Table of Contents

Wondering if State Farm offers 1 year auto insurance? Find out here and get the coverage you need for your vehicle.

Are you tired of being locked into a long-term auto insurance policy? Do you want the flexibility to switch your coverage as needed? Look no further than State Farm. With their 1 year auto insurance option, you can have the peace of mind knowing that you have coverage for a full year without the commitment of a longer policy. But that’s not all – State Farm also offers affordable rates and top-notch customer service. So why settle for anything less when you can have the best of both worlds with State Farm’s 1 year auto insurance? Let’s dive in and explore more about this option.

Does State Farm Offer 1 Year Auto Insurance without Title?

Auto insurance is an essential aspect of owning a vehicle. It not only protects you from potential financial losses but also helps you comply with state laws. While most auto insurance policies are valid for six or twelve months, some insurers offer shorter terms to cater to specific needs. One such insurer is State Farm. But do they offer one-year auto insurance without a title? Let’s find out.

What is State Farm?

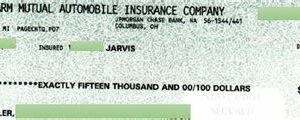

State Farm is an American insurance company that specializes in offering a wide range of insurance products, including auto, home, life, and health insurance. The company was founded in 1922 and has since grown to become one of the largest insurers in the United States. State Farm operates through a network of agents and offers its services in all 50 states.

Types of Auto Insurance Offered by State Farm

State Farm offers several types of auto insurance coverage, depending on your needs and budget. These include:

- Liability Coverage

- Collision Coverage

- Comprehensive Coverage

- Personal Injury Protection (PIP)

- Uninsured/Underinsured Motorist (UM/UIM) Coverage

- Rental Reimbursement Coverage

- Emergency Road Service Coverage

Does State Farm Offer 1 Year Auto Insurance without Title?

State Farm offers auto insurance policies that are typically valid for six or twelve months. However, the company does not offer one-year auto insurance without a title. In other words, you cannot purchase auto insurance from State Farm if you do not own the vehicle you want to insure or have legal ownership or title to it.

Why Does State Farm Require a Title to Offer Auto Insurance?

State Farm requires a title or legal ownership of the vehicle to offer auto insurance coverage because it is a legal requirement in most states. The title serves as proof that you own the vehicle and have the right to register it and operate it on public roads. Furthermore, the title contains critical information about the vehicle, such as its make, model, and year, which is necessary for determining the appropriate level of coverage and premium.

What if You Don’t Have a Title?

If you do not have a title or legal ownership of the vehicle you want to insure, you cannot purchase auto insurance from State Farm or any other insurer. However, there are some situations where you may be able to obtain a title, such as:

- Transferring the title from the previous owner

- Applying for a lost title

- Obtaining a bonded title

- Getting a court order to establish ownership

Conclusion

State Farm is a reputable insurer that offers a variety of auto insurance coverage options. However, the company does not offer one-year auto insurance without a title. To obtain auto insurance coverage from State Farm, you must have legal ownership or title to the vehicle you want to insure. If you do not have a title, you may be able to obtain one through various means, depending on your situation. Always ensure that you comply with state laws and regulations when purchasing auto insurance coverage.

State Farm – Your Trusted Insurance Partner – is known for providing reliable insurance solutions to millions of Americans. One of the options available to customers is the one-year auto insurance policy. The One-Year Auto Insurance Option is an excellent choice for those who need coverage for a limited time.

Importance of Auto Insurance cannot be overstated. It protects drivers financially from the expenses incurred in case of an accident. State laws require automobile owners to have liability coverage at a minimum. Auto insurance also covers theft, damage caused by natural disasters, and medical expenses incurred due to accidents.

Benefits of State Farm’s One-Year Auto Insurance include flexibility and affordability. Customers can choose a policy that suits their needs, whether it’s just liability coverage or comprehensive coverage. This option is ideal for people who own their cars outright and don’t want to commit to a long-term policy. With State Farm, customers can purchase auto insurance for as little as one year.

The Limitations of One-Year Auto Insurance are that it may not be cost-effective for some people. The premium rates are likely to be higher than a long-term policy due to the short-term nature of the policy. Additionally, if the customer decides to renew the policy after a year, the rates may increase further.

Who is Eligible for State Farm’s One-Year Auto Insurance? Anyone who owns a car and holds a valid driver’s license can apply for this policy. However, the eligibility criteria may vary based on the state of residence and other factors such as driving history, age, and credit score.

Additional Coverage Options with State Farm include rental car reimbursement, roadside assistance, and accident forgiveness. Customers can add these options to their policy for added protection and peace of mind.

