Table of Contents

Wondering if State Farm offers water and sewer line coverage? Check out our guide to find out if this insurance option is available to you.

Are you worried about the potential damage to your home’s water and sewer lines? If so, you may be wondering if State Farm offers coverage for these crucial components of your property. Well, the answer is yes! State Farm does indeed provide water and sewer line coverage as part of their homeowners insurance policies. But before you sign up, it’s important to understand what this coverage entails and how it can protect you from costly repairs and replacements in the future. So, let’s dive in and explore the details of State Farm’s water and sewer line coverage.

As a homeowner, it is important to protect your property from any unexpected damages. One of the most common issues that homeowners face is damage to their water and sewer lines. This can be caused by a variety of factors such as age, tree roots, or natural disasters. If you are a State Farm policyholder, you may be wondering if they offer water and sewer line coverage. In this article, we will explore whether or not State Farm offers this type of coverage and what it entails.

What is Water and Sewer Line Coverage?

Water and sewer line coverage is an insurance policy that protects homeowners from the cost of repairing or replacing damaged water or sewer lines. This type of coverage is important because the cost of repairing or replacing these lines can be very expensive. Most homeowners insurance policies do not cover this type of damage, which is why it is important to have a separate policy.

Does State Farm Offer Water and Sewer Line Coverage?

Yes, State Farm offers water and sewer line coverage as part of their home insurance policies. This coverage is called Service Line Coverage and it can be added to your existing policy for an additional premium. It provides protection for water and sewer lines that run from your home to the street or septic system.

What Does State Farm’s Service Line Coverage Include?

State Farm’s Service Line Coverage includes protection for the following:

- Water lines

- Sewer lines

- Power lines

- Internet and phone lines

- Cable and satellite lines

This coverage also provides protection for damages caused by events such as tree roots, wear and tear, and natural disasters.

How Much Does Service Line Coverage Cost?

The cost of Service Line Coverage varies depending on your location and the amount of coverage you choose. However, the average cost is around $35 per year. This is a small price to pay for the peace of mind that comes with knowing you are protected in case of an unexpected event.

Are There Any Exclusions?

Like any insurance policy, there are exclusions to State Farm’s Service Line Coverage. These exclusions include:

- Damage caused by earthquakes or floods

- Damage caused by intentional acts or negligence

- Damage to lines that are not located on your property

- Damage to lines that are not part of your primary residence

It is important to read your policy carefully to understand what is and is not covered by your specific policy.

How Do I Add Service Line Coverage to My Policy?

If you are interested in adding Service Line Coverage to your policy, you can contact your State Farm agent. They will be able to provide you with more information about the coverage and help you add it to your policy.

Conclusion

Water and sewer line damage can be a costly and unexpected expense for homeowners. State Farm’s Service Line Coverage provides protection for these types of damages and can give you peace of mind knowing you are covered in case of an unexpected event. If you are interested in adding Service Line Coverage to your policy, contact your State Farm agent today.

Protecting your home against unforeseen water damage is important, and State Farm understands that. That’s why we offer water and sewer line coverage to help you safeguard your investment in case of pipe damage or blockages. Knowing what is covered in your State Farm policy is crucial when it comes to water and sewer line coverage. Our coverage protects against damage due to line breaks, clogs, and leaks caused by frozen pipes, tree roots, corrosion, or wear and tear.

The benefits of adding water and sewer line coverage to your policy are numerous. Aside from added peace of mind, our coverage can help you avoid potentially costly repairs in the future. It can help pay for repair or replacement costs of damaged or clogged water and sewer lines. However, it’s important to understand the coverage limitations. Our coverage does not extend to damages caused by floods, earthquakes, or other natural disasters.

If you experience water or sewer line damage, filing a claim with State Farm is a quick and easy process. Simply contact your State Farm agent or file a claim online, and we’ll guide you through the rest. But to help avoid water and sewer line issues, regular maintenance is crucial. This includes checking for leaks, clearing clogs, and ensuring proper pipe insulation.

