Table of Contents

Comparing Progressive and State Farm for auto insurance? Learn about their coverage options, discounts, and customer satisfaction ratings.

When it comes to finding the right auto insurance provider, it can be overwhelming to choose from the numerous options available. Two popular choices are Progressive and State Farm Auto. While both offer reliable coverage, there are some significant differences between the two that are worth exploring.

Firstly, let’s talk about pricing. If you’re looking for affordable rates, Progressive might be the better option for you. They are known for their competitive pricing and offer a variety of discounts to help you save money. On the other hand, State Farm Auto may be more expensive, but they make up for it with their outstanding customer service.

Another key factor to consider is the level of coverage each company provides. Progressive is known for its comprehensive coverage options, including roadside assistance and rental car reimbursement. In contrast, State Farm Auto offers a range of coverage options, but their policies may not be as customizable as Progressive’s.

Ultimately, the choice between Progressive and State Farm Auto comes down to your individual needs and preferences. It’s important to do your research and compare quotes before making a decision. Whether you prioritize affordability or personalized coverage, both companies have something to offer.

When it comes to purchasing auto insurance, many people may be overwhelmed by the number of options available. Two popular choices are Progressive and State Farm. Although both companies offer car insurance, they are different in several ways. Here’s a breakdown of how Progressive compares to State Farm Auto.

Company Overview

Progressive is a well-known auto insurance company that was founded in 1937. It offers a variety of insurance coverage, including auto, home, and life. The company is known for its competitive rates and user-friendly website, which allows customers to compare rates from multiple providers.

State Farm Auto is one of the largest insurance companies in the United States. It offers a wide range of insurance products, including auto, home, and life. The company was founded in 1922 and has since become a household name. State Farm is known for its local agents, who provide personalized service to customers.

Price Comparison

When it comes to price, both Progressive and State Farm Auto offer competitive rates. However, the cost of insurance can vary depending on several factors, such as age, driving record, and location. Both companies offer discounts for safe driving, multiple vehicles, and bundling policies.

Progressive is known for its Name Your Price tool, which allows customers to enter their budget and receive a customized insurance plan. This feature is helpful for those who are on a tight budget and want to find the best coverage for their needs.

Coverage Options

When it comes to coverage options, both Progressive and State Farm Auto offer a variety of choices. Both companies provide liability coverage, collision coverage, and comprehensive coverage. However, Progressive offers additional options, such as gap insurance, pet injury coverage, and custom parts and equipment coverage.

State Farm Auto offers unique coverage options, such as rental reimbursement, travel expense coverage, and emergency roadside assistance. The company also offers rideshare insurance for those who drive for Uber or Lyft.

Customer Service

When it comes to customer service, both Progressive and State Farm Auto are highly rated. However, they have different approaches to providing support to customers.

Progressive offers 24/7 customer service through its website, app, and phone line. The company also has a chatbot, Flo, who can answer basic questions about insurance and policies. Progressive is known for its fast claims processing and convenient online tools.

State Farm Auto has a large network of local agents who provide personalized service to customers. The company also offers 24/7 customer support through its website and phone line. State Farm is known for its attentive agents who take the time to understand each customer’s needs.

Financial Strength

When it comes to financial strength, both Progressive and State Farm Auto are stable companies with strong ratings from independent agencies. However, State Farm has a higher rating than Progressive.

State Farm Auto has an A++ rating from AM Best, which is the highest rating possible. This indicates that the company has a strong financial position and is able to pay out claims to customers. Progressive has an A+ rating from AM Best, which is still a strong rating but slightly lower than State Farm’s.

Claims Process

When it comes to filing a claim, both Progressive and State Farm Auto offer easy and convenient processes. However, there are some differences in how they handle claims.

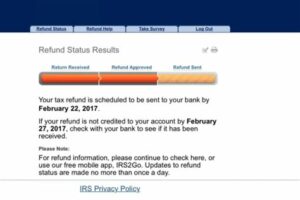

Progressive allows customers to file claims online, through its app, or by phone. The company offers an immediate response to claims filed online or through its app. Progressive also allows customers to track the progress of their claims through its website or app.

