Table of Contents

State Farm offers a wide range of insurance coverage, including car, home, life, and health insurance. Protect what matters most with State Farm.

Are you looking for an insurance provider that offers comprehensive coverage and exceptional customer service? Look no further than State Farm. As one of the largest insurance companies in the United States, State Farm provides a wide range of insurance products to meet your needs. Whether you’re in the market for auto, home, life, or health insurance, State Farm has got you covered. With over 19,000 agents across the country, you can trust that State Farm will be there for you when you need them most. Plus, their innovative tools and resources make managing your policies and claims a breeze. So why wait? Contact State Farm today and see why so many Americans trust them for their insurance needs.

State Farm is a well-known insurance provider in the United States, offering a variety of insurance products to its customers. From auto insurance to homeowners insurance, State Farm has something for everyone. But what type of insurance is State Farm really known for?

Auto Insurance

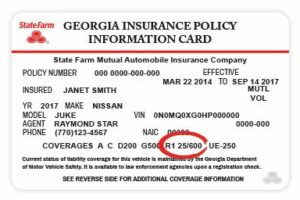

One of State Farm’s most popular insurance products is auto insurance. With State Farm auto insurance, policyholders can get coverage for liability, collision, and comprehensive damages. State Farm also offers optional coverage for things like rental cars and roadside assistance.

If you’re in an accident, State Farm’s auto insurance will cover the cost of repairs or replacement of your vehicle, as well as any medical expenses that may arise. Additionally, State Farm offers discounts for safe driving and multiple vehicles on one policy.

Overall, State Farm’s auto insurance is known for its comprehensive coverage and competitive rates.

Homeowners Insurance

State Farm also offers homeowners insurance, which provides coverage for your home, personal property, and liability. With State Farm homeowners insurance, policyholders can get coverage for things like fire, theft, and natural disasters.

If your home is damaged or destroyed, State Farm’s homeowners insurance will cover the cost of repairs or rebuilding. Additionally, if someone is injured on your property, State Farm’s liability coverage will protect you from lawsuits or other legal action.

State Farm’s homeowners insurance is known for its comprehensive coverage and competitive rates, making it a popular choice among homeowners.

Life Insurance

In addition to auto and homeowners insurance, State Farm also offers life insurance. Life insurance provides financial protection for your loved ones in the event of your death.

With State Farm life insurance, policyholders can choose from term life or whole life policies. Term life policies provide coverage for a set period of time, while whole life policies provide coverage for the policyholder’s entire life.

If the policyholder dies, State Farm’s life insurance will provide a lump sum payment to the beneficiary, which can be used to cover expenses like funeral costs, outstanding debts, and living expenses.

State Farm’s life insurance is known for its customizable coverage options and competitive rates.

Renters Insurance

If you’re renting a home or apartment, State Farm also offers renters insurance. Renters insurance provides coverage for your personal property, liability, and additional living expenses.

If your belongings are damaged or stolen, State Farm’s renters insurance will cover the cost of repairs or replacement. Additionally, if someone is injured in your rental unit, State Farm’s liability coverage will protect you from lawsuits or other legal action.

State Farm’s renters insurance is known for its affordable rates and customizable coverage options.

Health Insurance

Finally, State Farm also offers health insurance to its customers. Health insurance provides coverage for medical expenses, like doctor visits, hospital stays, and prescription medications.

With State Farm health insurance, policyholders can choose from a variety of plans, including HMOs, PPOs, and high-deductible plans. Additionally, State Farm offers optional coverage for things like dental and vision care.

State Farm’s health insurance is known for its affordable rates and comprehensive coverage options.

Conclusion

Overall, State Farm is known for its comprehensive insurance products and competitive rates. Whether you’re looking for auto insurance, homeowners insurance, life insurance, renters insurance, or health insurance, State Farm has something for everyone.

If you’re in the market for insurance, consider getting a quote from State Farm to see if they can provide the coverage you need at a price you can afford.

If you are looking for reliable insurance coverage, State Farm is a name you can trust. With over 19,000 agents and approximately 83 million policies in force, this company is one of the largest insurers in the United States. So what type of insurance is State Farm? Let’s take a closer look.

The Basics of State Farm Insurance: What You Need to Know

State Farm offers a wide range of insurance products and services to meet the needs of individuals, families, and businesses. The company was founded in 1922 by George J. Mecherle, a retired farmer and insurance salesman who believed in providing affordable coverage to rural communities. Today, State Farm operates in all 50 states and Canada, offering auto, home, life, health, and business insurance.

Understanding How State Farm Works: Insurance Products and Services

State Farm’s insurance products are designed to provide protection and peace of mind to policyholders. Whether you need coverage for your car, home, or business, State Farm has a solution that can meet your needs. The company also offers life insurance and health insurance, which can help protect your family’s financial future in case of unexpected events.

State Farm Car Insurance: How to Get the Right Coverage for Your Needs

If you own a vehicle, you need car insurance. State Farm offers a variety of auto insurance options, including liability coverage, collision coverage, comprehensive coverage, and personal injury protection. Depending on your needs and budget, you can choose the right level of coverage to protect yourself and your car.

Protecting Your Home and Belongings with State Farm Home Insurance

Your home is likely your most valuable asset, so it’s important to protect it with the right insurance coverage. State Farm offers homeowners insurance that can cover damage to your home, as well as your personal belongings. You can also add optional coverage for things like water damage, earthquake damage, and identity theft.

Building Confidence for Your Future with State Farm Life Insurance

If you have loved ones who depend on you financially, life insurance can provide them with the financial support they need in case of your unexpected death. State Farm offers whole life insurance, term life insurance, and universal life insurance, which can help protect your family’s financial future.

