Table of Contents

Wondering if State Farm offers long term health care? Check out our guide to learn about their policies and coverage options.

As we age, the need for long-term health care becomes increasingly important. However, many individuals assume that Medicare will cover all of their medical expenses in their later years. Unfortunately, this is not always the case. That’s why it’s essential to explore other options, such as long-term health care insurance. When it comes to insurance, State Farm is a household name. But does State Farm offer long-term health care insurance? This question has become increasingly relevant in recent years, considering the rising cost of healthcare and the fact that life expectancy continues to increase.

If you’re looking for a reliable insurance provider that offers long-term health care, you might be wondering if State Farm is the right choice for you. While State Farm is known for its car and home insurance policies, the company also offers a range of other services, including health insurance options. In this article, we’ll take a closer look at whether or not State Farm offers long-term health care coverage and what you need to know about their policies.

What is Long-Term Health Care?

Before we dive into State Farm’s policies, it’s important to understand what long-term health care is and why it’s important. Long-term health care refers to the type of care that people need when they can no longer perform daily activities on their own due to age, illness, or disability. This type of care can include assistance with bathing, dressing, eating, and other basic tasks, as well as medical care and supervision.

Does State Farm Offer Long-Term Health Care?

The short answer is no, State Farm does not offer long-term health care insurance policies. However, the company does offer a range of other health insurance options, including individual and family health insurance plans, Medicare supplement plans, and short-term health insurance plans. These plans may provide some coverage for long-term care services, but they are not specifically designed for this purpose.

What Health Insurance Options Does State Farm Offer?

As mentioned, State Farm offers a variety of health insurance options that may be suitable for your needs. These include:

- Individual and family health insurance plans

- Medicare supplement plans

- Short-term health insurance plans

Individual and Family Health Insurance Plans

State Farm’s individual and family health insurance plans are designed to provide coverage for medical expenses, including doctor visits, hospitalization, prescription drugs, and more. These plans are available in a range of deductibles and coinsurance options to fit your budget and needs.

Medicare Supplement Plans

If you’re eligible for Medicare, State Farm offers Medicare supplement plans that can help cover the gaps in your Medicare coverage. These plans are designed to help pay for out-of-pocket costs like deductibles, coinsurance, and copayments.

Short-Term Health Insurance Plans

State Farm’s short-term health insurance plans provide temporary coverage for people who are between jobs or waiting for other insurance coverage to begin. These plans typically offer lower premiums than traditional health insurance plans, but they may have limited coverage options.

What Are the Alternatives to Long-Term Health Care Insurance?

If you’re concerned about the cost of long-term health care and want to explore other options, there are several alternatives to consider:

- Self-funding: You can save money on your own to cover the cost of long-term care if it becomes necessary.

- Long-term care insurance: This type of insurance is specifically designed to cover the costs of long-term care services.

- Medicaid: If you meet certain income and asset requirements, Medicaid may cover the cost of long-term care services.

Conclusion

While State Farm does not offer long-term health care insurance policies, the company does provide a range of other health insurance options that may be suitable for your needs. It’s important to carefully consider your options and choose a policy that provides the coverage you need at a price you can afford. Additionally, you may want to consider alternatives to long-term care insurance, such as self-funding or Medicaid, to help cover the cost of long-term care services in the future.

State Farm’s Long-Term Health Care Coverage: An Overview

As we age, it’s important to consider how we’ll manage our healthcare needs in the long term. Unfortunately, many people overlook this aspect of planning for the future until it’s too late. That’s where State Farm’s Long-Term Health Care Coverage comes in. This coverage is designed to help individuals and families manage the costs associated with long-term care, such as nursing homes or in-home care.

The Importance of Long-Term Health Care Planning

Long-term health care planning is essential for anyone who wants to ensure they have access to quality care as they age. Without proper planning, individuals and families can find themselves struggling to cover the costs associated with long-term care. This can lead to financial hardship and even prevent individuals from receiving the care they need.

