Table of Contents

Need more time to pay your State Farm insurance bill? Learn about payment extensions and how to request them in this informative guide.

Are you struggling to make your State Farm insurance payments on time? Don’t worry, you’re not alone. Life can throw unexpected curveballs that can leave us with financial hardships. Fortunately, State Farm understands this and offers payment extensions to their policyholders. That’s right, you may be able to extend your payment due date and avoid late fees or cancellation. But how does it work? Is it difficult to apply for? Keep reading to find out everything you need to know about State Farm’s payment extensions.

State Farm is one of the most popular insurance companies in the United States. They offer a variety of insurance products, including car insurance, home insurance, life insurance, and more. When it comes to paying your insurance bill, sometimes unexpected financial situations can arise. In this article, we will explore whether or not State Farm offers payment extensions for their insurance policies.

What are Payment Extensions?

Payment extensions are a way to postpone making a payment on your insurance policy. This is helpful for individuals who are experiencing temporary financial difficulties and need a little extra time to make a payment. Payment extensions can be granted by the insurance company, but they are not guaranteed.

Does State Farm Offer Payment Extensions?

The short answer is yes, State Farm does offer payment extensions. However, like any insurance company, they have specific qualifications and guidelines that must be met in order to receive a payment extension. If you are struggling financially and need a little extra time to pay your insurance bill, it is worth contacting State Farm to see if you qualify for a payment extension.

How to Request a Payment Extension from State Farm

If you are interested in requesting a payment extension from State Farm, there are a few steps you will need to take. First, you should contact State Farm directly and explain your situation. They will likely ask for some financial information, such as your income and expenses, so that they can better understand your situation. Once they have reviewed your information, they will let you know if you qualify for a payment extension.

Qualifications for a Payment Extension from State Farm

There are several qualifications that must be met in order to receive a payment extension from State Farm. These include:

- Having an active insurance policy with State Farm

- Being up-to-date on any previous payments

- Demonstrating financial hardship or difficulty

- Being willing to pay the full amount owed within a specified period of time

If you meet these qualifications, you may be eligible for a payment extension from State Farm.

How Long Can a Payment Extension Last?

The length of a payment extension can vary depending on your specific situation. State Farm will work with you to determine the length of the extension based on your financial needs. It is important to note that a payment extension is not a forgiveness of the payment – you will still need to pay the full amount owed, just at a later date.

Other Options for Paying Your State Farm Insurance Bill

If you are unable to make a payment on your State Farm insurance policy, there are other options available to you. These include:

- Making a partial payment

- Setting up a payment plan

- Requesting a grace period

- Exploring financial assistance programs

It is important to contact State Farm as soon as possible if you are experiencing financial difficulties. They may be able to work with you to find a solution that works for both parties.

In Conclusion

If you are struggling to pay your State Farm insurance bill, it is worth exploring the option of a payment extension. State Farm does offer these extensions to individuals who meet specific qualifications and guidelines. However, there are also other options available to you if a payment extension is not feasible. Contact State Farm directly to discuss your situation and find a solution that works for both parties.

A Helping Hand During Tough Times: Does State Farm Offer Payment Extensions?

Managing your finances can be a daunting task, especially when unexpected events occur that may strain your budget. State Farm understands that life can throw curveballs, and they are committed to supporting their customers in times of need. One way they do this is through their policy on payment extensions.

Flexibility to Keep You Covered: State Farm’s Policy on Payment Extensions

State Farm offers payment extensions to customers who may be experiencing financial hardship. This policy allows individuals to extend their payment due date without incurring any late fees or penalties. This flexibility can help ease the burden of unexpected expenses and provide peace of mind knowing that your insurance coverage will not lapse.

Behind the Scenes: How State Farm Makes Payment Extensions Work for You

State Farm understands that each customer’s situation is unique, which is why they have dedicated teams to work with individuals on a case-by-case basis. Their agents will listen to your needs and concerns and work with you to find a solution that fits your individual circumstances. Whether it’s a short-term extension or a longer-term payment plan, State Farm is committed to finding a solution that works for you.

Going Above and Beyond: State Farm’s Commitment to Meeting Your Insurance Needs

State Farm’s commitment to their customers goes beyond just providing insurance coverage. They understand that financial stability is essential for a healthy lifestyle and are dedicated to helping their customers achieve this. Through their policy on payment extensions and other financial tools, State Farm is committed to supporting their customers’ financial well-being.

More Than Just Another Insurance Provider: State Farm Cares About its Customers’ Financial Well-being

State Farm is more than just another insurance provider; they care about their customers’ financial well-being. They understand that life can be unpredictable, and they are dedicated to providing their customers with the tools and resources they need to navigate these challenges. Through their policy on payment extensions, State Farm is committed to supporting their customers during times of financial hardship.

Your Peace of Mind is Our Priority: How State Farm Supports You in Difficult Times

State Farm’s top priority is their customers’ peace of mind. They understand that unexpected events can cause significant stress, which is why they offer payment extensions to help ease the burden. This policy allows customers to focus on what matters most, knowing that their insurance coverage is secure.

Assistance When You Need It Most: How State Farm Helps Customers Stay Protected

State Farm is dedicated to helping their customers stay protected, even during times of financial hardship. Their policy on payment extensions is just one example of how they provide assistance when their customers need it most. This commitment to their customers’ well-being is what sets State Farm apart from other insurance providers.