Navigating Health Coverage with State Farm Health Insurance Options

Healthcare costs can be expensive, so it’s important to have health insurance that can help cover the expenses. State Farm offers health insurance options for individuals and families, including major medical insurance, short-term health insurance, and Medicare supplement insurance. You can choose the coverage that best fits your needs and budget.

Business Insurance Solutions with State Farm for Entrepreneurs

If you own a small business, you need insurance coverage to protect your assets and liabilities. State Farm offers business insurance options that can cover property damage, liability claims, and business interruption. You can also add coverage for things like cyber liability and data breach.

The Importance of Umbrella Policies: What State Farm Offers

An umbrella policy provides additional liability coverage beyond the limits of your other insurance policies. State Farm offers umbrella policies that can provide coverage up to $10 million, which can help protect your assets in case of a lawsuit or other liability claim.

State Farm’s Approach to Insurance: Personalized Service for Every Client

At State Farm, customer service is a top priority. The company’s agents are committed to providing personalized service to every client, helping them choose the right insurance products and services for their unique needs and budget. With State Farm, you can feel confident that you are getting the coverage you need and the service you deserve.

Making Insurance Accessible: State Farm’s Commitment to Diversity and Inclusion

State Farm is committed to making insurance accessible to everyone, regardless of their background or circumstances. The company has a strong commitment to diversity and inclusion, and works to ensure that all customers have access to the insurance products and services they need.

In conclusion, State Farm offers a wide range of insurance products and services to meet the needs of individuals, families, and businesses. Whether you need coverage for your car, home, life, health, or business, State Farm has a solution that can meet your needs. With personalized service and a commitment to diversity and inclusion, State Farm is a name you can trust for reliable insurance coverage.

Once upon a time, there was a person named Jane who just got her driver’s license. She was excited to get on the road and explore the world. However, she realized that with great freedom comes great responsibility, and she needed to get car insurance.

After doing some research, Jane discovered State Farm Insurance. Here are some key points about what type of insurance State Farm offers:

- State Farm offers auto insurance that covers liability, collision, and comprehensive coverage.

- Liability coverage helps pay for damages or injuries you cause to others in an accident.

- Collision coverage helps pay for damages to your car if you hit another car or object.

- Comprehensive coverage helps pay for damages to your car from non-collision incidents, such as theft or weather damage.

- State Farm also offers other types of insurance, such as homeowners, renters, life, and health insurance.

Jane felt relieved to know that State Farm had her covered. She contacted an agent and received a quote for her car insurance. The agent explained the different coverage options and helped her choose the best plan for her needs and budget.

Jane appreciated the personalized service from State Farm and felt confident knowing that she had a reliable insurance plan in place. She knew that accidents could happen at any time, but with State Farm, she was prepared for whatever the road had in store for her.

In conclusion, State Farm offers a variety of insurance options to meet the needs of different individuals and situations. Whether you’re looking for auto, home, life, or health insurance, State Farm has you covered. With their personalized service and dependable coverage, you can rest assured that you’re in good hands.

Thank you for taking the time to visit our blog and learning about State Farm insurance. We hope that our comprehensive guide has provided you with all the information you need to make an informed decision about what type of insurance is right for you. State Farm offers a wide range of insurance products, including auto, home, life, and health insurance, as well as banking and financial services.

One of the key benefits of choosing State Farm is their commitment to personalized service. With over 19,000 agents across the United States, State Farm is dedicated to providing their customers with individualized attention and support. Whether you need help selecting the right coverage or filing a claim, State Farm agents are there to assist you every step of the way. They also offer 24/7 customer support through their website and mobile app, so you can access your policy information and make changes whenever you need to.

Another advantage of choosing State Farm is their strong financial stability. As one of the largest and most reputable insurance companies in the world, State Farm has the resources to provide their customers with reliable and affordable coverage. They also have a proven track record of paying out claims promptly and efficiently, so you can rest assured that you will be taken care of in the event of an accident or other unexpected event.

In conclusion, State Farm insurance is an excellent choice for anyone looking for high-quality coverage and personalized service. Whether you need auto, home, life, or health insurance, State Farm has a variety of options to choose from, and their commitment to customer satisfaction ensures that you will receive the support you need when you need it most. Thank you again for visiting our blog, and we wish you all the best in your insurance journey!

.

What Type Of Insurance Is State Farm?

State Farm is one of the largest insurance companies in the United States, offering a wide range of insurance products that cater to the needs of individuals, families, and businesses. Here are some of the common types of insurance offered by State Farm:

- Auto Insurance: State Farm offers coverage for cars, trucks, motorcycles, boats, and other vehicles. Their policies typically include liability coverage, collision coverage, comprehensive coverage, and uninsured motorist coverage.

- Homeowners Insurance: State Farm provides coverage for homeowners, renters, and condos. Their policies typically cover damages caused by fire, theft, weather-related events, and other perils.

- Life Insurance: State Farm offers both term and permanent life insurance policies. Their policies provide financial protection to your loved ones in case of your untimely death.

- Health Insurance: State Farm offers individual and family health insurance plans that provide coverage for medical expenses, prescription drugs, and preventive care.

- Business Insurance: State Farm offers a variety of insurance products for small business owners, including liability insurance, property insurance, and workers’ compensation insurance.

- Banking Products: State Farm also offers banking products such as auto loans, home loans, and credit cards.

Overall, State Farm is a one-stop-shop for all your insurance needs. Whether you need coverage for your car, home, life, or business, State Farm has got you covered.