Taking proactive steps to prevent water and sewer line damage can save you time and money in the long run. Some tips include avoiding flushing non-degradable items down the toilet, keeping grease and oil out of your drains, and investing in root barriers. State Farm is a trusted name in insurance, with over 90 years of experience. We’re committed to providing our customers with the protection and peace of mind they need to feel secure in their homes and in life.

When you choose State Farm for your water and sewer line coverage, you can also take advantage of the convenience of bundling other insurance policies, such as homeowners, auto, and life insurance. Water and sewer line damage can be a costly and stressful experience. With State Farm’s water and sewer line coverage, you can trust that you’re making the smart choice to protect your home and your investment. Contact us today to learn more.

Once upon a time, there was a homeowner named John who had just purchased his dream home. He was excited to start making memories in his new abode and wanted to ensure that he had all the necessary insurance coverage to protect his investment.

As he was reviewing his insurance policy with his agent, he asked, Does State Farm offer water and sewer line coverage? His agent smiled and said, Yes, we do! Let me explain the details.

- State Farm offers Water Backup and Sump Overflow coverage as an optional add-on to your homeowner’s insurance policy. This coverage protects you from damage caused by water backup or sump overflow from sewers, drains, and sump pumps.

- In addition, State Farm also offers Service Line coverage as an optional add-on to your homeowner’s insurance policy. This coverage protects you from the costs associated with repairing or replacing damaged water or sewer lines that run from your house to the street.

John was relieved to hear this and decided to add both coverages to his policy. A few weeks later, a heavy rainstorm caused a sewer backup in his basement. Thanks to his Water Backup and Sump Overflow coverage, State Farm covered the cost of cleaning up the mess and repairing the damage.

John was grateful that he had made the decision to add these coverages to his policy. He knew that he could count on State Farm to help him protect his dream home.

Thank you for taking the time to read about State Farm’s water and sewer line coverage. As a homeowner, it’s important to be aware of the potential risks and expenses associated with damage to your water and sewer lines. With State Farm’s coverage, you can have peace of mind knowing that you’re protected in case of unexpected repairs.If you’re interested in adding this coverage to your policy, it’s important to reach out to your State Farm agent to discuss your options and ensure that you have the appropriate coverage for your needs. Keep in mind that coverage may vary depending on your location and specific policy, so it’s important to review your policy and clarify any questions or concerns you may have.In addition to protecting your home with insurance coverage, it’s also important to take preventative measures to reduce the risk of water and sewer line damage. This includes regularly checking for leaks, avoiding flushing non-degradable items down the toilet, and ensuring that any landscaping or construction projects are carried out with caution around these important utilities.Overall, we hope that this article has been informative and helpful in your search for insurance coverage. Remember, as a homeowner, it’s always better to be safe than sorry when it comes to protecting your investment. Don’t hesitate to reach out to your State Farm agent to learn more about their water and sewer line coverage options and how they can help you protect your home..

People often ask if State Farm offers water and sewer line coverage. Below are some common questions and answers:

- Does State Farm offer water and sewer line coverage?

- What does State Farm’s water and sewer line coverage include?

- What are some common causes of water and sewer line damage?

- Is water and sewer line coverage necessary?

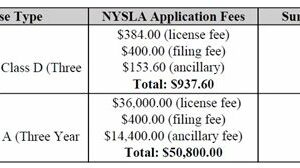

- How much does State Farm’s water and sewer line coverage cost?

Yes, State Farm offers water and sewer line coverage as an optional add-on to their homeowners insurance policy.

State Farm’s water and sewer line coverage typically includes repair or replacement costs for damaged water and sewer lines on the homeowner’s property.

Common causes of water and sewer line damage include tree roots, ground shifting, age and wear, and freezing temperatures.

It depends on the homeowner’s specific situation. If they live in an area with older pipes or a high risk of damage, water and sewer line coverage may be a wise investment.

The cost of water and sewer line coverage varies depending on factors such as location, age of the home, and the amount of coverage needed. Homeowners should contact their local State Farm agent for a personalized quote.

Overall, State Farm does offer water and sewer line coverage as an optional add-on to their homeowners insurance policy. Homeowners should evaluate their specific situation to determine if this coverage is necessary and contact their local State Farm agent for more information.