Curious about deducting the cost of farm animals on your taxes? Learn more about the rules and regulations surrounding this deduction. #taxes #farming #deductions Read more »

Learn if you can deduct expenses for your farm animals with our comprehensive guide. Maximize your tax savings and keep your farm running smoothly. Read more »

Can a farm deduct dead animals? Learn about the tax implications of disposing of livestock and how it can affect your farm’s bottom line. Read more »

State Farm agencies can be incorporated, allowing them to operate as separate legal entities while still benefiting from State Farm’s support and resources. Read more »

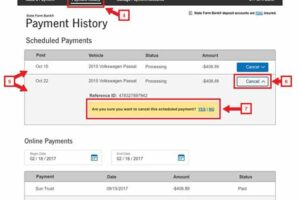

Learn how to easily set up automatic payments for your State Farm account, ensuring hassle-free bill payments every month. Follow our step-by-step guide! Read more »

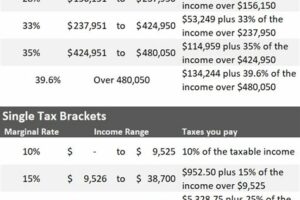

Learn how to report the State Farm insurance dividend excess on your 2018 taxes with our easy-to-follow guide. Maximize your deductions today! Read more »

Wondering if you can borrow from your life insurance policy with State Farm? Find out more about this option and how it works. Read more »

Learn how to enroll in Autopay with State Farm and simplify your life. Never miss a payment again and enjoy peace of mind. Read more »

State Farm assesses the extent of damage, vehicle’s value, and repair costs to determine if a car is totaled. Learn more about their process. Read more »

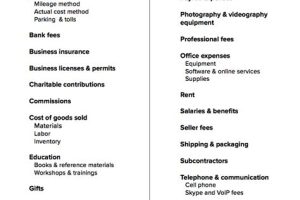

Farm Business Valuation is the process of determining the economic worth of a farm enterprise. This involves evaluating various factors such as land, buildings, equipment, livestock, crops, and financial records to determine... Read more »