Table of Contents

Protect your belongings with Renters Insurance from State Farm. Get coverage for theft, fire, and more. Get a quote today!

Renting a home or apartment comes with its own set of risks. From natural disasters to theft, unexpected events can occur at any moment, leaving you feeling vulnerable and helpless. That’s where renters insurance comes in, providing peace of mind for tenants and protecting their belongings in the event of unforeseen circumstances. State Farm offers comprehensive renters insurance coverage that goes beyond just protecting your personal property. With competitive rates and exceptional customer service, State Farm is a top choice for renters looking for reliable protection.

Renters insurance is a type of insurance that provides coverage for the personal property and liability of individuals who rent their homes or apartments. It is designed to protect renters against various risks, such as theft, fire, and natural disasters. State Farm is one of the leading providers of renters insurance in the United States, offering comprehensive coverage and excellent customer service.

What Does Renters Insurance Cover?

Renters insurance typically covers three main areas: personal property, liability, and additional living expenses. Personal property coverage protects your belongings, such as furniture, electronics, and clothing, in case they are damaged or stolen. Liability coverage provides protection if you are found responsible for causing damage to someone else’s property or if someone is injured in your rental unit. Finally, additional living expenses coverage covers the cost of living elsewhere if your rental becomes uninhabitable due to a covered loss, such as a fire or flood.

Why Do You Need Renters Insurance?

Many renters mistakenly believe that their landlord’s insurance policy covers their personal property. However, this is not the case, as the landlord’s policy only covers the building and not the tenant’s belongings. Therefore, renters insurance is essential to protect your personal property and safeguard yourself against liability claims. Additionally, many landlords require renters insurance as a condition of the lease agreement.

How Much Does Renters Insurance Cost?

The cost of renters insurance varies depending on various factors, such as your location, the value of your personal property, and the level of coverage you need. However, on average, renters insurance costs around $15 to $20 per month, making it a relatively affordable way to protect your belongings and liability.

How to Get Renters Insurance with State Farm?

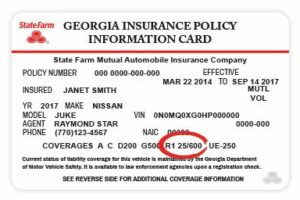

If you are interested in getting renters insurance with State Farm, you can start by contacting a local agent or visiting their website. You will need to provide some information about your rental unit and personal property, such as its location, value, and any unique features. State Farm will then provide you with a quote for the coverage you need and help you customize your policy to fit your specific needs.

What Are the Benefits of State Farm Renters Insurance?

State Farm offers a wide range of benefits for renters insurance policyholders, including:

- Comprehensive coverage for personal property, liability, and additional living expenses

- Flexible coverage options to fit your specific needs and budget

- 24/7 claims service and support

- Discounts for bundling renters insurance with other State Farm policies

- Excellent customer service and support from local agents

What Are Some Tips for Choosing Renters Insurance?

When choosing renters insurance, it is essential to consider several factors, such as:

- The level of coverage you need for your personal property and liability

- Your budget and how much you can afford to pay for premiums

- The reputation and financial stability of the insurance provider

- The availability of discounts and other benefits

- The ease of filing and handling claims

What Are Some Common Misconceptions About Renters Insurance?

There are many misconceptions about renters insurance that can lead people to overlook its importance. Some common misconceptions include:

- Renters insurance is too expensive

- Renters insurance is not necessary if you don’t have many valuable possessions

- Your landlord’s insurance policy covers your personal property

- You don’t need liability coverage if you don’t have any assets to protect

Conclusion

Renters insurance is a crucial investment for anyone who rents their home or apartment. It provides protection for your personal property and liability and can help you recover from unexpected losses due to theft, fire, or natural disasters. State Farm offers comprehensive renters insurance coverage and excellent customer service and support, making it an excellent choice for renters looking for reliable insurance protection.

