Find out how State Farm is refunding money to policyholders during the COVID-19 pandemic and what you need to know to receive your refund.

Are you a State Farm policyholder? If so, you may be in for a pleasant surprise. State Farm is refunding money to its policyholders due to the decrease in driving during the COVID-19 pandemic. That’s right, State Farm is giving back to the community in a big way. But how exactly is this process working and what does it mean for you? Let’s take a closer look.

Firstly, you might be wondering how much money you’re entitled to receive. The answer is, it depends. State Farm is calculating refunds based on the percentage of premium owed for the months of March through May. So, if you paid $100 for your car insurance in March, you could receive a refund of up to $33.33. It might not sound like much, but every little bit helps, especially during these uncertain times.

Secondly, you might be worried about the process of receiving the refund. Don’t be. State Farm is making it easy for policyholders to receive their money by either crediting their account or sending a check in the mail. They’re even planning to offer additional options for those who prefer their refunds via electronic payment methods.

All in all, State Farm’s decision to refund money to policyholders is a welcome relief during these trying times. So, sit back, relax, and wait for your refund to arrive. You deserve it!

State Farm, one of the largest insurers in the United States, recently announced its refund plan for auto insurance customers. The company is returning over $2 billion to policyholders as it recognizes the financial challenges that many individuals and families are facing amid the COVID-19 pandemic. This move is a testament to State Farm’s commitment to its clients and its unique approach to financial relief during these unprecedented times.

State Farm’s refund program is no-strings-attached, making it an effortless process for policyholders. Customers do not have to file any paperwork or take any action to receive their refund. The company has promised to automatically apply the refund to each policyholder’s account, with the average refund being around 25% of their premium for the period from March 20 to May 31, 2020. This means that customers can expect to see a reduction in their upcoming bills, providing much-needed financial relief during difficult times.

State Farm’s decision to give back money during COVID-19 is a reflection of its commitment to policyholders amid economic uncertainty. The company understands that many of its customers have lost their jobs or experienced a significant reduction in income due to the pandemic. By returning a portion of their premiums, State Farm hopes to alleviate some of the financial burden that its customers are facing and demonstrate its dedication to their well-being.

What makes State Farm’s refund program unique is its approach to financial relief for customers. Unlike other insurers, which offer discounts or credits towards future payments, State Farm is providing refunds upfront, without any strings attached. This means that policyholders will immediately feel the positive impact of the refund program on their finances, providing them with much-needed support during these challenging times.

Customers can expect a hassle-free experience with State Farm’s refund program. The company has made it clear that there is no need to reach out to a representative or file any paperwork. The refund will be applied automatically, and customers can expect to see the reduction in their upcoming bills. This process sets State Farm apart from other insurers and demonstrates the company’s commitment to providing excellent customer service.

State Farm’s refund program is a win-win situation for everyone involved. Policyholders will receive financial relief during a time of economic uncertainty, while the insurer will be able to demonstrate its commitment to its clients and set itself apart from competitors. The positive impact of this program will not only benefit State Farm’s policyholders but also the insurance industry as a whole. Other insurers may follow State Farm’s lead and implement similar programs, providing much-needed support to their customers.

In conclusion, State Farm’s refund plan for auto insurance customers is a testament to the company’s commitment to its clients and its unique approach to financial relief amid the COVID-19 pandemic. The no-strings-attached program is an effortless process for policyholders, with automatic refunds being applied to their accounts. State Farm’s decision to give back money during these challenging times sets it apart from other insurers and demonstrates its dedication to providing excellent customer service. The positive impact of State Farm’s refund program will benefit not only its policyholders but also the insurance industry as a whole.

Once upon a time, State Farm Insurance found itself in a bit of a predicament. Due to the COVID-19 pandemic, many of their customers were no longer driving as much as they used to, which meant they didn’t need as much insurance coverage. State Farm knew they needed to do something to help their customers during these difficult times, so they came up with a plan to refund money to policyholders.

Point of View: How Is State Farm Refunding Money?

As a customer of State Farm, I was pleasantly surprised to receive an email from them explaining that they would be refunding money to policyholders. Here’s how they’re doing it:

- State Farm is using data to determine which policyholders are eligible for refunds. They’re looking at things like how often you’ve been driving and how much you’ve been paying for insurance.

- Once they’ve determined your eligibility, they’ll calculate how much money they owe you. This will be based on a percentage of your premium for the months of April and May.

- You don’t have to do anything to receive your refund. State Farm will automatically apply the credit to your account or send you a check in the mail.

I think it’s really great that State Farm is taking this initiative to help their customers during these uncertain times. It shows that they care about more than just making money, and they want to do what they can to make things a little easier for people. I’m grateful to be a State Farm customer and appreciate their efforts to provide excellent service and support.

Dear valued readers,

We hope this blog post has been informative and helpful in shedding light on the recent news of State Farm’s decision to refund millions of dollars back to their policyholders. As you may know, State Farm is one of the largest insurance companies in the United States and their recent move has caused quite a stir in the industry.

So, how exactly is State Farm refunding money to their policyholders? Well, it all started when the company realized that they had been overcharging their customers for years due to a miscalculation in their rate system. As a result, they have decided to issue refunds to all eligible policyholders, which could amount to as much as $13.3 million in total.

This decision by State Farm is not only a great example of corporate responsibility, but it is also a testament to the power of consumer advocacy. By speaking up and demanding fair treatment, policyholders have succeeded in making a significant impact on the insurance industry and holding companies accountable for their actions.

In closing, we would like to thank you for taking the time to read our blog post and we hope that you found the information helpful. As always, we encourage you to stay informed and to continue advocating for your rights as a consumer. Together, we can make a difference!

Sincerely,

The [Blog Name] Team

.

People also ask: How is State Farm refunding money?

- State Farm is providing refunds to its policyholders due to the decreased driving during the COVID-19 pandemic.

- The refunds are being issued in two ways – as a credit on the policyholder’s account or as a check sent directly to the policyholder.

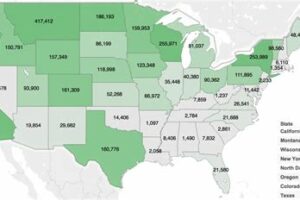

- The amount of the refund varies based on the individual policy and the state the policyholder resides in.

- Policyholders should expect to receive their refund by the end of May 2020.

- State Farm has also announced that it will be extending its Good Neighbor Relief Program through May 31, 2020, to continue providing assistance to customers affected by the pandemic.

If you have any questions or concerns about your refund or your policy, it is recommended that you contact your State Farm agent directly for assistance.