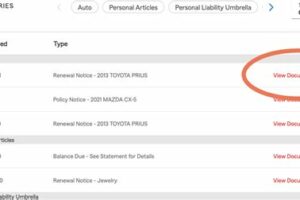

Curious about State Farm’s driving record check policy? Find out if they check your history every renewal and what it means for your premiums.

For many drivers, renewing their car insurance brings about a sense of dread. Will their rates increase? Will they be denied coverage altogether? And perhaps most worrisome of all: will their driving record be scrutinized? If you’re insured through State Farm, you may be wondering: does State Farm check your driving record every renewal? The answer isn’t straightforward, but it’s important to understand how your driving history can impact your insurance rates and overall coverage. So, let’s dive in and explore what you need to know about State Farm’s policies when it comes to your driving record.

State Farm Insurance is one of the largest auto insurance providers in the United States. When it comes to renewing your auto insurance policy with State Farm, you may be wondering if they check your driving record every renewal. It’s a valid concern, as your driving record can have a significant impact on your insurance premiums. In this article, we will explore whether State Farm checks your driving record every renewal.What is a Driving Record?Before we dive into whether State Farm checks your driving record every renewal, let’s first define what a driving record is. A driving record is a report that contains information about your driving history, including any traffic violations, accidents, and license suspensions. Your driving record is maintained by the Department of Motor Vehicles (DMV) in the state where you hold a driver’s license.Why Does Your Driving Record Matter?Your driving record matters because it’s used by insurance companies to determine your level of risk as a driver. If you have a history of traffic violations or accidents, insurance companies will see you as a higher risk driver and charge you higher premiums. On the other hand, if you have a clean driving record, you’ll be seen as a lower risk driver and pay lower premiums.Does State Farm Check Your Driving Record Every Renewal?Now, back to the question at hand: does State Farm check your driving record every renewal? The answer is not straightforward. State Farm does not check your driving record every renewal automatically. However, they do reserve the right to check your driving record at any time to determine your level of risk as a driver.When Does State Farm Check Your Driving Record?State Farm typically checks your driving record when you first apply for insurance with them. They will use the information on your driving record to determine your premium rate. Additionally, State Farm may check your driving record if you are involved in an accident or receive a traffic violation.How Often Should You Check Your Driving Record?While State Farm may not check your driving record every renewal, it’s still a good idea to check your driving record periodically. You can request a copy of your driving record from your state’s DMV. By checking your driving record, you can ensure that the information is accurate and up-to-date. If you notice any errors on your driving record, you can take steps to have them corrected.What Happens if State Farm Checks Your Driving Record?If State Farm checks your driving record and finds that you have a history of traffic violations or accidents, they may increase your premium rate. The amount of the increase will depend on the severity of the violations or accidents and how recent they were. In some cases, State Farm may even choose not to renew your policy if they deem you too high-risk as a driver.How Can You Lower Your Premium Rate?If you’re concerned about your driving record affecting your premium rate, there are steps you can take to lower it. First and foremost, drive safely and obey traffic laws. Avoid getting into accidents or receiving traffic violations. Additionally, you can look into taking a defensive driving course, which can help lower your premium rate.ConclusionIn conclusion, while State Farm does not check your driving record every renewal, they do reserve the right to check it at any time. Your driving record is an important factor in determining your insurance premiums, so it’s a good idea to check it periodically and strive to maintain a clean driving record. By doing so, you can potentially lower your premium rate and avoid any negative consequences from a high-risk driving record.

A commonly asked question among State Farm policyholders is whether or not the company checks their driving record every renewal. The short answer is yes – State Farm does review your driving record each time you renew your policy. But why is this important, and how does State Farm use your driving record? Understanding these factors can help you maintain a good driving record and avoid any negative consequences.

First and foremost, it’s crucial to understand the importance of your driving record. Your driving record is a history of your driving habits and any incidents that may have occurred while you were behind the wheel. This information is used by insurance companies to assess your risk as a driver and determine your insurance rates. A clean driving record indicates that you are a responsible driver and less likely to be involved in accidents, whereas a poor driving record suggests the opposite.

When it comes to State Farm, your driving record is one of several factors that the company uses to determine your insurance rates. State Farm uses a point system to evaluate your driving record, with points assigned for various types of violations or incidents. The more points you have on your driving record, the higher your insurance rates will be.

If your driving record has changed since you last renewed your policy, it could have an impact on your rates. For example, if you were involved in an accident or received a ticket for a moving violation, this could result in points being added to your driving record. On the other hand, if you’ve maintained a clean driving record, you may be eligible for discounts on your insurance rates.

There are several types of changes that might affect your driving record. These include traffic violations such as speeding or running a red light, accidents or collisions, and DUI or DWI convictions. Each of these incidents can result in points being added to your driving record, which can ultimately impact your insurance rates.

