Table of Contents

Worried if State Farm Bank blocks Mint? Don’t be. Learn the facts and find out how to connect your accounts for seamless money management.

Have you ever tried using Mint to track your finances, only to find out that your State Farm Bank account is blocked from connecting? If so, you’re not alone. Many people have experienced this frustrating issue, and the reason behind it may surprise you. Despite being a popular budgeting tool, Mint is not always compatible with certain financial institutions. So what can be done about it? Let’s take a closer look at why State Farm Bank may block Mint, and explore some possible solutions.

State Farm Bank is a well-known financial institution that offers various banking products and services to its clients. One of the popular personal finance management tools used by many people is Mint. However, there has been speculation that State Farm Bank blocks Mint from accessing account information. In this article, we will explore this issue in depth and provide you with all the information you need to know.

What is Mint?

Mint is a free online tool that helps individuals manage their finances. It allows users to connect all their financial accounts in one place, such as bank accounts, credit cards, loans, and investments. Mint automatically categorizes transactions, creates budgets, and provides personalized financial insights. It is a useful tool for people who want to track their spending, save money, and plan for the future.

Does State Farm Bank Block Mint?

There have been reports that State Farm Bank blocks Mint from accessing account information. Some users have complained that they are unable to add their State Farm Bank accounts to Mint or that their accounts have been disconnected. However, State Farm Bank has not officially confirmed or denied these claims.

Why Would State Farm Bank Block Mint?

There could be several reasons why State Farm Bank blocks Mint from accessing account information. One possible reason is security concerns. State Farm Bank may want to protect its customers’ financial data from potential security breaches or unauthorized access. Another reason could be a conflict of interest. State Farm Bank may not want its customers to use Mint, as it offers similar financial management tools.

What Are the Alternatives to Mint?

If you are unable to connect your State Farm Bank accounts to Mint, there are several alternatives that you can consider. Some popular personal finance management tools include:

- Personal Capital: Similar to Mint, Personal Capital offers free budgeting and investment tracking tools.

- You Need a Budget: This tool helps users create and stick to a budget by assigning every dollar a job.

- WalletHub: WalletHub offers free credit scores, credit monitoring, and personalized financial advice.

How to Connect State Farm Bank Accounts to Mint?

If you want to connect your State Farm Bank accounts to Mint, follow these steps:

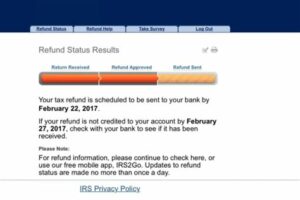

- Log in to your Mint account.

- Click on Add Accounts in the top menu.

- Select State Farm Bank from the list of available institutions.

- Enter your State Farm Bank login credentials.

- Follow the prompts to connect your accounts.

What Should You Do If You Cannot Connect Your State Farm Bank Accounts to Mint?

If you are unable to connect your State Farm Bank accounts to Mint, there are a few things you can do:

- Contact State Farm Bank customer support and ask if they block Mint.

- Try adding your accounts to Mint again after a few days or weeks.

- Consider using an alternative personal finance management tool.

The Bottom Line

State Farm Bank may or may not block Mint from accessing account information. However, if you are unable to connect your State Farm Bank accounts to Mint, there are several alternatives that you can consider. Remember to always prioritize the security of your financial data and use reputable personal finance management tools.

The controversy around State Farm Bank and Mint has been making headlines recently. Mint, a popular personal finance management tool, has been blocked by State Farm Bank, leaving many customers frustrated and confused. This move has raised questions about State Farm Bank’s authority to block Mint and the reasoning behind their decision.

So, does State Farm Bank have the authority to block Mint? The short answer is yes. As a financial institution, State Farm Bank has the right to decide which third-party services they allow access to their customers’ accounts. However, this decision has caused an uproar among Mint users who rely on the app to manage their finances easily and efficiently.

What is the reasoning behind State Farm Bank blocking Mint? State Farm Bank has not provided a clear explanation for their decision. Some speculate that the bank is concerned about the security of their customers’ data or that they want to offer their own financial management tools instead of relying on a third-party service.

The impact of State Farm Bank’s decision on Mint users cannot be understated. Many customers have expressed frustration with the lack of transparency and communication from the bank. Some have even decided to switch banks in order to continue using Mint.

Is State Farm Bank the only financial institution blocking Mint? No, they are not. Other financial institutions have also blocked Mint in the past, citing similar concerns about security and data privacy.

How can Mint users overcome State Farm Bank’s block? One option is to contact State Farm Bank directly and request that they unblock Mint. Another option is to switch banks to one that allows access to Mint. However, both options require effort and potential inconvenience for the customer.

Are there alternatives to Mint for State Farm Bank customers? Yes, there are. Other personal finance management tools, such as Personal Capital or YNAB, may offer similar features and accessibility for State Farm Bank customers.

