Table of Contents

Wondering if State Farm car insurance covers vandalism? Protect your vehicle & find out more about their comprehensive coverage options.

Have you ever woken up to find your car vandalized? It’s a frustrating and upsetting experience that no one wants to go through. But if you have State Farm car insurance, you may be wondering if you’re covered for this type of damage. Luckily, State Farm does offer coverage for vandalism, so you can rest assured that you won’t be left with the bill for repairs.

Firstly, it’s important to note that vandalism is typically covered under State Farm’s comprehensive coverage. This means that if someone damages your car intentionally (like keying it or smashing the windows), you should be able to file a claim to get it fixed. However, there are some things to keep in mind when it comes to this type of coverage.

For example, you’ll need to pay your deductible before State Farm will cover the rest of the repair costs. Additionally, if you don’t have comprehensive coverage on your policy, you won’t be covered for vandalism at all. So if you live in an area where vandalism is common or you’re worried about your car being targeted, it’s a good idea to make sure you have this type of coverage.

Ultimately, while dealing with vandalism can be a headache, having State Farm car insurance can help ease some of the stress. Knowing that you’re covered in the event of intentional damage to your vehicle can give you peace of mind and make the process of getting your car fixed a little bit easier.

What is Vandalism?

Vandalism refers to an intentional act of causing damage or destruction to someone else’s property. When it comes to cars, vandalism can take many forms, including scratches, dents, broken windows, and spray-painted graffiti. Acts of vandalism can occur anywhere, from busy city streets to quiet residential areas, and regardless of the location, the damage can be expensive to repair.

What Does State Farm Car Insurance Cover?

State Farm offers several different types of car insurance coverage, including liability, collision, comprehensive, and personal injury protection. Liability insurance covers damages that you cause to other people and their property, while collision insurance covers damages to your car in the event of a collision with another vehicle or object. Comprehensive insurance covers damages to your car that aren’t caused by a collision, such as theft, natural disasters, and vandalism.

Does State Farm Car Insurance Cover Vandalism?

The short answer is yes, State Farm’s comprehensive car insurance policies cover damages caused by vandalism. If your car is vandalized, you can file a claim with State Farm and they will cover the cost of repairs, up to the limits of your policy. However, it’s important to note that you’ll need to pay your deductible before the insurance kicks in.

What is a Deductible?

A deductible is the amount of money that you must pay out of pocket before your insurance coverage begins. For example, if your comprehensive coverage has a $500 deductible and the cost of repairs for your vandalized car is $2,000, you’ll need to pay $500 and State Farm will cover the remaining $1,500.

How to File a Vandalism Claim with State Farm

If your car has been vandalized, follow these steps to file a claim with State Farm:

- Document the damage: Take pictures of the damage to your car, including any broken windows, scratches, or spray-painted graffiti.

- File a police report: Call the police and file a report, providing as much information as possible about the vandalism.

- Contact State Farm: Call State Farm’s claims department or file a claim online.

- Provide information: Be prepared to provide your policy number, details about the incident, and any documentation or evidence you have.

- Wait for an adjuster: State Farm will send an adjuster to assess the damages and determine the cost of repairs.

- Pay your deductible: Once the adjuster has determined the cost of repairs, you’ll need to pay your deductible before State Farm covers the remaining costs.

The Benefits of Comprehensive Coverage

While comprehensive coverage is an optional add-on to your car insurance policy, it can provide valuable protection against a wide range of unexpected events, including vandalism. In addition to covering damages caused by vandalism, comprehensive coverage can also protect your car against theft, fire, natural disasters, and more.

The Cost of Comprehensive Coverage

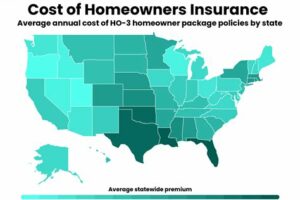

The cost of comprehensive coverage varies depending on several factors, including your age, driving history, location, and the make and model of your car. However, adding comprehensive coverage to your policy is usually more affordable than you might think. According to a report by the National Association of Insurance Commissioners, the average cost of comprehensive coverage in the United States is around $148 per year.

