Table of Contents

Wondering if your State Farm full coverage policy covers everything you need? Find out what’s included and what’s not in this comprehensive guide.

Are you a State Farm policyholder? Do you have full coverage on your vehicle? If so, you may be wondering what exactly is included in your policy. Well, wonder no more! Let’s dive into the details of what State Farm’s Full Coverage really means for you and your car. First and foremost, it’s important to understand that full coverage typically refers to a combination of liability, collision, and comprehensive coverage. But what does that all entail? Sit back, relax, and let’s explore the ins and outs of your State Farm policy.

When it comes to car insurance, having full coverage can provide peace of mind on the road. But what exactly does full coverage entail? If you’re a State Farm policyholder, you may be wondering if your policy includes comprehensive and collision coverage. Let’s take a closer look.

What is Full Coverage?

Full coverage typically refers to a combination of liability, collision, and comprehensive coverage. Liability coverage is required in most states and helps pay for damages or injuries you cause to others in an accident. Collision coverage helps pay for damage to your own vehicle in a crash, while comprehensive coverage protects against non-collision events such as theft, vandalism, or weather damage.

What Does State Farm Full Coverage Include?

State Farm’s full coverage policies include liability, collision, and comprehensive coverage. However, the specifics of your policy may vary depending on factors such as your state’s insurance laws, your driving record, and the type of vehicle you own.

Liability Coverage with State Farm

State Farm’s liability coverage includes bodily injury and property damage liability. Bodily injury liability helps pay for medical expenses and lost wages of others involved in an accident you caused, while property damage liability helps pay for repairs or replacement of the other person’s vehicle or property.

Collision Coverage with State Farm

If you’re in a collision, State Farm’s collision coverage can help pay for repairs to your own vehicle. This coverage applies regardless of who is at fault for the accident.

Comprehensive Coverage with State Farm

Comprehensive coverage with State Farm helps protect your vehicle against non-collision events such as theft, vandalism, or weather damage. If your car is stolen or damaged by a covered event, comprehensive coverage can help pay for repairs or replacement.

What is Not Covered by State Farm Full Coverage?

While State Farm’s full coverage policies offer robust protection, there are some events that may not be covered. For example, if you intentionally cause damage to your own vehicle, or if you use your car for illegal activities, your policy may not apply. Additionally, if your vehicle is used for commercial purposes, you may need a separate commercial auto insurance policy.

What Factors Affect State Farm Full Coverage Premiums?

The cost of your State Farm full coverage policy can depend on a variety of factors, such as:

- Your driving record

- The type of vehicle you own

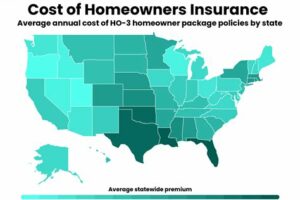

- Your location and state’s insurance laws

- The amount of coverage you select

- Your deductible (the amount you pay out of pocket before insurance kicks in)

- Your credit score (in some states)

How Can I Lower My State Farm Full Coverage Premiums?

If you’re looking to save money on your State Farm full coverage premiums, there are several strategies you can try:

- Increase your deductible

- Bundle multiple policies (such as home and auto) with State Farm

- Take advantage of discounts (such as good student or safe driver discounts)

- Shop around and compare quotes from multiple insurers

The Bottom Line

If you have a full coverage policy with State Farm, you can rest assured that you have protection against a wide range of potential risks on the road. However, it’s important to understand the specifics of your policy and any exclusions or limitations that may apply. If you’re looking to save money on your premiums, consider adjusting your coverage levels or taking advantage of discounts and other cost-saving strategies.

