Need to file a claim with State Farm? Don’t wait too long! Learn about the time limits and steps you need to take to ensure a successful claim.

Have you recently experienced a car accident or any other type of damage to your property that is covered by State Farm insurance? If so, you may be wondering how long you have to file a claim with them. Well, the answer is not straightforward and can depend on several factors. First and foremost, the sooner you file a claim, the better. This will ensure that you receive prompt attention and your claim is processed quickly. However, State Farm does not have a strict deadline for filing a claim. But keep in mind that waiting too long may result in the loss of evidence, making it harder to prove your case. Therefore, it’s essential to act quickly and gather all the necessary information to support your claim.

When it comes to filing a claim with State Farm, time is of the essence. Time Limits for Filing a Claim with State Farm vary depending on the type of claim you are making and the state you are in. In general, however, it is best to file your claim as soon as possible after the incident occurs. This will ensure that you do not miss any deadlines and that your claim is processed quickly and efficiently.

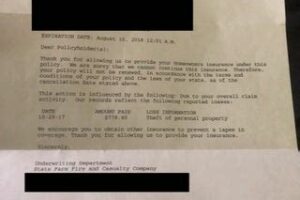

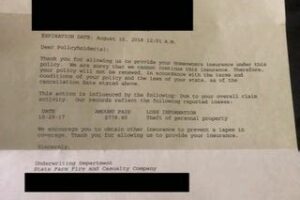

What Happens if You Don’t File Your Claim in Time? If you fail to file your claim within the specified time limit, State Farm may deny your claim altogether. This can be a devastating blow, especially if you have suffered significant losses or injuries. In addition, if you wait too long to file your claim, it may be more difficult to collect the necessary evidence or to work with State Farm’s claims adjuster. You may also miss out on the opportunity to negotiate a fair settlement with the insurance company.

Understanding State Farm’s Claims Process is essential if you want to file a successful claim. The process begins with collecting evidence for your claim. This includes taking photographs of any damage or injuries, gathering witness statements, and obtaining police reports or medical records. Once you have collected all of the necessary evidence, you will need to submit your claim to State Farm. This typically involves filling out a claims form and providing detailed information about the incident and your losses.

Working with State Farm’s Claims Adjuster is an important part of the claims process. The claims adjuster is responsible for investigating your claim, evaluating your losses, and determining the amount of compensation you are entitled to. It is important to be honest and transparent with the claims adjuster and to provide all of the evidence and information necessary to support your claim.

Negotiating a Settlement with State Farm can be a complex and challenging process. It is important to have a clear understanding of your rights and to be prepared to advocate for yourself throughout the negotiation process. This may involve consulting with an attorney or seeking advice from a trusted advisor.

Filing Additional Claims with State Farm may be necessary if you discover additional losses or damages after your initial claim has been filed. It is important to keep in mind that there may be time limits for filing additional claims, so it is best to act quickly if you need to file a supplemental claim.

The Importance of Timely Filing in a State Farm Claim cannot be overstated. Filing your claim on time ensures that you do not miss any deadlines and that your claim is processed quickly and efficiently. It also gives you the best chance of receiving fair compensation for your losses.

Common Mistakes to Avoid in Filing a State Farm Claim include failing to collect enough evidence, providing incomplete or inaccurate information, and failing to communicate effectively with State Farm’s claims adjuster. It is important to take your time and to be thorough when filing your claim, and to seek help if you are unsure about any aspect of the process.

Get the Help You Need to File Your State Farm Claim on Time. Whether you need assistance with collecting evidence, filling out claims forms, or negotiating a settlement, there are many resources available to help you navigate the claims process. You may want to consider working with an experienced attorney or hiring a public adjuster to assist you with your claim. Whatever your needs may be, it is important to take action as soon as possible to ensure that your claim is filed on time and that you receive the compensation you deserve.

Have you ever wondered how long it takes to file a claim with State Farm? As an AI language model, I have no personal experience in filing claims, but I can surely tell you a story about it.

