Table of Contents

Wondering if State Farm Insurance covers vandalism? Learn what types of damage are covered and how to file a claim in this informative guide.

Are you a State Farm Insurance policyholder who’s recently fallen victim to vandalism? If so, you might be wondering if your insurance policy covers the damages caused by these senseless acts. Well, wonder no more! In this article, we’ll explore whether or not State Farm Insurance provides coverage for vandalism and what steps you should take if your property has been vandalized. So, buckle up, grab a cup of coffee, and let’s dive in!

When it comes to protecting your property, the last thing you want is to have to worry about vandalism. Unfortunately, this is a very real risk for homeowners and business owners alike. Vandalism can be costly to repair, and it can also be emotionally taxing to deal with. If you have State Farm Insurance, you may be wondering whether or not your policy will cover vandalism damage. Here’s what you need to know.

What is Vandalism?

Vandalism refers to any malicious damage done to someone else’s property. This can take many forms, including graffiti, broken windows, and other types of destruction. Vandalism can be a random act of violence or a targeted attack, and it can happen anywhere, at any time.

Does State Farm Insurance Cover Vandalism?

If you have a State Farm Insurance policy, the good news is that vandalism is usually covered. This means that if your property is damaged by vandals, you can file a claim and have the repairs covered by your insurance. However, there are some important things to keep in mind.

What Does State Farm Insurance Cover?

State Farm Insurance typically covers damage to your property caused by vandalism. This can include things like broken windows, graffiti, and other types of destruction. However, it’s important to note that not all types of vandalism are covered. For example, if someone intentionally damages your property, but it’s not considered vandalism, your insurance may not cover the damage.

What Isn’t Covered?

There are some types of vandalism that may not be covered by your State Farm Insurance policy. These can include things like graffiti on a fence or a car, or damage caused by a tenant or roommate. In addition, if you don’t have comprehensive coverage on your policy, you may not be covered for vandalism at all.

How to File a Claim for Vandalism

If your property has been vandalized, the first thing you should do is call the police. They will need to come and take a report, which you will need to file a claim with State Farm Insurance. You should also take pictures of the damage and keep any receipts or other documentation related to the repairs.

How Long Does the Claims Process Take?

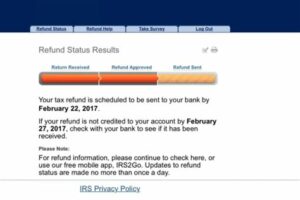

The claims process for vandalism can take anywhere from a few days to several weeks, depending on the severity of the damage and how quickly you are able to provide all the necessary documentation. During this time, you will need to work with your insurance adjuster to get an estimate for the repairs and have them approved.

How Much Will State Farm Insurance Cover?

The amount that State Farm Insurance will cover for vandalism damage will depend on your policy and the specific details of the damage. In general, your insurance will cover the cost of repairs or replacement up to the limits of your policy. If the damage is severe enough, you may be able to receive additional funds to cover any temporary living expenses that you may incur while your property is being repaired.

Conclusion

Vandalism can be a frustrating and costly experience, but if you have State Farm Insurance, you can rest assured that you will likely be covered. However, it’s important to read your policy carefully and understand what is and isn’t covered. Remember to take pictures and keep all documentation related to the damage, and work closely with your insurance adjuster to get the repairs done as quickly and efficiently as possible.

Introducing the topic of vandalism coverage, it is important to understand that vandalism can cause significant damage to your property. From graffiti on the walls to broken windows and damaged furniture, vandalism can be a frustrating and costly experience for homeowners. Fortunately, State Farm Insurance policies cover certain types of vandalism, providing financial protection and peace of mind for policyholders.

Understanding the concept of vandalism and the damage it can cause is crucial for homeowners. Vandalism refers to intentional damage or destruction of someone else’s property, and it can happen in many forms. Some common examples of vandalism include graffiti, broken windows, slashed tires, and damage to outdoor furniture. The damage caused by vandalism can be extensive and costly, often requiring repairs or replacements that can be a significant financial burden for homeowners.

Different types of vandalism covered by State Farm Insurance policies include damage caused by acts of vandalism and malicious mischief. Acts of vandalism refer to intentional damage or destruction of property, while malicious mischief refers to any intentional damage that is not considered an act of vandalism. State Farm Insurance policies also cover damages caused by riots, civil commotions, and other similar events.

If you experience vandalism damage to your property, filing a claim with State Farm Insurance is a straightforward process. You will need to provide documentation of the damage, including photographs, police reports, and any other relevant information. A claims adjuster will then assess the damage and determine the amount of coverage provided under your policy.

Factors that can affect the coverage of vandalism include the specific policy terms and conditions, the extent of the damage, and any deductibles or limits associated with the policy. It is essential to review your policy carefully to understand the coverage provided for vandalism and any limitations that may apply.

