Curious about State Farm Insurance agent salaries? Find out how much they make per hour and what factors affect their earnings.

Are you curious about how much State Farm insurance agents make an hour? Well, the answer may surprise you. First and foremost, it’s important to note that being a State Farm agent is not just a job, it’s a career. So, it’s safe to assume that they earn a decent salary. However, the exact figure varies depending on several factors such as location, experience, and performance. Nonetheless, one thing is for sure – State Farm agents are well-compensated for their hard work and dedication. Let’s dive deeper into the world of State Farm insurance agents and find out what their hourly rate looks like!

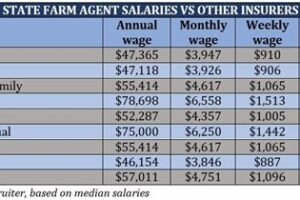

State Farm is a well-known insurance company in the United States that provides various insurance products and services to its customers. The company has a significant presence in the market, and it has thousands of agents who work for them across the country. One of the most common questions people ask is how much do State Farm insurance agents make an hour? In this article, we will discuss this topic in detail.What is State Farm Insurance?State Farm is a US-based insurance company that provides auto, home, life, and health insurance products and services. The company was founded in 1922 by George J. Mecherle, and it has its headquarters in Bloomington, Illinois. State Farm is one of the largest insurance companies in the United States, and it has over 83 million policies and accounts in force.Who are State Farm Insurance Agents?State Farm insurance agents are independent contractors who work for the company. They are responsible for selling insurance policies and providing customer service to their clients. State Farm agents work on a commission basis, which means they earn a percentage of the premiums their clients pay for their insurance policies.How Much Do State Farm Insurance Agents Make An Hour?The hourly wage for State Farm insurance agents varies depending on various factors, including location, experience, and the number of policies they sell. According to Glassdoor, the average hourly wage for State Farm insurance agents is $16 per hour. However, some agents may make more than this amount, while others may make less.Factors That Determine State Farm Insurance Agent’s Salary:There are several factors that determine how much a State Farm insurance agent makes per hour. Some of these factors include:1. Location: The location of the State Farm office where the agent works can affect their hourly wages. For example, agents working in large cities may make more money than those working in rural areas.2. Experience: Experienced agents who have been with the company for a long time may earn more than new agents.3. Sales Performance: The number of policies an agent sells can affect their earnings. Agents who sell more policies may earn higher commissions.4. Licenses and Certifications: Agents who have additional licenses or certifications may be eligible for higher commissions.5. Office Expenses: State Farm agents are responsible for paying for their office expenses, such as rent and utilities. These expenses can affect their earnings.How Do State Farm Insurance Agents Get Paid?State Farm insurance agents get paid on a commission basis. This means that they earn a percentage of the premiums their clients pay for their insurance policies. The commission rate varies depending on the type of policy sold and the agent’s experience. State Farm insurance agents also have the opportunity to earn bonuses and incentives based on their sales performance.Benefits of Being a State Farm Insurance Agent:There are several benefits of being a State Farm insurance agent. Some of these benefits include:1. Flexibility: State Farm agents have the flexibility to set their own schedules and work from home if desired.2. Unlimited Earning Potential: State Farm agents have unlimited earning potential since they earn a commission on every policy sold.3. Training and Support: State Farm provides its agents with training and support to help them succeed in their business.4. Reputation: State Farm is a well-known and respected insurance company, which can help agents build their reputation and credibility.Drawbacks of Being a State Farm Insurance Agent:There are also some drawbacks of being a State Farm insurance agent. Some of these drawbacks include:1. High Expenses: State Farm agents are responsible for paying for their office expenses, which can be expensive.2. No Guaranteed Income: Since State Farm agents work on a commission basis, there is no guaranteed income.3. Competitive Industry: The insurance industry is highly competitive, which can make it challenging for new agents to establish themselves.4. Licensing and Certification Requirements: State Farm agents must obtain licenses and certifications, which can be time-consuming and expensive.Conclusion:In conclusion, the hourly wage for State Farm insurance agents varies depending on several factors, including location, experience, and sales performance. While some agents may earn more than others, being a State Farm insurance agent has several benefits, including flexibility, unlimited earning potential, and training and support. However, there are also some drawbacks, such as high expenses and no guaranteed income. Overall, being a State Farm insurance agent can be a rewarding career for those who are willing to work hard and establish themselves in the industry.

Understanding State Farm Insurance Agent salaries is crucial for individuals who aspire to pursue a career in this industry. State Farm Insurance Agents are responsible for selling and promoting insurance policies to clients, providing them with helpful advice and guidance throughout the process. They also assist clients in filing claims and resolving insurance related issues. As such, the salary of State Farm Insurance Agents varies depending on several factors.

The first factor that determines State Farm Insurance Agent salaries is their educational background and experience. Individuals who have obtained a degree in business, marketing, or a related field, and possess relevant work experience, are more likely to earn higher salaries than those who do not. A State Farm Insurance Agent who has been in the industry for several years and has a proven track record of success may also earn a higher salary than a newly hired agent.

Geographical location is another factor that affects State Farm Insurance Agent salaries. The cost of living and demand for insurance policies in a particular area can greatly impact an agent’s earning potential. For instance, an agent working in a metropolitan area with a high demand for insurance policies may earn more than an agent working in a rural area with less demand for insurance policies.