State Farm Auto allows customers to file claims online, through its app, or by phone. The company assigns a dedicated claims representative to each customer to guide them through the claims process. State Farm also offers a mobile app that allows customers to view their claim status and upload photos of damage.

Online Tools

Both Progressive and State Farm Auto offer a variety of online tools to help customers manage their policies and coverage.

Progressive’s website and app allow customers to view their policy information, make payments, and file claims. The company also offers a Name Your Price tool, which allows customers to find customized coverage that fits their budget. Additionally, Progressive offers an online comparison tool, which allows customers to compare rates from multiple providers.

State Farm Auto’s website and app allow customers to view their policy information, make payments, and file claims. The company also offers a Pocket Agent app, which allows customers to access their policies, pay bills, and view their claim status. Additionally, State Farm offers a Drive Safe & Save program, which rewards safe drivers with discounts.

Final Thoughts

Ultimately, choosing between Progressive and State Farm Auto depends on your personal needs and preferences. Both companies offer competitive rates, a variety of coverage options, and convenient online tools. However, there are some differences in how they handle claims and provide customer service.

If you prefer to have a dedicated agent who can provide personalized service, State Farm Auto may be the better choice for you. If you prefer fast and convenient online tools, Progressive may be the better choice. No matter which company you choose, make sure to compare rates and coverage options to find the best policy for your needs.

When it comes to car insurance, two of the most popular providers in the United States are Progressive and State Farm Auto. Both companies offer a wide range of coverage options and discounts to help drivers save on their premiums. However, there are several key differences between the two providers that can make one a better fit for you depending on your needs.

One of the most important factors to consider when choosing an insurance provider is the claims process. Both Progressive and State Farm Auto have efficient and reliable claims processes, but Progressive is known for being faster and more efficient. With their streamlined online system, customers can file a claim and receive updates on its status in real-time. State Farm Auto also offers a user-friendly online claims system, but their process may take longer due to additional steps.

Another important consideration is coverage options. While both companies offer standard coverage options such as liability, collision, and comprehensive, Progressive has more unique options like gap insurance and pet injury coverage. State Farm Auto offers a wide range of additional coverages as well, but not as many unique options as Progressive.

When it comes to discounts, both companies have similar offerings such as safe driver discounts and multi-car discounts. However, Progressive stands out with its Snapshot program, which uses telematics technology to monitor driving habits and potentially save customers even more money on their premiums. State Farm Auto also offers telematics discounts through their Drive Safe & Save program, but it may not be as comprehensive as Progressive’s offering.

Customer service is also an important factor to consider. Both Progressive and State Farm Auto have good reputations for addressing customer concerns in a timely and effective manner. However, Progressive has a reputation for being more responsive to customer complaints and providing a better overall experience.

In terms of app and online tools, both companies have user-friendly websites and mobile apps that allow customers to manage their policies and file claims on-the-go. However, Progressive’s app has more features such as the ability to compare rates with other providers and track driving habits through the Snapshot program.

When it comes to financial strength ratings, both companies are highly rated by major rating agencies. However, State Farm Auto has a slight edge with slightly higher ratings across the board.

Insurance rates can vary depending on factors such as location, driving history, and coverage options. In general, both Progressive and State Farm Auto offer competitive rates, but it’s important to compare quotes from both companies to see which one offers the best value for your specific needs.

Finally, bundling options can be a key factor in saving money on insurance premiums. Both Progressive and State Farm Auto offer bundling discounts for customers who combine multiple policies such as auto and home insurance. However, State Farm Auto may have more comprehensive bundling options than Progressive.

