Table of Contents

Wondering if State Farm homeowners insurance covers tornado damage? Learn what your policy may cover and how to file a claim if needed.

Are you a homeowner living in an area prone to tornadoes? If so, you may be wondering if your State Farm homeowners insurance policy covers tornado damage. Dealing with the aftermath of a natural disaster can be overwhelming, and it’s crucial to know what your insurance policy covers to ensure you’re financially protected. The good news is that State Farm does provide coverage for tornado damage, but it’s essential to understand the details of your policy to determine what is covered and what isn’t. Let’s take a closer look at the specifics, so you can have peace of mind and be prepared in case of a tornado.

When a tornado hits, it can cause massive destruction in just a matter of minutes. Homeowners are left to deal with the aftermath and the financial burden that comes along with it. One question that often arises is whether or not State Farm homeowners insurance covers tornado damage. In this article, we will explore this question in detail.

Understanding State Farm Homeowners Insurance

State Farm is one of the largest insurance providers in the country, offering a wide range of insurance products, including homeowners insurance. Homeowners insurance from State Farm provides coverage for your home, personal property, liability, and additional living expenses in the event of a covered loss.

However, it’s important to note that not all losses are covered under a standard homeowners insurance policy. That’s why it’s essential to review your policy and understand what is and isn’t covered.

Does State Farm Homeowners Insurance Cover Tornado Damage?

The short answer is yes, State Farm homeowners insurance covers tornado damage, but it depends on the type of coverage you have. Most standard homeowners insurance policies cover wind damage, which includes damage caused by tornadoes.

If your home is damaged by a tornado, you may be eligible for reimbursement for repair or replacement costs up to your policy limit. However, it’s important to note that there may be exclusions and limitations to your coverage, depending on your policy.

What Does State Farm Homeowners Insurance Cover?

As mentioned earlier, a standard homeowners insurance policy from State Farm provides coverage for your home, personal property, liability, and additional living expenses. Here’s a closer look at what each of these coverages entails:

Home Coverage

Home coverage provides protection for the structure of your home, including the roof, walls, floors, and foundation. It also covers attached structures, such as garages and decks.

Personal Property Coverage

Personal property coverage provides protection for your personal belongings, such as furniture, clothing, and electronics. It also covers items that are not physically located in your home, such as your luggage while traveling.

Liability Coverage

Liability coverage provides protection if someone is injured on your property or you cause damage to someone else’s property. It also covers legal fees if you are sued.

Additional Living Expenses Coverage

Additional living expenses coverage provides reimbursement for expenses you incur if you are unable to live in your home due to a covered loss. This may include hotel costs, rental expenses, and food expenses.

Exclusions and Limitations

While State Farm homeowners insurance covers tornado damage, there may be exclusions and limitations to your coverage. For example, if your policy has a high deductible, you may be responsible for paying a significant portion of the repair or replacement costs out of pocket.

Additionally, certain items may not be covered under a standard homeowners insurance policy. For example, if you have valuable jewelry or artwork, you may need to purchase additional coverage to protect these items.

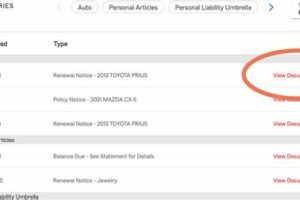

How to File a Claim

If your home is damaged by a tornado, the first step is to ensure that you and your family are safe. Once it’s safe to do so, you should contact State Farm to file a claim. Here’s what you’ll need to do:

- Contact State Farm as soon as possible to report the damage.

- Provide details about the damage, including the date and time of the tornado, and the extent of the damage.

- Take photos or videos of the damage for your records.

- Make any necessary temporary repairs to prevent further damage.

- Keep all receipts and invoices related to the repairs.

Conclusion

In conclusion, State Farm homeowners insurance does cover tornado damage, but the extent of your coverage depends on your policy. It’s essential to review your policy and understand what is and isn’t covered before a disaster strikes. If you need help understanding your policy or filing a claim, don’t hesitate to contact your State Farm agent for assistance.

Understanding the basics of State Farm homeowners insurance coverage is crucial for protecting your home and belongings in the event of a natural disaster like a tornado. While State Farm’s standard homeowners insurance policy covers a wide range of perils, including windstorm damage, it’s important to know exactly what is covered and what’s not when it comes to tornado damage.

The good news is that State Farm’s standard homeowners insurance policy typically covers damages caused by tornadoes, including damage to your home’s structure and personal property. However, it’s important to note that certain exclusions may apply depending on your policy’s specific terms and conditions.

If you’ve experienced tornado damage, there are several steps you should follow to ensure that you’re able to recover as quickly and efficiently as possible. First, assess the damage and take photos to document the extent of the destruction. Then, contact your insurance company as soon as possible to report the damage and begin the claims process.

It’s also important to understand your homeowners insurance policy limits and whether they are enough to cover the costs of repairing or rebuilding your home in the event of a tornado. Depending on your policy, you may be able to purchase additional coverage to supplement your standard policy and protect yourself against unforeseen losses.

One type of additional coverage offered by State Farm is tornado coverage, which provides additional protection beyond what is covered under the standard policy. While this coverage may come at an additional cost, it can be well worth the investment in the event of a catastrophic natural disaster like a tornado.

In addition to tornado damage, homeowners in tornado-prone areas should also consider purchasing flood insurance to protect against the potential damages caused by heavy rainfall and flooding. While many homeowners insurance policies include coverage for wind-driven rain, this coverage may not extend to flooding caused by a tornado.

