Table of Contents

Wondering if State Farm charges fees for liquidating an IRA? Read on to learn about the potential costs and considerations you should keep in mind.

Have you been considering liquidating your IRA account with State Farm? It is important to understand the potential costs involved in such a decision. First and foremost, it is crucial to note that liquidating an IRA before the age of 59 ½ may result in early withdrawal penalties. However, even if you are past this age limit, State Farm may still charge fees for liquidation and account closure. Additionally, there may be tax implications to consider, as withdrawing funds from an IRA can result in taxable income. With all of these factors to take into account, it is important to carefully weigh the potential costs before making a decision about liquidating your State Farm IRA.

If you are thinking of liquidating your IRA in State Farm, it is essential to understand the costs involved. An Individual Retirement Account (IRA) is a popular retirement savings account that allows you to save for retirement while enjoying tax benefits. However, there may be instances when you need to liquidate your IRA, and this process can incur fees and taxes.

What is IRA Liquidation?

IRA liquidation refers to the process of selling off all the assets in your IRA account and withdrawing the funds. You may need to liquidate your IRA for various reasons, such as financial emergencies, unexpected expenses, or to meet other financial goals.

What are the Costs of Liquidating an IRA in State Farm?

Liquidating an IRA in State Farm may involve different costs, depending on the type of IRA account you have and the specific circumstances surrounding the liquidation. Here are some of the costs you may incur:

1. Taxes

If you have a traditional IRA, you will have to pay taxes on the amount you withdraw. The taxes you pay will depend on your tax bracket and the amount you withdraw. Additionally, if you are under 59½ years old, you may have to pay an early withdrawal penalty of 10% on top of the taxes.

2. Fees

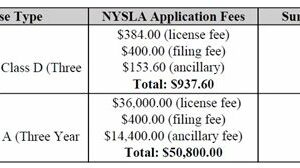

Your IRA account may incur various fees, such as custodial fees, maintenance fees, and transaction fees. These fees can eat into your retirement savings, so it is essential to understand them before liquidating your IRA.

3. Brokerage Fees

If you have invested in stocks, bonds, or mutual funds, you may need to sell these assets to liquidate your IRA. Your brokerage may charge you a fee for selling these assets, which can add up to a significant cost.

4. Early Withdrawal Penalty

If you are under 59½ years old and withdraw money from your IRA, you may have to pay an early withdrawal penalty of 10%. This penalty is in addition to the taxes you will have to pay on the amount you withdraw.

How Can You Minimize Costs When Liquidating Your IRA?

Liquidating your IRA can be costly, but there are ways to minimize these costs. Here are some tips:

1. Consider a Rollover

Instead of liquidating your IRA, you can consider rolling over your funds into another retirement account. This way, you can avoid paying taxes and penalties on the withdrawn amount. However, you must complete the rollover within 60 days of withdrawing the funds.

2. Plan Ahead

If you anticipate needing to withdraw money from your IRA in the future, it is best to plan ahead. Consider creating an emergency fund or saving for expected expenses to avoid having to liquidate your IRA prematurely.

3. Shop Around for Fees

Before liquidating your IRA, shop around for the best fees and rates. Compare custodial fees, brokerage fees, and other costs to find the most cost-effective option.

4. Consult with a Financial Advisor

Consulting with a financial advisor can help you understand the costs of liquidating your IRA and provide guidance on how to minimize these costs. A financial advisor can also help you explore alternative options, such as loans or hardship withdrawals, that may be less costly than liquidating your IRA.

Conclusion

Liquidating your IRA in State Farm can be costly, but it may be necessary in certain circumstances. Understanding the costs involved and exploring alternative options can help you minimize these costs and make the most of your retirement savings.

Understanding the process of liquidating an IRA in State Farm is essential for anyone looking to withdraw funds from their retirement savings account. While IRA liquidation may be necessary in some cases, it can result in significant fees and penalties that can impact your financial future. As such, it is crucial to have a clear understanding of the costs associated with IRA liquidation before making any decisions.

An overview of the fees associated with IRA liquidation in State Farm reveals that there are several costs to consider. These fees can include administrative fees, custodial fees, and transaction fees, among others. Additionally, if you are under the age of 59 and a half, you may also be subject to early withdrawal penalties and taxes on the liquidated funds.

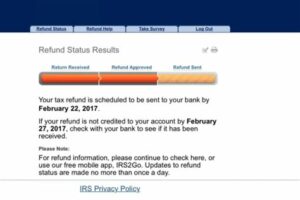

Calculating early withdrawal penalties and taxes on liquidated IRA funds can be complex and requires a thorough understanding of IRS rules and regulations. The penalty for early withdrawal is typically 10% of the total amount withdrawn, in addition to any applicable taxes. However, there are certain exceptions to this rule, such as for medical expenses or first-time homebuyers, which may allow you to avoid penalties and reduce taxes.

Understanding the importance of IRA withdrawal rules and regulations is crucial to ensure that you do not incur unnecessary fees and penalties. For example, the IRS requires that you take required minimum distributions (RMDs) from traditional IRAs starting at age 72. Failure to do so can result in a penalty of up to 50% of the RMD amount. Additionally, there are limits on how much you can contribute to an IRA each year, and exceeding these limits can result in additional penalties and taxes.

Tips to minimize the costs of liquidating an IRA in State Farm include exploring alternative options to withdraw funds without incurring significant fees. For example, you may be able to take out a loan against your IRA or convert it to a Roth IRA, which may offer more flexible withdrawal options. Additionally, seeking professional advice from a financial advisor can help you make informed decisions about IRA withdrawal and minimize unnecessary fees and penalties.

