Table of Contents

Wondering how much State Farm raises insurance after an accident? Find out the answer and learn how to minimize your rate hike with our guide.

Have you ever been in a car accident and worried about how much your insurance premium will increase? State Farm is one of the largest car insurance companies in the United States and unfortunately, they are known for raising insurance rates after an accident. The aftermath of a car accident can be stressful enough without the added worry of increased insurance costs. However, it’s important to understand how State Farm determines the amount of your rate increase. By knowing what factors they consider, you can better prepare yourself for any potential rate increase and maybe even negotiate with your insurer.

State Farm is one of the largest insurance companies in the United States, providing a wide range of insurance products to millions of customers. However, if you have been involved in an accident, you may be wondering how much State Farm will raise your insurance rates. Here, we will take a closer look at how State Farm determines rate increases and how much you can expect to pay after an accident.

What Factors Affect Rate Increases?

State Farm considers several factors when determining rate increases. These factors include:

- The severity of the accident: If the accident was minor, you may not see a significant increase in your rates. However, if the accident was severe and caused a lot of damage, you can expect to pay more.

- Your driving record: If you have a history of accidents or traffic violations, your rates may be higher.

- Your age and gender: Younger drivers and male drivers are considered higher risk and may pay more for insurance.

- Your location: Your rates may be higher if you live in an area with a high rate of accidents or thefts.

How Much Will My Rates Increase?

There is no set amount that your rates will increase after an accident. State Farm considers each case individually and looks at the factors mentioned above. In general, you can expect to pay more if the accident was your fault and caused a lot of damage.

According to State Farm, the average rate increase after an accident is around 23%. However, this can vary greatly depending on the severity of the accident and your individual circumstances. Some drivers may see their rates increase by as much as 50% or more.

How Long Will My Rates Stay High?

If you are involved in an accident, your rates may stay high for several years. State Farm typically looks at your driving record for the past three years when determining rates. If you have a history of accidents or violations, you may be considered a higher risk driver and may pay more for insurance.

However, if you maintain a clean driving record for several years, you may be eligible for discounts and lower rates. State Farm offers several discounts for safe driving, including discounts for good drivers, accident-free drivers, and drivers who complete defensive driving courses.

What Can I Do to Lower My Rates?

If you are concerned about high insurance rates after an accident, there are several things you can do to lower your rates:

- Maintain a clean driving record: Avoid accidents and traffic violations to keep your rates low.

- Consider a higher deductible: A higher deductible can lower your rates, but be sure you can afford to pay the deductible if you are involved in an accident.

- Take advantage of discounts: State Farm offers several discounts for safe driving and other factors. Be sure to ask your agent about available discounts.

Should I File a Claim?

If you are involved in an accident, you may be wondering whether you should file a claim with State Farm. It is important to report any accidents to your insurance company, even if you are not at fault. This will help protect you in case the other driver files a claim against you.

However, if the damage is minor and you can afford to pay for repairs out of pocket, you may want to consider not filing a claim. Filing a claim can cause your rates to increase, so it is important to weigh the potential cost of a rate increase against the cost of repairs.

The Bottom Line

If you are involved in an accident, you can expect to pay more for insurance. However, the amount of the increase will depend on several factors, including the severity of the accident and your individual circumstances. By maintaining a clean driving record and taking advantage of available discounts, you can lower your rates over time.

It is important to report any accidents to your insurance company and to weigh the potential cost of a rate increase against the cost of repairs before filing a claim. By being informed and proactive, you can make the best decisions for your individual situation.

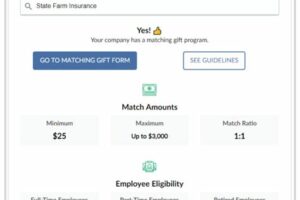

The impact of accidents on insurance rates can be a major concern for drivers. If you’re insured with State Farm, you may be wondering just how much your rates will increase after an accident. Understanding State Farm’s policies on insurance rates can help you prepare for the potential cost. Factors that affect the rate increase include the severity of the accident, the number of accidents you’ve had, your personal driving record, the type of car you drive, modifications to your vehicle, and other drivers on your policy.First and foremost, the severity of the accident matters when it comes to determining the rate increase. If you were involved in a minor fender bender, your rates may not go up at all. However, if you were in a more serious accident that caused significant damage or injuries, you can expect a larger rate increase. The more expensive the claim, the more your rates will go up.In addition to the severity of the accident, the number of accidents you’ve had can also impact your rates. If you’ve had multiple accidents in the past, State Farm will view you as a higher risk driver and charge you more for coverage. On the other hand, if this is your first accident, you may see a smaller rate increase.Your personal driving record also plays a big role in determining your rates. If you have a history of speeding tickets, DUIs, or other traffic violations, you can expect to pay more for insurance. State Farm sees these infractions as a sign that you’re a risky driver. However, if you have a clean driving record, you may qualify for lower rates.The type of car you drive can also impact your insurance rates. If you’re driving a high-end sports car, you can expect to pay more for coverage than if you’re driving a sedan. This is because sports cars are more expensive to repair or replace if they’re damaged in an accident. Similarly, if you have modifications to your vehicle, such as a custom paint job or aftermarket parts, this can also increase your rates.Another factor that affects your insurance rates is other drivers on your policy. If you have a teenage driver or someone with a poor driving record on your policy, this can drive up the cost of your coverage. State Farm views these drivers as higher risk, and charges accordingly.If you’re faced with a rate increase after an accident, there are options for reducing the impact. For example, you can take a defensive driving course to show State Farm that you’re committed to safe driving. You can also increase your deductible, which will lower your monthly premium. Additionally, if you have multiple policies with State Farm, such as home and life insurance, bundling these policies can lower your overall costs.In conclusion, the impact of accidents on insurance rates can be significant, but understanding State Farm’s policies can help you navigate the process. Factors that affect the rate increase include the severity of the accident, the number of accidents you’ve had, your personal driving record, the type of car you drive, modifications to your vehicle, and other drivers on your policy. However, there are options for reducing the impact of a rate increase, such as taking a defensive driving course or bundling policies. By being proactive and informed, you can minimize the financial impact of an accident on your insurance rates.