Deductibles and limits for State Farm Insurance policies vary depending on the specific policy and coverage selected. A deductible refers to the amount of money you will need to pay out of pocket before your insurance coverage kicks in. Limits refer to the maximum amount of coverage provided under your policy. It is important to consider these factors when selecting an insurance policy to ensure that you have adequate coverage for vandalism damage.

Additional coverage options for vandalism damage include adding a rider or endorsement to your policy. This can provide extra protection for specific types of vandalism, such as graffiti or damage caused by riots. It is essential to discuss these options with your insurance provider to determine if they are appropriate for your needs.

Tips for preventing vandalism to your property include installing security cameras, motion-activated lights, and fencing. These measures can deter vandals from targeting your property and can provide valuable evidence if vandalism does occur. It is also important to remove any graffiti or other damage promptly to discourage further vandalism.

Why it’s essential to have vandalism coverage is simple: vandalism damage can be costly and unexpected. Without insurance coverage, homeowners may be left to cover the cost of repairs or replacements themselves, which can be financially devastating. Having insurance coverage for vandalism provides peace of mind and financial protection in the event of unexpected damage.

In conclusion, choosing a reliable insurance provider like State Farm Insurance is essential for homeowners seeking protection against vandalism damage. Understanding the coverage provided under your policy, filing a claim promptly, and taking steps to prevent vandalism to your property are all important considerations for homeowners seeking to protect their investment and financial well-being.

Have you ever experienced the frustration of waking up to find that someone has vandalized your property? It’s a violation that can leave you feeling angry and helpless. But if you have State Farm Insurance, you may be able to get some relief from the financial burden of repairing the damage. Here’s what you need to know about whether or not State Farm covers vandalism.

- First of all, it’s important to understand that not all insurance policies are created equal. Some policies may exclude coverage for certain types of damage, including vandalism. That’s why it’s important to review your policy carefully and talk to your agent if you have any questions.

- Luckily, most State Farm policies do cover vandalism, as long as it’s not excluded in your specific policy. This means that if someone intentionally damages your property, you may be able to file a claim and get reimbursed for the cost of repairs.

- It’s important to note, however, that there are some limitations to State Farm’s coverage for vandalism. For example, if the damage is done by someone who lives in your household, it may not be covered. Additionally, there may be limits on the amount of coverage available for certain types of damage, so make sure you check your policy for details.

So if you’re a State Farm customer and you’ve been the victim of vandalism, don’t despair. You may be able to get the help you need to repair the damage and move on from this frustrating experience. Just make sure you review your policy carefully and talk to your agent if you have any questions or concerns. With the right coverage and support, you can get through even the toughest situations with confidence.

Well folks, we’ve reached the end of our discussion on whether State Farm Insurance covers vandalism. We hope that this article has provided you with valuable information and insights into what coverage options are available to protect your property from vandalism.

As we’ve discussed, State Farm offers a variety of insurance policies that can cover damages caused by vandalism. However, it’s important to note that not all policies are created equal. Some policies may have more comprehensive coverage than others, so it’s essential to review your policy and speak with your agent to ensure that you have the right coverage for your needs.

Ultimately, the best way to protect your property from vandalism is to take preventative measures. This could include installing security cameras, motion-sensor lights, or even fencing around your property. By taking these proactive steps, you can reduce the risk of vandalism occurring in the first place and minimize the potential damage if it does occur.

With that said, we hope that this article has been helpful in answering your questions about State Farm Insurance and vandalism coverage. Remember, if you ever have any questions or concerns about your policy, don’t hesitate to reach out to your agent for assistance. Thank you for reading, and we wish you all the best in protecting your property from harm!

.

People also ask about Does State Farm Insurance Cover Vandalism:

- Is vandalism covered by State Farm insurance?

- What kind of vandalism does State Farm insurance cover?

- Will State Farm insurance cover my stolen car if it was vandalized?

- What should I do if my car is vandalized?

- Will my insurance rates go up if I file a vandalism claim?

Yes, vandalism is typically covered under State Farm’s comprehensive coverage. This coverage protects against damage to your car that is not caused by a collision, such as theft, weather-related damage, and vandalism.

State Farm insurance covers a wide range of vandalism, including broken windows, keyed doors, and spray-painted graffiti. However, it’s important to note that intentional acts of vandalism may not be covered.

Yes, if your car was stolen as a result of vandalism, State Farm’s comprehensive coverage will typically cover the cost of repairs or replacement. However, you’ll need to file a police report and provide evidence of the theft and vandalism.

If your car has been vandalized, you should first report the incident to the police and obtain a copy of the police report. Then, contact your State Farm agent to file a claim. Be sure to document all damage with photographs and keep track of any repair bills or other expenses related to the incident.

It’s possible that your insurance rates could go up if you file a vandalism claim, but it depends on several factors, including the severity of the damage, your driving record, and your claims history. Your State Farm agent can provide more information about how filing a claim may affect your rates.