Table of Contents

Need reliable insurance coverage? State Farm has your back! Get personalized service and competitive rates for all your insurance needs.

When it comes to insurance, you want a company that can provide reliable coverage and exceptional service. State Farm Insurance is a name that’s been around for decades, and for good reason. With a wide range of policies available, State Farm can protect you from the unexpected and give you peace of mind. But does State Farm Ins provide the level of coverage and customer care you need? Let’s take a closer look at what this insurance giant has to offer.

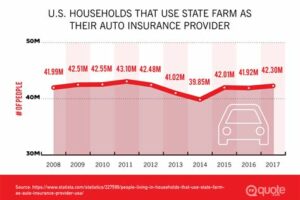

State Farm is one of the largest insurance companies in the United States, providing a variety of insurance products to its customers. One of the most common questions asked about State Farm is whether or not they offer insurance without a title. This article will explore that question and provide insight into the services offered by State Farm.

What is Title Insurance?

Before we delve into whether or not State Farm offers insurance without a title, it’s important to understand what title insurance is. Title insurance is a type of insurance that protects the owner of a property from any legal claims against the property’s ownership. These claims can include liens, unpaid taxes, and other issues that can arise with the title of a property.

Does State Farm Offer Insurance Without a Title?

The short answer is no, State Farm does not offer insurance without a title. Title insurance is a necessary component of any real estate transaction, as it protects the buyer from any potential legal issues that may arise with the property’s title. Without title insurance, the buyer would be responsible for any legal claims against the property’s ownership, which could be financially devastating.

What Types of Insurance Does State Farm Offer?

While State Farm does not offer insurance without a title, they do offer a wide range of insurance products to meet the needs of their customers. These products include:

- Auto Insurance

- Home Insurance

- Life Insurance

- Health Insurance

- Business Insurance

Why is Title Insurance Important?

As previously mentioned, title insurance is important because it protects the buyer from any legal claims against the property’s ownership. Without title insurance, the buyer would be responsible for any legal claims, which could result in significant financial loss. Title insurance is a necessary component of any real estate transaction, and it is required by most lenders.

How Much Does Title Insurance Cost?

The cost of title insurance varies depending on a variety of factors, including the location of the property, the value of the property, and the type of policy being purchased. On average, title insurance can cost anywhere from $500 to $3,000, but this can vary significantly depending on the circumstances of the transaction.

How Do I Get Title Insurance?

When purchasing a property, the buyer’s attorney or real estate agent will typically arrange for title insurance on behalf of the buyer. The title insurance company will conduct a search of public records to ensure that there are no outstanding liens or other legal claims against the property’s ownership. Once the search is complete, the title insurance company will issue a policy to the buyer.

What Happens if I Don’t Get Title Insurance?

If you do not get title insurance when purchasing a property, you are putting yourself at significant financial risk. If any legal claims arise against the property’s ownership, you could be responsible for paying for those claims out of pocket. This could result in significant financial loss and could potentially even lead to bankruptcy.

The Bottom Line

While State Farm does not offer insurance without a title, they do offer a wide range of insurance products to meet the needs of their customers. Title insurance is an important component of any real estate transaction, and it is necessary to protect the buyer from any potential legal claims against the property’s ownership. If you are purchasing a property, make sure to obtain title insurance to protect yourself from any potential financial loss.

In Conclusion

State Farm is a reputable insurance company that provides a variety of insurance products to its customers. While they do not offer insurance without a title, they offer a wide range of other insurance products to meet the needs of their customers. Title insurance is an important component of any real estate transaction, and it is necessary to protect the buyer from any potential legal claims against the property’s ownership. If you are purchasing a property, make sure to obtain title insurance to protect yourself from any potential financial loss.

Looking for reliable insurance coverage that will protect your assets and give you peace of mind assurance? Look no further than State Farm Insurance. With a wide range of coverage options, State Farm has you covered from home insurance to life insurance. But what sets State Farm apart from other insurance providers? For one, their ability to personalize coverage options to suit your unique needs. You can choose the level of coverage that feels comfortable for you and your family. And with State Farm’s competitive rates, you won’t have to break the bank to protect yourself. Plus, their commitment to excellent customer service means that if you ever need assistance with your policy or have an insurance claim, they’ll be there for you. And managing your policy is easier than ever with State Farm’s digital tools and resources. But that’s not all – State Farm also offers various discounts and savings opportunities to help you save even more. With a trusted name and reputation, State Farm is one of the largest insurance providers in the United States, offering coverage options for health, business, and even pet insurance. And with a network of local agents across the country, you can count on personalized service in your community. So why wait? Protect the things that matter most to you with State Farm Insurance.

