Curious about the relationship between State Farm and Farmers Insurance? Find out if State Farm owns Farmers Insurance in this informative article.

It’s no secret that State Farm and Farmers Insurance are two of the biggest names in the insurance industry. However, what many people may not know is that these two powerhouses are actually owned by different companies. That’s right, despite their similar-sounding names and the fact that they both offer a wide range of insurance products, State Farm and Farmers Insurance have different owners. So, who owns these insurance giants? And what does this mean for policyholders? Let’s take a closer look.

Conspiracy theories have been circulating for years that State Farm and Farmers Insurance are somehow intertwined. Some people claim that State Farm owns Farmers Insurance, while others speculate that the two companies are the same entity operating under different names. But what is the truth behind these rumors? Let’s get to the bottom of it.

First, let’s take a closer look at State Farm. Founded in 1922, State Farm is one of the largest insurance companies in the United States. With more than 58,000 employees and a network of over 19,000 agents, the company provides a wide range of insurance products and financial services to customers across the country. State Farm has a reputation for excellent customer service and comprehensive coverage options, making it a popular choice for insurance shoppers.

Now, let’s turn our attention to Farmers Insurance. Founded in 1928, Farmers Insurance is another major player in the insurance industry. The company offers a variety of insurance products, including auto, home, life, and business insurance. Like State Farm, Farmers Insurance has a large network of agents and a reputation for quality service.

So, do these two companies have any connection to each other? The answer is yes and no. While State Farm and Farmers Insurance are not the same company, they do share some similarities. For example, both companies were founded around the same time and offer similar types of insurance products. Additionally, both companies have a strong presence in the insurance market and are known for their customer service and reliability.

However, despite these similarities, there is no evidence to suggest that State Farm owns Farmers Insurance or vice versa. In fact, the two companies operate independently and are not affiliated with each other in any way.

So, why do these conspiracy theories persist? One reason may be the striking similarities between the two companies. Some people may assume that because State Farm and Farmers Insurance offer similar products and have similar reputations, they must be the same company. Others may simply enjoy spreading rumors and creating drama.

Whatever the reason for these rumors, it is important to separate fact from fiction when it comes to State Farm and Farmers Insurance. While the two companies are not the same entity, they do share some commonalities that make them attractive options for insurance shoppers.

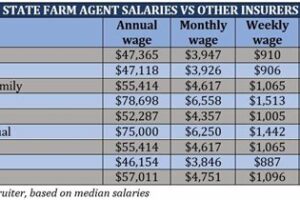

When comparing State Farm and Farmers Insurance, there are a few key differences to keep in mind. For example, State Farm offers a wider range of financial services than Farmers Insurance, including banking and investment products. Additionally, State Farm has a larger network of agents than Farmers Insurance, which may make it easier for customers to find an agent in their area.

On the other hand, Farmers Insurance offers a unique feature called Smart Plan, which allows customers to customize their coverage based on their individual needs. This level of flexibility may be appealing to customers who want more control over their insurance policies.

Despite these differences, both State Farm and Farmers Insurance are well-respected insurance companies that offer quality products and services. Whether you choose to go with State Farm or Farmers Insurance will ultimately depend on your personal preferences and insurance needs.

As for the possibility of a merger between State Farm and Farmers Insurance, there is no concrete evidence to suggest that such a union is in the works. However, as with any large corporation, it is always possible that mergers or acquisitions could take place in the future. For now, though, both State Farm and Farmers Insurance are operating independently and providing valuable services to their customers.

In conclusion, while there may be conspiracy theories suggesting that State Farm owns Farmers Insurance or that the two companies are the same entity, the truth is much simpler. State Farm and Farmers Insurance are independent companies that share some similarities but are not affiliated with each other. Both companies offer quality insurance products and services, and customers can choose the company that best fits their needs. So, the next time you hear someone spreading rumors about State Farm and Farmers Insurance, you can set the record straight and debunk the myths once and for all.

Once upon a time, there was a great debate about whether State Farm owned Farmers Insurance. The truth is, both companies are giants in the insurance industry and have been around for decades.

Here are some key points to consider:

- State Farm was founded in 1922 by George J. Mecherle in Bloomington, Illinois, while Farmers Insurance was founded in 1928 by John C. Tyler and Thomas E. Leavey in Los Angeles, California.

- Both companies offer similar products and services, including auto, home, and life insurance, as well as financial planning and banking services.

- While State Farm is a mutual company owned by its policyholders, Farmers Insurance is owned by Zurich Insurance Group, a Swiss multinational insurance company.

- State Farm has a larger market share in the United States, with over 83 million policies in force as of 2020, while Farmers Insurance has around 10 million policies in force.

So, does State Farm own Farmers Insurance? The answer is no. Although both companies are major players in the insurance industry and have many similarities, they are separate entities with different ownership structures. However, they both strive to provide excellent customer service and quality insurance products to their customers.

In conclusion, it’s important to do your research and compare insurance companies before making a decision on which one to go with. Whether you choose State Farm, Farmers Insurance, or another insurance provider, make sure to read the fine print and understand what you’re getting into. And always remember, insurance is there to protect you and your assets, so don’t skimp on coverage!

Dear valued blog visitors,

As we come to the end of this discussion, we hope that we have been able to provide you with some valuable insights into the world of insurance. In particular, we have looked at the question of whether State Farm owns Farmers Insurance. While there is certainly a lot of speculation and misinformation out there, we have endeavored to present you with the facts, so that you can make an informed decision when it comes to choosing an insurance provider.

We started by examining the history of both companies, tracing their roots back to the early part of the 20th century. We then looked at the current ownership structures of each company, and whether there was any evidence to suggest that one company had acquired the other. Ultimately, we concluded that while State Farm and Farmers are both major players in the insurance industry, they are in fact separate entities, and there is no evidence to suggest that State Farm owns Farmers Insurance.

At the end of the day, choosing the right insurance provider is a personal decision that will depend on a variety of factors, including your individual needs, budget, and preferences. We hope that this article has helped to shed some light on the relationship between State Farm and Farmers Insurance, and that you feel better equipped to make an informed decision when it comes to your own insurance needs.

Thank you for taking the time to read our blog, and we hope that you will continue to find value in the content that we provide. If you have any questions or comments, please don’t hesitate to get in touch!

.

People often wonder about the relationship between State Farm and Farmers Insurance. Here are some of the most common questions:

-

Does State Farm own Farmers Insurance?

No, State Farm and Farmers Insurance are two separate companies. They are both large insurance providers in the United States, but they have no ownership or control over each other.

-

Are State Farm and Farmers Insurance affiliated?

No, there is no affiliation between the two companies. They operate independently and compete with each other in the insurance market.

-

Do State Farm and Farmers Insurance offer similar products?

Yes, both companies offer a range of insurance products, including auto, home, life, and business insurance. However, the specific coverage options and pricing may vary between the two companies.

-

Which company is better, State Farm or Farmers Insurance?

It’s difficult to determine which company is better as it depends on individual needs and preferences. Both companies have strong financial ratings and offer quality insurance products. It’s recommended to compare policies from both companies and choose the one that best fits your needs.

Overall, while State Farm and Farmers Insurance may be similar in some ways, they are separate entities that operate independently in the insurance market.