Table of Contents

Wondering if State Farm auto insurance covers rodent damage? Check out our guide for everything you need to know about this type of coverage.

Are you tired of dealing with pesky rodents that keep damaging your car? Did you know that State Farm Auto Insurance might have you covered? That’s right, State Farm offers comprehensive coverage that includes protection against rodent damage. So, if you’re worried about rats, mice, or other critters gnawing on your vehicle’s wires and causing costly repairs, it’s time to consider State Farm Auto Insurance. But before you make a decision, let’s explore what this coverage entails and how it can benefit you in the long run.

As a car owner, it’s never a great feeling to discover that rodents have caused damage to your vehicle. This can be especially frustrating if you have insurance and are wondering whether or not your policy will cover any resulting repairs. In this article, we’ll take a closer look at State Farm Auto Insurance and whether or not it covers rodent damage.

What is Rodent Damage?

Rodent damage refers to any harm caused to a vehicle by rodents such as rats, mice, squirrels, and others. These small critters can cause significant damage to car wiring, insulation, and other components that they chew on to build nests or collect food.

Does State Farm Auto Insurance Cover Rodent Damage?

Unfortunately, rodent damage is not typically covered under a standard auto insurance policy. State Farm is no exception to this rule, and they do not cover damage caused by rodents under their comprehensive coverage policies.

What Kind of Coverage Does State Farm Offer?

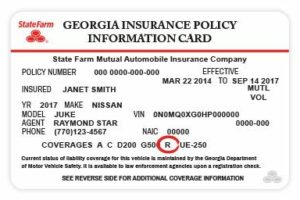

State Farm offers several types of auto insurance coverage, including liability, collision, and comprehensive coverage. Liability coverage typically pays for damages that you cause to other people or their property in an accident. Collision coverage pays for damages to your vehicle in the event of an accident, regardless of who was at fault.

Comprehensive coverage, on the other hand, is designed to cover damage to your vehicle that occurs due to non-collision events such as theft, vandalism, fire, and natural disasters. While this coverage may seem like it would cover rodent damage, it typically does not.

Why Doesn’t Comprehensive Coverage Cover Rodent Damage?

Comprehensive coverage is intended to cover events that are outside of your control, such as natural disasters or theft. Rodent damage, however, is considered a preventable event, and as such, it’s not covered under comprehensive coverage. Insurance companies consider rodent damage to be preventable because there are steps you can take to protect your vehicle from these critters, such as parking in a garage or using rodent repellent sprays.

What Can You Do if Your Car is Damaged by Rodents?

If your car has been damaged by rodents, your best bet is to file a claim with your insurance company anyway. While it’s unlikely that they will cover the damage, they may be able to refer you to a reputable repair shop or offer advice on how to prevent future damage.

You can also try filing a claim with your homeowner’s insurance policy if you have one. Some policies may offer coverage for rodent damage to personal property, which could include your vehicle.

How Can You Prevent Rodent Damage to Your Vehicle?

The best way to prevent rodent damage to your vehicle is to take preventive measures. Here are some tips:

- Park your car in a garage or carport whenever possible.

- Keep your garage or storage area clean and free from clutter.

- Remove any food or trash from your vehicle.

- Use rodent repellent sprays or traps around your parking area.

- Regularly inspect your vehicle for signs of rodent activity.

The Bottom Line

While State Farm Auto Insurance does not typically cover damage caused by rodents, it’s still important to have comprehensive coverage to protect your vehicle from other non-collision events. If you do experience rodent damage to your vehicle, file a claim with your insurance company anyway and take steps to prevent future damage.

State Farm Auto Insurance and Rodent Damage: What You Need to Know. As much as we love our furry friends, rodents can wreak havoc on our vehicles. From gnawed wires to chewed upholstery, rodent damage is a common problem that affects many car owners. If you’re insured with State Farm, you may be wondering if your policy covers this type of damage.

Does State Farm Auto Insurance Cover Rodent Damage? The Answer Might Surprise You. The good news is that most State Farm auto insurance policies do cover rodent damage. However, the extent of the coverage can vary depending on the specific policy. It’s important to read through your policy documents carefully to understand what is covered and what is not.

Are You Protected? Understanding the Fine Print of State Farm Auto Insurance Policies. When it comes to insurance, it’s always better to be safe than sorry. Make sure you understand the fine print of your State Farm auto insurance policy, including any exclusions or limitations related to rodent damage. If you have any questions, don’t hesitate to reach out to your State Farm agent for clarification.

From Gnawed Wires to Chewed Upholstery: State Farm’s Coverage for Rodent Damage. Rodent damage can take many forms, from gnawed wires that prevent your car from starting to chewed upholstery that ruins the interior of your vehicle. State Farm’s coverage for rodent damage typically includes repairs or replacement of damaged parts, as well as any necessary cleaning or restoration of the affected areas.

How Much Does State Farm Auto Insurance Cover for Rodent Damage? A Breakdown. The amount of coverage you receive for rodent damage will depend on your specific policy. Some policies may have a higher deductible for this type of damage, while others may have a limit on the total amount of coverage available. Make sure you understand the details of your policy so you can make an informed decision about how to handle any rodent damage that occurs.

Get the Facts: State Farm’s Policy on Rodent Damage Claims. If you need to file a claim for rodent damage, it’s important to understand State Farm’s policy regarding these types of claims. In most cases, you will need to provide evidence of the damage, such as photographs or a written estimate from a repair shop. Your State Farm agent can guide you through the claims process and help you understand what documentation is required.