Understanding the Basics of State Farm Full Coverage is essential for any car owner. It’s critical to know what you’re paying for and what coverage options you have available in case of an accident or other damage to your vehicle. Full coverage insurance is an option that covers both liability and physical damage to your car. Liability coverage is required by law, but it only covers damages to other people’s property and injuries. Full coverage adds protection for your own vehicle. However, it’s important to note that full coverage doesn’t cover everything. Understanding the limitations of your policy is crucial.The Importance of Knowing the Limitations of Your Policy cannot be overstated. While full coverage may seem like the ultimate protection for your vehicle, there are limitations to what it covers. For example, full coverage doesn’t cover wear and tear on your car or mechanical breakdowns. It also doesn’t cover damages caused by intentional acts or criminal behavior. It’s important to read and understand your policy’s terms and conditions to know what is and isn’t covered. This knowledge will help you make informed decisions about your coverage needs.Is Liability Coverage Enough? Liability coverage is mandatory in most states, but it only covers damages and injuries to others in an accident. If you’re at fault in an accident, liability coverage won’t protect your vehicle. That’s where full coverage comes in. Full coverage combines liability coverage with physical damage coverage for your vehicle. It’s a way to give yourself peace of mind and protect your investment.How Full Coverage Can Protect Your Vehicle. Full coverage protects your vehicle from various types of damage, including collisions, theft, vandalism, and weather-related incidents. If you’re in an accident, collision coverage pays for damages to your car. Comprehensive coverage covers non-collision incidents such as theft, fire, or weather damage. Both types of coverage can help you repair or replace your vehicle without having to pay out of pocket.Examining the Different Types of Coverage Available. When shopping for full coverage insurance, it’s important to understand the different types of coverage available. Collision coverage pays for damages to your car in a collision, while comprehensive coverage covers non-collision incidents. Liability coverage covers damages and injuries you may cause to others. Uninsured motorist coverage protects you if you’re hit by an uninsured driver. Personal injury protection (PIP) covers medical expenses and lost wages for you and your passengers. Roadside assistance coverage provides help if your car breaks down or you have a flat tire.The Cost of Comprehensive Coverage: Is it Worth it? Comprehensive coverage can be expensive, but it’s worth considering if you live in an area prone to weather-related damage or theft. It’s also a good idea if you have a newer or more expensive car. The cost of comprehensive coverage will vary based on factors such as your driving record, age, and location. Be sure to shop around and compare prices from different insurance companies.What’s Covered Under Collision Coverage. Collision coverage pays for damages to your car in an accident, regardless of who is at fault. This type of coverage includes damages from hitting another car, a tree, or a building. It also covers damages from single-car accidents such as hitting a pothole or a guardrail. Collision coverage typically has a deductible, which is the amount you pay out of pocket before your insurance kicks in.The Benefits of Adding Uninsured Motorist Coverage. Uninsured motorist coverage protects you if you’re hit by a driver who doesn’t have insurance. It also covers hit-and-run accidents. If you’re in an accident with an uninsured driver, you could be left with significant expenses. Uninsured motorist coverage ensures that you’re protected in this situation.Taking Advantage of State Farm’s Rental Car Coverage. State Farm offers rental car coverage as an add-on to your full coverage policy. This coverage pays for a rental car if your car is being repaired due to a covered incident. Rental car coverage can save you money and provide peace of mind if you rely on your car for transportation.Navigating Deductibles: Choosing the Right Option for You. Full coverage insurance typically has a deductible, which is the amount you pay out of pocket before your insurance kicks in. Choosing the right deductible can be tricky. A higher deductible will lower your monthly premium, but it also means you’ll pay more out of pocket if you need to make a claim. A lower deductible will increase your monthly premium but lower your out-of-pocket expenses. Consider your budget and how much risk you’re willing to take on when choosing your deductible.In conclusion, understanding State Farm Full Coverage is crucial for any car owner. It’s important to know the limitations of your policy and what coverage options are available. Liability coverage is mandatory, but it may not be enough to protect your vehicle. Full coverage combines liability coverage with physical damage coverage for your car. Examining the different types of coverage available and navigating deductibles can help you make informed decisions about your coverage needs. Consider the benefits of adding comprehensive, uninsured motorist, and rental car coverage to your policy. With the right coverage, you can have peace of mind and protect your investment.

As I sat in my car, watching the chaos of the accident scene unfold, I couldn’t help but feel grateful for my State Farm Full Coverage policy. Here’s why:

Bullet Points:

- My State Farm Full Coverage policy includes liability coverage, which means that if I’m at fault in an accident, State Farm will cover the costs of any damage or injuries I cause to others.

- State Farm Full Coverage also includes collision coverage, which means that if I’m involved in an accident with another vehicle, State Farm will cover the cost of repairs to my car.

- If my car is stolen or damaged by something other than a collision, like a hailstorm or a fallen tree, my State Farm Full Coverage policy includes comprehensive coverage.

- One of the best things about my State Farm Full Coverage policy is that it includes uninsured motorist coverage. This means that if I’m in an accident with someone who doesn’t have insurance, State Farm will cover my costs.

Overall, I have peace of mind knowing that I’m covered in case of an accident or unexpected damage to my car. While I hope I never have to use my State Farm Full Coverage policy, I’m glad that it’s there just in case.

Hello there, dear reader! Thank you for taking the time to read through our article on State Farm Full Coverage without title. We hope that it has been informative and useful in answering any questions you may have had regarding this topic.

As we have discussed, State Farm Full Coverage without title is a great option for those who have purchased a vehicle but are still in the process of obtaining the title. This type of coverage is designed to protect your investment and provide you with peace of mind while you wait for your title to arrive.

While we cannot speak for every individual case, we do know that State Farm is committed to providing excellent customer service and support. They are available to answer any questions you may have about your policy and can help you determine if Full Coverage without title is the right choice for you.

We hope that you found this article helpful and informative. If you have any additional questions or concerns, please do not hesitate to reach out to us or your local State Farm representative. Thank you again for reading, and we wish you all the best as you navigate the world of auto insurance and vehicle ownership!

.

People also ask about Does My State Farm Full Coverage:

- What does State Farm full coverage include?

- Is State Farm full coverage expensive?

- Does State Farm full coverage cover rental cars?

- Does State Farm full coverage cover towing?

- Can I customize my State Farm full coverage?

State Farm full coverage typically includes liability, collision, and comprehensive insurance. Liability covers damages to other people and their property if you’re at fault in an accident. Collision covers damages to your vehicle if you’re involved in an accident. Comprehensive covers damages from non-collision incidents, like theft or natural disasters.

The cost of State Farm full coverage can vary depending on several factors, including your age, driving history, location, and the type of vehicle you own. However, State Farm is known for offering competitive rates and discounts, so it’s worth getting a quote to see how much full coverage would cost you.

State Farm full coverage typically includes rental car reimbursement, which means that if your car is being repaired after an accident, State Farm will cover the cost of renting a car until your car is ready. However, this coverage may have limits, so it’s important to check with your State Farm agent to see how much coverage you have.

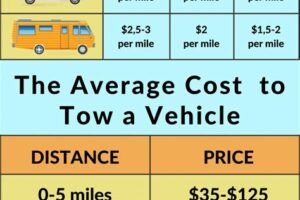

State Farm full coverage may include roadside assistance, which can cover the cost of towing your vehicle if it breaks down. However, this coverage may have limits and may not be available in all areas, so it’s important to check with your State Farm agent to see what coverage you have.

Yes, State Farm allows you to customize your coverage based on your individual needs. You can add additional coverage options, like uninsured motorist coverage or personal injury protection, to your policy for extra protection. Your State Farm agent can help you determine what additional coverage options are right for you.