In Conclusion

If you’re a State Farm customer and your car is vandalized, you can rest assured that your comprehensive coverage will cover the cost of repairs. Remember to document the damage, file a police report, and contact State Farm as soon as possible to begin the claims process. While comprehensive coverage isn’t required by law, it provides valuable protection against a wide range of unexpected events, including vandalism, and is worth considering as an add-on to your car insurance policy.

Understanding Vandalism Coverage in State Farm Car Insurance is essential for car owners who want to protect their vehicles from damage caused by malicious individuals. Vandalism is defined as any intentional damage done to a car, including breaking windows, spray-painting graffiti, or scratching the car’s surface. State Farm recognizes vandalism as a common occurrence and offers coverage to its policyholders. But, what is considered vandalism in State Farm? Any damage done to the car that was not caused by a collision with another vehicle or object is considered vandalism. This includes malicious acts such as keying, dents, or scratches on the car’s exterior.The good news for State Farm policyholders is that their car insurance does protect against vandalism. State Farm offers comprehensive coverage that covers a range of incidents, including theft, natural disasters, and vandalism. Comprehensive coverage is an optional coverage that can be added to a policy and protects the car from non-collision damages. So, how does State Farm Car Insurance Protect Against Vandalism? If a car is vandalized, the policyholder can file a claim with State Farm and receive compensation for the damages done to their vehicle. This compensation may vary based on the policyholder’s coverage limits and deductibles.One may wonder, will a State Farm Comprehensive Coverage Protect Against Vandalism? The answer is yes. Comprehensive coverage provides protection against damages to the car caused by non-collision incidents, including vandalism. Policyholders who have comprehensive coverage can rest assured that their car is protected against malicious damage.Another common question is whether State Farm Car Insurance Cover Broken Windows Due to Vandalism. The answer is yes. Broken windows caused by vandalism are covered under comprehensive coverage. Policyholders can file a claim with State Farm and receive compensation for the cost of repairing or replacing the broken windows.Is Damage to the Car Due to Graffiti Covered by State Farm? Yes, damage caused by graffiti is covered under comprehensive coverage. Graffiti can cause significant damage to a car’s exterior, and the cost of repairing or repainting the car can be expensive. With State Farm’s comprehensive coverage, policyholders can receive compensation for the damages done to their car.Car key scratches are another form of vandalism that car owners may worry about. Are Car Key Scratches Considered Vandalism in State Farm Car Insurance? The answer is yes. Car key scratches are a form of intentional damage to a car’s exterior and are considered vandalism. Policyholders can file a claim with State Farm and receive compensation for the cost of repairing the scratches on their car.If your car is vandalized, it is essential to know what to do when you have State Farm Insurance. The first step is to file a police report and document the damages done to the car. Then, contact State Farm and file a claim. A claims adjuster will assess the damages and determine the compensation amount. It is important to note that policyholders may have to pay a deductible before receiving compensation from State Farm.Finally, it is important to understand the benefits of having vandalism coverage in State Farm Car Insurance. Vandalism coverage provides peace of mind to car owners who want to protect their vehicles from malicious damage. With comprehensive coverage added to the policy, policyholders can rest assured that their car is protected against a range of non-collision damages, including vandalism. Vandalism coverage can save policyholders money in the long run by providing compensation for the cost of repairing or replacing damages caused by malicious individuals.In conclusion, State Farm Car Insurance does cover vandalism. Policyholders who have comprehensive coverage can receive compensation for damages caused by malicious individuals, including broken windows, graffiti, and car key scratches. It is important to file a police report and contact State Farm to file a claim if your car is vandalized. Vandalism coverage provides peace of mind to car owners and can save them money in the long run by providing compensation for damages caused by malicious individuals.

State Farm car insurance is one of the most reliable insurance policies in the United States. It provides excellent coverage for damages caused by accidents, theft, and natural disasters. However, many people wonder whether State Farm car insurance covers vandalism.

The answer is yes! State Farm car insurance covers vandalism damages to your vehicle, as long as you have comprehensive coverage. Comprehensive coverage protects your car from non-collision damages, including vandalism.

Here are some points to consider about State Farm car insurance and vandalism:

- What is considered vandalism?

- What does comprehensive insurance cover?