What Does State Farm’s Long-Term Health Care Coverage Include?

State Farm’s Long-Term Health Care Coverage includes a range of benefits designed to help individuals and families manage the costs associated with long-term care. These benefits may include coverage for nursing home care, in-home care, and assisted living facilities. The coverage may also include benefits such as caregiver training, medical equipment, and prescription drugs.

How to Determine if State Farm’s Coverage is Right for You

If you’re considering State Farm’s Long-Term Health Care Coverage, it’s important to evaluate your current health status and future needs. Consider factors such as your age, overall health, and family history. If you have a history of chronic illness or a family history of conditions that require long-term care, State Farm’s coverage may be a good option for you. Additionally, if you’re concerned about the cost of long-term care and want to ensure you have access to quality care in the future, State Farm’s coverage may be worth considering.

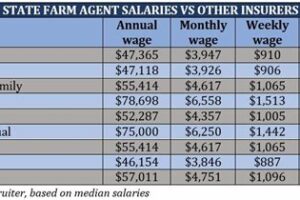

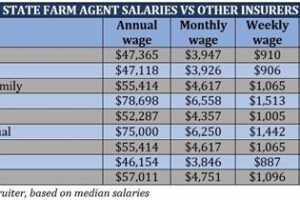

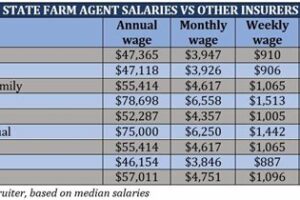

Comparing State Farm’s Long-Term Health Care Coverage to Other Providers

When evaluating long-term health care coverage options, it’s important to compare different providers and policies. Consider factors such as the cost of coverage, the range of benefits offered, and any exclusions or limitations. When comparing State Farm’s coverage to other providers, be sure to evaluate all aspects of the policy to determine which option best meets your needs and budget.

Understanding the Benefits and Limitations of State Farm’s Long-Term Health Care Coverage

State Farm’s Long-Term Health Care Coverage offers a range of benefits that can help individuals and families manage the costs associated with long-term care. However, it’s important to understand the limitations of the coverage as well. For example, there may be restrictions on the types of care covered or limits on the amount of coverage available. Be sure to review the policy carefully and ask questions to ensure you fully understand the benefits and limitations of the coverage.

How to Enroll in State Farm’s Long-Term Health Care Coverage

If you’re interested in enrolling in State Farm’s Long-Term Health Care Coverage, you’ll need to contact a State Farm agent to discuss your options. The agent can help you evaluate your needs, review the available coverage options, and enroll in the policy that best meets your needs.

Frequently Asked Questions about State Farm’s Long-Term Health Care Coverage

If you have questions about State Farm’s Long-Term Health Care Coverage, you’re not alone. Here are some frequently asked questions that may help:

- What types of long-term care are covered?

- What are the limits on coverage?

- Are there any exclusions or limitations?

- What is the cost of coverage?

- Can I customize my coverage to meet my specific needs?

Finding Additional Resources for Long-Term Health Care Planning

If you’re looking for more resources to help you plan for long-term health care, there are a variety of options available. Consider reaching out to a financial advisor or elder care attorney for guidance. Additionally, organizations such as AARP and the National Council on Aging offer resources and information to help individuals and families plan for their long-term care needs.

The Future of Long-Term Health Care Coverage: Trends and Predictions

The landscape of long-term health care coverage is constantly evolving. As the population ages and healthcare costs continue to rise, it’s likely that we’ll see new policies and options emerge to help individuals and families manage the costs associated with long-term care. Some predicted trends include an increase in home-based care options and the expansion of coverage for non-traditional care providers, such as family caregivers. Keeping up-to-date on these trends can help you make informed decisions about your long-term health care coverage.

Overall, State Farm’s Long-Term Health Care Coverage can be a valuable tool for individuals and families looking to plan for their future healthcare needs. By understanding the benefits and limitations of the policy, comparing it to other providers, and working with a State Farm agent to enroll, you can take steps to ensure you have access to quality care when you need it most.