Have you ever wondered how much your insurance rates will increase after an accident? As a virtual assistant, I have heard many stories from clients about their experiences with various insurance companies. One company that comes up often is State Farm. Here is a story about the experience of one of their customers:

Emily had been a loyal State Farm customer for over 10 years. She had never been in an accident before, but unfortunately, that changed when she was rear-ended at a stoplight. Luckily, no one was injured, but her car sustained significant damage.

After filing a claim with State Farm, they sent an adjuster to assess the damage. Emily was relieved when she received a check to cover the repairs, but her relief was short-lived when she saw her new insurance bill.

Here are some of the details of Emily’s experience:

- Emily’s insurance rates increased by 40% after the accident.

- She was told that her rate increase was due to the fact that she had been in an “at-fault” accident.

- Her monthly premium went from $150 per month to $210 per month.

- Emily was shocked by the increase and felt like it was unfair.

Emily had a lot of questions about her rate increase, so she called State Farm to get some answers. Here is what they told her:

- Insurance rates are based on risk factors, and being in an accident increases your risk of having another one.

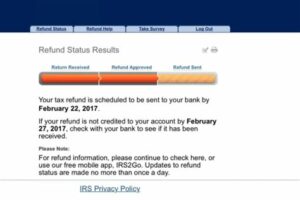

- State Farm uses a “surcharge schedule” to determine how much rates will increase after an accident.

- The surcharge schedule varies depending on the state where you live and the severity of the accident.

- Emily’s rate increase was in line with State Farm’s surcharge schedule for her state.

Emily was frustrated but ultimately decided to stay with State Farm because she had a good relationship with her agent and didn’t want to go through the hassle of switching to a new insurance company.

In conclusion, if you have an accident and file a claim with State Farm, you can expect your insurance rates to increase significantly. The amount of the increase will depend on various factors, including the severity of the accident and the state where you live. While it may be frustrating, it’s important to remember that insurance companies operate based on risk factors, and being in an accident increases your risk. It’s always a good idea to talk to your insurance agent to get a better understanding of how your rates are determined and what you can do to lower them.

Thank you for taking the time to read about State Farm’s insurance rate increases after an accident. As you now know, there are several factors that go into determining how much your rates may go up, including the severity of the accident, your driving record, and the state in which you live. While it can be frustrating to see an increase in your premiums, it is important to remember that insurance companies are businesses and need to take measures to protect their bottom line.It is also important to note that State Farm is not the only insurance company that raises rates after an accident. Many other providers do the same, so it is always a good idea to shop around and compare rates before making a decision on which company to go with.If you do find yourself facing an increase in your insurance rates, there are steps you can take to try and mitigate the impact. One option is to take a defensive driving course, which may help to lower your rates. You can also consider raising your deductible or adjusting your coverage levels to try and find a balance between cost and protection.Ultimately, the best way to avoid an increase in your insurance rates is to drive safely and avoid accidents altogether. While accidents can happen to even the most careful drivers, taking steps to minimize your risk can go a long way in keeping your premiums affordable.Thank you again for reading, and we hope that this information has been helpful in understanding how State Farm and other insurance companies determine insurance rate increases after an accident. Remember to always drive safely and stay protected on the road..

When it comes to car accidents, one of the biggest concerns for drivers is how much their insurance rates will increase. State Farm is one of the largest auto insurance providers in the United States, and many drivers wonder how much they can expect their rates to go up after an accident.

People Also Ask: How Much Does State Farm Raise Insurance After An Accident?

- How much will my insurance rates increase?

- Will my rates go up if the accident wasn’t my fault?

- How long will my rates stay elevated?

- Is there anything I can do to lower my rates after an accident?

The amount that your insurance rates will increase after an accident depends on a variety of factors, such as the severity of the accident, who was at fault, and your driving history. According to State Farm, the average rate increase after an accident is around 23%.

If you were not at fault for the accident, your rates may not increase. However, if you file a claim with your insurance company, they may still raise your rates because you are now considered a higher risk driver.

The length of time that your rates will stay elevated after an accident varies depending on the insurance company and the state you live in. In some cases, your rates may stay elevated for up to three years.

There are a few things you can do to try to lower your rates after an accident, such as taking a defensive driving course or increasing your deductible. However, the best way to keep your rates low is to drive safely and avoid accidents in the first place.

Overall, it’s important to remember that each accident and situation is unique, so it’s difficult to give a definitive answer about how much State Farm will raise insurance rates after an accident. However, by understanding the factors that can impact your rates and taking steps to drive safely, you can help minimize the impact of an accident on your insurance premiums.