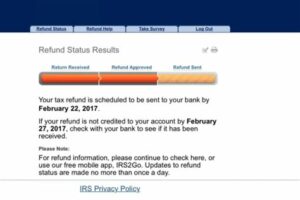

How to Apply for One-Year Auto Insurance from State Farm is a simple process. Customers can visit the State Farm website or contact their local agent to get a quote. The application process involves providing personal information, details about the car, and choosing the coverage options. Customers can also customize the policy to fit their budget and preferences.

Understanding State Farm’s Insurance Policies is crucial for customers to make informed decisions. State Farm offers various types of auto insurance policies such as liability, collision, comprehensive, and personal injury protection. Each policy has its own terms and conditions, coverage limits, and deductibles. Customers should carefully read through the policy documents before signing up for any policy.

Why Choose State Farm for Your Auto Insurance Needs? State Farm has been in the insurance business for almost a century and has earned a reputation for being a reliable and customer-centric company. They offer flexible policies, competitive rates, and excellent customer service. State Farm also has a network of agents and claims adjusters who are available 24/7 to assist customers in case of an emergency.

In conclusion, State Farm’s One-Year Auto Insurance Option is a great choice for people who need short-term coverage. It offers flexibility, affordability, and additional coverage options. However, customers should carefully consider the limitations and eligibility criteria before making a decision. With State Farm, customers can rest assured that they have a trusted partner to protect them on the road.

Have you ever wondered if State Farm offers 1 year auto insurance? Well, the answer is yes!

As a customer of State Farm, I can attest to the fact that they offer various options when it comes to auto insurance. One of these options is the ability to purchase a policy for one year.

Here are a few things to keep in mind about State Farm’s 1 year auto insurance:

- It provides coverage for a full year: With State Farm’s 1 year auto insurance policy, you can rest assured knowing that you are covered for a full year. This means that you won’t have to worry about renewing your policy every few months.

- You can customize your policy: State Farm understands that each driver has individual needs when it comes to auto insurance. That’s why they allow you to customize your policy to fit your specific needs. Whether you need liability coverage or comprehensive coverage, State Farm has you covered.

- It’s affordable: One of the biggest concerns when it comes to auto insurance is the cost. State Farm’s 1 year auto insurance policy is affordable and can fit into your budget.

In conclusion, if you’re looking for a reliable and affordable auto insurance policy, look no further than State Farm’s 1 year auto insurance. As a satisfied customer, I highly recommend this option to anyone in need of auto insurance.

Greetings, dear blog visitors! I hope you have enjoyed reading about State Farm’s 1-year auto insurance policy without title. Before we wrap things up, I’d like to summarize the key points we’ve discussed and add a few final thoughts.

Firstly, it’s important to note that State Farm does indeed offer a 1-year auto insurance policy without requiring the title of your vehicle. This can be incredibly helpful if you’re in the process of purchasing a car or if you’re borrowing one from a friend or family member for an extended period of time. It allows you to get the coverage you need without the hassle of obtaining the title.

Secondly, while this policy may seem like a great option, it’s worth considering whether it’s the best fit for your specific situation. Depending on how long you plan to use the vehicle, it may be more cost-effective to purchase a longer-term policy. Additionally, if you do own the vehicle, it’s generally a good idea to have the title in your possession as proof of ownership.

In conclusion, State Farm’s 1-year auto insurance policy without title is a convenient option for those who need coverage for a shorter period of time or don’t have immediate access to the title. However, it’s always wise to weigh your options and make sure you’re getting the best policy for your needs. Thanks for reading, and drive safely!

.

When it comes to auto insurance, people have a lot of questions. One common question is whether State Farm offers one year auto insurance policies. Here are some of the most frequently asked questions about this topic:

- Does State Farm offer one year auto insurance policies?

- Is a one year policy better than a six month policy?

- Are there any benefits to choosing a one year policy with State Farm?

- How do I know if a one year policy with State Farm is right for me?

Yes, State Farm does offer one year auto insurance policies. However, they also offer six-month policies, which are more common in the industry.

It really depends on your individual situation. Some people prefer the convenience of a one year policy because they don’t have to worry about renewing their coverage as often. Others prefer a six month policy because it gives them more flexibility to change providers or adjust their coverage mid-year.

One benefit of choosing a one year policy with State Farm is that you may be eligible for discounts or other perks for committing to a longer term of coverage. Additionally, if you have a good driving record and maintain continuous coverage with State Farm, you may be eligible for their safe driver discount, which could save you money over time.

The best way to determine if a one year policy with State Farm is right for you is to speak with an agent directly. They can help you assess your needs and budget, and recommend a policy that fits your unique situation.

Overall, State Farm does offer one year auto insurance policies, but whether or not this type of policy is right for you depends on your individual needs and preferences. To learn more about your options with State Farm, it’s best to speak with an agent directly.