State Farm Bank has a responsibility to inform their customers of their block on Mint. Many customers were caught off guard by the sudden block and were not given adequate notice or explanation. Financial transparency is crucial in online services, and State Farm Bank should strive to communicate any changes to their services clearly and promptly.

The future of State Farm Bank and Mint’s relationship remains uncertain. It is possible that State Farm Bank may unblock Mint in the future or offer their own personal finance management tools. However, until then, Mint users with State Farm Bank accounts will have to explore alternative options.

In conclusion, the controversy around State Farm Bank and Mint highlights the importance of financial transparency and customer communication. Although State Farm Bank has the authority to block Mint, they should be transparent about their reasoning and provide customers with adequate notice and information. In the meantime, customers can explore alternative personal finance management tools and communicate their concerns to the bank directly.

Once upon a time, there was a customer who loved using the Mint app to manage their finances. However, they soon discovered that their State Farm Bank account was not syncing with Mint.

- Initially, the customer thought it was a technical issue with Mint. They contacted Mint’s customer support, but they confirmed that the problem was with State Farm Bank.

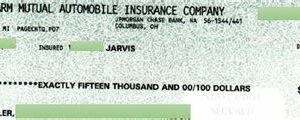

- The customer then contacted State Farm Bank’s customer support and was informed that the bank had blocked Mint’s access to their accounts. The reason given was that Mint posed a security risk.

- The customer was disappointed with this response as they found Mint to be a secure and convenient way to manage their finances. They tried to reason with State Farm Bank’s representatives, but they were met with resistance.

- The customer then decided to switch to another bank that allowed them to use Mint. They found that many other banks were willing to provide access to Mint and other financial management apps without any issues.

From the customer’s point of view, State Farm Bank’s decision to block Mint seemed unnecessary and inconvenient. They felt that the bank should have provided more information about their security concerns and worked towards finding a solution rather than blocking access altogether.

Overall, this story highlights the importance of open communication between financial institutions and their customers. It also emphasizes the need for banks to keep up with technological advancements and adapt to changing customer needs.

Thank you for taking the time to read our article on State Farm Bank and its relationship with Mint. We hope we were able to provide you with valuable insights into why State Farm Bank blocks Mint, and what alternatives you can use to manage your finances.

It’s important to note that while State Farm Bank may block Mint, it doesn’t necessarily mean that the bank is trying to prevent you from accessing your financial information. As we mentioned in our article, State Farm Bank takes customer privacy and security seriously, and may have implemented certain measures to protect your personal and financial data.

However, if you’re a Mint user looking for an alternative way to manage your finances, there are plenty of other options available. You could try using other budgeting apps like Personal Capital, YNAB, or PocketGuard, which offer similar features to Mint and may be more compatible with State Farm Bank.

In conclusion, while it may be frustrating to discover that State Farm Bank blocks Mint, it’s important to remember that there are always alternatives available. We hope our article has helped shed some light on this issue, and that you feel better equipped to manage your finances going forward.

Thank you again for reading, and we look forward to sharing more valuable insights with you soon!

.

As a popular online budgeting tool, Mint has gained a lot of attention from users who want to manage their finances more efficiently. However, some people have raised concerns about whether State Farm Bank blocks Mint or not. Below are some common questions that people ask about this issue:

- Does State Farm Bank block Mint?

- What can I do if I can’t link my State Farm Bank account to Mint?

- Make sure that you have the correct login credentials for your State Farm Bank account.

- Check if there are any pending transactions or alerts on your account that might be blocking the connection with Mint.

- Contact State Farm Bank customer support to ask if they have any specific requirements or restrictions for linking accounts to third-party apps like Mint.

- Is it safe to use Mint with my State Farm Bank account?

- Are there any alternatives to Mint that work well with State Farm Bank accounts?

State Farm Bank does not officially block Mint. However, some users have reported experiencing issues when linking their State Farm Bank accounts to Mint. This could be due to various reasons, such as technical glitches or security measures.

If you’re having trouble linking your State Farm Bank account to Mint, there are a few things you can try:

Mint uses bank-level encryption and security measures to protect your financial information. However, as with any online service that involves sharing sensitive data, there is always a risk of data breaches or unauthorized access. It’s important to use strong passwords and keep your devices and software up-to-date to minimize these risks.

Yes, there are several other budgeting and personal finance apps that you can use to manage your State Farm Bank accounts, such as Personal Capital, YNAB, or PocketGuard. It’s worth trying out a few different options to see which one suits your needs and preferences best.

Overall, while there may be some challenges in linking State Farm Bank accounts to Mint, it is generally possible to use these two services together safely and securely. By following best practices for online security and exploring alternative apps if necessary, you can make the most of the tools available to help you achieve your financial goals.