Table of Contents

Wondering if State Farm covers your new car? Find out all the details about their coverage options and get peace of mind on the road.

Are you in the market for a new car, but worried about finding the right insurance coverage? Look no further than State Farm. As one of the largest insurers in the country, State Farm offers a range of policies to fit your needs and budget. But does State Farm cover new cars specifically? The answer is yes – and they do it with their signature mix of affordability and quality service. So if you’re ready to hit the road in your brand new ride, read on to learn more about what State Farm can offer you.

Understanding the importance of a car title is crucial when purchasing a new vehicle. A car title is a legal document provided by the state that proves ownership of a vehicle. It contains important information such as the vehicle identification number (VIN), the make and model of the vehicle, and the owner’s name and address. Without a car title, it can be difficult to obtain insurance coverage for a new car.

Can you get insurance for a new car without a title? The answer is no. Insurance companies require proof of ownership before providing coverage for a new car. This is because the owner of the vehicle is liable for any damages or accidents that occur while driving the car. Without a title, there is no way to prove that the individual requesting insurance coverage is the rightful owner of the vehicle.

State Farm is a popular insurance company that provides coverage for new cars. Their policies and requirements for new car insurance vary depending on the state in which the vehicle is registered. In general, State Farm requires the owner of a new car to provide proof of ownership in the form of a car title or registration paperwork.

How does State Farm determine coverage for a new car without a title? In some cases, State Farm may accept a temporary registration or bill of sale as proof of ownership. However, this is not always the case and is dependent on the specific circumstances surrounding the purchase of the vehicle.

What documents are required to secure new car insurance with State Farm? To secure new car insurance with State Farm, the owner of the vehicle must provide proof of ownership in the form of a car title or registration paperwork. Additionally, the owner must provide personal information such as their name, address, and driver’s license number. The make and model of the vehicle, as well as the VIN, are also required.

Can a temporary registration or bill of sale sufficiently secure new car insurance? It is possible, but not always guaranteed. State Farm’s policies on temporary registration and bill of sale vary depending on the state in which the vehicle is registered. It is best to consult with a State Farm representative to determine if these documents are sufficient for obtaining new car insurance.

There are several advantages to securing insurance for a new car from State Farm. State Farm offers a variety of coverage options to fit the needs of each individual customer. Additionally, they have a reputation for providing excellent customer service and handling claims quickly and efficiently.

However, there are potential challenges that may arise when attempting to obtain insurance for a new car without a title. In some cases, the process may be more complicated or take longer than expected. It is important to be patient and prepared when working with an insurance company to obtain coverage for a new car.

When requesting new car insurance from State Farm without a title, there are several steps to follow. First, contact a State Farm representative to discuss your specific situation and determine what documentation is required. Then, gather all necessary paperwork and submit it to the insurance company for review. Be prepared to answer any additional questions or provide additional information as needed.

In summary, obtaining insurance coverage for a new car without a title can be a complex process. State Farm requires proof of ownership in the form of a car title or registration paperwork. While a temporary registration or bill of sale may suffice in some cases, it is not always guaranteed. It is important to consult with a State Farm representative and be prepared to provide all necessary documentation and personal information when requesting new car insurance.

Key takeaways from State Farm’s coverage for new cars without a title include understanding the importance of a car title, knowing that insurance cannot be obtained without proof of ownership, familiarizing oneself with State Farm’s policies and requirements, and being prepared to provide all necessary documentation and personal information when requesting insurance coverage.

Once upon a time, I was in the market for a new car. I had done my research and finally found the perfect vehicle. But before making the purchase, I had to make sure that my insurance would cover it. That’s when I started wondering, does State Farm cover new cars?

Point of View: Personal Experience

- As someone who has been a loyal customer of State Farm for years, I was confident that they would provide the coverage I needed for my new car.

- After speaking with my agent, I was relieved to find out that State Farm did indeed cover new cars.