Job performance and industry standards also play a significant role in determining State Farm Insurance Agent salaries. Agents who meet or exceed their sales goals and provide exceptional customer service are more likely to receive bonuses and salary increases. Additionally, the insurance industry as a whole sets certain standards for agent salaries, which can vary depending on the type of insurance policies being sold and the client base being served.

Other benefits and incentives can also impact State Farm Insurance Agent salaries. Agents may receive bonuses for meeting certain milestones or achieving specific goals. They may also receive commissions on the policies they sell, which can greatly increase their earning potential. State Farm Insurance Agents may also receive benefits such as health insurance, retirement plans, and paid time off.

The salary range for State Farm Insurance Agents varies depending on the factors mentioned above. According to Glassdoor, the average annual salary for a State Farm Insurance Agent in the United States is $38,000 to $65,000. However, this can vary greatly depending on the agent’s location, experience, and job performance.

The average hourly rate of pay for State Farm Insurance Agents is also affected by these factors. According to Payscale, the average hourly rate for a State Farm Insurance Agent is $15.92 per hour. However, this rate can range from $11.01 per hour to $27.85 per hour depending on the agent’s experience, location, and job performance.

State Farm Insurance Agents can increase their hourly income by taking steps to improve their job performance and gain more experience. They can attend training sessions and workshops to enhance their skills and knowledge, and aim to exceed their sales goals and provide exceptional customer service. They can also seek out promotions or job opportunities in areas with higher demand for insurance policies.

In conclusion, becoming a successful State Farm Insurance Agent requires willingness, dedication, and hard work. The salary range for State Farm Insurance Agents can vary significantly depending on several factors, including educational background, experience, location, job performance, and industry standards. However, agents who are willing to put in the effort and continually strive to improve their skills can increase their hourly income and achieve success in this rewarding field.

Have you ever wondered how much State Farm insurance agents make an hour? Well, let me tell you a story about it.

Once upon a time, there was a State Farm insurance agent named Sarah. She had been working for the company for over five years and had built a loyal customer base. Sarah loved her job as she got to help people protect the things they love and care about.

One day, a curious customer asked Sarah, How much do you make an hour as a State Farm insurance agent? Sarah smiled and replied, Well, it depends on a few factors.

Curious to know more, the customer asked Sarah to explain. Here’s what Sarah said:

-

Experience: State Farm insurance agents’ hourly pay increases with experience. As an agent with over five years of experience, I make around $25 per hour.

-

Location: The hourly pay of a State Farm insurance agent can also vary depending on the location. For example, agents in large cities may earn more than those in smaller towns.

-

Performance: State Farm insurance agents who perform well and meet their sales goals may receive bonuses and incentives, which can increase their hourly pay.

The customer was impressed by Sarah’s explanation and thanked her for sharing. Sarah went on to explain that while the hourly pay is important, what she loves most about her job is being able to help her customers protect the things they value most.

In conclusion, State Farm insurance agents’ hourly pay can vary depending on experience, location, and performance. However, what matters most to them is being able to help their customers protect their assets and provide them with peace of mind.

Well, folks, we’ve reached the end of our journey through the world of State Farm insurance agents’ salaries. I hope you’ve found this article informative and enlightening, and that it’s given you a better understanding of what goes into determining an agent’s hourly wage.

As we’ve seen, there are many factors that can influence an agent’s pay, from experience and education to location and performance. While the average hourly wage for a State Farm agent is around $19.20, there’s no one-size-fits-all answer when it comes to how much any individual agent will make.

Ultimately, the best way to find out what kind of salary you can expect as a State Farm agent is to talk to someone who’s been there before. Reach out to current or former agents in your area, or connect with industry groups and forums to get a sense of what others are making. And remember, while money is certainly important, there are many other factors to consider when deciding whether a career as a State Farm agent is right for you.

Thanks for joining me on this exploration of State Farm insurance agents’ wages. Whether you’re considering a career in insurance or simply curious about how the industry works, I hope you’ve found something here that has piqued your interest. Keep asking questions, seeking answers, and learning all you can about this fascinating field.

.

People also ask about How Much Do State Farm Insurance Agents Make An Hour?

- 1. What is the average hourly wage for a State Farm Insurance agent?

- 2. Is being a State Farm Insurance agent a lucrative career?

- 3. What factors affect how much a State Farm Insurance agent makes?

- 4. Can State Farm Insurance agents make commissions on policies they sell?

- 5. Are there opportunities for advancement as a State Farm Insurance agent?

The average hourly wage for a State Farm Insurance agent is around $19 per hour.

Being a State Farm Insurance agent can be a lucrative career if you are successful in building a large customer base and selling policies.

Factors that can affect how much a State Farm Insurance agent makes include location, experience, commission rates, and the amount of business they generate.

Yes, State Farm Insurance agents can earn commissions on the policies they sell. The commission rate varies depending on the type of policy and the agent’s level of experience.

Yes, there are opportunities for advancement as a State Farm Insurance agent. Successful agents can become agency managers or even open their own State Farm agencies.

Overall, the amount that a State Farm Insurance agent makes per hour can vary depending on various factors. However, it can be a lucrative career for those who are able to build a strong customer base and generate a high volume of business. Commission rates also play a significant role in determining an agent’s income, and there are opportunities for advancement within the company for successful agents.