Adapting to Your Needs: How State Farm Offers Payment Extensions to Accommodate Your Situation

State Farm understands that each customer’s situation is unique, which is why they offer payment extensions that can be tailored to fit your individual circumstances. Whether you need a short-term extension or a longer-term payment plan, State Farm is committed to finding a solution that works for you. Their agents will work with you to understand your needs and find a solution that provides peace of mind while keeping you covered.

Taking Care of Our Customers: State Farm’s Dedication to Providing Exceptional Service

State Farm’s dedication to providing exceptional service goes beyond just offering insurance coverage. They care about their customers’ well-being and are committed to supporting them during times of need. Through their policy on payment extensions and other financial tools, State Farm is dedicated to taking care of their customers and providing them with the resources they need to achieve financial stability.

In conclusion, State Farm understands that life can be unpredictable, and unexpected events can cause significant stress. Through their policy on payment extensions, State Farm is committed to supporting their customers during times of financial hardship. Their agents work with individuals on a case-by-case basis to find a solution that fits their individual circumstances. State Farm’s dedication to their customers’ financial well-being is what sets them apart from other insurance providers. They are more than just another insurance company; they are committed to providing exceptional service and taking care of their customers’ needs.

State Farm is known for providing reliable and affordable insurance to millions of people across the United States. But what happens when unexpected events occur, and you’re unable to make your payment on time? Does State Farm do payment extensions?

The answer is yes! State Farm understands that life can be unpredictable, and financial hardships can happen to anyone. That’s why they offer payment extensions as a way to help their customers during difficult times.

If you find yourself in a situation where you’re unable to make your payment on time, here’s what you need to know:

- Contact State Farm: The first step is to contact your State Farm agent or customer service representative. They will be able to provide you with information on payment extensions and assist you with the process.

- Qualifying for a Payment Extension: State Farm will review your payment history and account information to determine if you qualify for a payment extension. If approved, they will work with you to set up a new payment date that works for you.

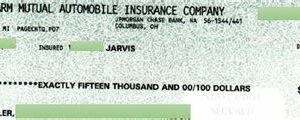

- Payment Extension Fees: State Farm may charge a fee for processing a payment extension. Be sure to ask your agent or representative about any fees associated with the extension.

- Impact on Your Policy: It’s important to note that a payment extension may impact your policy. For example, if you have auto insurance and miss a payment, your coverage may lapse, and you could be driving uninsured. A payment extension can help prevent this from happening, but it’s essential to understand the potential impact on your coverage.

Overall, State Farm does offer payment extensions to help their customers during difficult times. If you find yourself in a situation where you’re unable to make your payment on time, don’t hesitate to contact your State Farm agent or customer service representative for assistance. They’re there to help you and ensure that you have the coverage you need when you need it most.

Thank you for taking the time to read about State Farm’s payment extension options. We understand that life can be unpredictable and financial hardships can arise unexpectedly. That’s why we offer payment extensions to help ease the burden during these challenging times.

Our payment extension options are designed to provide flexibility and support to our customers who may need additional time to make their payments. We understand that every situation is unique, which is why we offer a variety of options to fit your specific needs. Whether it’s a short-term extension or a longer-term solution, we are committed to working with you to find the best option for your situation.

If you are experiencing financial difficulties and need help with your State Farm payments, please don’t hesitate to reach out to us. Our friendly and knowledgeable representatives are here to assist you and answer any questions you may have. We are dedicated to providing exceptional customer service and helping you navigate through any challenges that may come your way.

At State Farm, we believe in supporting our customers through difficult times. Our payment extension options are just one way we show our commitment to your well-being. We are here for you, and we will continue to work with you to ensure that your insurance needs are met with ease and convenience.

Thank you again for visiting our blog and learning more about our payment extension options. We hope that you found this information helpful and informative. If you have any further questions or concerns, please don’t hesitate to contact us. We are always here to help!

.

As an AI language model, I do not have any personal experience with State Farm’s payment extensions. However, I can provide you with some information on what people also ask about this topic.

- Does State Farm do payment extensions?

- How do I get a payment extension with State Farm?

- Is there a fee for a payment extension with State Farm?

- How long can a payment extension be with State Farm?

- Will a payment extension affect my credit score?

The answer is yes. State Farm does offer payment extensions to customers who are experiencing financial difficulties and need more time to make their payments. This can be a helpful option for those who may be struggling to make ends meet due to unforeseen circumstances.

The process for getting a payment extension with State Farm will vary depending on your specific situation. According to the State Farm website, you should contact your agent or call the customer service number on your bill to discuss your options. They may ask you to fill out a form or provide some documentation to support your request.

State Farm does not charge a fee for payment extensions, but interest may continue to accrue on any outstanding balances. It is important to discuss the details of your payment extension with your agent or customer service representative to ensure that you fully understand the terms and conditions.

The length of a payment extension with State Farm can vary depending on your specific situation and the terms of your policy. It is important to discuss your options with your agent or customer service representative to determine what length of extension is available to you.

It is possible that a payment extension could affect your credit score, depending on how it is reported to the credit bureaus. It is important to discuss this with your agent or customer service representative to understand how a payment extension could impact your credit.

Overall, State Farm does offer payment extensions as an option for customers who need more time to make their payments. If you are experiencing financial difficulties, it is important to reach out to your agent or contact State Farm’s customer service to discuss your options.