Table of Contents

Wondering if State Farm offers home loans? Get the answer to your question and explore their loan options today.

#StateFarm #homeloans

Looking for the perfect home can be an exciting and rewarding journey. However, finding the right home loan to finance your dream home can often be an overwhelming task. This is where State Farm comes in. As one of the largest insurance and financial services providers in the United States, many wonder if State Farm also offers home loans. Well, the answer is yes! With their competitive rates, flexible terms, and exceptional customer service, State Farm is a great option to consider when searching for a home loan. So, if you’re in the market for a new home or looking to refinance an existing mortgage, let’s dive into what State Farm has to offer.

When it comes to buying a home, there are many options available for financing. One option that some may consider is getting a home loan through their insurance provider. State Farm is one such insurance company that offers a variety of financial products and services, but does State Farm offer home loans without title? Let’s dive in and find out.

The Basics of Home Loans

Before we explore whether State Farm offers home loans without title, let’s first go over the basics of home loans. A home loan, also known as a mortgage, is a loan provided by a lender that allows an individual to purchase a home. The loan is typically paid back over a period of 15-30 years and includes interest payments.

The amount of the loan and the interest rate will depend on a number of factors, including the individual’s credit score, income, and the value of the property being purchased. It’s important to shop around and compare different lenders and loan options to find the best fit for your specific needs.

What is Title Insurance?

When purchasing a home with a loan, a borrower is typically required to obtain title insurance. Title insurance is a type of insurance that protects the lender (and sometimes the borrower) from any legal claims against the property’s title.

For example, if there was a mistake or error in the chain of ownership of the property, title insurance would protect the lender from any financial loss resulting from a legal claim against the property.

Does State Farm Offer Home Loans?

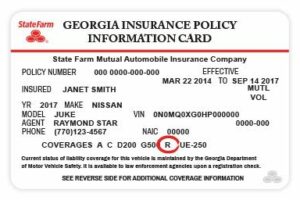

Now, let’s get to the question at hand – does State Farm offer home loans? The answer is yes, State Farm does offer home loans through its banking division, State Farm Bank.

State Farm Bank offers a variety of mortgage options, including fixed-rate and adjustable-rate mortgages, jumbo loans, and government-backed loans such as FHA and VA loans. These loans can be used for purchasing a home, refinancing an existing mortgage, or accessing home equity.

Does State Farm Offer Home Loans Without Title?

So, what about the original question – does State Farm offer home loans without title? The answer is no, State Farm does not offer home loans without title insurance. As mentioned earlier, title insurance is a requirement when obtaining a home loan through most lenders, and State Farm Bank is no exception.

While it may seem like an extra cost, title insurance is crucial in protecting both the lender and the borrower from any potential legal claims against the property’s title. It’s important to budget for this cost when purchasing a home and to work with a reputable title insurance provider.

The Benefits of Working with State Farm Bank

While State Farm Bank does require title insurance when obtaining a home loan, there are still many benefits to working with them for your mortgage needs. Here are just a few:

- Competitive interest rates

- Flexible loan terms

- Online and mobile banking options

- Ability to earn rewards through the State Farm Loyalty Rewards program

In addition to these benefits, working with State Farm Bank for your mortgage needs can offer added convenience if you already have other financial products with State Farm, such as insurance policies or investment accounts.

Final Thoughts

While State Farm does not offer home loans without title insurance, they do offer a variety of mortgage options and other financial products and services that can help make the home buying process easier and more convenient.

Remember to shop around and compare different lenders and loan options before making a final decision on your home loan. And don’t forget to budget for title insurance – it may seem like an extra expense, but it’s an important one in protecting your investment in your new home.

Happy home buying!

Introduction: Exploring State Farm’s Home Loan Options

If you’re planning to buy a new home or refinance your current one, you may be wondering if State Farm offers home loans. The answer is yes! State Farm offers a variety of home loan options, including fixed-rate and adjustable-rate mortgages, jumbo loans, FHA loans, VA loans, and USDA loans. With so many options available, you’re sure to find a loan that fits your unique needs and budget.

Understanding the Importance of a Title in Home Loan Process

When you apply for a home loan, one of the most important documents you’ll need is a title. A title is a legal document that proves you own the property you want to buy or refinance. It also shows any liens or other encumbrances on the property. Having a clear title is essential for getting a home loan because it gives the lender confidence that they can recover their investment if you default on your loan.

