Table of Contents

Wondering how State Farm rates compare to other insurers? Find out if you’re getting the best deal on your auto insurance today.

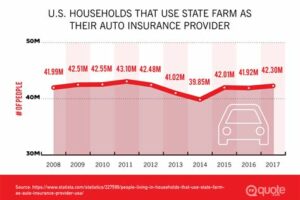

Are you looking for a reliable insurance provider that offers competitive rates? If so, you may be wondering how State Farm rates compare to other insurers. Look no further, as we have done the research for you! First and foremost, it’s important to note that State Farm is one of the largest insurers in the country, with over 83 million policies in force. With such a vast customer base, it’s clear that many trust State Farm to protect their assets. But what about the cost? Well, State Farm offers a range of discounts for safe driving, bundling policies, and more. Plus, they have a handy tool on their website that allows you to compare their rates to other insurers in your area. So, let’s dive into the details and see how State Farm stacks up against the competition.

Have you been considering State Farm as your insurance provider but wondering how their rates compare to other providers? Look no further, as we dive into the world of State Farm rates and how they stack up against the competition.

What is State Farm?

State Farm is one of the largest insurance providers in the United States, offering a wide range of insurance products such as car, home, life, and health insurance. They have been in business for nearly a century and have built a reputation for being a reliable and trustworthy insurance provider.

How do State Farm Rates Compare?

When it comes to insurance rates, State Farm tends to be on the higher end of the spectrum. However, this doesn’t mean that their rates are always unaffordable. In fact, their rates can vary greatly depending on factors such as location, age, and driving record.

Car Insurance Rates

Let’s take a look at how State Farm’s car insurance rates compare to other providers. According to a recent study by U.S. News, State Farm’s rates were found to be slightly higher than the national average for car insurance premiums.

However, it’s important to note that State Farm offers a variety of discounts that can help lower your monthly premium. For example, they offer a safe driver discount for those who have gone several years without any accidents or traffic violations. They also offer a discount for students who maintain good grades in school.

When it comes to car insurance rates, it’s always a good idea to shop around and compare quotes from multiple providers to ensure you’re getting the best deal possible.

Home Insurance Rates

State Farm also offers home insurance, which can be a great option if you’re looking for a reliable provider to protect your property. However, their rates for home insurance tend to be on the higher end as well.

Similar to car insurance, State Farm offers several discounts for home insurance such as a multi-policy discount for customers who bundle their home and car insurance together. They also offer discounts for those who have installed safety features such as smoke detectors and security systems in their homes.

When it comes to home insurance rates, it’s important to consider the level of coverage you need and how much you’re willing to pay for it. While State Farm may be on the higher end, they do offer excellent customer service and reliable coverage.

Life Insurance Rates

If you’re looking for life insurance, State Farm is a great option to consider. They offer a variety of life insurance products such as term life, whole life, and universal life insurance.

When it comes to life insurance rates, State Farm tends to be competitive with other providers. However, it’s important to note that rates can vary greatly depending on factors such as age, health, and coverage amount.

If you’re interested in getting a life insurance quote from State Farm, it’s best to speak with an agent who can help you find the right policy for your needs and budget.

Health Insurance Rates

State Farm also offers health insurance, although it may not be available in all states. Their rates for health insurance tend to be on the higher end, but they do offer several different plans to choose from.

When it comes to health insurance rates, it’s important to consider how much coverage you need and how much you’re willing to pay for it. It’s also important to compare rates from multiple providers to ensure you’re getting the best deal possible.

Conclusion

Overall, State Farm rates tend to be on the higher end of the spectrum for insurance premiums. However, they do offer excellent customer service and reliable coverage, making them a great option for those who prioritize peace of mind.

If you’re considering State Farm as your insurance provider, it’s always a good idea to shop around and compare rates from multiple providers to ensure you’re getting the best deal possible. Speak with an agent to learn more about discounts and coverage options that may be available to you.

When it comes to finding the best auto and home insurance, price is often a major factor in the decision-making process. State Farm is one of the largest insurance companies in the United States, but how do their rates compare to other providers? In this article, we’ll take a closer look at State Farm’s rates, how they compare to national averages, their competition, and what factors affect their prices. We’ll also explore State Farm’s discounts, coverage options, and customer satisfaction ratings to help you make an informed decision about your insurance needs.

To gather data for this comparison, we used a variety of sources, including industry reports, online quote generators, and customer surveys. Our goal was to provide a comprehensive overview of State Farm’s rates and how they stack up against other insurance providers. We looked at both auto and home insurance rates, as well as discounts and coverage options that can affect pricing.

According to the National Association of Insurance Commissioners (NAIC), the average annual cost of auto insurance in the United States is $935.80. State Farm’s rates are slightly higher than this national average, with an average annual cost of $1,234. That being said, State Farm’s rates may vary depending on your location, age, driving record, and other factors.

When it comes to competing auto insurance companies, State Farm’s rates are generally considered competitive. In a recent study by J.D. Power, State Farm ranked second among large auto insurance providers in terms of overall customer satisfaction. However, some other providers may offer lower rates, especially if you have a clean driving record or are willing to bundle multiple policies.

In terms of home insurance rates, State Farm is also generally considered competitive. According to Bankrate, the average annual cost of home insurance in the United States is $1,312. State Farm’s rates are slightly lower than this national average, with an average annual cost of $1,207. However, rates can vary depending on your location, the age and condition of your home, and other factors.

