Table of Contents

Does State Farm liability cover hit and run accidents? Learn what is covered and how to file a claim if you are the victim of a hit and run.

Hit and run accidents can be both frustrating and scary, especially when it comes to determining who is responsible for the damages. If you are a State Farm policyholder, you may be wondering if your liability coverage will protect you in the event of a hit and run incident. The good news is that State Farm does offer liability coverage for hit and runs, but there are certain factors that come into play. Let’s take a closer look at what this means for you as a driver and what steps you should take if you find yourself in this situation.

State Farm is one of the most popular insurance providers in the United States. The company offers a wide range of insurance policies, including auto insurance. If you are a State Farm policyholder and have been involved in a hit and run accident, you may be wondering whether your liability coverage will apply. In this article, we will discuss whether State Farm liability covers hit and run accidents.

What is a Hit and Run Accident?

A hit and run accident is an accident where the driver who caused the accident flees the scene without providing any information or help to the other parties involved. Hit and run accidents can be devastating, both emotionally and financially. If you are a victim of a hit and run accident, your first step should be to contact the police and seek medical attention if necessary.

What Does Liability Coverage Mean?

Liability coverage is a type of auto insurance that covers the cost of damages or injuries that you may cause to another person or their property while driving your vehicle. Liability coverage does not cover your own injuries or damages to your own vehicle. The two types of liability coverage are bodily injury liability and property damage liability.

Does State Farm Liability Cover Hit and Run Accidents?

If you have liability coverage with State Farm, it will cover the damages or injuries that you may cause to another person or their property while driving your vehicle. However, liability coverage only applies if you are at fault for the accident. If you are involved in a hit and run accident, you are not at fault, and therefore, your liability coverage will not apply.

What Should You Do If You Are Involved in a Hit and Run Accident?

If you are involved in a hit and run accident, you should contact the police immediately and provide as much information as possible, such as the make and model of the other vehicle, the license plate number, and any other details that can help identify the driver who fled the scene. You should also seek medical attention if necessary and contact your insurance provider to report the accident.

What Can You Do If the Driver Who Caused the Hit and Run Accident Cannot Be Identified?

If the driver who caused the hit and run accident cannot be identified, you may still be able to recover compensation for your damages and injuries through your own insurance policy. If you have uninsured motorist coverage, it will cover the cost of your damages and injuries up to the limits of your policy.

What is Uninsured Motorist Coverage?

Uninsured motorist coverage is a type of auto insurance that covers the cost of damages or injuries that you may sustain in an accident caused by a driver who does not have insurance or who flees the scene without providing any information. Uninsured motorist coverage also applies if you are involved in a hit and run accident where the driver who caused the accident cannot be identified.

What Should You Do If You Want to File a Claim for a Hit and Run Accident?

If you want to file a claim for a hit and run accident, you should contact your insurance provider as soon as possible. Your insurance provider will ask you to provide all the details of the accident, such as the date and time, the location, the make and model of the other vehicle, and any other details that can help identify the driver who fled the scene. You may also need to provide a police report if one was filed.

Conclusion

In conclusion, if you have liability coverage with State Farm, it will not cover hit and run accidents unless you are at fault for the accident. If you are involved in a hit and run accident, you should contact the police immediately and seek medical attention if necessary. If the driver who caused the accident cannot be identified, you may still be able to recover compensation through your own insurance policy, such as uninsured motorist coverage. If you want to file a claim for a hit and run accident, you should contact your insurance provider as soon as possible and provide all the necessary details.

If you’re a State Farm policyholder, it’s important to understand what your liability coverage entails. The Basics of State Farm Liability Coverage include protection from bodily injury and property damage that you may cause to others while driving your vehicle. This coverage also includes legal defense if needed. But what happens if you’re the victim of a hit and run accident?

Hit and Run: What Exactly Is It? A hit and run accident is when a driver causes damage or injury to another person or their property and then leaves the scene without providing their contact information. Unfortunately, these types of accidents happen all too often on our roads.

Am I Covered If I’m the Victim of a Hit and Run? If you’re the victim of a hit and run accident, State Farm liability coverage may cover you. Depending on the circumstances, your policy may provide coverage for physical injuries, property damage, and even lost wages resulting from the accident. However, it’s important to note that you’ll need to file a police report and provide as much information about the other driver as possible to make a claim.

Am I Covered If I’m the Driver at Fault in a Hit and Run? If you’re the driver at fault in a hit and run accident, your State Farm liability coverage may still kick in to cover damages and injuries to the other party. However, you’ll likely face legal consequences for leaving the scene of an accident. It’s always best to stay at the scene, call for help, and provide your contact information.

What to Do If an Uninsured Driver Hits You? If you’re hit by an uninsured driver, your State Farm liability coverage may still cover damages and injuries, but only up to your policy limits. If you have uninsured/underinsured motorist coverage, that can help cover costs beyond your liability limits.

Can I File a Claim If I Don’t Have Collision Coverage? Yes, you can file a claim with State Farm liability coverage even if you don’t have collision coverage. However, your policy limits will apply, and you may have to pay out of pocket for any damages that exceed those limits.

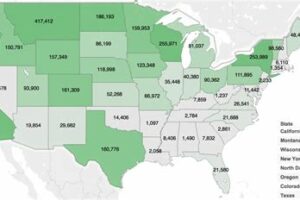

How Much Does State Farm Liability Coverage Cost? The cost of State Farm liability coverage varies depending on several factors, including your driving record, age, and location. On average, liability coverage costs around $600 per year, but your actual cost may be higher or lower.

What if the Other Driver Can’t Be Identified? If the other driver in a hit and run accident can’t be identified, you may still be able to make a claim under your State Farm uninsured motorist coverage. This coverage is designed to help protect you from drivers who don’t have insurance or can’t be identified.

