Table of Contents

Find out if State Farm includes towing when you have an accident. Learn about their coverage options and get peace of mind on the road.

Getting into an accident can be a frustrating and stressful experience, especially if you’re left stranded on the side of the road. But does State Farm include towing when you have an accident? The answer to this question can vary depending on your specific policy and coverage. However, it’s important to know what options are available to you in case you find yourself in this situation. Whether you’re a new State Farm customer or have been with them for years, understanding the details of your insurance plan can make all the difference in your peace of mind and financial security.

When it comes to car accidents, the aftermath can be a stressful and overwhelming experience. From dealing with insurance companies to repairing any damage done to your vehicle, there’s a lot to handle. One question many people have is whether their insurance company, such as State Farm, includes towing services when you have an accident. Let’s take a closer look at what’s included in a State Farm policy.

What Is State Farm?

State Farm is one of the largest insurance providers in America. The company offers a wide range of services, including car insurance. Founded in 1922, State Farm has been providing insurance coverage to customers for almost a century. Today, the company has over 58,000 employees and more than 19,000 agents across the United States.

Does State Farm Include Towing?

Whether or not towing services are included in your State Farm policy depends on the type of coverage you have. In general, towing is not automatically included in a standard State Farm policy. However, you can add roadside assistance coverage to your policy for an additional fee. This coverage includes towing services in case of an accident or other emergency.

What Is Roadside Assistance Coverage?

Roadside assistance coverage is an optional add-on to your State Farm policy. This coverage includes a variety of services, including:

- Towing

- Battery jump-starts

- Tire changes

- Fuel delivery

- Lockout assistance

With roadside assistance coverage, you can call for help 24/7 if you experience any of these issues while on the road. If you need towing services after an accident, this coverage will cover the cost of towing your vehicle to a repair shop.

How Much Does Roadside Assistance Coverage Cost?

The cost of adding roadside assistance coverage to your State Farm policy varies depending on your location and the level of coverage you choose. In general, you can expect to pay between $5 and $15 per month for this coverage. The cost may be higher if you have multiple vehicles on your policy.

What Should You Do After an Accident?

If you’re involved in an accident, there are several steps you should take to ensure your safety and protect your legal rights:

- Check for injuries: If anyone is injured, call 911 right away.

- Move to a safe location: If possible, move your vehicle out of traffic to avoid further accidents.

- Exchange information: Get the other driver’s name, contact information, and insurance information. Also, take note of the make, model, and license plate number of the other vehicle.

- Take photos: Take pictures of the damage to both vehicles and the surrounding area.

- File a police report: Even if the accident is minor, file a police report to protect your legal rights.

- Contact your insurance company: Call your insurance company as soon as possible to report the accident and start the claims process.

Conclusion

If you have a State Farm policy, towing services are not automatically included in your coverage. However, you can add roadside assistance coverage to your policy for an additional fee. This coverage includes towing services in case of an accident or other emergency. If you’re involved in an accident, follow the steps outlined above to ensure your safety and protect your legal rights.

If you’re a State Farm policyholder, you may be wondering whether the company includes towing services in their coverage after an accident. Understanding State Farm’s towing coverage is important so that you know what to expect if you find yourself in a roadside emergency.

Can you count on State Farm for towing assistance post-accident? The answer is yes, but with some conditions and limitations. State Farm offers two types of towing coverage: emergency roadside service and towing and labor coverage. Emergency roadside service is included in all policies and covers up to $100 per occurrence for services such as jump-starts, lockout assistance, and fuel delivery. Towing and labor coverage, on the other hand, is an optional add-on that provides up to $150 per occurrence for towing and labor costs.

The fine print: conditions and limitations for State Farm’s towing services include restrictions on the distance the vehicle can be towed and the type of tow truck that can be used. State Farm will only cover towing to the nearest repair facility if the accident occurs within the policyholder’s service area. Additionally, the company may only cover the cost of a flatbed tow truck if it’s necessary to prevent further damage to the vehicle.

If you need to request towing services after an accident with State Farm, you can call the 24/7 claims hotline or use the State Farm mobile app. The app allows you to track the progress of your service request and provides an estimated time of arrival for the tow truck.

State Farm’s network of tow service providers is extensive, with over 30,000 providers across the country. However, it’s important to note that while State Farm works with reputable providers, policyholders are ultimately responsible for any additional charges beyond the coverage limits.

Alternatives to towing assistance with State Farm after an accident include using a roadside assistance membership service such as AAA or choosing a policy with a higher towing and labor coverage limit. Some credit card companies also offer roadside assistance as a benefit for their cardholders.

Does State Farm’s coverage include towing for all types of vehicles? The answer is no. State Farm’s towing coverage is limited to private passenger vehicles and light trucks with a gross weight of up to 10,000 pounds. Vehicles such as RVs, motorcycles, and commercial trucks may require additional coverage.

Is State Farm’s towing coverage worth the extra cost? The answer depends on your individual needs and budget. If you frequently travel long distances or have an older vehicle that may be prone to breakdowns, adding towing and labor coverage may provide peace of mind. However, if you have access to alternative roadside assistance services, it may not be necessary.