Once upon a time, there was a family who had just purchased their dream home. They were excited to start their new life in their beautiful abode, but they knew that they needed to protect it with insurance. After doing some research, they decided to go with State Farm Ins.

- The family was impressed with the company’s reputation for excellent customer service. They felt confident that if anything happened, State Farm would be there to help them through the process.

- State Farm Ins offered a wide range of coverage options, including protection for their home, personal property, and liability. The family appreciated the flexibility to choose the coverage that best suited their needs.

- The company also had a user-friendly website and mobile app that made it easy to manage their policy and file claims. They were able to access their policy information and make changes as needed, all from the convenience of their computer or phone.

Overall, the family was very satisfied with their decision to go with State Farm Ins. They felt that the company provided them with the peace of mind they needed to enjoy their new home without worrying about the what-ifs.

From the company’s point of view, State Farm Ins is committed to providing its customers with the best possible experience. They strive to offer comprehensive coverage options, personalized service, and innovative technology to make managing policies and filing claims as easy as possible.

- State Farm Ins believes that insurance should be more than just a safety net. It should be a tool that helps people protect what matters most to them and achieve their goals.

- The company is constantly working to improve its offerings, whether it’s through developing new products or enhancing existing ones. They are dedicated to staying ahead of the curve and providing customers with the latest and greatest in insurance technology.

- State Farm Ins also recognizes that insurance can be confusing and overwhelming for many people. That’s why they make it a priority to provide clear, easy-to-understand information to help customers make informed decisions about their coverage.

In short, State Farm Ins is more than just an insurance company. It’s a partner in protecting what matters most to its customers. With top-notch service, comprehensive coverage options, and innovative technology, it’s no wonder that so many families choose State Farm Ins to safeguard their homes and belongings.

Dear blog visitors,

I hope that you have found this article informative and helpful in understanding the ins and outs of State Farm insurance without title. As you may have learned, State Farm offers a variety of insurance options, including insurance for vehicles without a title. This is great news for those who may have lost their title or purchased a vehicle without one.

State Farm’s insurance policies without title coverage can provide peace of mind knowing that you are protected in case of an accident or theft. It’s important to note that this coverage may vary by state, so be sure to check with your local State Farm agent to ensure that you have the proper coverage for your specific situation.

Overall, State Farm is a trusted and reliable insurance provider that offers a wide range of coverage options to fit your needs. Whether you’re looking for car insurance, home insurance, or any other type of coverage, State Farm has got you covered. With its commitment to excellent customer service and affordable rates, it’s no wonder why State Farm is one of the most popular insurance providers in the country.

Thank you for taking the time to read this article on State Farm insurance without title. I hope that it has provided you with valuable information and insights into this topic. If you have any further questions or would like to learn more about State Farm’s insurance options, please don’t hesitate to reach out to your local State Farm agent. They will be more than happy to assist you in finding the right coverage for your needs.

Best regards,

[Your Name]

.

As a reputable insurance company in the United States, State Farm is a popular choice for individuals seeking reliable coverage. Below are some of the most frequently asked questions about State Farm insurance:

- What types of insurance does State Farm offer?

- State Farm offers a wide range of insurance products, including auto, home, renters, life, health, disability, and business insurance.

- What discounts are available with State Farm?

- State Farm offers a variety of discounts, including multi-policy, safe driver, good student, accident-free, and loyalty discounts.

- How can I file a claim with State Farm?

- You can file a claim with State Farm online, through the mobile app, or by calling their toll-free number.

- What is State Farm’s customer service like?

- State Farm is known for its exceptional customer service, with representatives available 24/7 to answer questions and assist with claims.

- How does State Farm compare to other insurance companies?

- State Farm is often ranked highly in customer satisfaction and is known for its competitive rates and comprehensive coverage options.

If you have any other questions about State Farm insurance, don’t hesitate to reach out to a representative for more information.