Table of Contents

Wondering if State Farm offers insurance for employment agencies? Find out here! Protect your business and employees with State Farm.

As an employer, you understand the importance of having insurance coverage for your business. But what about when you work with employment agencies to help you find the right talent? Do you still need insurance coverage in this scenario? This is where State Farm comes in. With their extensive range of insurance options, you can rest assured that your business will be protected in every situation. From protecting your property and equipment to providing liability coverage for accidents and injuries, State Farm has you covered. Let’s take a closer look at the insurance options State Farm has for employment agencies.

In today’s world, insurance has become a necessity, especially for businesses. Employment agencies, in particular, are always on the lookout for insurance policies that cover their employees and the company itself. One such company that offers insurance policies is State Farm.

What is State Farm?

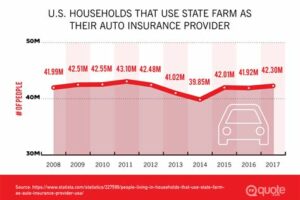

State Farm is an American insurance company that was founded in 1922. It has been providing insurance policies to individuals and businesses for almost a century now. The company offers various insurance policies, including car insurance, home insurance, life insurance, and business insurance.

Does State Farm offer insurance for employment agencies?

Yes, State Farm does offer insurance policies for employment agencies. These policies are specifically designed to cater to the needs of businesses that provide employment services. The policies cover a range of risks that employment agencies face, such as liability claims, property damage, and data breaches.

What are the different insurance policies offered by State Farm for employment agencies?

State Farm offers a range of insurance policies for employment agencies. These policies include:

General Liability Insurance

This policy provides coverage for third-party bodily injury, property damage, and personal injury claims. It also covers advertising injury claims and medical expenses related to these claims.

Professional Liability Insurance

This policy provides coverage for claims arising from errors and omissions in the services provided by the employment agency. It covers legal expenses, settlements, and judgments related to these claims.

Commercial Property Insurance

This policy covers the physical assets of the employment agency, such as the building, equipment, and inventory. It also provides coverage for loss of income due to damage or destruction of these assets.

Business Auto Insurance

This policy provides coverage for vehicles owned or leased by the employment agency. It covers bodily injury and property damage claims arising from accidents involving these vehicles.

Workers’ Compensation Insurance

This policy provides coverage for employees who are injured or become ill while on the job. It covers medical expenses, lost wages, and rehabilitation costs related to the injury or illness.

Benefits of getting insurance from State Farm for employment agencies

Getting insurance from State Farm for employment agencies has several benefits. These include:

Customized policies

The insurance policies offered by State Farm are customized to meet the specific needs of employment agencies. This means that the policies provide comprehensive coverage for the risks faced by the business.

24/7 support

State Farm provides 24/7 support to its customers. This means that employment agencies can reach out to the company at any time for assistance with their insurance policies.

Financial stability

State Farm is a financially stable company that has been in the insurance business for almost a century. This means that employment agencies can trust the company to pay out claims when needed.

Discounts

State Farm offers discounts to businesses that have multiple insurance policies with the company. This means that employment agencies can save money on their insurance premiums.

Conclusion

In conclusion, State Farm offers insurance policies for employment agencies that cover a range of risks faced by these businesses. The policies are customized to meet the specific needs of employment agencies and provide comprehensive coverage. Employment agencies can benefit from getting insurance from State Farm due to the company’s financial stability, 24/7 support, and discounts.

When it comes to running an employment agency, protecting your workforce is a top priority. That’s where State Farm’s insurance policies come in, offering customizable coverage to help you find the right fit for your unique agency. One essential type of coverage is workers’ compensation, which can help cover medical bills and lost wages if one of your employees is injured on the job. General liability insurance is also crucial, protecting your agency against claims of bodily injury or property damage. For employment agencies responsible for matching job seekers with employers, errors and omissions insurance can provide protection if a mistake results in financial loss for a client. And in today’s digital age, cybersecurity insurance can help safeguard your agency’s data from cyber threats and data breaches. Business interruption insurance is also important, providing a safety net for unexpected events that may cause your agency to shut down temporarily. If your agency uses company vehicles, commercial auto insurance is a must-have. Employment practices liability insurance can also be vital for protecting your agency from discrimination and harassment claims. With State Farm’s trusted insurance policies, you can have peace of mind knowing your employment agency is protected.