When it comes to calculating the cost of tornado damage, it’s important to understand the difference between replacement cost and actual cash value. Replacement cost refers to the amount it would cost to replace your damaged property with a brand new item of like kind and quality, while actual cash value takes into account depreciation and the age and condition of the damaged property.

If you’ve experienced tornado damage, you’ll likely need to work closely with an insurance adjuster to investigate the extent of the damage and determine the appropriate compensation for your losses. It’s important to be honest and transparent throughout this process and provide as much documentation and evidence as possible to support your claim.

Finally, prevention is key when it comes to mitigating tornado damage risk. Taking proactive steps such as reinforcing your home’s roof, securing loose outdoor items, and trimming trees and branches can help reduce the risk of damage in the event of a tornado.

Overall, State Farm homeowners insurance provides valuable protection against the potential damages caused by tornadoes and other natural disasters. By understanding your policy’s coverage limits and taking proactive steps to reduce your risk of damage, you can ensure that you’re prepared for whatever Mother Nature may throw your way.

Once upon a time, there was a family living in a house in the middle of Tornado Alley. They had heard stories about how destructive tornadoes could be but never thought it would happen to them.

One day, a tornado touched down in their area and caused significant damage to their home. The family was devastated and had no idea what to do next.

That’s when they remembered that they had State Farm homeowners insurance. They quickly contacted their agent to see if their policy covered tornado damage.

The agent informed them that State Farm homeowners insurance does cover tornado damage. The family was relieved to hear this news and immediately filed a claim.

Thanks to their State Farm homeowners insurance, the family was able to get the necessary repairs done to their home and get back to living their lives.

From the point of view of someone wondering if State Farm homeowners insurance covers tornado damage:

- First, it’s essential to understand what your homeowners insurance policy covers.

- If you live in an area prone to tornadoes, it’s essential to make sure your policy covers tornado damage.

- Contact your State Farm agent to confirm if your policy covers tornado damage.

- If your policy does cover tornado damage, file a claim as soon as possible after the storm has passed.

- Be prepared to provide documentation of the damage, including photos and estimates from contractors.

- Work with your State Farm agent to get the necessary repairs done to your home.

- Take steps to prepare for future tornadoes, such as creating an emergency kit and having a plan in place for where to go during a storm.

In conclusion, State Farm homeowners insurance does cover tornado damage, providing peace of mind for those living in areas prone to tornadoes. It’s crucial to understand what your policy covers and to take steps to prepare for future storms.

Hey there, dear blog visitors! We hope you found our article on whether State Farm homeowners insurance covers tornado damage informative and helpful. Before we sign off, we wanted to leave you with a few key takeaways.

Firstly, it’s important to understand that every insurance policy is different and may have specific exclusions or limitations when it comes to natural disasters like tornadoes. That’s why it’s crucial to carefully review your policy and speak with your agent to ensure you have adequate coverage for your home and belongings.

Secondly, if you do experience tornado damage, it’s important to act quickly and take steps to mitigate further damage and protect your property. This may include boarding up broken windows, covering damaged roofs with tarps, and removing debris from your yard and surrounding areas.

Lastly, we want to remind you that while recovering from a tornado can be a daunting process, you don’t have to go it alone. Your insurance company, including State Farm, is here to support you and help you navigate the claims process. Be sure to document all damage and losses, keep receipts for any repairs or replacements, and don’t hesitate to reach out for assistance.

Thanks for stopping by and reading our article. We hope you found it helpful and informative, and we wish you all the best in protecting your home and belongings from the unpredictable forces of nature.

.

When it comes to natural disasters, tornadoes are one of the most destructive forces of nature. So, it’s no surprise that homeowners want to know if their insurance policy covers this type of damage. Here are some of the most common questions people ask about State Farm homeowners insurance and tornado damage:

-

Does State Farm homeowners insurance cover tornado damage?

Yes, State Farm homeowners insurance typically covers tornado damage. This can include damage to your home, personal property, and other structures on your property, such as garages or sheds.

-

What specifically does State Farm homeowners insurance cover in the event of a tornado?

State Farm homeowners insurance covers a wide range of damage caused by tornadoes, including:

- Damage to the structure of your home

- Damage to personal property, such as furniture, appliances, and electronics

- Damage to other structures on your property, such as garages or sheds

- Additional living expenses if you are unable to live in your home due to tornado damage

- Debris removal and cleanup costs

- Repairs to landscaping or outdoor features, like fences or patios

-

Are there any exclusions to State Farm homeowners insurance coverage for tornado damage?

While State Farm homeowners insurance does cover tornado damage, there may be some exclusions or limitations depending on your specific policy. For example, your policy may have a separate deductible for windstorm or hail damage. It’s important to review your policy carefully and speak with your agent if you have any questions about your coverage.

-

What steps should I take if my home is damaged by a tornado?

If your home is damaged by a tornado, the first step is to ensure that you and your family are safe. Then, take photos of the damage and contact State Farm to file a claim as soon as possible. A claims adjuster will assess the damage and work with you to determine the next steps for repairs and rebuilding.

Overall, State Farm homeowners insurance does typically cover tornado damage, but it’s important to review your policy carefully and understand any exclusions or limitations that may apply. If you have questions or concerns about your coverage, don’t hesitate to reach out to your agent for assistance.