Table of Contents

Wondering if State Farm renters insurance covers mold? Find out here. Protect your belongings and living space from potential mold damage.

Do you know if your State Farm renters insurance covers mold? If you’re a renter, mold can be a serious concern that can cause health issues and damage to your property. Mold can grow in hidden spaces such as walls, ceilings, and floors, making it difficult to detect until it’s too late. This is where your renters insurance policy comes in. However, not all policies cover mold damage, which can leave you with a hefty bill. That’s why it’s important to understand what your State Farm renters insurance policy covers when it comes to mold. So, let’s dive into the details and find out if you’re protected.

When it comes to home insurance, many people assume that their policy covers everything. However, this is not always the case, and it is important to understand what your policy covers and what it does not. One of the most common questions renters ask is whether their State Farm renters insurance covers mold. In this article, we will explore this topic and provide you with all the information you need.

Mold: What is it?

Mold is a type of fungus that grows in damp areas. It can be found both indoors and outdoors and is often present in areas such as bathrooms, kitchens, and basements. Mold can cause a variety of health problems, including respiratory issues, allergies, and infections. It can also damage your property, including your furniture, walls, and floors.

Does State Farm Renters Insurance Cover Mold?

The answer to this question is not straightforward. Whether your State Farm renters insurance covers mold depends on the cause of the mold and the type of coverage you have. Generally, if the mold is caused by a covered peril, such as water damage from a burst pipe, then your policy may cover the cost of mold remediation. However, if the mold is caused by neglect or lack of maintenance, then your policy may not cover it.

Types of Coverage for Mold

There are two types of coverage for mold: limited and comprehensive. Limited coverage only covers mold caused by a covered peril, such as water damage from a burst pipe. Comprehensive coverage covers both mold caused by a covered peril and mold caused by other factors, such as neglect or lack of maintenance.

What to do if you Discover Mold

If you discover mold in your rental property, the first thing you should do is contact your landlord or property manager. They will be responsible for addressing the issue, whether it is through mold remediation or repairs to prevent further mold growth. It is also important to contact your insurance provider to determine whether your policy covers the cost of mold remediation.

Preventing Mold in Your Rental Property

The best way to deal with mold is to prevent it from growing in the first place. Here are some tips for preventing mold in your rental property:

- Keep humidity levels low by using a dehumidifier or air conditioner.

- Fix any leaks or water damage as soon as possible.

- Clean up spills and messes immediately.

- Use exhaust fans in bathrooms and kitchens.

- Open windows and doors to increase ventilation.

In Conclusion

If you have State Farm renters insurance, it may cover mold remediation if the mold is caused by a covered peril. However, if the mold is caused by neglect or lack of maintenance, then your policy may not cover it. To be sure, check with your insurance provider and review your policy carefully. If you discover mold in your rental property, contact your landlord or property manager immediately to address the issue.

As a renter, you may be concerned about the potential for mold growth in your living space and whether your State Farm renters insurance policy covers damages related to mold. Mold is a type of fungus that thrives in damp environments with high humidity levels, and it can cause health problems and property damage.

Understanding the causes and risks of mold is crucial to preventing its growth in your rental space. Mold can grow on various surfaces, including walls, ceilings, and furniture, and exposure to mold can lead to respiratory problems, skin irritation, and other health issues.

The good news is that State Farm renters insurance policies typically provide coverage for mold damage caused by covered perils. If the mold is caused by water damage from a burst pipe, overflowing sink, or natural disaster, your policy should cover the cost of remediation, including mold removal.

However, if the mold is caused by negligence or poor maintenance on your part as the renter, State Farm may not cover damages related to mold growth. It’s your responsibility to keep your living space clean and dry to prevent mold growth.

Like all insurance policies, State Farm’s renters insurance coverage for mold is subject to certain limits. Homeowners may want to consider optional endorsements, including extra coverage for mold, to ensure they are fully protected.

If you experience mold growth in your rented property, you should notify your landlord immediately and take photos to document the damage. Contact State Farm’s claims department as soon as possible to file a claim for the damages.

To prevent mold growth in your rental space, it’s important to keep it clean, dry, and well-ventilated. Use a dehumidifier if necessary to keep moisture levels in check, and address any water leaks or plumbing issues promptly.

In conclusion, State Farm renters insurance generally covers mold caused by covered perils and can provide financial protection in the event of mold damage. However, it’s important to take preventative measures to avoid mold growth and take responsibility for proper maintenance in your rented space.

Have you ever wondered if your State Farm renters insurance covers mold? Well, let me tell you a story about a young couple named Lisa and Tom who had to deal with this exact issue.