Additional Coverage Options for Hit and Run Accidents. To further protect yourself from hit and run accidents, consider adding collision coverage and uninsured motorist property damage coverage to your policy. These options can help cover damages to your own vehicle and property if the other driver can’t be identified or doesn’t have insurance.

Get the Help You Need to Navigate Your State Farm Liability Coverage. If you’ve been involved in a hit and run accident, it’s essential to understand your coverage options and file a claim as soon as possible. Contact your State Farm agent for guidance and support throughout the claims process.

Overall, State Farm liability coverage is an essential part of protecting yourself on the road. Whether you’re the victim of a hit and run accident or the driver at fault, understanding your coverage options can help you navigate the aftermath of an accident with confidence.

State Farm is a well-known insurance company that offers a variety of insurance policies, including liability coverage. Liability coverage is essential for protecting you financially in case you cause an accident that damages someone else’s property or injures them. But what happens if you’re the victim of a hit and run accident? Does State Farm liability cover hit and run incidents? Let’s explore this topic further.

Point of View: A State Farm Policyholder

- It was a typical Monday morning, and I was on my way to work. As I approached the intersection, the light turned yellow, and I slowed down to a stop. Suddenly, I heard a loud crash from behind me, followed by screeching tires. I quickly realized that I had been rear-ended by another car.

- I got out of my car to assess the damage, but the other driver had already fled the scene. I was shaken and frustrated. How could someone be so irresponsible and reckless? I called the police and then contacted my insurance company, State Farm.

- When I spoke with the State Farm representative, I explained what had happened and asked if my liability coverage would cover the hit and run incident. The representative assured me that it would, as long as I had uninsured motorist coverage.

- I was relieved to hear this news. I knew that I would have to pay a deductible, but at least I wouldn’t be responsible for the full cost of the damages. The State Farm representative helped me file a claim and gave me instructions on what to do next.

- Over the next few days, I worked with State Farm to get my car repaired and handle the legal aspects of the hit and run incident. Though it was a frustrating experience, I was grateful for State Farm’s liability coverage and their helpful representatives.

Point of View: A State Farm Representative

- As a State Farm representative, it’s my job to help policyholders when they have questions or concerns about their coverage. One common question we receive is whether our liability coverage covers hit and run incidents.

- The answer is that it depends on the specific policy and coverage options that the policyholder has chosen. Liability coverage typically only covers damages or injuries that you cause to someone else. However, uninsured motorist coverage can provide additional protection in case you’re in an accident with an uninsured or hit and run driver.

- When a policyholder contacts us about a hit and run incident, we first ensure that they are safe and unharmed. Then, we ask for details about the incident and their coverage. If they have uninsured motorist coverage, we explain how it works and what they need to do next to file a claim.

- We also help policyholders navigate the claims process and work with them to get their car repaired or replaced. It’s important to us that our policyholders feel supported and taken care of during these stressful situations.

- In the end, it’s always best to speak with your insurance company directly if you have questions about your coverage or are involved in an accident. We’re here to help and want to ensure that you’re protected financially in case the unexpected happens.

Overall, State Farm liability coverage can offer valuable protection in case you cause damage or injury to others. And if you’re the victim of a hit and run incident, uninsured motorist coverage can provide additional peace of mind. As a policyholder, it’s important to understand your coverage options and contact your insurance company as soon as possible after an accident.

Hello there, fellow blog visitors! I hope you found our discussion about State Farm Liability Cover Hit and Run informative and helpful. Before we end this article, let me leave you with some closing thoughts that may help you in case you find yourself in a hit and run accident.

First and foremost, it is important to understand that State Farm’s liability coverage can protect you in case of a hit and run accident. However, it is essential to file a police report as soon as possible and gather as much evidence as you can to support your claim. This includes taking pictures of the damage, identifying witnesses, and providing any other pertinent information that can help the authorities identify the responsible party.

Furthermore, it is crucial to be honest and transparent with your insurance provider. Provide them with all the necessary information and be prepared to answer any questions they may have. Remember, being truthful and upfront can help expedite the claims process and ensure that you receive the compensation you deserve.

Lastly, always make sure that you have adequate insurance coverage that suits your needs. While no one wants to be involved in an accident, it is better to be prepared and protected in case the unexpected happens. Consider speaking with your State Farm agent to learn more about your options and how you can customize your policy to fit your specific situation.

Thank you for taking the time to read our article about State Farm Liability Cover Hit and Run. We hope that you found it useful and that you learned something new today. Remember, safe driving is always a priority, but in case of an accident, it pays to be prepared and informed.

.

When it comes to hit and run accidents, many people wonder if their State Farm liability insurance will cover the damages. Here are some common questions people ask about State Farm liability coverage for hit and run accidents:

- Will my State Farm liability insurance cover a hit and run accident?

- What if I don’t have liability coverage with State Farm?

- What should I do if I’m involved in a hit and run accident?

- Will I have to pay a deductible for a hit and run claim?

- What if the hit and run driver is never caught?

Yes, if you have liability coverage with State Farm, it should cover damages caused by a hit and run driver, up to your policy limits.

If you don’t have liability coverage with State Farm, you will not be covered for damages caused by a hit and run driver.

If you’re involved in a hit and run accident, you should call the police and report the incident. You should also document any damages and injuries, if possible. If you have liability coverage with State Farm, you should contact your agent to file a claim.

It depends on your policy. Some policies may have a deductible for hit and run claims, while others may not.

If the hit and run driver is never caught, you can still file a claim with State Farm for damages, as long as you have liability coverage.

Overall, if you have liability coverage with State Farm, you should be covered for damages caused by a hit and run driver. However, it’s important to review your policy to understand your coverage limits and any deductibles that may apply.