Wondering if State Farm covers rebuilt titles? Find out everything you need to know about salvaged vehicles and insurance coverage.

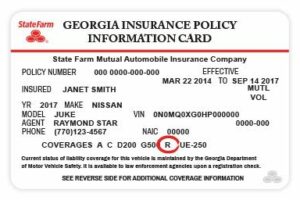

Are you in the market for a vehicle with a rebuilt title, but wondering if your insurance provider will cover it? Look no further than State Farm. As one of the largest insurance companies in the United States, State Farm offers coverage for a variety of vehicles, including those with rebuilt titles. However, before you hit the road, it’s important to understand what a rebuilt title is and what kind of coverage you can expect from State Farm. So, let’s dive into the details and explore everything you need to know about State Farm’s coverage for rebuilt titles.

If you’re considering purchasing a vehicle with a rebuilt title, it’s important to understand the insurance coverage options available to you. As one of the largest insurance providers in the United States, State Farm is a popular choice for many drivers looking for coverage for their vehicles. However, you may be wondering whether State Farm covers vehicles with rebuilt titles. In this article, we’ll provide an overview of State Farm’s policies for rebuilt titles and what you need to know before insuring your rebuilt title vehicle with them.

State Farm and Rebuilt Titles: An Overview

State Farm, like many other insurance companies, provides coverage for vehicles with rebuilt titles. A rebuilt title means that the vehicle has been previously declared a total loss by an insurance company and then repaired and restored to a roadworthy condition. While rebuilt titles can often be obtained at a lower cost than clean titles, they can also come with some drawbacks, such as potentially decreased resale value and difficulty obtaining financing.

Insurance Coverage for Rebuilt Titles: What You Need to Know

When it comes to insuring a rebuilt title vehicle, it’s important to understand that not all insurance companies provide the same level of coverage. Some insurers may only offer liability coverage, while others may offer full coverage options such as comprehensive and collision coverage. It’s important to fully understand the coverage options available to you before purchasing insurance for your rebuilt title vehicle.

Understanding State Farm’s Policies for Rebuilt Titles

State Farm offers coverage for vehicles with rebuilt titles, but the specific coverage options may vary depending on the state where you reside. Generally, State Farm will provide liability coverage for rebuilt title vehicles, but may also offer collision and comprehensive coverage in some cases. It’s important to speak with a State Farm representative to determine what coverage options are available in your state.

Can You Insure a Vehicle with a Rebuilt Title through State Farm?

If you own a vehicle with a rebuilt title, you can typically obtain insurance coverage through State Farm. However, as mentioned before, the specific coverage options may vary depending on your location and other factors. It’s always best to speak directly with a State Farm representative to determine the coverage options available for your specific situation.

The Benefits and Drawbacks of Insuring a Rebuilt Title Vehicle

There are both benefits and drawbacks to insuring a rebuilt title vehicle. The main benefit is the potential cost savings, as rebuilt title vehicles can often be purchased at a lower price than clean title vehicles. However, there can also be drawbacks, such as decreased resale value and difficulty obtaining financing. Additionally, some insurance companies may charge higher premiums or offer limited coverage options for rebuilt title vehicles.

What Factors Affect State Farm’s Decision to Cover a Rebuilt Title Vehicle?

State Farm will consider several factors when deciding whether to provide coverage for a rebuilt title vehicle. These factors may include the age of the vehicle, the extent of damage that led to the previous salvage title, and the quality of repairs made. It’s important to provide as much information as possible about the vehicle’s history and repairs when applying for coverage.

Does State Farm Offer Comprehensive Coverage for Rebuilt Title Vehicles?

While State Farm may offer comprehensive coverage for rebuilt title vehicles in some cases, this is not always the case. It’s important to speak with a State Farm representative to determine what coverage options are available for your specific situation.

The Role of Salvage Titles in Rebuilt Title Insurance Coverage with State Farm

Salvage titles are different from rebuilt titles, but they can play a role in insurance coverage for rebuilt title vehicles. A salvage title means that the vehicle has been declared a total loss by an insurance company and is not roadworthy. Salvage titles can make it more difficult to obtain insurance coverage for a rebuilt title vehicle, as insurers may view the vehicle as a higher risk.

What Options Do You Have If State Farm Doesn’t Cover Your Rebuilt Title Vehicle?

If State Farm does not offer coverage for your rebuilt title vehicle, there are still options available. You can try contacting other insurance companies to see if they offer coverage for rebuilt title vehicles. Alternatively, you may be able to obtain liability-only coverage through your state’s assigned risk plan.

Getting the Best Insurance Rates for Your Rebuilt Title Vehicle with State Farm

If you’re insuring a rebuilt title vehicle with State Farm, there are several things you can do to help get the best rates possible. These include maintaining a good driving record, choosing a higher deductible, and taking advantage of any discounts that may be available. It’s also important to provide as much information as possible about the vehicle’s history and repairs when applying for coverage.

