Table of Contents

Wondering if State Farm debit card charges fees for overseas use? Find out here and avoid unexpected charges while traveling.

Are you planning to use your State Farm debit card while traveling overseas? Before you swipe that card, it’s important to know the potential fees that may come with it.

As a frequent traveler, you don’t want to be caught off-guard by unexpected charges that could impact your budget. Therefore, it’s essential to understand the terms and conditions of your debit card, including the fees for overseas transactions.

Luckily, we’ve got you covered! In this article, we’ll explore whether State Farm debit card charge fees for overseas use and what you need to know before using your card abroad. So, buckle up and let’s dive into the details.

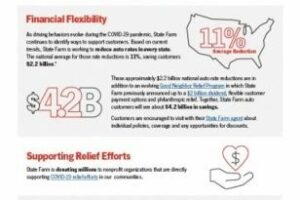

State Farm is a US-based insurance company that offers various financial services, including checking accounts and debit cards. If you are a State Farm debit cardholder and planning to travel overseas, you may be wondering if there are any charges for using your card abroad.

State Farm Debit Card: A Brief Overview

Before we dive into the fees charged by State Farm for overseas use of its debit card, let’s first understand what the card is all about. A State Farm debit card is linked to your checking account and allows you to make purchases or withdraw cash from ATMs.

The card comes with a Mastercard logo, which means it can be used for transactions worldwide, wherever Mastercard is accepted.

Overseas Transaction Fees

State Farm charges a foreign transaction fee of 3% of the purchase amount for any transaction made outside the US. This fee is in addition to any other fees charged by the merchant or ATM operator.

For example, if you make a purchase of $100 while traveling abroad, you will be charged $103, with $3 being the foreign transaction fee.

If you plan to use your State Farm debit card frequently during your overseas trip, the foreign transaction fee can add up quickly, resulting in a significant dent in your account balance.

ATM Withdrawal Fees

State Farm also charges a fee for withdrawing cash from ATMs outside the US. The fee is $3 per withdrawal, in addition to any other fees charged by the ATM operator.

For instance, if you withdraw $50 from an ATM abroad, you will be charged $53, with $3 being the State Farm fee.

It is worth noting that some international banks may also charge a fee for using their ATMs. Therefore, it is advisable to check with your bank before traveling to avoid any surprises.

Other Fees

Aside from foreign transaction and ATM withdrawal fees, State Farm may charge other fees for certain transactions or services.

For example, if you overdraw your account, State Farm may charge an overdraft fee of $29.50 per item. Similarly, if you request a replacement card, you may be charged a fee of $5.

It is crucial to read and understand the terms and conditions of your State Farm checking account and debit card to avoid unexpected fees.

How to Minimize Fees When Using Your State Farm Debit Card Overseas

While it is impossible to avoid foreign transaction and ATM withdrawal fees entirely, there are some steps you can take to minimize them when using your State Farm debit card overseas.

- Notify your bank before traveling: Inform State Farm of your travel plans to avoid any security concerns that may result in a blocked card. Additionally, the bank may offer some travel tips to help minimize fees.

- Use ATMs affiliated with major banks: Some international banks have partnerships with US banks and may not charge any ATM fees for withdrawals. Look for ATMs with logos of major banks such as HSBC, Citibank, or Deutsche Bank.

- Avoid dynamic currency conversion: When using your State Farm debit card abroad, you may be given the option to pay in your home currency. However, this option may come at a higher exchange rate than what your bank would have given you. Instead, choose to pay in the local currency.

- Consider getting a travel credit card: If you travel frequently, it may be worth getting a credit card specifically designed for overseas use. Some credit cards offer no foreign transaction fees and may even offer travel rewards or insurance.

Conclusion

State Farm charges a foreign transaction fee of 3% and an ATM withdrawal fee of $3 for any transactions made outside the US. To minimize these fees, inform your bank of your travel plans, use ATMs affiliated with major banks, avoid dynamic currency conversion, and consider getting a travel credit card.

Remember to read and understand the terms and conditions of your State Farm checking account and debit card to avoid unexpected fees.

Traveling overseas can be exciting and enriching, and with the right financial planning, you can enjoy your trip without worrying about excessive fees.

International travel can be exciting and life-changing, but it also comes with its fair share of financial challenges. If you’re a State Farm debit cardholder heading overseas, you might be wondering whether the company charges fees for international transactions. Unfortunately, the answer is yes. A global network is no match for State Farm debit card fees, which can quickly add up and put a damper on your vacation or business trip.

Before you start using your State Farm debit card abroad, it’s important to read the fine print and familiarize yourself with the company’s fee structure for international transactions. While State Farm does not charge a foreign transaction fee, it does impose fees for ATM withdrawals, balance inquiries, and other transactions performed outside of the United States.

