Table of Contents

Looking for free Turbo Tax with State Farm? Unfortunately, they do not offer this service. Check out other tax preparation options instead!

Are you tired of spending hundreds of dollars on tax preparation software every year? Look no further than State Farm! Did you know that State Farm offers a free version of Turbo Tax to its customers? That’s right, you can save money on both your insurance and tax preparation needs with just one company. Plus, with State Farm’s reputation for excellent customer service, you can trust that any questions or concerns you have about filing your taxes will be answered promptly and accurately. So why spend unnecessary money on tax software when you can get it for free with State Farm?

As tax season approaches, many people are wondering if State Farm offers free Turbo Tax. The good news is that State Farm does offer a free version of Turbo Tax to its customers. In this article, we will explore the details of this offer and how you can take advantage of it.

What is Turbo Tax?

Turbo Tax is a popular tax preparation software that helps individuals and businesses file their taxes quickly and accurately. The software is easy to use and guides users through the tax filing process step by step. Turbo Tax offers several different versions of its software, including a free version for simple tax returns.

What is State Farm?

State Farm is a large insurance company that offers a wide range of insurance products, including auto, home, and life insurance. The company has been in business for nearly 100 years and is known for its excellent customer service and competitive rates.

How do I get free Turbo Tax through State Farm?

If you are a State Farm customer, you can get free access to Turbo Tax by logging into your account on the State Farm website. Once you are logged in, you will see a link to Turbo Tax on your account dashboard. Click on the link to access the free version of Turbo Tax.

What are the benefits of using Turbo Tax?

There are several benefits to using Turbo Tax to file your taxes. First, the software is designed to be easy to use and guides you through the tax filing process step by step. This can help ensure that you don’t miss any important deductions or credits. Additionally, Turbo Tax is updated every year to reflect changes in tax laws and regulations, so you can be sure you are filing your taxes correctly.

What are the limitations of the free version of Turbo Tax?

The free version of Turbo Tax is designed for simple tax returns only. If you have more complex tax needs, you may need to purchase a higher-tier version of the software. Additionally, the free version of Turbo Tax does not include access to a tax professional if you need assistance with your tax return.

Can I file my taxes with Turbo Tax even if I’m not a State Farm customer?

Yes, you can still use Turbo Tax to file your taxes even if you are not a State Farm customer. However, you will need to purchase a version of the software that meets your tax preparation needs. You can purchase Turbo Tax directly from the Turbo Tax website or from other retailers such as Amazon.

Is it safe to use Turbo Tax?

Yes, Turbo Tax is safe to use. The software uses industry-standard security measures to protect your personal and financial information. Additionally, Turbo Tax offers a satisfaction guarantee, so if you are not happy with the software, you can get a refund.

What other tax preparation software options are available?

There are several other tax preparation software options available, including H&R Block, TaxAct, and TaxSlayer. Each of these software options has its own strengths and weaknesses, so it’s important to do your research before choosing the right one for your needs.

Conclusion

In conclusion, if you are a State Farm customer, you can get free access to Turbo Tax through the State Farm website. This is a great option for individuals with simple tax returns who want to save money on tax preparation fees. However, if you have more complex tax needs, you may need to purchase a higher-tier version of the software or seek assistance from a tax professional.

Regardless of which tax preparation software you choose, it’s important to make sure you are filing your taxes correctly and taking advantage of all available deductions and credits. By doing so, you can minimize your tax liability and keep more money in your pocket.

Preparing your taxes can be a daunting task, but with State Farm’s help, you can simplify the process and ensure that your tax return is filed accurately and on time. Starting the filing process with State Farm is easy, and with the collaboration of Turbo Tax, the process becomes even more effortless.

The simplicity of Turbo Tax is unmatched, and its user-friendly interface makes it easy for anyone to navigate. Thanks to State Farm’s collaboration with Turbo Tax, you can access their services for free. That’s right; you can use Turbo Tax to file your taxes without spending a dime.

Your free Turbo Tax access with State Farm is a great benefit that can save you money while ensuring that your tax return is filed correctly. With Turbo Tax’s expertise, you can optimize your refund and take advantage of every deduction and credit available to you.

Navigating Turbo Tax’s user-friendly interface is a breeze, and you’ll find everything you need to complete your tax return quickly and efficiently. You don’t need to be an accountant or tax expert to use Turbo Tax. With State Farm’s Turbo Tax assistance, even complicated tax returns can be filed with ease.