Once upon a time, there was a man named Jack who was approaching his retirement years. As he began to plan for his future, he realized that he had not yet considered long-term health care. Jack wondered if his insurance provider, State Farm, offered any options for this type of coverage.

After doing some research, Jack discovered that State Farm does indeed offer long-term health care insurance. Here are some key points to consider:

- State Farm’s Long-Term Care policy provides coverage for a variety of services, including nursing home care, in-home care, and assisted living facilities.

- The policy also offers options for inflation protection, which adjusts the coverage amount over time to keep up with rising healthcare costs.

- State Farm’s Long-Term Care policy is customizable, allowing individuals to choose the amount of coverage they need and the length of time the policy will be in effect.

Jack was pleased to learn about these options and felt relieved that he could trust his insurance provider to help him plan for his future healthcare needs.

In conclusion, if you’re like Jack and wondering if State Farm offers long-term health care insurance, the answer is yes. With customizable options and coverage for a variety of services, State Farm can help you plan for your future healthcare needs with confidence.

Dear blog visitors,

As you have read in our previous articles, long term health care is crucial for many people. It provides peace of mind for individuals who may require assistance with daily living activities as they age or face an illness or injury. In this article, we will explore whether State Farm offers long term health care insurance and what you need to know about it.

State Farm does offer long term health care insurance policies. These policies can help cover the costs of long term health care services that may not be covered by traditional health insurance plans. They can also provide additional benefits such as in-home care, nursing home care, and hospice care.

It is important to note that long term health care insurance policies vary depending on the individual’s needs and circumstances. Factors such as age, health, and the amount of coverage desired can all affect the cost and availability of policies. It is essential to consult with a licensed insurance agent at State Farm to determine the best policy for your needs.

In conclusion, State Farm offers long term health care insurance policies that can provide financial protection and peace of mind for those who require extended health care services. We urge you to contact a licensed insurance agent at State Farm to learn more about your options and to discuss your long term health care needs. Thank you for reading and we hope this article has been helpful in your search for long term health care insurance.

Sincerely,

[Your Name]

Video Does State Farm Offer Long Term Health Care

Does State Farm Offer Long Term Health Care?

State Farm is one of the largest insurance providers in the United States. They offer various types of insurance policies, including auto, home, life, and health insurance. However, many people wonder if State Farm offers long-term health care insurance. Below are some frequently asked questions about this topic:

People also ask:

- What is long-term health care insurance?

- Does State Farm offer long-term health care insurance?

- What are some alternatives to long-term health care insurance?

- Self-insurance: saving money over time to cover potential long-term care costs

- Life insurance with long-term care benefits: a type of hybrid policy that combines life insurance and long-term care coverage

- Critical illness insurance: a policy that pays a lump sum if you are diagnosed with a critical illness, such as cancer or a stroke

- Medicaid: a government-funded program that provides long-term care coverage for individuals who meet certain income and asset requirements

- Should I consider long-term health care insurance?

Long-term health care insurance is a type of insurance policy that covers the cost of long-term care services, such as nursing home care, assisted living facilities, and in-home care for individuals who are unable to care for themselves due to an illness, injury, or disability.

No, State Farm does not currently offer long-term health care insurance policies. However, they do offer other types of health insurance policies, such as individual health plans, Medicare supplement plans, and short-term health plans.

There are several alternatives to long-term health care insurance, including:

Whether or not you should consider long-term health care insurance depends on your age, health, financial situation, and personal preferences. If you are young and healthy, it may not be necessary to purchase long-term care insurance. However, if you have a family history of chronic illnesses or disabilities, or if you have significant assets that you want to protect, long-term care insurance may be a good investment.

Overall, while State Farm does not offer long-term health care insurance, there are alternative options available. It is important to carefully consider your individual needs and circumstances before purchasing any type of insurance policy.