1. Lisa and Tom’s Dream Apartment

Lisa and Tom moved into their dream apartment in the heart of the city. It was a cozy one-bedroom apartment with a beautiful view of the skyline. They were thrilled to start their new life together in such a perfect place.

2. The Unpleasant Discovery

However, a few months after they settled in, they noticed a strange smell coming from the bathroom. At first, they thought it was just a clogged drain, but when they investigated further, they discovered that there was mold growing behind the walls.

3. The Frustrating Search for Solutions

Lisa and Tom tried everything they could think of to get rid of the mold, but nothing seemed to work. They contacted their landlord, who promised to take care of the problem, but weeks went by without any action being taken. Lisa and Tom were frustrated and worried about their health since mold can cause respiratory problems.

4. The Relief of State Farm Renters Insurance

Finally, Lisa remembered that they had State Farm renters insurance. She called their agent and explained the situation. To her relief, she found out that their policy covered mold damage caused by a covered peril, such as a burst pipe or storm damage. Their agent advised them to file a claim and provided them with the necessary information.

5. The Happy Ending

Thanks to their State Farm renters insurance, Lisa and Tom were able to hire professionals to remediate the mold and repair the damage. They were relieved that the problem was finally taken care of, and they could breathe easy again. They were grateful that their insurance policy covered the cost of the repairs and that they didn’t have to pay out of pocket.

So, the answer to the question, Does State Farm renters insurance cover mold? is yes, but it depends on the cause of the mold. If it’s caused by a covered peril, your policy may provide coverage. It’s always a good idea to review your policy and discuss any concerns with your agent to make sure you have the right coverage for your needs.

Hello there, dear blog visitors! We hope you’ve found our article on State Farm renters insurance and mold to be informative and helpful. As we wrap things up, we’d like to leave you with a few final thoughts.

First and foremost, if you’re a renter, it’s important to understand that mold is a serious issue that can have harmful effects on your health and your home. That’s why having renters insurance that covers mold is so crucial. With State Farm, you can rest assured knowing that you’re protected in the event of a mold problem in your rental property.

Of course, prevention is always better than cure. If you’re concerned about mold growth in your home, be sure to take steps to prevent it from occurring in the first place. This might include keeping your home well-ventilated, fixing any leaks or water damage promptly, and using mold-resistant products where possible.

Finally, we want to emphasize that while State Farm does cover mold under certain circumstances, it’s important to read your policy carefully and understand exactly what is and isn’t covered. If you have any questions or concerns about your coverage, don’t hesitate to reach out to your State Farm agent for assistance.

Thank you for taking the time to read our article. We hope you found it useful, and we wish you all the best in your search for the right renters insurance policy!

.

People also ask about Does State Farm Renters Insurance Cover Mold:

-

Does State Farm renters insurance cover mold?

Yes, State Farm renters insurance covers mold damage caused by a covered peril. However, it does not cover mold remediation or removal if the mold is caused by long-term neglect or lack of maintenance.

-

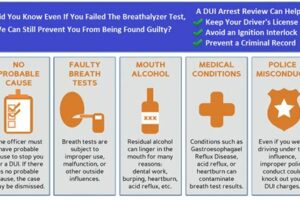

What is considered a covered peril for mold damage under State Farm renters insurance?

A covered peril for mold damage under State Farm renters insurance includes water damage caused by burst pipes or fire suppression efforts, as well as storm damage that allows water to enter the rental property.

-

Does State Farm renters insurance cover mold caused by a tenant’s negligence?

No, State Farm renters insurance does not cover mold caused by a tenant’s negligence or failure to maintain the rental property. It is the responsibility of the tenant to notify the landlord of any water leaks or other issues that could lead to mold growth.

-

How does one file a mold damage claim with State Farm renters insurance?

To file a mold damage claim with State Farm renters insurance, contact your local State Farm agent or call the claims department at 1-800-732-5246. Be prepared to provide documentation of the damage and any expenses incurred as a result of the mold, such as hotel expenses if you had to temporarily relocate due to the mold.

-

What steps can renters take to prevent mold growth in their rental property?

Renters can take several steps to prevent mold growth in their rental property, including:

- Reporting any water leaks or damage to the landlord immediately

- Running a dehumidifier to keep humidity levels below 50%

- Venting bathrooms, kitchens, and laundry areas to the outside

- Cleaning up spills and drying wet areas promptly

- Using mold-resistant products, such as paint and drywall, when possible

By understanding what is covered under State Farm renters insurance for mold damage, renters can make informed decisions about their coverage and take steps to prevent mold growth in their rental property.