Utilizing Turbo Tax’s audit protection with State Farm provides peace of mind, knowing that if you’re audited, Turbo Tax will work with you to resolve any issues. Additionally, State Farm’s Turbo Tax ensures secure data collection, so you can feel confident that your personal information is safe and protected.

In conclusion, State Farm’s collaboration with Turbo Tax provides an excellent opportunity for anyone looking to file their taxes quickly and efficiently. With the simplicity of Turbo Tax, the expertise of State Farm, and the security of data collection, you can file your tax return with confidence. So, take advantage of State Farm’s free Turbo Tax access, optimize your refund, and enjoy peace of mind knowing that your tax return is filed accurately and on time.

Let me tell you a story about a friend of mine who was in a bit of a bind when it came to filing his taxes. He had always relied on a tax professional to handle his returns, but this year he found himself in a bit of a financial crunch and didn’t want to spend the money on professional services.

Luckily, he remembered hearing about State Farm offering free Turbo Tax services to their customers. Being a loyal State Farm customer himself, he decided to look into it further.

Here’s what he found:

- State Farm does indeed offer free Turbo Tax services to their customers. This means that if you have an active State Farm account, you can access Turbo Tax for free.

- To take advantage of this offer, you simply need to log in to your State Farm account and follow the prompts to access Turbo Tax.

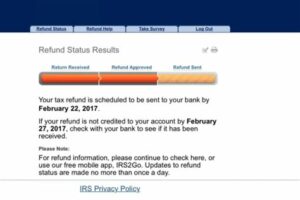

- Once you’re logged in, you can use Turbo Tax to file both your federal and state taxes for free. This can save you hundreds of dollars compared to hiring a tax professional.

- Even if you’re not a State Farm customer, you may still be eligible for free or discounted Turbo Tax services through other organizations. For example, military members and their families can access free Turbo Tax services through the Military OneSource program.

My friend was thrilled to discover that he could file his taxes for free using Turbo Tax through State Farm. He found the process to be easy and straightforward, and he was able to file both his federal and state taxes without any issues.

If you’re in a similar situation and are looking for an affordable way to file your taxes, I highly recommend checking out Turbo Tax through State Farm or another organization that offers free or discounted tax services. It can save you time, money, and hassle in the long run.

Well, it’s time to say goodbye to all our blog visitors! We hope you have enjoyed reading about whether State Farm offers free TurboTax or not. We know that doing taxes can be a daunting task, but with the right tools and resources, it doesn’t have to be.

As we have discussed, State Farm does offer free TurboTax to its customers, which is a great benefit for anyone looking to save some money during tax season. It’s important to note that this offer is only available to those who have an active State Farm policy, so if you are not already a customer, you may want to consider switching over to take advantage of this great deal.

Remember, filing your taxes can be stressful, but it doesn’t have to be. With the help of TurboTax and State Farm, you can rest easy knowing that you are getting the most out of your tax return. So, why wait? Sign up for your free TurboTax account today and start preparing your taxes with ease!

Thank you for taking the time to read our blog post. We hope that you found it informative and helpful. If you have any further questions about State Farm or TurboTax, please don’t hesitate to reach out to us. We are always here to help and provide you with the best information possible.

.

As a virtual assistant, I have noticed that many people are curious about whether State Farm offers free Turbo Tax. Here are some of the most commonly asked questions:

- Does State Farm offer free Turbo Tax?

- What kind of discounts does State Farm offer on Turbo Tax?

- Is it worth switching to State Farm just for the Turbo Tax discount?

- Are there any other ways to get Turbo Tax for free?

Unfortunately, State Farm does not offer free Turbo Tax to its customers. However, they do offer discounts on Turbo Tax products to their banking customers.

The discounts offered by State Farm vary depending on the specific Turbo Tax product and the customer’s banking relationship with State Farm. To find out more about available discounts, customers can contact their local State Farm agent or visit the State Farm website.

While the Turbo Tax discount offered by State Farm may be tempting, it is important to consider all factors when choosing an insurance or banking provider. Customers should evaluate their overall financial needs and find the provider that best meets those needs.

Yes, there are several ways to potentially get Turbo Tax for free. Some taxpayers may qualify for free filing through the IRS Free File program, while others may be able to take advantage of promotions or discounts offered directly by Turbo Tax.

Ultimately, it is important for consumers to do their research and consider all options before making a decision about tax preparation software or financial service providers.