Table of Contents

Curious about State Farm insurance adjuster salaries? Find out how much they make and what factors impact their pay in this informative article.

Are you curious about how much State Farm insurance adjusters make? Well, you’re not alone. As one of the largest insurance companies in the United States, State Farm employs a massive team of adjusters who help their clients recover from various damages and losses. But just how much do these professionals earn? Let’s dive into the numbers and explore what factors can affect their salaries.

Firstly, it’s important to note that State Farm adjusters’ salaries can vary widely depending on their experience, location, and job title. Entry-level adjusters typically earn around $40,000 per year, while senior adjusters can make upwards of $100,000 annually. However, there are also many other factors that can influence their pay, such as their education level, performance, and the complexity of the claims they handle.

Additionally, some State Farm adjusters may receive bonuses, commissions, or other incentives based on their work performance. For example, adjusters who exceed their targets for customer satisfaction or claims handling efficiency may receive extra compensation or recognition from their superiors. These rewards can be a significant boost to their overall income, making their job even more rewarding and fulfilling.

In conclusion, State Farm insurance adjusters can earn a decent living with the potential for growth and development in their careers. Whether you’re considering a career in insurance or simply curious about how much these professionals make, it’s clear that State Farm adjusters play an essential role in helping people recover from unexpected events and disasters.

State Farm Insurance is one of the most well-known insurance companies in the United States. They offer a wide range of insurance products, including auto, home, and life insurance. However, one of the most important aspects of an insurance company is their claims department, and State Farm has a large team of adjusters who are responsible for handling claims. If you’re considering a career as a State Farm Insurance adjuster, you might be wondering how much you can expect to earn.

What Is a State Farm Insurance Adjuster?

Before we dive into the details of how much State Farm Insurance adjusters make, let’s first define what an adjuster is and what they do. An insurance adjuster is responsible for investigating claims that have been filed by customers. They evaluate the damage or loss that has occurred and determine the amount of money that the insurance company should pay out to the customer.

State Farm Insurance adjusters work with all types of claims, including those related to auto accidents, home damage, and personal injury. They also work directly with customers to answer questions and help them navigate the claims process.

Types of State Farm Insurance Adjusters

There are several different types of State Farm Insurance adjusters, each with their own area of expertise. Here are a few of the most common types:

- Auto Claims Adjuster: These adjusters handle claims related to car accidents and other auto-related incidents.

- Home Claims Adjuster: These adjusters investigate claims related to damage to a customer’s home, including things like water damage, fire damage, and theft.

- Catastrophe Claims Adjuster: These adjusters are called in when there is a major disaster, such as a hurricane or tornado. They help customers file claims and determine the amount of money they should receive from the insurance company.

- Liability Claims Adjuster: These adjusters handle claims related to personal injury, such as slip and fall accidents or dog bites.

How Much Do State Farm Insurance Adjusters Make?

Now that you have a better understanding of what a State Farm Insurance adjuster does, let’s get to the question at hand: how much do they make?

Salary Range

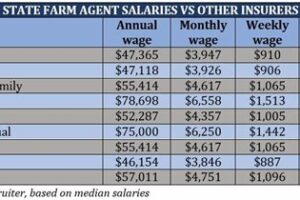

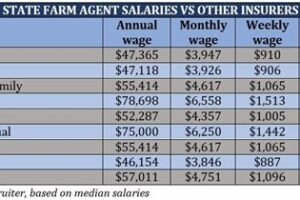

According to Glassdoor, the average salary for a State Farm Insurance adjuster is $47,029 per year. However, this number can vary depending on a variety of factors, including experience level, location, and type of claims being handled. Entry-level adjusters may start out making closer to $40,000 per year, while more experienced adjusters can earn upwards of $70,000 per year.

Bonuses and Other Compensation

In addition to their base salary, State Farm Insurance adjusters may also be eligible for bonuses and other types of compensation. For example, they may receive a bonus for meeting certain performance metrics or for handling a high volume of claims. They may also receive benefits such as health insurance, retirement plans, and paid time off.

How to Become a State Farm Insurance Adjuster

If you’re interested in becoming a State Farm Insurance adjuster, there are a few steps you’ll need to take:

- Educational Requirements: Most State Farm Insurance adjusters have at least a bachelor’s degree in a related field, such as business or finance.