So what factors does State Farm consider when reviewing your driving record? In addition to the types of incidents mentioned above, State Farm also looks at the frequency and severity of these incidents. For example, a single speeding ticket may not have as much of an impact on your rates as multiple tickets or a DUI conviction.

It’s also important to note that State Farm doesn’t just look at your driving record when you initially sign up for coverage – they also review it periodically throughout the life of your policy. While the frequency of these checks can vary, it’s not uncommon for State Farm to review your driving record every time you renew your policy.

The consequences of having a poor driving record can be significant. In addition to higher insurance rates, you may also face legal penalties such as fines, license suspension, or even jail time depending on the severity of the offense. Additionally, a poor driving record can make it difficult to obtain insurance coverage from other providers in the future.

So how can you keep your driving record in good standing? The most obvious answer is to practice safe driving habits and avoid any incidents or violations. However, if you do find yourself facing a ticket or accident, there are steps you can take to minimize the impact on your driving record. For example, attending traffic school or defensive driving courses may help reduce the number of points added to your record.

In conclusion, State Farm does check your driving record every renewal, and it’s important to understand how they use this information to assess your risk as a driver. Maintaining a clean driving record can help you avoid higher insurance rates and legal penalties, so it’s important to practice safe driving habits and take steps to mitigate any incidents that may occur.

Once upon a time, there was a man named Jack who had been a loyal State Farm customer for years. He had always wondered if State Farm checked his driving record every renewal. This question had been on his mind for some time now, and he had never found a clear answer.

One day, Jack decided to call State Farm’s customer service to ask them directly. The representative on the other end of the line told him that yes, State Farm does check its customers’ driving records every time they renew their policies.

Jack was relieved to hear this news. He had always been a safe driver, but he knew that accidents could happen to anyone. Knowing that State Farm would check his driving record every renewal gave him peace of mind that his rates were based on his current driving record.

Point of View

From the perspective of a State Farm customer, it is important to know whether or not the company checks your driving record every time you renew your policy. This information can help you make informed decisions about your coverage and ensure that you are getting the best rates possible.

- If State Farm did not check driving records every renewal, some customers may be paying more than they should due to previous accidents or violations on their record.

- Knowing that State Farm does check driving records every renewal gives customers peace of mind that their rates are fair and based on their current driving behavior.

- It is important for customers to be honest about their driving history when renewing their policies, as State Farm will check their records to verify the information provided.

In conclusion, State Farm does indeed check its customers’ driving records every time they renew their policies. This is an important factor for customers to consider when choosing a car insurance provider, as it ensures that their rates are based on their current driving record and not outdated information. By being honest about their driving history and maintaining safe driving habits, customers can ensure that they are getting the best rates possible from State Farm.

Well, folks, we’ve reached the end of our discussion on whether State Farm checks your driving record every time you renew your policy. Hopefully, this blog post has provided you with all the information you need to understand how State Farm assesses your driving record and how it can impact your auto insurance rates.

As we’ve discussed, State Farm does not check your driving record every time you renew your policy. Instead, they typically only check your driving record when you first apply for coverage or if you make changes to your policy. However, it’s important to note that if you have a poor driving record, your rates may be higher than someone with a clean driving record.

At the end of the day, it’s always a good idea to drive safely and responsibly to keep your driving record clean. But if you do have a less-than-stellar record, don’t worry – there are still ways to save money on your car insurance. Shop around, compare quotes from different providers, and consider taking a defensive driving course to help improve your driving skills and potentially lower your rates.

Thank you for taking the time to read this article. We hope you found it informative and useful. And remember – drive safe out there!

.

People also ask about Does State Farm Check Driving Record Every Renewal:

- How often does State Farm check driving records?

- Will my premium increase if State Farm checks my driving record?

- Can I hide violations or accidents from State Farm?

- What happens if I have a DUI on my driving record?

- Is it worth it to shop around for car insurance?

State Farm typically checks driving records when a policy is initially issued or renewed. However, they may also check driving records if you file a claim or if you add a new driver to your policy.

It’s possible that your premium could increase if State Farm discovers any violations or accidents on your driving record. However, this will depend on the severity of the incidents and how long ago they occurred.

No, it’s not recommended to hide any violations or accidents from State Farm. They will likely find out about them eventually, and failing to disclose this information could result in your policy being canceled or denied coverage.

If you have a DUI on your driving record, it’s possible that State Farm could either raise your premiums significantly or deny you coverage altogether. However, this will depend on the specific circumstances of your case.

Yes, it’s always a good idea to shop around for car insurance every few years. This can help you find better rates and coverage options that fit your needs and budget.