State Farm offers Gap Insurance to cover the difference between what you owe on your car and its actual value in case of theft or total loss.

Are you in the market for a new car? If so, you may have heard of gap insurance. Gap insurance can be a lifesaver in the event of an accident or theft. But does State Farm offer it? The answer is yes, and you’ll be pleased to know that State Farm’s gap insurance is both comprehensive and affordable. So if you’re looking to protect yourself from financial loss when you buy a new car, read on to find out more about State Farm’s gap insurance and how it can benefit you.

Gap insurance is an essential policy that protects car owners from financial loss in the event of an accident or theft. The importance of gap insurance cannot be overstated, especially for those who have recently purchased a new car or financed their vehicle. Understanding what gap insurance covers is crucial to determining whether it’s right for you.

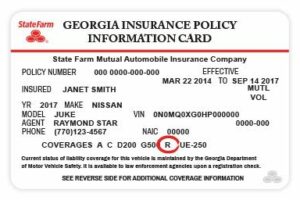

So, does State Farm offer gap insurance? The answer is yes. State Farm offers gap insurance to its customers as an optional coverage add-on. This insurance policy covers the difference between the actual cash value of your car and the amount you still owe on your loan or lease. Without gap insurance, you could be left with a significant financial burden in the event of a total loss or theft of your car.

Why might you need gap insurance without a title? If you’ve recently purchased a new car or financed a vehicle, you may not have the title yet. In this case, you are still responsible for paying off the loan or lease even if the car is totaled or stolen. Gap insurance can help cover the remaining balance on your loan or lease, preventing you from being stuck with a large debt.

When is gap insurance necessary? Generally, gap insurance is necessary for those who have financed or leased a vehicle. If the car is totaled or stolen and you owe more on your loan or lease than the car is worth, gap insurance will cover the difference. Additionally, if you put down a small down payment or have a high interest rate, you may also benefit from having gap insurance.

How much does gap insurance cost? The cost of gap insurance varies depending on several factors, including the make and model of your car, the length of your loan or lease, and your credit score. Generally, gap insurance costs around 5-6% of your total car insurance premium.

What should you consider before choosing gap insurance? Before deciding whether to purchase gap insurance, consider factors such as the value of your car, the length of your loan or lease, and your ability to cover the difference between your car’s actual cash value and your outstanding loan or lease balance. Additionally, check with your lender to see if they require gap insurance as part of your loan or lease agreement.

State Farm offers two gap insurance policy options: vehicle loan/lease coverage and lease/loan security coverage. Vehicle loan/lease coverage pays the difference between the actual cash value of your car and the amount you owe on your loan or lease. Lease/loan security coverage goes a step further, covering up to $1,000 of your insurance deductible in addition to the difference between the actual cash value and your loan or lease balance.

If you decide to purchase gap insurance from State Farm, you can do so through your local agent or online. It’s important to note that you must have comprehensive and collision coverage on your car insurance policy to be eligible for gap insurance.

Making an informed decision about gap insurance is crucial to protecting yourself from financial loss. Consider your individual circumstances, the cost of the policy, and the coverage options available to you before making a decision. By choosing State Farm for your gap insurance needs, you can rest assured that you are getting reliable coverage from a trusted insurer.

Once upon a time, a young couple named Jack and Jill were in the market for a new car. They found the perfect vehicle at a dealership and were excited to make the purchase. However, the salesperson informed them about the possibility of owing more than the car was worth in the event of an accident or theft. This is where gap insurance comes into play.

Gap insurance, also known as Guaranteed Asset Protection, covers the difference between what you owe on a car loan and the car’s actual cash value if it is totaled or stolen. For example, if your car is worth $20,000 but you owe $25,000 on it, gap insurance covers the $5,000 difference.

Jack and Jill had heard about gap insurance before, but they weren’t sure if their insurance provider, State Farm, offered it. They decided to do some research and found out that State Farm does offer gap insurance.

Here are a few reasons why choosing State Farm for your gap insurance needs might be a good idea:

- Convenience – If you already have auto insurance with State Farm, adding gap insurance to your policy is quick and easy.

- Competitive Pricing – State Farm offers competitive pricing for gap insurance, so you can rest assured that you’re getting a good deal.

- Peace of Mind – Knowing that you’re covered in the event of an accident or theft can provide peace of mind and alleviate financial stress.

Overall, gap insurance is a smart investment for anyone who finances a vehicle. And if you’re already a State Farm customer, you may want to consider adding gap insurance to your policy for added protection. Don’t wait until it’s too late – get gap insurance today!

Well, folks, that’s all the information we have for you today about State Farm and their gap insurance policies. We hope that this article has been helpful in answering some of your questions about gap insurance and its importance when it comes to protecting your investments.

It’s always important to remember that accidents can happen at any time, and having gap insurance can provide peace of mind knowing that you won’t be left with a financial burden in the event of a total loss.

If you’re considering purchasing gap insurance, we highly recommend reaching out to a State Farm agent to discuss your options and find the best policy for your needs. They can help answer any additional questions you may have and guide you through the process of securing coverage.

Thank you for taking the time to read our article and learn more about State Farm’s gap insurance offerings. We wish you the best of luck in your insurance journey and hope that you stay safe on the road!

Video Does State Farm Offer Gap Insurance

People also ask about Does State Farm Offer Gap Insurance?

- What is gap insurance?

- Does State Farm offer gap insurance?

- What does State Farm’s gap insurance cover?

- How much does State Farm’s gap insurance cost?

- Is gap insurance necessary?

Gap insurance is a type of auto insurance that covers the difference between your car’s actual cash value and what you owe on your car loan. It can be helpful if you owe more on your car than it’s worth, or if you’re leasing a car.

Yes, State Farm offers gap insurance as an optional coverage add-on for their auto insurance policies.

State Farm’s gap insurance covers the difference between the actual cash value of your car and the amount you owe on your car loan or lease. It can also cover your deductible up to $1,000 if your car is declared a total loss.

The cost of State Farm’s gap insurance varies depending on factors such as your location, your car’s make and model, and your driving record. You may be able to get a discount by bundling gap insurance with other types of insurance, such as collision coverage.

Gap insurance is not required by law, but it can be a good idea if you owe more on your car than it’s worth or if you’re leasing a car. Without gap insurance, you could be responsible for paying the difference between your car’s actual cash value and what you owe on your car loan or lease in the event of a total loss.

Overall, State Farm does offer gap insurance as an optional coverage add-on for their auto insurance policies. It can be a helpful addition if you owe more on your car than it’s worth or if you’re leasing a car. The cost of State Farm’s gap insurance varies depending on several factors, but you may be able to get a discount by bundling it with other types of insurance. While gap insurance is not required by law, it can provide peace of mind and protect you from unexpected expenses in the event of a total loss.