- Experience: While not always required, having experience in the insurance industry can be beneficial when applying for a job as an adjuster.

- Licensing: In order to work as an insurance adjuster, you will need to be licensed in your state. The requirements for licensing vary by state, but typically involve completing a pre-licensing course and passing an exam.

- Training: Once hired, State Farm Insurance adjusters will go through a training program to learn about the company’s policies and procedures, as well as how to handle different types of claims.

Is a Career as a State Farm Insurance Adjuster Right for You?

Becoming a State Farm Insurance adjuster can be a rewarding career path for those who enjoy helping others and have strong analytical skills. However, it can also be a stressful job at times, as adjusters are often dealing with customers who are going through difficult situations. It’s important to consider all aspects of the job before deciding if it’s the right fit for you.

Conclusion

State Farm Insurance adjusters play a critical role in helping customers receive the compensation they deserve after an accident or other type of loss. While the salary for adjusters can vary depending on a number of factors, it can be a lucrative career path for those with the right skills and experience. If you’re interested in becoming a State Farm Insurance adjuster, be sure to research the educational requirements, licensing requirements, and job responsibilities before applying.

Are you considering a career as a State Farm insurance adjuster? One of the most important factors to consider is how much money you can expect to make. In this article, we’ll explore the basics of State Farm insurance adjuster salaries, including educational requirements and experience, geographic location and cost of living, job titles and corresponding salaries, benefits and perks of working for State Farm, typical day-to-day responsibilities, salary comparisons to industry averages, potential for career growth and advancement, industry trends and forecasts, and tips for negotiating your State Farm adjuster salary package.

First, let’s start with the basics. The average State Farm insurance adjuster salary ranges from $41,000 to $87,000 per year, with the median salary falling around $57,000 per year. Factors such as education level, experience, job title, geographic location, and cost of living all play a significant role in determining an adjuster’s salary.

In terms of education, State Farm requires that its adjusters have at least a high school diploma or GED equivalent. However, many adjusters have bachelor’s degrees in fields such as business, finance, or accounting. Additionally, experience in the insurance industry or related fields such as law enforcement or construction can also increase an adjuster’s salary potential.

Geographic location and cost of living are also important considerations. For example, an adjuster working in New York City will likely make a higher salary than one working in a rural area of the Midwest. Similarly, adjusters working in areas with a higher cost of living may receive additional compensation to offset those expenses.

Job title also plays a role in determining an adjuster’s salary. State Farm offers several different types of adjuster positions, each with its own salary range. For example, entry-level adjusters typically start out making around $41,000 per year, while senior adjusters can make upwards of $87,000 per year.

Benefits and perks of working for State Farm include a comprehensive health insurance package, retirement savings plans, paid time off, and flexible scheduling options. Additionally, State Farm offers opportunities for professional development and growth, such as training programs and tuition reimbursement.

Typical day-to-day responsibilities of a State Farm insurance adjuster include investigating claims, assessing damages, negotiating settlements with customers and third parties, and communicating with policyholders and other stakeholders. Adjusters must also stay up-to-date on industry regulations and guidelines and maintain accurate records of their work.

When compared to industry averages, State Farm insurance adjuster salaries are generally competitive. According to the Bureau of Labor Statistics, the median salary for insurance adjusters in general is around $67,000 per year. However, it’s important to note that salaries can vary widely depending on factors such as company size, location, and industry specialization.

For those interested in advancing their careers as State Farm insurance adjusters, there are plenty of opportunities for growth and advancement. Adjusters can move up the ranks to become team leaders, supervisors, or managers, or they may choose to specialize in a particular type of insurance or claim. Additionally, there are opportunities to transition into related fields such as risk management or underwriting.

Looking ahead, industry trends suggest that demand for insurance adjusters will continue to grow over the next decade. This is due in part to an aging population and an increase in natural disasters and other catastrophic events. As a result, adjuster salaries are expected to remain competitive and potentially even increase over time.

Finally, when negotiating your State Farm adjuster salary package, it’s important to do your research and come prepared with a clear understanding of your value and the market rates for your position. Consider factors such as your education, experience, geographic location, and cost of living, and be prepared to negotiate for additional benefits or perks that may be important to you.

