Curious about how illegal U-turns can impact your State Farm insurance? Find out what you need to know to stay protected on the road.

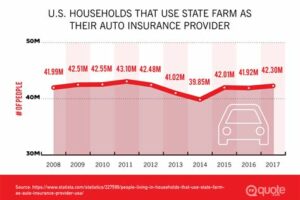

Illegal U-turns can be troublesome for drivers, especially when it comes to their insurance. State Farm, one of the largest insurers in the country, takes a firm stance when it comes to these types of violations. Not only can an illegal U-turn result in hefty fines, but it can also negatively impact your driving record and ultimately, your insurance rates. So, what does State Farm have to say about this? Let’s take a closer look at how illegal U-turns can affect your insurance coverage with State Farm and what steps you can take to avoid any potential consequences.

Illegal U-turns can have a significant impact on your State Farm insurance policy. As a driver, it’s important to understand the legality of U-turns and how they affect your insurance rates.

Firstly, let’s define what a U-turn is. A U-turn is a complete 180-degree turn made by a vehicle in the opposite direction. In some areas, U-turns are legal and allowed under certain circumstances. However, in many situations, making a U-turn is considered illegal and can result in hefty fines and penalties.

Under State Farm’s insurance policies, illegal U-turns are considered risky behavior for drivers. Insurance companies assess risk based on a variety of factors, including driving history and traffic violations. When drivers make illegal U-turns, they are putting themselves and others at risk on the road, which increases the likelihood of accidents and claims.

The consequences of being caught making an illegal U-turn on your insurance policy can be severe. Depending on the severity of the violation, State Farm may increase your insurance rates or even cancel your policy altogether. Insurance rates are determined based on risk, and drivers who engage in risky behavior are seen as high-risk individuals by insurers.

When determining the severity of an illegal U-turn violation, State Farm takes into account several factors. These include the location of the violation, the speed at which the driver was traveling, and the presence of other vehicles or pedestrians. The more dangerous the situation, the more severe the violation.

Factors that influence State Farm’s decision to raise your rates after an illegal U-turn violation include your driving history, the number of previous violations, and the severity of the current violation. Drivers who have a history of traffic violations or accidents are seen as higher risk by insurers and may face steeper rate increases.

If you believe that you have been unfairly charged with an illegal U-turn violation on your State Farm insurance policy, you may be able to dispute the charge. However, it’s important to keep in mind that insurance companies have a lot of power when it comes to determining rates and coverage. It’s always best to try to avoid violations in the first place.

Here are some tips for avoiding an illegal U-turn violation and protecting your insurance rates:

- Always obey traffic laws and signs

- Pay attention to road markings and signals

- Plan your route in advance to avoid situations where U-turns may be necessary

- Be aware of your surroundings and other vehicles on the road

- Practice defensive driving techniques to avoid accidents

Other traffic violations, such as speeding, running red lights, and driving under the influence, can also impact your State Farm insurance rates. It’s important to stay vigilant and obey traffic laws to maintain a good driving record and insurance rates.

In conclusion, illegal U-turns can have a significant impact on your State Farm insurance policy. Understanding the legality of U-turns and the consequences of violating traffic laws is essential for responsible driving. By following traffic laws and practicing safe driving techniques, you can protect yourself and your insurance rates from unnecessary risk.

Once upon a time, there was a young driver named Jack who was always in a hurry. One day, he took an illegal U-turn and unfortunately got into an accident. He was worried about the consequences of his actions, specifically how it would affect his insurance policy with State Farm.

From the point of view of an insurance agent at State Farm, taking an illegal U-turn can have serious consequences for a driver’s insurance policy. Here are some of the ways that an illegal U-turn can affect insurance with State Farm:

- Raised Rates: When a driver takes an illegal U-turn and gets into an accident, their insurance rates will almost certainly go up. This is because they are now considered a higher risk to insure, and State Farm will want to recoup some of the costs associated with their increased risk.

- Cancellation: If a driver takes an illegal U-turn and causes a serious accident, their insurance policy with State Farm may be cancelled altogether. This is because they are now considered too risky to insure, and State Farm may not want to take on the liability associated with insuring them.

- Loss of Coverage: If a driver takes an illegal U-turn and gets into an accident, their insurance policy may not cover all of the damages incurred. This is because insurance policies typically have exclusions for illegal activities, and taking an illegal U-turn is no exception.

As for Jack, he learned his lesson the hard way. He had to pay higher insurance rates and his coverage was limited due to his illegal U-turn. From then on, he made sure to follow traffic laws and avoid risky driving behaviors.

In conclusion, taking an illegal U-turn can have serious consequences for a driver’s insurance policy with State Farm. It is always best to follow traffic laws and avoid risky driving behaviors in order to maintain a good driving record and avoid any negative effects on one’s insurance policy.

Dear blog visitors,

Thank you for taking the time to read our article on how an illegal U-turn can affect your State Farm insurance. We hope that this information has been informative and helpful in understanding the consequences of making such a maneuver on the road.

It’s important to remember that the act of making an illegal U-turn is not only dangerous but also against the law. It can result in hefty fines, points on your license, and even court appearances. On top of that, it can have a significant impact on your car insurance rates with State Farm.

If you are found guilty of making an illegal U-turn, it may be considered a moving violation by State Farm. This can result in increased insurance premiums, loss of discounts, and even policy cancellations. It’s important to note that State Farm may also consider factors such as the severity of the violation, your driving record, and the frequency of violations when determining the impact on your insurance rates.

In conclusion, we urge all drivers to be mindful of the rules of the road and avoid making illegal U-turns at all costs. Not only does it put yourself and others in danger, but it can also have long-lasting consequences on your car insurance rates with State Farm. Drive safely, obey traffic laws, and always prioritize the safety of yourself and those around you.

Thank you again for visiting our blog and learning more about how an illegal U-turn can affect your State Farm insurance. We hope to provide you with more valuable insights and information in the future.

Video Does Illegal U Turn Affect Insurance State Farm

People often wonder if making an illegal U-turn affects their insurance with State Farm. Here are some frequently asked questions about the topic:

-

Question: Does making an illegal U-turn increase my insurance rates with State Farm?

Answer: It’s possible that making an illegal U-turn could result in a traffic violation, which could then lead to points on your driving record and potentially higher insurance rates. However, the specific impact on your rates will depend on your driving history and other factors. It’s best to contact your State Farm agent for more information.

-

Question: What happens if I get into an accident while making an illegal U-turn?

Answer: If you cause an accident while making an illegal U-turn, you will likely be considered at fault for the accident. This means that you may be responsible for paying damages to the other driver(s) involved. Additionally, your insurance rates could go up as a result of the accident.

-

Question: Can I still file a claim with State Farm if I’m in an accident while making an illegal U-turn?

Answer: Yes, you can still file a claim with State Farm if you’re in an accident while making an illegal U-turn. However, as mentioned earlier, you will likely be considered at fault for the accident, which could impact your rates.

-

Question: What should I do if I receive a ticket for making an illegal U-turn?

Answer: If you receive a ticket for making an illegal U-turn, you should contact your State Farm agent to discuss the potential impact on your insurance rates. Additionally, you may want to consider hiring a traffic lawyer to help fight the ticket and potentially reduce its impact on your driving record and insurance rates.

It’s important to always follow traffic laws and drive safely to avoid accidents and potential impacts on your insurance rates. If you have any further questions or concerns about how an illegal U-turn could affect your insurance with State Farm, don’t hesitate to reach out to your agent for guidance.