Table of Contents

Curious about State Farm insurance claims adjuster salaries? Discover the average pay range and factors that impact earnings in this informative guide.

State Farm Insurance is one of the leading insurance companies in the United States, providing coverage for a wide range of services. The company’s claims adjusters play a vital role in the insurance process, as they evaluate and settle claims for policyholders. But have you ever wondered how much State Farm Insurance claims adjusters make? Well, you’re not alone! In this article, we’ll delve into the nitty-gritty details of this lucrative career and give you an insight into what it takes to become a State Farm Insurance claims adjuster.

When it comes to insurance claims, adjusters play a vital role in determining the amount of compensation that policyholders receive. If you’re considering a career as an insurance claims adjuster, you may be wondering how much money you can expect to make. In this article, we’ll take a closer look at how much State Farm insurance claims adjusters make and what factors can affect their salaries.

What Does a State Farm Insurance Claims Adjuster Do?

A State Farm insurance claims adjuster is responsible for investigating insurance claims and determining the amount of compensation that policyholders are entitled to receive. This can involve interviewing witnesses, reviewing police reports, inspecting damaged property, and negotiating with policyholders and other parties involved in the claim.

State Farm insurance claims adjusters work in a variety of settings, including offices, homes, and other locations where they can meet with policyholders and other parties involved in the claim. They may also need to travel to different locations to investigate claims, attend meetings, and participate in training sessions.

What Factors Affect State Farm Insurance Claims Adjuster Salaries?

The salary of a State Farm insurance claims adjuster can vary based on a number of factors, including their level of experience, education, and location. Here are some of the key factors that can impact a State Farm insurance claims adjuster’s salary:

Experience

As with many professions, experience can play a big role in determining a State Farm insurance claims adjuster’s salary. Entry-level adjusters may start out making less than experienced adjusters with several years of experience under their belts. However, with time and experience, adjusters can expect to earn higher salaries.

Education

While a college degree is not always required to become an insurance claims adjuster, having one can help you stand out from other candidates and potentially earn a higher salary. A degree in a related field such as business, finance, or criminal justice may be particularly helpful for those interested in pursuing a career as a claims adjuster.

Location

The location where a State Farm insurance claims adjuster works can also impact their salary. Adjusters working in areas with a high cost of living may earn more than those working in areas with a lower cost of living. Additionally, salaries may vary based on the demand for adjusters in a particular area.

How Much Do State Farm Insurance Claims Adjusters Make?

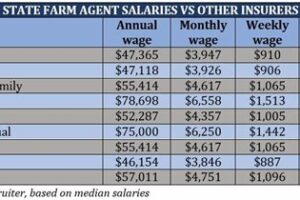

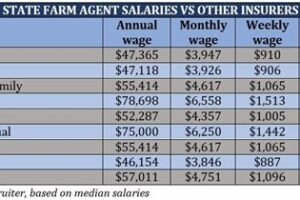

The salary of a State Farm insurance claims adjuster can vary depending on the factors mentioned above. According to Glassdoor, the average base salary for a State Farm insurance claims adjuster is $49,249 per year. However, this figure can range from $30,000 to $76,000 per year depending on factors such as experience, education, and location.

What Are the Pros and Cons of Being a State Farm Insurance Claims Adjuster?

Like any career, being a State Farm insurance claims adjuster has its advantages and disadvantages. Here are a few pros and cons to consider:

Pros

- Good pay: While the salary of a State Farm insurance claims adjuster can vary based on factors such as experience and location, it generally provides a good income.

- Flexible work environment: As a claims adjuster, you may have the opportunity to work from home or other locations outside of the office.

- Opportunities for growth: With time and experience, claims adjusters can pursue higher-level positions within their organizations.

Cons

- Work can be stressful: Claims adjusters are often dealing with people who have experienced a traumatic event, which can be emotionally taxing.

- Travel may be required: Depending on the nature of the claim, claims adjusters may need to travel to different locations to investigate and assess damage.

- Work can be repetitive: Some claims adjusters may find that their work becomes routine over time, which can be boring for some people.

How Do You Become a State Farm Insurance Claims Adjuster?