Tips for Dealing with Rodent Damage and Filing a Claim with State Farm. Dealing with rodent damage can be frustrating and time-consuming. To make the process smoother, consider taking photos of the damage as soon as it occurs and filing a claim with State Farm right away. Be prepared to provide detailed information about the damage and any repairs that are needed.

Keeping Your Car Safe from Rodent Damage: Prevention Tips from State Farm. While it’s impossible to completely eliminate the risk of rodent damage, there are steps you can take to reduce the likelihood of an infestation. Some tips from State Farm include storing your car in a garage or other enclosed space, keeping the area around your car clean and free of debris, and using rodent repellents or traps if necessary.

Is Rodent Damage Considered an Act of God? State Farm’s Stance on Natural Disasters and Insurance Claims. Rodent damage is not typically considered an act of God under State Farm’s policies. Instead, it is usually classified as a general type of damage that can occur as a result of normal wear and tear or external factors like weather or animals. However, it’s always a good idea to check with your State Farm agent to understand the specifics of your policy.

Navigating the Claims Process: What to Expect When Filing a Rodent Damage Claim with State Farm. Filing a claim for rodent damage can be a complex process, but it doesn’t have to be overwhelming. With the help of your State Farm agent, you can navigate the claims process and get the repairs you need to get back on the road. Be prepared to provide documentation and answer questions about the damage, and remember that your agent is there to support you every step of the way.

Overall, if you’re insured with State Farm, you can feel confident that you are protected in the event of rodent damage to your vehicle. By understanding the details of your policy and taking steps to prevent infestations, you can minimize the impact of this common problem and get back to enjoying your car in no time.

As a car owner, it’s important to have insurance coverage that protects your vehicle from all possible threats and damages. One such threat that often goes unnoticed is rodent damage. Many people wonder if their auto insurance policy covers rodent damage, and in this story, we’ll explore if State Farm Auto Insurance provides this coverage.

Point of View:

As a curious car owner, I wanted to know if my State Farm Auto Insurance policy covered rodent damage. I did some research and spoke with a State Farm representative to get the answers I needed. Here’s what I found out:

The Answer:

State Farm Auto Insurance does provide coverage for rodent damage under certain circumstances. Here’s a breakdown of how it works:

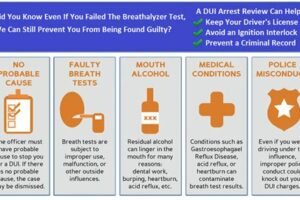

- If you have comprehensive coverage on your policy, rodent damage will be covered. Comprehensive coverage is an optional add-on that protects your car from non-collision damages like theft, vandalism, and natural disasters.

- If the damage is caused by a wild animal, it will be covered under your comprehensive coverage. However, if the damage is caused by a pet or domesticated animal, it may not be covered.

- If the damage is caused by negligence on your part, like leaving food in your car that attracts rodents, the damage may not be covered.

Creative Voice and Tone:

Rodent damage may seem like an unlikely threat to your car, but trust me, it happens more often than you think. As a car owner, it’s important to know that your insurance policy has got your back, even in the face of tiny but mighty rodents. State Farm Auto Insurance understands this and provides coverage for rodent damage under certain circumstances. So, next time you park your car near a rodent-infested area, rest assured that State Farm has got you covered!

Thank you for taking the time to read our article on whether State Farm Auto Insurance covers rodent damage. We hope that we were able to provide you with the information you were looking for and help you make an informed decision about your insurance coverage.

While it may be surprising to some, rodent damage is a common issue that many car owners face. Whether it’s mice, rats, squirrels, or other critters, these pests can cause significant damage to your vehicle’s wiring, upholstery, and other components. However, not all insurance policies cover rodent damage, which is why it’s essential to understand your coverage and know what to do if you encounter this problem.

If you are a State Farm Auto Insurance policyholder, you can rest assured that you are covered for rodent damage. State Farm’s comprehensive coverage includes protection against damage caused by rodents, as well as other non-collision events such as fire, theft, and vandalism. However, it’s important to note that you will still need to pay your deductible, and coverage limits may apply depending on your policy.

In conclusion, rodent damage is a frustrating problem that can be costly to repair. Fortunately, if you have State Farm Auto Insurance, you can have peace of mind knowing that you are covered. If you do encounter rodent damage, be sure to file a claim with your insurer as soon as possible and document the damage with photos. As always, it’s best to consult with your insurance agent directly to ensure that you fully understand your policy and coverage limits.

.

People also ask about Does State Farm Auto Insurance Cover Rodent Damage:

- Does State Farm auto insurance cover rodent damage?

- What types of rodent damage are covered under State Farm auto insurance?

- What should I do if my car is damaged by rodents?

- Will filing a claim for rodent damage increase my insurance premium?

Yes! State Farm auto insurance covers rodent damage, provided the policyholder has comprehensive coverage. Comprehensive coverage is an optional add-on to your auto insurance policy that covers damages caused by events beyond your control, including animal damage.

State Farm auto insurance covers damages caused by a variety of rodents, including mice, rats, squirrels, and other small animals. This includes damage to wiring, upholstery, and other car components that may be damaged by rodents.

If your car is damaged by rodents, you should file a claim with your insurance provider as soon as possible. Take pictures of the damage and keep any receipts or invoices related to the repairs. Your insurance adjuster will inspect the damage and determine the appropriate amount of compensation.

It depends on the circumstances. If you already have a history of filing claims, your premium may increase. However, if this is your first time filing a claim for rodent damage, your premium may not increase.

Overall, if you have comprehensive coverage with State Farm auto insurance, you can rest assured that you are covered in case of any rodent damage to your car.