Table of Contents

State Farm is returning $2 billion to their customers due to reduced driving during COVID-19. Policyholders can expect a credit on their bills.

Great news for State Farm customers! The insurance company is returning money to its policyholders. Yes, that’s right! State Farm has announced a plan to give back $2 billion to its auto insurance customers. But how exactly is this happening? Well, the answer lies in the unprecedented decline in driving due to the pandemic. With fewer cars on the road, there have been fewer accidents and claims, resulting in lower costs for the insurer. And instead of keeping all the savings to themselves, State Farm is passing them on to their loyal clients.

State Farm, one of the largest insurance companies in the United States, recently announced that it will be returning money to its customers. This decision was made as a result of the COVID-19 pandemic, which has impacted millions of Americans financially. State Farm’s decision to return money to its customers is a sign of their commitment to helping those in need during this difficult time.

The COVID-19 Pandemic

The COVID-19 pandemic has had a significant impact on people’s lives across the world. Many people have lost their jobs, and businesses have closed. The pandemic has also affected the insurance industry, with many companies receiving fewer claims due to the lockdowns and travel restrictions. However, State Farm recognized that their customers were still struggling financially and wanted to do something to help them.

Returning Money to Customers

State Farm is returning $2 billion to their auto insurance customers. This is because the pandemic has reduced the number of accidents, which means that State Farm has received fewer claims. As a result, they have decided to pass on these savings to their customers. The average refund per customer will be about 25% of their premiums for the period between March 20 and May 31. This refund will be made automatically, and customers do not need to take any action to receive it.

What State Farm Customers Can Expect

If you are a State Farm auto insurance customer, you can expect to receive a refund on your premiums. The amount of the refund will depend on how much you paid during the period between March 20 and May 31. State Farm will calculate the refund based on the policyholder’s premium and issue refunds to customers in the coming weeks. Customers will receive the refund by mail, direct deposit, or credit to their account, depending on how they pay their premium.

How State Farm is Helping its Customers During the Pandemic

State Farm has taken several steps to help its customers during the pandemic. In addition to returning money to their customers, they have also extended payment due dates, waived late fees, and offered flexible billing options to those who are struggling financially. They have also provided additional support to customers who have been affected by the pandemic, such as healthcare workers and first responders.

The Importance of Supporting Customers During a Crisis

The COVID-19 pandemic has shown us how important it is to support each other during a crisis. Companies like State Farm that have taken steps to help their customers are setting an example for others to follow. By returning money to its customers, State Farm is not only helping them financially but also showing that they care about their customers’ well-being.

Conclusion

In conclusion, State Farm’s decision to return money to its customers is a welcome relief during these challenging times. The COVID-19 pandemic has affected millions of Americans, and any help that can be provided is greatly appreciated. By returning $2 billion to its customers, State Farm is not only providing financial assistance but also showing its commitment to supporting its customers during a crisis.

State Farm has taken an unprecedented move to return money to its customers during the COVID-19 pandemic. This decision comes as a relief to many policyholders who are struggling financially due to the pandemic’s impact on the economy. The insurance giant has pledged to refund $2 billion to its auto insurance customers, which will result in an average of a 25% credit on their premiums from March 20 to May 31.

State Farm is reacting responsibly to the pandemic and its effects on people’s livelihoods. The company understands that many Americans are facing financial hardship, and it has decided to take action to help its customers stay afloat. While some insurance companies have chosen to delay premium payments, State Farm has gone further by providing refunds to its policyholders.

This refund policy is a win-win situation for both State Farm and its customers. By refunding premiums, State Farm is recognizing the financial difficulties faced by its customers and is helping to ease their burden. In return, the insurance company is strengthening customer loyalty and building trust with its policyholders. This move demonstrates that the company values its customers and is willing to support them during tough times.

It is essential to know that State Farm’s refund policy applies to all its auto insurance customers. Policyholders do not need to apply for the refund as the credit will automatically be applied to their account. Customers will receive the refund either through a mailed check or a direct deposit into their bank account.

The refund policy matters to you because it shows that State Farm is committed to putting its customers first. The company understands that its customers are facing challenging times, and it is willing to go above and beyond to support them. State Farm’s decision to provide refunds to its policyholders highlights its customer-centric business practice and sets an example for other businesses to follow.

State Farm is supporting its customers during tough times by not just providing refunds but also offering flexible payment options and extending coverage to those who are using their personal vehicles for commercial purposes. The insurance company has also implemented safety measures for its employees and customers, such as remote work and virtual appointments.

The reasons behind State Farm’s decision to refund customers are clear. The COVID-19 pandemic has caused significant financial strain on individuals and businesses, and State Farm wants to help its customers in any way possible. Additionally, with fewer cars on the road due to stay-at-home orders, there have been fewer accidents, resulting in lower claims for the insurance company. By returning the savings to its policyholders, State Farm is showing its commitment to fairness and transparency.