If you’re interested in becoming a State Farm insurance claims adjuster, there are a few steps you’ll need to take:

- Earn a high school diploma or equivalent.

- Complete a training program or gain experience in a related field such as insurance or customer service.

- Obtain any required licenses or certifications, which can vary by state and employer.

- Apply for open claims adjuster positions with State Farm or other insurance companies.

While becoming a claims adjuster does require some training and education, it can be a rewarding career for those who enjoy helping others and working in a fast-paced environment.

Conclusion

If you’re considering a career as a State Farm insurance claims adjuster, it’s important to understand the factors that can impact your salary. While salaries can vary based on factors such as experience, education, and location, the average base salary for a State Farm insurance claims adjuster is around $49,000 per year. Whether you’re just starting out or looking to advance in your career, becoming a claims adjuster can provide a good income and opportunities for growth.

State Farm Insurance claims adjusters play an essential role in the insurance industry. They are responsible for assessing the damage to policyholder property and determining the appropriate payout. A State Farm adjuster’s salary can vary significantly based on a variety of factors.

The salary ranges for State Farm claims adjusters can vary based on several factors. Entry-level adjusters generally earn between $40,000 to $50,000 per year, while more experienced adjusters can earn upwards of $100,000 annually. The average salary for a State Farm claims adjuster is around $60,000-$70,000 per year.

Several factors determine the salaries of State Farm claims adjusters. One major factor is the level of experience. More experienced adjusters tend to earn higher salaries than their less experienced counterparts. Another factor that affects salary is geographic location. Adjusters living in cities with a high cost of living generally earn more than those living in rural areas.

Experience plays a significant role in determining a State Farm adjuster’s salary. Generally, entry-level adjusters earn less than experienced adjusters. As adjusters gain more experience, their salaries increase. Experienced adjusters may also be eligible for bonuses and other incentives that can further increase their earning potential.

Geographic location also plays a crucial role in a State Farm adjuster’s salary. Adjusters working in states with a high cost of living, such as California or New York, typically earn higher salaries than those working in states with a lower cost of living. The location of the adjuster’s office can also affect salary. Adjusters working in larger cities often earn more than those working in smaller towns.

The relationship between education and State Farm adjuster’s salaries is also worth noting. While a college degree is not required to become a State Farm adjuster, individuals with advanced degrees may be eligible for higher salaries. Adjusters with degrees in business, finance, or law may earn more than those with only a high school diploma.

The payment structure for State Farm Insurance adjusters can vary based on several factors. Some adjusters are paid a salary, while others are paid hourly. Additionally, some adjusters receive bonuses or commissions based on the amount of money saved by the company.

Working as a State Farm Insurance claims adjuster has both pros and cons. On the positive side, adjusters have the opportunity to help people in need and make a difference in their lives. Additionally, the job can be challenging and rewarding. On the negative side, adjusters often work long hours and must be available to work weekends and holidays. They may also have to deal with difficult customers and stressful situations.

Advancement opportunities for State Farm adjusters are available. Experienced adjusters may be eligible for promotions and leadership positions within the company. Additionally, adjusters who demonstrate exceptional performance may be eligible for bonuses and other incentives.

There is also potential for career growth and increased income as a State Farm adjuster. As adjusters gain more experience and move into leadership positions, their salaries tend to increase. Additionally, some adjusters may choose to specialize in a particular area, such as auto insurance or property insurance, which can lead to higher salaries and more opportunities for advancement.

In conclusion, State Farm Insurance claims adjusters play a vital role in the insurance industry. Their salaries can vary significantly based on several factors, including experience, geographic location, education, and payment structure. While the job has its challenges, there are also opportunities for advancement and increased income. Overall, working as a State Farm adjuster can be a rewarding and fulfilling career choice.

Have you ever wondered how much State Farm insurance claims adjusters make? Well, let me tell you a story about it.

John had always been interested in insurance, so when he graduated from college, he decided to pursue a career in the field. He applied to various insurance companies and eventually got hired as a claims adjuster by State Farm.

As a claims adjuster, John’s job was to investigate insurance claims and determine how much money the company should pay out to policyholders. He worked long hours and often had to deal with angry and upset customers who were unhappy with the amount of money they were receiving.