In conclusion, whether Progressive or State Farm Auto is a better fit for you depends on your specific needs and priorities. If you value fast claims processing, unique coverage options, and advanced online tools, Progressive may be the better choice. On the other hand, if you prioritize strong financial ratings, comprehensive bundling options, and a slightly more established reputation, State Farm Auto may be a better fit. Ultimately, it’s important to compare quotes and do your research to find the insurance provider that offers the best value for your individual needs.

When it comes to car insurance, there are two big players in the game: Progressive and State Farm. Both companies offer a range of coverage options and discounts, but which one is better? Let’s take a closer look and compare.How Does Progressive Compare To State Farm Auto

- Pricing: Progressive tends to be more affordable than State Farm, especially for drivers with less-than-perfect records. They also offer a variety of discounts, such as multi-car and safe driver discounts.

- Coverage options: Both companies offer similar coverage options, including liability, collision, and comprehensive coverage. However, Progressive also offers gap insurance, which covers the difference between what you owe on your car and what it’s worth if it’s totaled in an accident.

- Customer service: State Farm is known for its excellent customer service, with agents available 24/7 to help customers with claims or other issues. However, Progressive also has a good reputation for customer service and offers online tools for managing your policy.

- Technology: Progressive is known for its use of technology, such as its Snapshot program that offers discounts based on your driving habits. They also have a mobile app that allows you to manage your policy, make payments, and file claims. State Farm also has a mobile app, but it’s not as advanced as Progressive’s.

- Financial strength: Both companies are financially stable and have strong ratings from independent rating agencies like A.M. Best and Standard & Poor’s.

Overall, both Progressive and State Farm offer solid car insurance options, but it really depends on your individual needs and preferences. If you’re looking for affordable rates and innovative technology, Progressive might be the better choice. However, if you value excellent customer service and a more traditional approach to insurance, State Farm might be the way to go.So, when it comes to choosing between Progressive and State Farm auto insurance, it’s important to do your research and compare quotes and coverage options. After all, every driver is different and has unique needs when it comes to car insurance.Thank you for taking the time to read our comparison of Progressive and State Farm auto insurance. We hope that this article has given you a better idea of the differences between these two popular insurance companies.When it comes to pricing, Progressive tends to be more affordable than State Farm. However, State Farm may offer more discounts for specific groups such as students or military personnel. It’s important to consider your individual circumstances and needs when choosing an insurance provider.In terms of coverage options, both companies offer similar policies such as liability, collision, and comprehensive coverage. However, Progressive stands out with their usage-based insurance program, Snapshot, which allows drivers to potentially save money based on their driving habits. On the other hand, State Farm offers unique coverage options such as rideshare insurance for those who drive for companies like Uber or Lyft.Ultimately, the decision between Progressive and State Farm auto insurance comes down to personal preference and priorities. We encourage you to compare quotes and policies from both companies before making a decision. Thank you for visiting our blog and we wish you the best in finding the right car insurance for you..

When it comes to choosing an auto insurance provider, two of the most popular choices are Progressive and State Farm. Many people ask how these two companies compare to each other. Here are some common questions people have:

-

Which company has better rates?

Answer: This can vary based on a number of factors such as your location, driving record, and type of vehicle. It’s best to get quotes from both companies to compare.

-

Which company has better customer service?

Answer: Both companies have strong reputations for customer service. State Farm is known for its network of agents who provide personalized service, while Progressive offers online tools and resources for customers who prefer self-service.

-

Which company has better coverage options?

Answer: Both companies offer a range of coverage options such as liability, collision, and comprehensive. However, Progressive may have more options for customization based on your needs.

-

Which company has better discounts?

Answer: Both companies offer various discounts such as safe driver, multi-policy, and loyalty discounts. Again, it’s best to get quotes from both companies to see which discounts you may qualify for.

-

Which company is more financially stable?

Answer: Both companies are financially stable and have high ratings from independent rating agencies such as A.M. Best and Standard & Poor’s.

Ultimately, the choice between Progressive and State Farm will depend on your specific needs and preferences. It’s important to do your research and compare quotes and coverage options before making a decision.