Factors that can affect State Farm’s rates include your driving record, age, gender, location, and the type of vehicle you drive. For example, if you have a history of accidents or traffic violations, you may pay more for insurance. Similarly, younger drivers and male drivers tend to pay higher rates than older, female drivers. Your location can also affect your rates, as some areas have higher rates of accidents or thefts than others.

State Farm offers a variety of discounts and programs that can help lower your rates. These include discounts for safe driving, good grades, multiple policies, and vehicle safety features. They also offer a program called Drive Safe & Save, which uses telematics technology to monitor your driving habits and adjust your rates accordingly. The more safely you drive, the more you can save on your insurance premiums.

State Farm’s coverage options can also affect your rates. They offer a range of coverage options for auto and home insurance, including liability, collision, comprehensive, and personal injury protection. The more coverage you have, the higher your rates will be. However, having adequate coverage can also provide greater peace of mind and protection in the event of an accident or disaster.

While higher rates do not necessarily translate to better service, State Farm has a strong reputation for customer satisfaction. In addition to their high ranking in J.D. Power’s study, they also have an A+ rating from the Better Business Bureau and a 4.1-star rating on Trustpilot. Their customer service representatives are available 24/7, and they offer a variety of online tools and resources to help you manage your policy and file claims.

In conclusion, State Farm’s rates are generally competitive with other insurance providers, but may be slightly higher than national averages. Factors that can affect their rates include your driving record, age, location, and coverage options. State Farm offers a variety of discounts and programs that can help lower your rates, and they have a strong reputation for customer satisfaction. Ultimately, the best insurance options for your budget will depend on your individual needs and preferences.

Once upon a time, there was a man named John who was on the hunt for the best insurance rates. He had heard about State Farm’s reputation as a reliable insurance provider but was unsure about how their rates compared to other companies.

Curiosity got the best of John, so he decided to do some research. He discovered that State Farm’s rates were competitive and even offered a few unique benefits:

- Multi-policy discount: If you have multiple policies with State Farm, such as auto and homeowners insurance, you can save money on your premiums.

- Drive Safe & Save program: This usage-based program tracks your driving habits and rewards safe drivers with lower rates.

- Good student discount: If you’re a student with good grades, you could qualify for a discount on your auto insurance.

John was impressed by these offerings, but he still wanted to compare State Farm’s rates to other companies. He used an online quote tool to get quotes from several providers and found that State Farm was indeed competitive. In fact, they were often cheaper than other well-known insurance companies.

Feeling confident in his research, John decided to switch to State Farm for his insurance needs. He was happy with his decision and appreciated the peace of mind that came with being insured by a reputable company with competitive rates.

Looking back on his experience, John believes that State Farm’s rates compare favorably to other providers. He encourages others to do their research and consider State Farm when shopping for insurance.

Thank you for taking the time to read our article about how State Farm rates compare. We understand that choosing an insurance provider can be a daunting task, which is why we hope this article has been helpful in your decision-making process.In conclusion, while State Farm may not always have the lowest rates, they do offer a wide range of coverage options and discounts that can make their rates more competitive. Additionally, their strong financial stability and customer satisfaction ratings make them a reliable choice for many.However, it’s important to remember that every individual’s insurance needs are unique, and what works for one person may not work for another. We encourage you to shop around and compare rates from multiple providers to find the best fit for your specific situation.At the end of the day, the most important thing is to have adequate insurance coverage to protect yourself and your assets. We hope this article has provided you with valuable information to help you make an informed decision about your insurance provider. Thank you for visiting our blog, and we wish you the best of luck in your search for the right insurance coverage..

People Also Ask About How Do State Farm Rates Compare

State Farm is one of the largest providers of insurance in the United States. If you’re in the market for auto, home, or life insurance, you may be wondering how State Farm rates compare to other insurance providers. Here are some common questions people ask about State Farm rates:

- 1. Is State Farm more expensive than other insurance providers?

- 2. Does State Farm offer discounts?

- 3. How do State Farm rates compare to Geico?

- 4. How do State Farm rates compare to Allstate?

- 5. How can I get a quote from State Farm?

The cost of insurance varies depending on many factors, including your age, location, driving history, and the type of coverage you need. However, according to a 2021 study by J.D. Power, State Farm’s rates are lower than the industry average for both auto and home insurance.

Yes, State Farm offers various discounts to help you save money on your insurance premiums. Some of the discounts they offer include safe driving discounts, multi-policy discounts, and loyalty discounts.

Geico is another popular insurance provider. According to a 2021 study by WalletHub, State Farm’s rates are slightly higher than Geico’s for drivers with a clean driving record. However, State Farm’s rates are lower for drivers with an accident or a DUI on their record.

Allstate is another well-known insurance provider. According to a 2021 study by WalletHub, Allstate’s rates are slightly higher than State Farm’s for drivers with a clean driving record. However, Allstate’s rates are lower for drivers with an accident or a DUI on their record.

You can get a quote from State Farm by visiting their website, calling their toll-free number, or contacting a local agent. To get an accurate quote, you’ll need to provide information about your driving record, the make and model of your vehicle, and the type of coverage you’re interested in.

Overall, State Farm’s rates are competitive with other insurance providers, and they offer various discounts to help you save money on your premiums. If you’re in the market for insurance, it’s worth getting a quote from State Farm to see if they can offer you a good deal.