Exploring alternative options to withdraw funds from IRA without incurring significant fees can be a wise decision, as liquidating an IRA can have a significant impact on retirement savings and future financial goals. When you liquidate an IRA, you are essentially taking money out of your retirement savings, which can reduce the amount of money you have available for retirement. As such, it is important to weigh the pros and cons of IRA liquidation carefully before making any decisions.

Considerations to weigh before deciding to liquidate an IRA in State Farm include your current financial situation, your retirement goals, and your overall financial plan. If you are facing financial hardship or need immediate access to funds, liquidating an IRA may be necessary. However, if you are still working and have other sources of income, it may be wiser to leave your IRA intact and explore other options for accessing funds.

Seeking professional advice to make informed decisions about IRA withdrawal is crucial to minimizing costs and avoiding unnecessary penalties. A financial advisor can help you understand the rules and regulations surrounding IRA withdrawal and provide guidance on the best course of action based on your individual financial situation and goals. They can also help you create a comprehensive financial plan that takes into account your retirement savings, investments, and other financial goals.

Final thoughts: Weighing the pros and cons of IRA liquidation is essential to make the best decision for your financial future. While liquidating an IRA can provide immediate access to funds, it can also result in significant fees and penalties that can impact your retirement savings. By understanding the costs associated with IRA liquidation, exploring alternative options for accessing funds, and seeking professional advice, you can make informed decisions that align with your financial goals and help you achieve long-term financial success.

Have you ever wondered if it costs to liquidate your IRA in State Farm? Well, let me tell you a story.

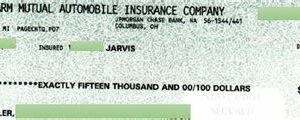

John had been saving for retirement through his IRA account with State Farm for over 10 years. However, he recently found himself in a financial emergency and needed to access the funds in his IRA account. John was worried that he would have to pay hefty fees to liquidate his account.

He decided to call State Farm to inquire about the cost of liquidating his IRA account. The customer service representative informed him that there are fees associated with liquidating an IRA account, but they vary depending on the type of account and the reason for the liquidation.

The representative explained that if John wanted to withdraw his funds before reaching the age of 59 ½, he would have to pay a 10% early withdrawal penalty in addition to regular income taxes. However, if John was withdrawing funds due to a qualified disability or to pay for certain educational expenses, he may be exempt from the penalty.

The representative also informed John that there may be account closing fees and other administrative charges associated with the liquidation process. These fees can range from a few dollars to a few hundred dollars depending on the circumstances.

Overall, John learned that there is a cost to liquidate his IRA account with State Farm, but the fees vary depending on his specific situation. He was relieved to learn that he could access his funds if he needed to, but he also understood the importance of considering the potential fees before making any decisions.

In conclusion, while there are costs associated with liquidating an IRA account with State Farm, it is important to understand that these fees vary depending on the situation. It’s always best to speak with a representative to get a clear understanding of the fees associated with your specific circumstances.

Hello dear visitors, it was my pleasure to share with you all about the process of liquidating an IRA in State Farm. I hope that this article has provided you with valuable insights and helped you understand the various costs involved in the process.

As you know, liquidating an IRA is not a decision that should be taken lightly. It requires careful consideration and planning to ensure that you make the best use of your retirement savings. While there are costs involved in liquidating your IRA in State Farm, it is essential to note that these costs can vary depending on several factors.

Ultimately, whether or not it is worth it to liquidate your IRA in State Farm will depend on your unique situation. If you are considering this option, I encourage you to speak with a financial advisor who can help you assess the costs and benefits and determine the best course of action for your retirement savings.

Thank you for taking the time to read this article. I hope that it has been informative and helpful in your decision-making process. Remember to always do your research and seek professional advice before making any significant financial decisions.

.

People also ask about the cost to liquidate IRA in State Farm. Here are some of the common questions:

-

How much does it cost to liquidate an IRA in State Farm?

The cost to liquidate an IRA in State Farm may vary depending on several factors, such as the type of IRA, the amount of the account balance, and the investment options chosen. Generally, there may be fees charged for early withdrawal, closing the account, or selling assets within the account. It’s best to check with your State Farm advisor to get a breakdown of any potential costs.

-

Are there penalties for liquidating an IRA in State Farm?

Yes, there may be penalties for liquidating an IRA in State Farm if you’re under the age of 59½ and don’t qualify for an exception. The penalty is typically 10% of the amount withdrawn, in addition to any taxes owed on the distribution. However, there may be exceptions, such as for first-time homebuyers or certain medical expenses. Again, it’s best to consult with your State Farm advisor to understand the potential penalties.

-

Can I liquidate my IRA in State Farm without penalty?

It depends on your age and the reason for the withdrawal. If you’re over the age of 59½, you can generally withdraw from your IRA without penalty. Additionally, there may be exceptions for certain qualifying events, such as disability or death, unreimbursed medical expenses, or higher education costs. However, if you’re under the age of 59½ and don’t meet any of the exceptions, you may be subject to the early withdrawal penalty.

-

What’s the best way to liquidate an IRA in State Farm?

The best way to liquidate an IRA in State Farm will depend on your individual goals and circumstances. Your advisor can help you explore your options and create a plan that aligns with your financial objectives. Some factors to consider may include tax implications, investment strategies, and timing of the distribution.

-

How long does it take to liquidate an IRA in State Farm?

The length of time it takes to liquidate an IRA in State Farm can vary depending on the complexity of the account and the investment options involved. Generally, it’s best to allow several weeks for the process to be completed, especially if there are multiple assets within the account that need to be sold or transferred. Your advisor can give you a more specific timeline based on your individual situation.

Overall, liquidating an IRA in State Farm can involve some costs and penalties, but there may also be opportunities to make withdrawals without penalty under certain circumstances. Your advisor is the best resource for understanding the potential costs and developing a strategy that aligns with your unique financial situation.