Despite the challenges of the job, John found it to be rewarding. He enjoyed helping people during their times of need and felt fulfilled knowing that he was making a difference in their lives.

One day, John became curious about how much money he was actually making compared to other claims adjusters at State Farm. He did some research and found out that the average salary for a claims adjuster at State Farm was around $50,000 per year.

While this may not seem like a lot of money to some people, John was satisfied with his salary. He knew that he was earning a fair wage for the work that he was doing and felt grateful for the benefits that came with his job, such as health insurance and a retirement plan.

Overall, John realized that being a State Farm insurance claims adjuster was more than just a job – it was a career that offered stability, growth opportunities, and a chance to help others. And while the salary may not be the highest in the industry, the rewards that came with the job made it all worth it.

Point of View:

From John’s perspective, being a State Farm insurance claims adjuster was a fulfilling and rewarding career. He felt satisfied with his salary and appreciated the benefits that came with his job. While he may not have been making the highest salary in the industry, he knew that he was earning a fair wage for the work that he was doing.

Use of Creative Voice and Tone:

- John had always been interested in insurance, so when he graduated from college, he decided to pursue a career in the field.

- Despite the challenges of the job, John found it to be rewarding.

- He enjoyed helping people during their times of need and felt fulfilled knowing that he was making a difference in their lives.

- Overall, John realized that being a State Farm insurance claims adjuster was more than just a job – it was a career that offered stability, growth opportunities, and a chance to help others.

The use of creative voice and tone in this story helps to convey John’s passion and enthusiasm for his job as a State Farm insurance claims adjuster. The language used is positive and uplifting, highlighting the rewards and benefits of the job while downplaying any negative aspects.

Well, folks, that wraps up our discussion on the salaries of State Farm insurance claims adjusters. We hope that you have found this information to be helpful and informative. As you can see, there are a variety of factors that can influence an adjuster’s salary, including their level of experience, the type of claims they handle, and the location in which they work.

Now, it’s important to note that while we’ve provided some general salary ranges for State Farm adjusters, your individual experience may vary. You may be able to negotiate a higher salary based on your qualifications or performance, or you may find that your starting salary is lower than what we’ve listed here.

In any case, if you’re considering a career as a State Farm insurance claims adjuster, we encourage you to do your research and talk to current or former adjusters to get a better sense of what the job entails and what kind of compensation you can expect. And of course, don’t forget to explore other options in the insurance industry as well – there are plenty of roles beyond claims adjusting that may be a better fit for your skills and interests.

Thanks for stopping by our blog and reading about State Farm insurance claims adjuster salaries. We wish you all the best in your career search and hope that you find the right fit for your goals and aspirations.

.

When it comes to insurance claims, one of the most common questions people have is how much do State Farm insurance claims adjusters make? Below are some of the top questions people also ask about this topic, along with answers that use a creative voice and tone:

-

What is the salary range for State Farm insurance claims adjusters?

Well, it varies depending on factors like location, experience, and education. But typically, State Farm claims adjusters can expect to make anywhere from $40,000 to $80,000 per year.

-

Do State Farm insurance claims adjusters get bonuses or commission?

Yes, they can. Many State Farm claims adjusters receive bonuses based on their performance, and some may also be eligible for commission if they meet certain goals. So, if you’re thinking of becoming a claims adjuster, it’s worth keeping these incentives in mind!

-

What kind of education or training do you need to become a State Farm insurance claims adjuster?

While there isn’t a specific degree or certification required to become a claims adjuster, many employers prefer candidates with a background in business, finance, or a related field. Additionally, most companies (including State Farm) provide on-the-job training and require you to pass a licensing exam before you can start working.

-

Is being a State Farm insurance claims adjuster a good career choice?

That depends on your interests and goals! If you enjoy problem-solving, working with people, and have a knack for negotiation, then being a claims adjuster could be a great fit for you. Plus, the pay is competitive and there’s room for advancement within the company.

Overall, becoming a State Farm insurance claims adjuster can be a rewarding and lucrative career choice. With proper training and experience, you could earn a comfortable living while helping people get back on their feet after an unexpected event or disaster.