen or damaged by a covered peril like theft, fire, or water damage.

Yes, State Farm’s homeowners insurance includes liability coverage, which can protect you if someone is injured on your property or if you accidentally cause damage to someone else’s property.

State Farm’s standard homeowners insurance policy covers damage caused by certain natural disasters, such as windstorms, hail, lightning, fire, and smoke. However, coverage for earthquakes and floods may require additional coverage.

Yes, State Farm offers several discounts on homeowners insurance, including discounts for having a security system, bundling your home and auto insurance policies, and being a new homeowner. Be sure to ask your State Farm agent about available discounts.

Overall, State Farm homeowners insurance can provide valuable coverage for your home and personal property. Be sure to review your policy carefully and ask your agent any questions you may have to ensure that you have the right coverage for your needs.