Once upon a time, there was a woman named Sarah who owned an employment agency. She had been in the business for many years and had a loyal client base. However, one day she realized that she did not have insurance for her agency, and she began to worry about what would happen if something went wrong.

As Sarah pondered her options, she remembered hearing about State Farm insurance. She decided to do some research to find out if they offered coverage for employment agencies.

Here are some key points Sarah discovered:

- State Farm offers liability insurance that can protect businesses from claims made by employees or third parties. This type of insurance is essential for any business owner, including those in the employment agency industry.

- In addition to liability insurance, State Farm also offers other types of insurance that may be useful for employment agencies. For example, they offer property insurance, which can protect a business’s physical assets.

- State Farm has a reputation for excellent customer service and a commitment to helping business owners find the right insurance coverage for their needs.

With this information in mind, Sarah decided to reach out to State Farm to learn more about their insurance options. She was pleasantly surprised by how easy it was to get a quote and purchase a policy that met her needs.

Thanks to State Farm, Sarah was able to rest easy knowing that her employment agency was protected from potential lawsuits or other issues. She continued to grow her business, confident in the knowledge that she had the right insurance coverage in place.

In conclusion, if you own an employment agency, it is essential to have insurance coverage to protect your business. State Farm offers a variety of insurance options that can help you safeguard your company and focus on what matters most: finding quality candidates for your clients.

Dear readers,

As you may already know, employment agencies play a crucial role in today’s workforce. These agencies provide employment opportunities to millions of job seekers and offer valuable staffing solutions to businesses worldwide. However, with the rise of employment agencies, it is essential to ensure that they are adequately covered by insurance policies to protect their business from any unforeseen liabilities.

If you are an employment agency owner or manager, you may be wondering whether State Farm offers insurance for your business. The good news is that State Farm does provide comprehensive insurance coverage for employment agencies. Whether you are looking for liability coverage, property damage protection, or workers’ compensation insurance, State Farm has got you covered.

State Farm understands the unique needs of employment agencies and has tailored its insurance policies to meet these specific demands. With State Farm’s insurance coverage, you can have peace of mind knowing that your business is protected against any potential lawsuits, damages, or accidents that may occur in the workplace.

In conclusion, if you own or manage an employment agency, it is crucial to have adequate insurance coverage to protect your business. State Farm provides comprehensive insurance policies tailored to meet the unique needs of employment agencies. We encourage you to reach out to State Farm’s team of experts to learn more about the insurance options available and to ensure that your business is adequately protected.

Thank you for visiting our blog, and we hope that this article has been informative and helpful to you. We wish you all the best in your entrepreneurial journey.

.

Many people ask if State Farm has insurance for employment agencies. Here are some of the most common questions:

- 1. Does State Farm offer workers’ compensation insurance for employment agencies?

- 2. What other types of insurance does State Farm offer for employment agencies?

- 3. How much does insurance from State Farm cost for an employment agency?

- 4. Is State Farm a good choice for insurance for an employment agency?

Yes, State Farm offers workers’ compensation insurance for employment agencies. This type of insurance provides coverage for employees who are injured on the job or become ill due to their work. It can help pay for medical expenses, lost wages, and other related costs.

In addition to workers’ compensation insurance, State Farm also offers general liability insurance, commercial auto insurance, and umbrella insurance for employment agencies. These policies can provide coverage for a variety of risks, such as property damage, lawsuits, and accidents involving company vehicles.

The cost of insurance from State Farm for an employment agency will depend on several factors, including the size of the agency, the types of services it provides, and the level of coverage needed. To get an accurate quote, it is best to contact a State Farm agent directly and discuss your specific needs.

State Farm is a well-established insurance provider with a strong reputation for customer service and reliability. Many employment agencies choose State Farm for their insurance needs because of their competitive rates and comprehensive coverage options. However, it is always a good idea to compare quotes from multiple providers to ensure you are getting the best value for your money.

In conclusion, State Farm does offer insurance options for employment agencies, including workers’ compensation, general liability, commercial auto, and umbrella insurance. The cost of these policies will depend on various factors, and it is important to compare quotes from multiple providers to find the best coverage at the most affordable price.