- What should I do if my car is vandalized?

- Will my insurance rates go up if I file a claim for vandalism?

- How can I prevent my car from being vandalized?

Vandalism is any intentional damage caused to your car by another person without your consent. This can include keying, graffiti, slash tires, and broken windows.

Comprehensive insurance covers damages to your car caused by incidents outside of your control, such as theft, fire, flood, and vandalism.

If you notice that your car has been vandalized, immediately contact the police and file a report. Then, call your insurance company to report the damage and start the claim process.

Your insurance rates may increase after filing a claim, but this depends on your policy and the extent of the damage. However, if you have a good driving record and history with State Farm, your rate increase may be minimal or nonexistent.

To reduce the risk of vandalism, park your car in well-lit areas and avoid leaving valuable items visible inside your car. Consider installing a security system or adding anti-theft devices to your car.

Overall, State Farm car insurance covers vandalism damages to your vehicle, as long as you have comprehensive coverage. It is always important to take precautions to prevent vandalism, but if it does happen, you can trust that State Farm will be there to protect you and your car.

Greetings, dear blog visitors! We hope you enjoyed reading our article about State Farm car insurance and its coverage against vandalism. As we come to the end of our discussion, we would like to leave you with some final thoughts and reminders.

Firstly, we want to emphasize that State Farm does offer protection against damages caused by vandalism. This means that if your car gets defaced or destroyed by vandals, you can file a claim with State Farm and get reimbursed for the repairs or replacement. However, it’s important to remember that not all types of vandalism are covered by insurance policies. For example, if you were the one who intentionally damaged your own car, or if the vandalism was committed by someone you know or hired, then you might not be eligible for compensation.

Another factor to consider is your deductible. This is the amount of money you have to pay out of pocket before your insurance kicks in. Depending on your policy, your deductible can range from a few hundred dollars to several thousand. If the cost of repairing the vandalism is lower than your deductible, then it might not be worth filing a claim. On the other hand, if the damage is extensive and costly, then it’s definitely worth contacting State Farm as soon as possible.

In conclusion, we hope that this article has provided you with some valuable insights into State Farm car insurance and its coverage against vandalism. Remember that prevention is always better than cure, so make sure to take precautions such as parking in well-lit areas, installing security cameras, and being aware of your surroundings. And should the worst happen, don’t hesitate to reach out to State Farm for assistance. With their reliable and comprehensive insurance policies, you can have peace of mind knowing that you’re protected against unexpected mishaps.

Thank you for reading, and we wish you safe and happy travels!

.

Does State Farm Car Insurance Cover Vandalism?

State Farm is one of the largest car insurance providers in the United States, offering various coverage options to their policyholders. If you have State Farm car insurance, you may be wondering if your policy covers vandalism. Here are some common questions people ask about State Farm car insurance and vandalism:

- Does State Farm car insurance cover vandalism?

- What kind of damages caused by vandalism does State Farm cover?

- Do I need to file a police report to make a vandalism claim with State Farm?

- Will filing a vandalism claim with State Farm affect my premiums?

- What should I do if my car has been vandalized?

Yes, State Farm car insurance typically covers vandalism as long as you have a comprehensive coverage. This type of coverage protects your vehicle from non-collision damages such as theft, fire, and vandalism.

State Farm covers damages caused by vandalism to your car’s exterior, interior, and mechanical parts. Examples of vandalism damages include broken windows, key scratches, spray-painted graffiti, slashed tires, and stolen car parts.

Yes, State Farm requires you to file a police report if your car has been vandalized. This helps to document the incident and provides evidence for your claim.

Filing a vandalism claim with State Farm may affect your premiums, especially if you file multiple claims within a short period of time. However, the impact of a single claim on your premiums depends on various factors such as your driving history, location, and coverage options.

If your car has been vandalized, take photos of the damages and file a police report as soon as possible. Then, contact State Farm to report the incident and start the claims process. State Farm will guide you through the next steps and help you get your car repaired or replaced.

In conclusion, State Farm car insurance covers vandalism under their comprehensive coverage. If your car has been vandalized, make sure you document the damages and file a police report before contacting State Farm to report the incident and start the claims process.