Introduction to Renters Insurance: State Farm

Renters insurance is a type of insurance policy that is designed to protect tenants from financial loss due to unforeseen events. State Farm, one of the largest insurance providers in the United States, offers a comprehensive renters insurance policy that covers a wide range of risks. Whether you are renting an apartment, a townhouse, or a single-family home, State Farm’s renters insurance can provide you with peace of mind and protection against unexpected events.

What Does Renters Insurance Cover?

State Farm renters insurance covers a variety of events that can cause damage or loss to your personal property. This includes theft, fire, water damage, vandalism, and more. In addition to covering your personal property, renters insurance also provides liability coverage, which can protect you if someone is injured on your property or if you accidentally cause damage to someone else’s property. State Farm’s renters insurance policy also includes additional living expenses coverage, which can cover the cost of temporary housing if your rented property becomes uninhabitable due to a covered event.

Why Do You Need Renters Insurance?

Renters insurance is important because it provides protection for your personal property and liability coverage in case someone is injured while on your rented property. While your landlord may have insurance coverage for the building itself, that coverage does not extend to your personal belongings. Without renters insurance, you would be responsible for replacing your personal property in the event of a covered loss. Additionally, without liability coverage, you could be held responsible for medical bills or property damage caused by your actions.

Who Needs Renters Insurance?

If you are renting a property and have personal belongings that you would like to protect, you should consider purchasing renters insurance. Even if you do not own expensive items, the cost of replacing everyday items like clothing, furniture, and electronics can add up quickly. Additionally, if you have any valuable items like jewelry or artwork, you may want to consider adding additional coverage to your renters insurance policy.

What Are The Benefits of State Farm Renters Insurance?

State Farm’s renters insurance policy offers a number of benefits. One of the biggest benefits is the comprehensive coverage it provides. State Farm’s policy covers a wide range of risks, including theft, fire, water damage, and more. Additionally, State Farm offers flexible deductible options, so you can choose a deductible that fits your budget. State Farm also provides excellent customer service, with a 24/7 claims hotline and online tools that make it easy to manage your policy and file a claim.

How Much Does State Farm Renters Insurance Cost?

The cost of State Farm renters insurance varies depending on a number of factors, including the amount of coverage you need, the deductible you choose, and the location of your rented property. On average, renters insurance from State Farm costs around $15-$20 per month. However, this price can vary based on your individual needs and circumstances.

Can You Customize Your Renters Insurance Coverage?

Yes, you can customize your renters insurance coverage with State Farm. State Farm offers a variety of add-on coverage options, including additional coverage for high-value items like jewelry or artwork. Additionally, you can adjust your deductible to fit your budget. State Farm also offers discounts for customers who have multiple policies with them, so it may be worth considering bundling your renters insurance with other insurance products like auto insurance or life insurance.

What Is the Claims Process for State Farm Renters Insurance?

If you need to file a claim with State Farm renters insurance, the process is straightforward and easy. You can file a claim online or by calling State Farm’s 24/7 claims hotline. Once your claim is filed, a claims representative will contact you to discuss the details of your claim and guide you through the process. State Farm’s claims process is designed to be efficient and hassle-free, so you can get back to your normal routine as quickly as possible.

What Are Some Common Exclusions in Renters Insurance Coverage?

While renters insurance from State Farm provides comprehensive coverage, there are some common exclusions that you should be aware of. For example, most renters insurance policies do not cover damage caused by earthquakes or flooding. Additionally, if you run a business out of your rented property, you may need to purchase additional coverage to protect your business assets. Finally, if you have a roommate, it is important to note that your renters insurance policy will only cover your personal property, not your roommate’s belongings.

Final Thoughts on Renters Insurance with State Farm

Renters insurance is an important investment for anyone who is renting a property. State Farm’s renters insurance policy provides comprehensive coverage, flexible deductible options, and excellent customer service. Whether you are renting an apartment, a townhouse, or a single-family home, State Farm’s renters insurance can give you the peace of mind you need to enjoy your rented space without worrying about unexpected events.

Have you ever considered what would happen if your rented house or apartment caught fire, was burglarized, or suffered damage from a natural disaster? Would you be able to replace all of your belongings? This is where renters insurance comes in.

What Is Renters Insurance State Farm?

