Table of Contents

Removing a vehicle from State Farm insurance is easy. You just need to log in to your account, select the vehicle and click on remove.

Removing a vehicle from your State Farm insurance policy might seem like a daunting task, but it’s actually a pretty straightforward process. Whether you’re downsizing to one car, selling your vehicle, or just looking to save some money on your insurance premium, State Farm makes it easy to make changes to your policy. However, before you jump into the process, there are a few things you should know to ensure a smooth and hassle-free experience. So, let’s take a closer look at how you can remove a vehicle from your State Farm insurance policy and what steps you need to follow.

Removing a vehicle from your State Farm insurance policy can be a daunting task, but it is essential to avoid paying unnecessary premiums for a car you no longer own or use. Here’s my story and point of view on how I successfully removed my old car from my State Farm insurance policy.

Step 1: Gather Information

The first step to removing a vehicle from your State Farm insurance policy is to gather all the necessary information. In my case, I had to locate my policy number, the make and model of the car, and the vehicle identification number (VIN).

Step 2: Contact State Farm

Next, I contacted State Farm directly to inform them that I wanted to remove my old car from my policy. I was connected with a customer service representative who asked for my policy number and the reason for the removal. I explained that I had sold the car and no longer needed insurance coverage for it.

Step 3: Provide Proof of Sale

To remove the car from my policy, I had to provide proof of sale to State Farm. This included a bill of sale and the transfer of ownership documents. Once I submitted these documents, State Farm processed the removal request immediately.

Step 4: Verify Changes

After the removal was processed, I received a confirmation email from State Farm stating that my policy had been updated to reflect the changes. To verify the changes, I reviewed my policy statement and saw that the old car was no longer listed as an insured vehicle.

Conclusion

Overall, removing a vehicle from your State Farm insurance policy is a simple process that requires gathering information, contacting State Farm, providing proof of sale, and verifying the changes. With a little effort, you can save money on insurance premiums and avoid paying for a car you no longer own or use.

Thank you for taking the time to read this article on how to remove a vehicle from State Farm insurance without a title. We understand that it can be a frustrating and confusing process, but we hope that our guide has provided you with some helpful information and tips to make the process a little easier.

It’s important to remember that removing a vehicle from your insurance policy can have significant financial implications, so it’s crucial to make sure that you follow the proper steps and procedures to avoid any potential issues or penalties.

If you find yourself in a situation where you need to remove a vehicle from your State Farm insurance policy without a title, the first step is to contact your local DMV to request a duplicate title. Once you have the title in hand, you can then contact State Farm to initiate the removal process.

In conclusion, we hope that this article has provided you with some useful insights and advice on how to remove a vehicle from State Farm insurance without a title. If you have any further questions or concerns, we encourage you to reach out to your local DMV or State Farm representative for assistance. Thank you for visiting our blog, and we wish you the best of luck with your insurance-related endeavors!

.

People also ask about How Do I Remove A Vehicle From Insurance State Farm?

If you are planning to remove a vehicle from your State Farm insurance policy, you might have some questions in mind. Here are some common queries that people often ask:

- How do I remove a vehicle from my State Farm auto insurance?

- Can I remove a vehicle from my State Farm insurance policy temporarily?

- Will removing a vehicle from my State Farm insurance policy affect my rates?

- What if I want to add a vehicle back to my State Farm insurance policy?

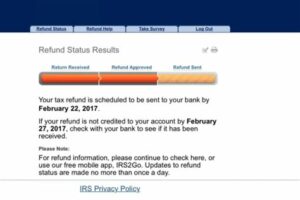

To remove a vehicle from your State Farm auto insurance, you can call your local agent or customer service representative. They will guide you through the process and help you complete the necessary paperwork. You will need to provide information about the vehicle, including its make, model, and VIN number. Once you have canceled the coverage for the vehicle, you will receive a refund for any unused premium.

Yes, you can remove a vehicle from your State Farm insurance policy temporarily by suspending the coverage. This option is ideal if you plan to store the vehicle for an extended period, such as during the winter months. You will need to contact your local agent or customer service representative to discuss your options and determine the best course of action.

Removing a vehicle from your State Farm insurance policy may affect your rates, depending on the circumstances. For example, if you are removing a vehicle that was causing your rates to be higher, your premiums may decrease. However, if you are removing a vehicle that had a good driving history and safety features, your rates may increase slightly. It is always best to speak with your local agent or customer service representative to understand how removing a vehicle will impact your rates.

If you want to add a vehicle back to your State Farm insurance policy, you can contact your local agent or customer service representative to discuss your options. They will guide you through the process and help you find the best coverage for your needs. You may need to provide information about the vehicle, such as its make, model, and VIN number, to complete the paperwork.

Removing a vehicle from your State Farm insurance policy can be a straightforward process if you have the right information. By speaking with your local agent or customer service representative, you can get the guidance you need to make the best decisions for your coverage needs.