State Farm debit cards abroad should be used with caution, as the hidden costs of usage can quickly accumulate. Don’t get stung by State Farm’s overseas ATM fees, which can range from $2 to $5 per transaction, in addition to any fees charged by the ATM provider. Similarly, balance inquiries can cost you up to $1.50 per transaction, while purchases made in a foreign currency may be subject to a conversion fee of up to 3% of the transaction amount.

To avoid State Farm’s international transaction fees, there are a few strategies you can employ. First, consider using cash instead of your debit card whenever possible. This can help you avoid ATM fees and minimize the impact of State Farm’s foreign exchange rates, which may not always be favorable.

If you do need to use your State Farm debit card abroad, try to plan ahead and make larger withdrawals to minimize the number of transactions you need to make. Additionally, look for ATMs that are part of the Global ATM Alliance, which includes banks such as Barclays, Deutsche Bank, and Bank of America. Using one of these ATMs can help you avoid some of the fees associated with using non-partner ATMs.

When using your State Farm debit card abroad, it’s important to be aware of the company’s foreign exchange rates. While State Farm does not charge a conversion fee, it does use its own exchange rate when converting currencies. This rate may not always be the most favorable, so it’s a good idea to compare it to other rates available and choose the one that is most advantageous for you.

In summary, if you’re planning to use your State Farm debit card abroad, it’s important to be aware of the company’s fee structure for international transactions. Don’t let the hidden costs of usage catch you off guard. Instead, plan ahead, be cautious, and take steps to minimize the impact of State Farm’s overseas usage fees. By doing so, you can enjoy your international travels without breaking the bank.

Once upon a time, I was planning a trip overseas and I wondered if my State Farm debit card would charge me fees for using it abroad. So, I did some research and here’s what I found:

- State Farm does charge fees for using their debit card overseas.

- The fees vary depending on the type of transaction and currency conversion.

- For ATM withdrawals, there’s a $3 fee plus 3% of the transaction amount.

- For purchases made with the debit card, there’s a 2% currency conversion fee in addition to any other fees charged by the merchant or ATM operator.

- State Farm also recommends notifying them of your travel plans ahead of time to avoid any issues with your card being blocked for suspicious activity.

While it’s not ideal to pay fees for using your debit card overseas, it’s important to know what to expect before you go. And with State Farm, at least you can plan ahead and avoid any surprises.

As for my own trip, I made sure to notify State Farm of my travel plans and budgeted for the fees associated with using my debit card abroad. And you know what? It was worth it to have the convenience and security of using my trusted State Farm debit card while exploring new places.

Thank you for taking the time to read this article on State Farm debit card fees for overseas use. As a State Farm customer, it is important to be aware of the potential fees associated with using your debit card while traveling abroad. While State Farm does not charge any foreign transaction fees, there may still be fees imposed by foreign banks or merchants.It is recommended that you notify State Farm of your travel plans prior to departure in order to prevent any potential issues with accessing your funds while abroad. Additionally, it is important to have a backup plan in case your card is lost or stolen. This may include carrying cash or having a second debit or credit card as a backup.Overall, State Farm offers a convenient and secure way to access your funds while traveling abroad. By being aware of potential fees and taking necessary precautions, you can ensure a smooth and stress-free financial experience while exploring new destinations around the world.Thank you again for reading and we hope that this article has provided useful information for your future travels. Safe travels!

.

People also ask about State Farm Debit Card Charge Fees for Overseas Use:

-

What are the fees for using my State Farm debit card overseas?

State Farm charges a 3% foreign transaction fee on all purchases made with your debit card outside of the United States. Additionally, ATM withdrawals made outside of the U.S. will incur a $2.50 fee plus 3% of the withdrawal amount.

-

Is it cheaper to use cash or my State Farm debit card when traveling overseas?

It is generally advisable to carry some cash when traveling overseas, but using your State Farm debit card for purchases and ATM withdrawals can be convenient. However, keep in mind that you will be charged a foreign transaction fee and ATM withdrawal fee, so it may be more cost-effective to withdraw larger amounts of cash at once instead of making frequent ATM withdrawals.

-

Can I avoid State Farm’s overseas fees by using a different debit card?

It is possible to find debit cards that do not charge foreign transaction fees or ATM withdrawal fees, so it may be worth researching other options if you plan to travel frequently. However, keep in mind that other banks may have their own fees and restrictions, so be sure to read the fine print before making a decision.

-

How can I notify State Farm of my overseas travel plans?

You can notify State Farm of your travel plans by logging into your account online or by contacting customer service. It is important to let your bank know when you will be traveling so that they can monitor your account for any suspicious activity.

Overall, while State Farm’s fees for overseas use may be higher than some other options, they offer the convenience and security of using a trusted financial institution. By planning ahead and being mindful of fees, you can make the most of your State Farm debit card while traveling overseas.