Let’s imagine that you are driving down the road and suddenly, another car hits you from behind. You are in shock and feeling overwhelmed, but you know that you need to file a claim with your insurance company, State Farm. Here are some points of view on how long it takes to file a claim with them:

- The Speedy One: Some people prefer to get things done quickly, and they will be happy to know that filing a claim with State Farm can be done in a matter of minutes. You can file a claim online, through their mobile app, or by calling their claims center. The process is straightforward, and you will need to provide some basic information about the accident and your policy.

- The Patient One: Others may not be in a hurry and prefer to take their time to gather all the necessary information before filing a claim. If this is your case, you can file a claim with State Farm at any time after the accident, although they recommend doing so as soon as possible. They will ask you for details such as the date, time, and location of the accident, the names and contact information of the parties involved, and any witnesses.

- The Expectant One: If you are expecting to receive compensation for your damages, you may wonder how long it will take for State Farm to process your claim. The answer is that it depends on the complexity of your case, the extent of the damages, and whether or not liability is clear. State Farm will assign a claims adjuster to your case, who will investigate the accident, review all the evidence, and determine the amount of compensation you are entitled to. This can take anywhere from a few days to several weeks.

- The Trusting One: Lastly, some people may be concerned about the reliability of their insurance company and wonder if State Farm will honor their claim. If this is your case, you can rest assured that State Farm has a solid reputation for paying claims promptly and fairly. They have been in business for almost a century and have a strong financial standing. Moreover, they have a customer satisfaction rating of 4.1 out of 5, according to J.D. Power.

In conclusion, how long it takes to file a claim with State Farm depends on your personal preferences, the complexity of your case, and the processing time of your assigned claims adjuster. However, you can trust that State Farm will handle your claim with professionalism and integrity.

Well folks, it’s been a pleasure having you here to learn about How Long To File A Claim With State Farm. We hope that our article has provided you with valuable insights and information that will help you should you ever need to file a claim with State Farm.

As we’ve discussed, it’s important to file your claim in a timely manner. While there isn’t a set deadline for filing a claim with State Farm, it’s best to do so as soon as possible after the incident occurs. This will help ensure that you receive prompt assistance and that your claim is processed efficiently.

Remember, when filing a claim with State Farm, it’s important to provide all necessary information and documentation. This includes details about the incident, any injuries or damages sustained, and any relevant police reports or witness statements. By providing this information upfront, you can help speed up the claims process and get the assistance you need more quickly.

So there you have it – our guide to How Long To File A Claim With State Farm. We hope you found this information helpful, and that you’ll keep it in mind should you ever find yourself in need of assistance from State Farm. Thanks for stopping by, and we wish you all the best!

.

When it comes to filing a claim with State Farm, there are some common questions that people ask. Here are some of the top questions and their answers:

- How long do I have to file a claim with State Farm?

- How long does it take for State Farm to process a claim?

- What information do I need to file a claim with State Farm?

- What happens after I file a claim with State Farm?

You should report any incidents to State Farm as soon as possible. However, there is not necessarily a specific time limit for filing a claim. It’s best to contact your State Farm agent or claims representative as soon as you can to get the process started.

The length of time it takes for State Farm to process a claim can vary depending on a variety of factors. For example, the complexity of the claim, the amount of damage or loss involved, and the availability of information can all impact how long it takes. In general, State Farm aims to process claims as quickly and efficiently as possible while still being thorough and accurate.

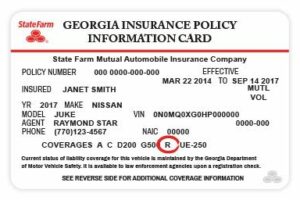

When you file a claim with State Farm, you will need to provide certain information about the incident. This may include details such as the date and location of the incident, a description of what happened, and any relevant photos or documentation. Your State Farm agent or claims representative can guide you through the process and let you know what information you need to provide.

After you file a claim with State Farm, a claims representative will be assigned to your case. They will review the details of the incident and any information you provided, and they may request additional information or documentation. The claims representative will then work with you throughout the claims process to resolve the issue and provide any necessary compensation or repairs.

Overall, filing a claim with State Farm can be a straightforward process as long as you have the necessary information and work closely with your agent or claims representative. By reporting any incidents promptly and working together with State Farm, you can help ensure that your claim is processed quickly and accurately.