State Farm has a long history of putting its customers first. The insurance company was founded in 1922 by George J. Mecherle, who believed that insurance should be affordable and accessible to everyone. This philosophy has guided the company’s business practices for almost a century, and it continues to be the driving force behind its success.

Looking ahead, State Farm’s commitment to its customers and their well-being bodes well for the future. As the insurance industry evolves and adapts to new challenges, State Farm remains at the forefront of customer service and support. The insurance giant has set an example for other businesses to follow, demonstrating that companies can be successful while still putting their customers first.

In conclusion, State Farm’s unprecedented move to return money to its customers is a testament to its commitment to doing what is right. The refund policy is a win-win situation for both the insurance company and its policyholders. State Farm’s decision to provide refunds shows that it values its customers and is willing to go above and beyond to support them during tough times. As we navigate through the COVID-19 pandemic, State Farm’s customer-centric business practice sets an example for other businesses to follow, and we can expect a bright future for the insurance industry and its customers.

State Farm, the renowned insurance company, recently announced that it will be returning $2.2 billion to its customers. This is due to the decrease in claims made during the COVID-19 pandemic, resulting in a surplus of funds. However, the way in which State Farm is returning the money is not your typical refund check.

The Return Process

- State Farm will be issuing credits to customers’ accounts, which can be used towards their next auto insurance bill.

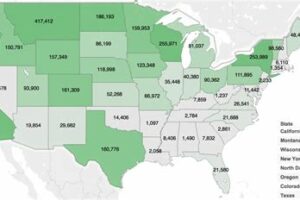

- The credit amount will be based on the customer’s policy and the state they reside in.

- Customers will also have the option to request a refund check instead of a credit.

The process is simple and straightforward, but what really sets State Farm apart is their approach to customer service.

The Customer Experience

State Farm understands that these are trying times for many people and is taking a compassionate approach to returning the funds. They are making sure that their customers have the information they need to make informed decisions about their options. Furthermore, they are being transparent about the process and why it is happening.

State Farm’s decision to issue credits instead of checks is not only more convenient for customers, but it also shows that they are thinking about the long-term relationship with their clients. By providing a credit, they are essentially saying thank you for being a valued customer, we hope you continue to choose us for your insurance needs.

Conclusion

State Farm’s decision to return $2.2 billion to its customers is a testament to their commitment to providing excellent customer service. By issuing credits instead of checks, they are showing that they care about their clients and want to make the process as easy as possible. State Farm’s approach to returning the funds is a shining example of how companies can use creative voice and tone to show their customers that they truly care.

Dear valued readers,

As we come to the end of this article, we would like to share some exciting news with you. State Farm, one of the largest insurance providers in the United States, has recently announced that it will be returning money to its customers. This is a significant move that has been welcomed by many, especially in light of the current economic climate.

The decision to return money to customers stems from the fact that many people are driving less due to the COVID-19 pandemic. As a result, there are fewer accidents and claims being made, which means that insurance companies are saving money on payouts. State Farm has decided to pass these savings on to its customers in the form of refunds. This is a welcome move that will help many people during these uncertain times.

If you are a State Farm customer, you may be eligible for a refund. The amount of money you receive will depend on a number of factors, including the type of policy you have and how much you pay in premiums. You can find out more about the refund process by visiting the State Farm website or contacting your local agent. We encourage you to take advantage of this opportunity and see if you are eligible for a refund.

In conclusion, we hope that this article has been informative and helpful. We are pleased to see that State Farm is taking steps to support its customers during these challenging times. If you have any questions or comments, please feel free to leave them below. Thank you for reading and stay safe!

.

How Is State Farm Returning Money To Customers?

State Farm is one of the largest insurance providers in the United States, and they have recently announced that they will be returning money to their customers due to the COVID-19 pandemic. Here are some of the most common questions people ask about how State Farm is returning money to their customers:

-

Why is State Farm returning money to its customers?

State Farm is returning money to its customers because many people are driving less due to the COVID-19 pandemic. This means that there are fewer accidents and claims being filed, which results in lower costs for insurance companies. State Farm has decided to pass these savings on to its customers by returning money to them.

-

How much money is State Farm returning to its customers?

The amount of money that State Farm is returning to its customers varies depending on the state in which they live. In total, State Farm is returning around $2 billion to its customers. Some customers may receive a credit on their next bill, while others may receive a refund check in the mail.

-

Who is eligible to receive money from State Farm?

Most State Farm customers who had an auto insurance policy as of March 31, 2020, will be eligible to receive money from State Farm. The amount of money that each customer receives will depend on their individual policy and the state in which they reside.

-

When will State Farm return money to its customers?

State Farm has already started returning money to its customers, and the process will continue throughout 2020. Some customers may receive their credit or refund check as early as June, while others may have to wait until later in the year.

If you are a State Farm customer and have not yet received information about how much money you will be receiving, contact your State Farm agent for more information.