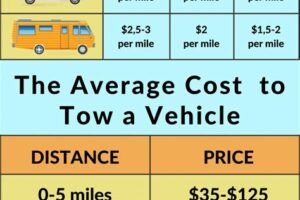

- Not only did they provide comprehensive coverage for accidents and theft, but they also offered additional options like gap insurance and roadside assistance.

- My agent explained that State Farm’s coverage extended to new cars and used cars, as long as they were registered and titled under my name.

- I was impressed with State Farm’s commitment to providing their customers with reliable and comprehensive coverage.

Point of View: Creative Voice

- State Farm has got you covered! Yes, they do cover new cars.

- You can rest easy knowing that your shiny new ride is protected against accidents, theft, and more.

- But wait, there’s more! State Farm also offers additional coverage options like gap insurance and roadside assistance.

- So go ahead and get that dream car you’ve always wanted, because State Farm has your back.

- Trust in State Farm’s commitment to providing their customers with top-notch coverage, no matter what kind of car you drive.

In conclusion, State Farm does indeed cover new cars. Whether you’re looking for basic coverage or additional options, they have everything you need to protect your investment. So go ahead and get that new car you’ve been eyeing, knowing that State Farm has got you covered.

Thank you for taking the time to read about State Farm’s coverage for new cars without titles. We understand that purchasing a new car can be an exciting and overwhelming experience, and we want to ensure that you have all the information you need to protect your investment.

As we mentioned in the article, State Farm provides coverage for new cars without titles through our comprehensive and collision insurance policies. These policies offer protection against damages or losses caused by accidents, theft, vandalism, and natural disasters, among other things. However, it is important to note that State Farm may require proof of ownership or other documentation before providing coverage for a new car without a title.

At State Farm, we are committed to providing our customers with the best possible coverage and customer service. If you have any questions or concerns about coverage for your new car without a title, we encourage you to reach out to one of our knowledgeable agents. Our team is always available to help you navigate the sometimes complicated world of insurance and ensure that you have the coverage you need to protect your new car.

Again, thank you for reading our article. We hope that it has been helpful in answering your questions about State Farm’s coverage for new cars without titles. Remember, State Farm is here to help you protect your investment and provide peace of mind on the road.

.

When it comes to purchasing a new car, one of the most important things to consider is insurance coverage. State Farm is one of the top providers of auto insurance in the United States, but does it cover new cars? Below are some of the most common questions people ask about State Farm’s coverage for new cars:

-

Does State Farm offer coverage for new cars?

Yes, State Farm offers coverage for new cars. They offer a variety of different coverage options that can be customized to fit your needs and budget.

-

What types of coverage does State Farm offer for new cars?

State Farm offers a variety of different coverage options for new cars, including liability, collision, comprehensive, and personal injury protection (PIP) coverage.

-

Will State Farm cover the full cost of a new car if it’s totaled?

It depends on the specific policy you have with State Farm. Some policies will cover the full cost of a new car if it’s totaled, while others may only cover the actual cash value of the car at the time of the accident.

-

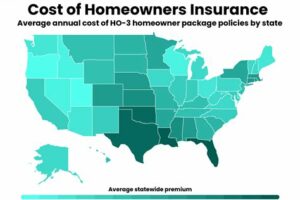

Is State Farm more expensive for new cars?

The cost of insurance for a new car can vary depending on a number of factors, including the make and model of the car, your driving history, and your location. While State Farm may be more expensive for some drivers with new cars, they also offer a variety of discounts that can help lower your premiums.

-

Does State Farm offer any discounts for new cars?

Yes, State Farm offers a variety of discounts for new cars, including discounts for safety features, anti-theft devices, and good driving habits. They also offer a discount for insuring multiple vehicles with them.

Overall, State Farm does offer coverage for new cars and has a variety of different options to choose from. While the cost of insurance for a new car can vary, State Farm offers discounts that can help lower your premiums. It’s important to review your policy and speak with an agent to determine the best coverage options for you and your new car.