In conclusion, State Farm insurance adjuster salaries vary widely depending on a variety of factors, including education level and experience, geographic location, job title, and industry trends. However, with competitive salaries, comprehensive benefits packages, and opportunities for growth and advancement, a career as a State Farm insurance adjuster can be a rewarding and lucrative choice for those looking to break into the insurance industry.

Have you ever wondered how much State Farm insurance adjusters make? Well, let me tell you, as someone who has worked in the insurance industry for years, I can give you some insight.

First and foremost, it’s important to understand what an insurance adjuster does. They are responsible for investigating insurance claims and determining how much money should be paid out to the policyholder. This involves evaluating damage, speaking with witnesses, and reviewing policy documents.

So, how much do these professionals make? It really depends on a few factors:

- Experience: Just like any other job, the more experience an insurance adjuster has, the more they will typically be paid. Entry-level adjusters may start out making around $40,000-$50,000 per year, while more experienced adjusters could make upwards of $100,000.

- Location: Salaries for insurance adjusters can vary depending on where they are located. For example, adjusters working in large cities like New York or Los Angeles may be paid more than those working in smaller towns.

- Type of insurance: The type of insurance an adjuster works with can also impact their salary. For example, adjusters who work with high-risk policies like flood insurance may be paid more than those who work with more common policies like auto insurance.

Overall, insurance adjusters can make a decent living, especially if they have experience and work in a high-paying location or with a specialized type of insurance. However, it’s important to keep in mind that this is a demanding job that requires a lot of attention to detail and excellent communication skills.

If you’re considering a career in insurance adjusting, it’s important to do your research and understand the requirements and expectations of the job. With hard work and dedication, you could find yourself making a comfortable living in this exciting and rewarding industry.

Hey there, dear blog visitors! Thanks for stopping by and joining me in exploring the world of insurance adjusters and their salaries. I hope you found this article insightful and informative. Before we part ways, let me give you a quick summary of what we’ve covered so far.In the first paragraph, we talked about the role of State Farm insurance adjusters and what they do on a day-to-day basis. We also discussed some of the skills and qualifications required to become an adjuster, such as strong communication skills, analytical thinking, and attention to detail. If you’re considering a career in insurance adjusting, make sure to check out our previous articles on how to become an insurance adjuster and what to expect from the job.Moving on to the second paragraph, we delved into the topic of State Farm insurance adjuster salaries. While there’s no one-size-fits-all answer to how much State Farm adjusters make, we did provide some general guidelines based on industry data and job postings. On average, State Farm adjusters can expect to earn anywhere from $40,000 to $70,000 annually, depending on their experience level, location, and other factors. Of course, these numbers are subject to change and may not reflect the exact salary you’ll receive as an adjuster.Finally, in the third paragraph, we talked about some of the pros and cons of working as a State Farm insurance adjuster. From the flexible work schedule to the potential for high earnings and job security, there are certainly some attractive perks to this career path. However, there are also some downsides to consider, such as dealing with difficult clients, working in high-stress situations, and facing the possibility of burnout. Ultimately, the decision to become an adjuster is up to you and your personal preferences and goals.So, there you have it, folks – a quick rundown of how much State Farm insurance adjusters make and what to expect from the job. I hope this article has been helpful and informative for you. If you have any questions or comments, feel free to leave them below. Thanks again for reading, and I wish you all the best in your insurance adjusting career!.

People often ask about how much State Farm Insurance adjusters make. Here are some of the most commonly asked questions and their answers:

-

What is the average salary for a State Farm Insurance adjuster?

The average salary for a State Farm Insurance adjuster is around $51,000 per year.

-

Do State Farm Insurance adjusters get bonuses?

Yes, many State Farm Insurance adjusters receive bonuses based on their performance and the company’s financial success.

-

How much experience do you need to become a State Farm Insurance adjuster?

Typically, State Farm Insurance requires at least two years of experience in the insurance industry before becoming an adjuster.

-

Do State Farm Insurance adjusters receive benefits?

Yes, State Farm Insurance adjusters typically receive benefits such as health insurance, retirement plans, and paid time off.

-

Are there opportunities for advancement within State Farm Insurance as an adjuster?

Yes, there are opportunities for advancement within State Farm Insurance as an adjuster. Adjusters can move up to a supervisory role or even become a manager.

Overall, working as a State Farm Insurance adjuster can be a rewarding career with competitive pay and opportunities for growth within the company.