Find out if you have insurance on your new car with State Farm. Protect yourself and your investment with the right coverage.

Are you the proud owner of a brand new car? Congratulations! But have you thought about protecting your investment with insurance? As a State Farm customer, you may be wondering – does State Farm provide insurance for my new car? Well, the answer is yes! State Farm offers comprehensive auto insurance coverage for drivers like you who want to ensure that their vehicles are protected in case of accidents, theft, or other damages. So why take any risks when it comes to your prized possession? Let State Farm provide the peace of mind you deserve with their reliable and affordable insurance options.

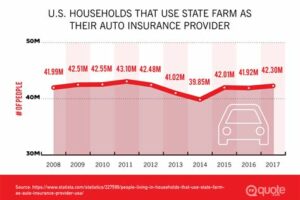

Buying a new car is an exciting experience, but it also comes with a lot of responsibilities. One of the most important things you need to consider is getting car insurance. Protecting your investment should be your top priority, and that’s where State Farm comes in. As one of the largest auto insurance providers in the United States, State Farm offers a variety of coverage options to meet your needs.

Understanding State Farm’s car insurance options is essential when selecting the right policy for your new car. State Farm offers liability coverage, collision coverage, comprehensive coverage, and personal injury protection. Liability insurance covers damages to other people’s property or injuries in case of an accident. Collision insurance covers damages to your vehicle if you collide with another object or vehicle. Comprehensive insurance covers damages caused by events such as theft, vandalism, or natural disasters. Personal injury protection covers medical expenses and lost wages in case of an injury.

Several factors can affect your car insurance rates. Your driving record, age, gender, location, and type of car are some of the common factors that determine your rates. State Farm uses these factors to calculate your premium, so it’s essential to keep them in mind when choosing a new car.

In addition to the coverage options and rates, State Farm’s deductibles are also essential to consider. A deductible is the amount you pay out of pocket before your insurance kicks in. Higher deductibles can lower your premiums, but they also mean you’ll pay more out of pocket in case of an accident. It’s important to choose a deductible that you can afford in case of an emergency.

If you’re involved in an accident, filing a claim with State Farm is a straightforward process. You can file a claim online, over the phone, or through the State Farm mobile app. Once you file a claim, a State Farm claims representative will guide you through the process and answer any questions you may have.

State Farm offers discounts and savings to help you save money on your car insurance. Some of the discounts available include good driver discounts, multiple vehicle discounts, and safe driver discounts. You can also save money by bundling your auto insurance policy with other State Farm policies like home insurance or renters insurance.

Choosing the right insurance coverage for your new car is crucial in protecting your investment. It’s important to consider the type of car you have, your driving habits, and your budget when selecting a policy. State Farm’s customer service and support are top-notch, and they offer 24/7 customer support to help you with any questions or concerns you may have.

Protecting your financial future is why choosing the right car insurance matters. Accidents can happen at any time, and having the right coverage can help protect you from financial ruin. State Farm offers a variety of coverage options to meet your needs and budget. Don’t wait until it’s too late; get the right coverage for your new car today with State Farm.

As the proud owner of a new car, I was excited to hit the road and explore. But before I could do that, I needed to make sure I had insurance coverage for my vehicle. That’s when I turned to State Farm, one of the most trusted names in the insurance industry.

Here’s what I learned about my insurance coverage from State Farm:

- Yes, I have insurance on my new car with State Farm.

- I opted for full coverage, which includes liability, collision, and comprehensive coverage.

- With liability coverage, I’m protected if I cause damage to someone else’s property or injure someone in an accident.

- Collision coverage protects me if I’m in an accident with another vehicle or object.

- Comprehensive coverage covers non-accident related damage, such as theft, vandalism, or natural disasters.

- I also added on some optional coverages, such as roadside assistance and rental car reimbursement.

Overall, I feel confident and secure knowing that I have insurance coverage for my new car through State Farm. Their knowledgeable agents and excellent customer service make the process easy and stress-free.

If you’re in the market for insurance coverage for your new car, I highly recommend checking out State Farm. You won’t be disappointed!

Hello, my dear blog visitors! I hope you found this article informative and helpful. As you know, having car insurance is essential for protecting your vehicle and yourself in case of any accidents or damages. State Farm is one of the most popular insurance providers in the US, offering a wide range of policies tailored to your needs and budget.

Now, the question is – does your new car have insurance with State Farm? The answer is not straightforward and depends on several factors, such as your existing policy, the type of car you bought, and your state’s insurance laws. However, there are some general guidelines that can help you understand your insurance situation better.

If you already have a State Farm policy for your old car, it may cover your new car as well for a limited period, typically 14-30 days. During this time, you should contact your agent and update your policy to reflect the new vehicle’s details, such as make, model, year, and VIN. If you don’t have a policy yet, you can apply for one online or through an agent, and get a quote based on your driving record, location, and other factors.

In conclusion, having insurance on your new car with State Farm is crucial for your peace of mind and financial security. Make sure to check your current policy and contact your agent to update it or apply for a new one. Remember that driving without insurance is not only illegal but also risky and costly. Thank you for reading, and drive safely!

Video Does I Have Insurance On My New Car State Farm

When it comes to purchasing a new car, one of the most important considerations is insurance coverage. State Farm is a popular insurance company that offers a range of coverage options for new car owners. As such, many people have questions about whether they have insurance on their new car from State Farm. Here are some of the most common queries:

-

Do I have automatic insurance coverage when I buy a new car from State Farm?

Yes, if you already have an existing policy with State Farm, your new car will be automatically added to your coverage. If you don’t have an existing policy, you’ll need to purchase a new one before driving your new car off the lot.

-

What types of coverage does State Farm offer for new cars?

State Farm offers a variety of coverage options for new cars, including liability coverage, collision coverage, comprehensive coverage, and personal injury protection. You can customize your coverage to meet your specific needs and budget.

-

How do I know if I have enough insurance coverage for my new car?

The amount of coverage you need will depend on a variety of factors, including the value of your car, your driving habits, and your financial situation. It’s important to work with a State Farm agent to determine the right amount of coverage for your individual needs.

-

What should I do if I get into an accident in my new car?

If you get into an accident, the first thing you should do is make sure that everyone involved is safe and call the police if necessary. Then, contact your State Farm agent to report the accident and start the claims process.

-

How can I save money on my insurance premiums for my new car?

State Farm offers a variety of discounts that can help you save money on your insurance premiums, including safe driving discounts, multi-car discounts, and good student discounts. Be sure to talk to your State Farm agent about what discounts you may be eligible for.

Overall, having insurance coverage for your new car from State Farm is important for protecting yourself and your investment. By working with a State Farm agent, you can ensure that you have the right amount of coverage for your needs and budget.