Learn about the various tax deductions available for farm businesses. Discover how you can maximize your savings by taking advantage of deductions for expenses such as equipment purchases, livestock feed, and property... Read more »

Farm Business LLC or S Corp is a legal structure for agricultural enterprises, offering limited liability protection to owners. This metadescription briefly explains the benefits of forming an LLC or S Corp... Read more »

The Farm Business Income Formula is a crucial tool for farmers looking to assess the profitability of their operations. This formula takes into account factors such as crop yield, market prices, input... Read more »

Farm Business Income refers to the profit generated by agricultural activities and operations. It encompasses the financial gains earned through crop production, livestock farming, and other related ventures within the agricultural sector.... Read more »

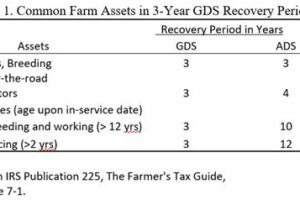

Mastering Depreciation: A Step-by-Step Guide on Depreciating Farm Animals for Profitable Agriculture

Learn how to depreciate your farm animals for tax purposes with our step-by-step guide. Maximize your deductions and save money this tax season! Read more »

Farm Equipment Leasing is a flexible financing option that allows farmers to access the latest agricultural machinery without the need for heavy upfront investment. Discover the benefits of leasing, including cost savings,... Read more »

Choosing the best business structure for a farm is crucial for its success. Factors such as liability protection, tax advantages, and ease of ownership transition must be considered. Common options include sole... Read more »

Learn how to cancel your State Farm car insurance easily and efficiently. Follow our simple steps to avoid any confusion or penalties. Read more »

Curious about tax write-offs for farm animals? Learn what you can deduct, including feed, vet bills, and depreciation expenses. Read more »

Does State Farm combine loss value? Learn how this insurance company assesses your claims and calculates the total amount you can recover. Read more »