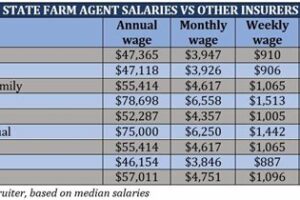

When it comes to towing services, how does State Farm compare to other insurance providers? While many insurance companies offer some form of towing coverage, the specifics can vary widely. Some companies may have higher coverage limits or more lenient distance restrictions, while others may not cover towing at all. It’s important to compare policies and read the fine print to determine which provider offers the best towing coverage for your needs.

Seeking clarity: common questions and concerns about State Farm’s towing coverage after an accident include whether the coverage applies if the accident is the policyholder’s fault, whether there are any exclusions for certain types of accidents, and whether the coverage is affected by the policyholder’s driving record. In general, towing coverage applies regardless of fault, but there may be limitations based on the circumstances of the accident. Exclusions may vary by policy, so it’s important to review the terms carefully. Finally, towing coverage is typically not affected by the policyholder’s driving record, as it is considered a separate type of coverage.

Overall, State Farm’s towing coverage can provide valuable assistance in the event of an accident or roadside emergency. However, it’s important to understand the conditions and limitations of the coverage, as well as explore alternative options if necessary. By doing so, you can ensure that you have the best possible protection and peace of mind on the road.

Once upon a time, there was a young woman named Sarah. She had just gotten her driver’s license and was excited to hit the road. One day, as she was driving home from work, she accidentally rear-ended the car in front of her. Her car was badly damaged and she didn’t know what to do.

Luckily, Sarah had State Farm insurance. She quickly called their customer service hotline and was relieved to hear a friendly voice on the other end. The representative asked her if she was okay and if she needed any medical assistance. Sarah assured them that she was fine and just needed a tow truck.

The representative informed her that State Farm does include towing services in their insurance policies. Sarah was overjoyed, knowing that she wouldn’t have to pay for the tow truck out of her own pocket. The representative then asked for her location and promised to send a tow truck right away.

True to their word, the tow truck arrived within 20 minutes. The driver was courteous and professional, and he made sure that Sarah and her car were safely transported to a nearby auto body shop. Sarah breathed a sigh of relief, knowing that State Farm had her back.

From Sarah’s point of view, State Farm’s towing service was a lifesaver. She never expected to get into an accident, but she was grateful to have such a reliable insurance company behind her. She knew that she could always count on State Farm to take care of her in times of need.

In conclusion, State Farm does indeed include towing services in their insurance policies. This can be a huge relief for drivers who find themselves stranded after an accident. With State Farm, you can rest assured that you’ll be taken care of every step of the way.

- State Farm’s towing service is included in their insurance policies.

- State Farm’s customer service representatives are friendly and helpful.

- State Farm’s tow truck drivers are courteous and professional.

- State Farm provides peace of mind for drivers who find themselves in accidents.

Hello there, dear blog visitors! It’s been a pleasure to have you reading our article about State Farm and their towing services. We hope that we were able to provide you with valuable information about the topic. Now, before we end this blog post, we would like to give you a quick summary of what we’ve discussed so far.

First and foremost, we’ve established that State Farm does indeed offer towing services as part of their auto insurance policies. Depending on the type of coverage you have, towing may be included or may require an additional fee. We’ve also highlighted the importance of reviewing your policy to ensure that you have the necessary coverage, especially in the event of an accident.

Furthermore, we’ve shared some tips on what to do if you find yourself in a situation where you need towing services. We’ve emphasized the need to prioritize safety and to call for help immediately if needed. We’ve also provided some useful information on how to file a claim with State Farm for towing expenses.

Overall, we hope that this article has been informative and helpful to you. Remember, accidents can happen at any time, and it’s always better to be prepared. If you have any further questions about State Farm’s towing services or auto insurance policies, don’t hesitate to reach out to them directly. Thank you for reading, and stay safe on the road!

.

When you have an accident, the last thing you want to worry about is whether or not your insurance policy covers towing. For many drivers, this is a crucial factor in their decision-making process when choosing an insurance company. Here are some of the most frequently asked questions about State Farm’s towing coverage:

1. Does State Farm include towing in their policies?

Yes, State Farm offers towing and labor coverage as an optional add-on to their auto insurance policies. This coverage can help pay for the cost of towing your vehicle to a repair shop or other location after an accident.

2. How much does State Farm’s towing coverage cost?

The cost of towing and labor coverage varies depending on several factors, including your location, driving history, and the type of vehicle you drive. However, the average cost of this coverage is typically around $5-$10 per month.

3. What services are included in State Farm’s towing coverage?

State Farm’s towing and labor coverage typically includes services such as:

- Towing your vehicle to a repair shop or other location

- Jump-starting your vehicle if the battery dies

- Changing a flat tire

- Unlocking your vehicle if you’re locked out

4. Is there a limit to how many times I can use State Farm’s towing coverage?

Yes, there may be limits to how many times you can use State Farm’s towing and labor coverage. However, these limits vary depending on your specific policy and the state you live in. It’s important to read your policy carefully and talk to your agent if you have any questions about your coverage.

5. What should I do if I need to use State Farm’s towing coverage?

If you need to use State Farm’s towing and labor coverage, you should call their 24-hour roadside assistance hotline as soon as possible. They will help you arrange for a tow truck or other services, depending on your needs.

Overall, State Farm’s towing and labor coverage can provide peace of mind for drivers who want to be prepared for unexpected situations on the road. If you’re interested in adding this coverage to your policy, talk to your local State Farm agent for more information.