In conclusion, while State Farm does offer coverage for vehicles with rebuilt titles, the specific coverage options may vary depending on your location and other factors. It’s important to fully understand the coverage options available to you before purchasing insurance for your rebuilt title vehicle. Additionally, providing as much information as possible about the vehicle’s history and repairs can help increase your chances of obtaining coverage and getting the best rates possible.

Once upon a time, there was a man named John who had recently purchased a car with a rebuilt title. He was worried about whether his insurance company, State Farm, would cover him in case of an accident. He decided to do some research and find out if State Farm covers rebuilt titles.

Here are some points of view on the matter:

- Yes, State Farm does cover rebuilt titles: Some State Farm policies may cover rebuilt titles, but it depends on the state and the specific policy. It’s important to check with your State Farm agent to see if your policy covers rebuilt titles.

- No, State Farm does not cover rebuilt titles: In some states, State Farm may not offer coverage for cars with rebuilt titles. If you live in one of these states, you may need to look for another insurance company that provides coverage for rebuilt titles.

- State Farm may offer limited coverage for rebuilt titles: In some cases, State Farm may offer limited coverage for cars with rebuilt titles. This means that the coverage may be less than what is offered for cars with clean titles. If you have a car with a rebuilt title, it’s important to understand the limitations of your coverage.

In John’s case, he contacted his State Farm agent and found out that his policy did cover his car with a rebuilt title. He was relieved to know that he was protected in case of an accident. He also learned that he needed to disclose that his car had a rebuilt title when he renewed his policy.

So, the answer to the question “Does State Farm cover rebuilt titles?” is that it depends on the state and the specific policy. If you have a car with a rebuilt title, it’s important to check with your insurance company to see if you are covered.

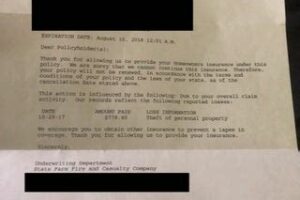

Dear Blog Visitors,We hope that you have found the information in this article helpful regarding State Farm’s coverage of rebuilt titles. Our goal is to provide you with accurate and informative content so that you can make informed decisions about your insurance needs.As we mentioned earlier, State Farm does not offer coverage for vehicles with rebuilt titles. This means that if you own a vehicle with a rebuilt title, you will need to look for coverage elsewhere. While this might seem like a hassle, it’s important to remember that rebuilt title vehicles come with their own set of risks. By choosing an insurance provider that specializes in these types of vehicles, you can ensure that you are fully protected in the event of an accident or other unforeseen circumstances.If you are in the market for a vehicle with a rebuilt title, we recommend doing your research and carefully considering the potential risks before making a purchase. While these vehicles might be more affordable than their clean title counterparts, they can come with a host of issues that could end up costing you more in the long run.In conclusion, we hope that this article has been helpful in answering your questions about State Farm’s coverage of rebuilt titles. While they do not offer coverage for these types of vehicles, there are plenty of other insurance providers out there who specialize in this area. As always, it’s important to do your due diligence and choose an insurance policy that meets your unique needs and budget. Thank you for taking the time to read our article and we wish you all the best in your insurance journey..

As an AI language model, I do not have personal experiences with insurance policies. However, I can provide information on the common questions that people ask about State Farm’s coverage on rebuilt titles. Here are some of them:

-

Does State Farm provide insurance for cars with rebuilt titles?

-

What is a rebuilt title?

-

Is it more expensive to insure a car with a rebuilt title?

-

Can I get full coverage insurance on a car with a rebuilt title?

-

What documents do I need to insure a car with a rebuilt title?

Yes, State Farm can provide insurance for vehicles with rebuilt titles. However, it may depend on the state laws and the extent of the damage that the vehicle has incurred.

A rebuilt title means that the vehicle has been previously declared as a total loss but has undergone repairs and passed inspection to be roadworthy again. Essentially, it means that the car has been rebuilt from salvage.

Generally, yes. Insuring a car with a rebuilt title can be more expensive due to the higher risk involved, as these vehicles may have underlying issues that could cause accidents or breakdowns. Insurance companies may also consider the diminished value of the vehicle.

It may be possible to get full coverage insurance on a car with a rebuilt title, but it depends on the insurer’s policies and the state laws. Some insurers may limit the coverage options for rebuilt titles and may not offer comprehensive or collision coverage.

You will typically need to provide the rebuilt title certificate, proof of ownership, and documentation of the repairs and inspections that the vehicle has undergone.

These are just some of the common questions that people ask about State Farm’s coverage on rebuilt titles. If you are considering insuring a car with a rebuilt title, it is best to contact your insurer directly and inquire about their policies and requirements.