Renters insurance is a type of insurance policy that provides protection to renters against the loss or damage of their personal property. It covers the cost of replacing or repairing personal items such as furniture, electronics, clothing, and appliances. In addition, renters insurance also provides liability coverage, which protects renters from financial responsibility for accidents that occur in their rental property.

Why Do You Need Renters Insurance State Farm?

There are several reasons why renters insurance is essential:

- Protection of Personal Property: If your rented house or apartment is damaged due to fire, theft, or natural disasters, renters insurance will provide compensation for the loss or damage of your personal belongings.

- Liability Coverage: Renters insurance also offers liability coverage, which safeguards you financially from any lawsuits arising from third-party personal injury or property damage that occurs on your rental property.

- Affordable: Renters insurance is an affordable way to safeguard your personal property and protect yourself from financial liabilities. It costs much less than homeowners’ insurance policies.

Conclusion

As a renter, it’s crucial to protect your personal property with renters insurance. State Farm offers a comprehensive renters insurance policy that includes personal property coverage, liability coverage, and additional living expenses coverage. Don’t wait until it’s too late; get renters insurance today!

Thank you for taking the time to learn about renters insurance with State Farm. Whether you’re a first-time renter or a seasoned tenant, understanding the importance of protecting your belongings is crucial. With State Farm’s renters insurance, you can rest assured that your personal property is covered in the event of unexpected events such as theft, fire, or natural disasters.One of the biggest misconceptions about renters insurance is that it’s an unnecessary expense. However, the reality is that accidents can happen at any time, and without proper coverage, you could be left with a significant financial burden. Renters insurance not only covers your personal belongings, but it also provides liability protection in case someone is injured on your property. Additionally, if your living situation becomes uninhabitable due to a covered event, State Farm’s renters insurance will cover temporary living expenses.When choosing renters insurance, it’s important to consider the value of your personal belongings and select a policy that adequately covers your assets. State Farm offers several options for renters insurance, including personal property coverage, liability coverage, and additional living expenses coverage. With these options, you can customize your policy to meet your specific needs and budget.In conclusion, renters insurance with State Farm is a smart investment for anyone renting a home or apartment. It provides peace of mind knowing that your personal property is protected in case of unexpected events and helps to alleviate financial stress during difficult times. We hope this article has been informative and helpful in making an informed decision about renters insurance. Thank you for reading!.

What Is Renters Insurance State Farm?

People often ask about what renters insurance is and how it works. State Farm, one of the largest insurance companies in the United States, offers renters insurance policies to protect tenants and their belongings from unexpected events. Here are some common questions people have about renters insurance from State Farm:

1. What does renters insurance cover?

A renters insurance policy from State Farm typically covers personal property, liability protection, and additional living expenses. Personal property coverage helps replace or repair your belongings, such as furniture, clothes, and electronics, if they are damaged or stolen. Liability protection covers you if someone is injured on your property and files a lawsuit against you. Additional living expenses help cover the cost of temporary housing if your rental unit becomes uninhabitable due to a covered loss.

2. How much does renters insurance cost?

The cost of renters insurance from State Farm depends on several factors, including the amount of coverage you need, your location, and your deductible. On average, renters insurance from State Farm costs about $15 to $20 per month, but prices can vary widely based on your specific situation.

3. Is renters insurance required?

Renters insurance is not typically required by law, but some landlords may require tenants to carry it as a condition of the lease agreement. Even if your landlord does not require renters insurance, it’s still a good idea to have it to protect your belongings and liability.

4. How do I file a renters insurance claim with State Farm?

If you need to file a renters insurance claim with State Farm, you can do so online, over the phone, or through the State Farm mobile app. Before filing a claim, be sure to gather any necessary information or documentation about the incident, such as police reports, receipts, or photos of the damage. A State Farm representative will then guide you through the claims process and help you get reimbursed for any covered losses.

In summary, renters insurance from State Farm can provide valuable protection for tenants and their belongings. By understanding what renters insurance covers, how much it costs, and how to file a claim, you can make an informed decision about whether renters insurance is right for you.