Does State Farm Offer Home Loans Without a Title?

No, State Farm does not offer home loans without a title. All lenders require a clear title before approving a home loan. If there are any liens or other issues with the title, the lender will not be able to approve the loan until those issues are resolved.

Advantages and Disadvantages of Home Loans Without a Title

While it may be tempting to try to get a home loan without a title, it’s not a good idea. There are several disadvantages to this approach, including:- You may not be able to get a loan at all.- You may have to pay higher interest rates and fees.- You may be more likely to default on your loan.On the other hand, there are some advantages to having a clear title, including:- You’ll have peace of mind knowing that you own your property.- You’ll be able to sell your property more easily if you decide to do so.- You’ll have more options when it comes to refinancing your home loan.

Exceptions Where State Farm May Offer Home Loans Without Title

While State Farm generally requires a clear title for home loans, there may be some exceptions in certain situations. For example, if you’re buying a new home that hasn’t been built yet, you may be able to get a loan without a title. This is because the builder will not have completed the home yet, so there won’t be a title available. In this case, the lender will usually require a construction loan, which will be converted to a traditional mortgage once the home is completed.

Factors That Affect Home Loan Approval Without a Title

If you’re applying for a home loan without a title, there are several factors that can affect your approval. These include:- Your credit score: Lenders will look at your credit score to determine how likely you are to repay your loan.- Your income: Lenders will want to make sure you have enough income to cover your monthly mortgage payments.- Your debt-to-income ratio: Lenders will also look at your debt-to-income ratio to see how much of your income is already committed to other debts.- The value of the property: Lenders will want to make sure the property is worth the amount of the loan.

Alternatives to Home Loans Without a Title

If you’re having trouble getting approved for a home loan because of issues with the title, there are some alternatives you can consider. These include:- Fixing any issues with the title: If there are liens or other issues with the title, you may be able to resolve them by working with an attorney or title company.- Getting a co-signer: If you have a friend or family member with good credit and income, they may be able to co-sign on your loan, which can increase your chances of approval.- Applying for a different type of loan: If you’re having trouble getting approved for a traditional mortgage, you may want to consider other types of loans, such as a personal loan or home equity loan.

How to Apply for a Home Loan with State Farm

If you’re interested in applying for a home loan with State Farm, the first step is to contact a local agent or visit their website. You’ll need to provide information about your income, credit score, and the property you want to buy or refinance. The lender will then review your application and let you know if you’re approved.

Tips for Getting Approved for a Home Loan Without a Title

If you’re trying to get approved for a home loan without a title, there are some things you can do to increase your chances of approval. These include:- Improving your credit score: You can improve your credit score by paying off debts, making payments on time, and keeping your credit utilization low.- Increasing your income: You can increase your income by taking on a second job, freelancing, or starting a side business.- Reducing your debt: You can reduce your debt by paying off credit cards and other loans.- Finding a co-signer: As mentioned earlier, having a co-signer can increase your chances of approval.

Conclusion: Making an Informed Decision on Home Loans with State Farm

In conclusion, State Farm offers a variety of home loan options that can help you achieve your homeownership goals. While they do require a clear title for their loans, there may be some exceptions in certain situations. If you’re having trouble getting approved for a loan, there are alternatives you can consider, such as fixing any issues with the title, getting a co-signer, or applying for a different type of loan. By following these tips and working with a reputable lender like State Farm, you can make an informed decision on your home loan and achieve your dream of homeownership.

State Farm is a well-known insurance company that offers a wide range of financial products and services. Many people wonder if State Farm offers home loans. The answer is yes! State Farm offers both conventional and jumbo home loans to its customers.

Storytelling

As a young couple, Sarah and John were excited to finally purchase their dream home. They had been saving for years and were now ready to take the next step. However, they were unsure about where to start when it came to securing a home loan. They had heard about State Farm’s reputation for excellent customer service and decided to reach out to them.

After a quick call to their local State Farm agent, Sarah and John were connected with a loan officer who walked them through the entire process. The loan officer took the time to explain all of the different types of home loans that State Farm offered and helped them choose the one that was best suited for their needs.

The loan officer also helped them gather all of the necessary documents and answered any questions they had along the way. Sarah and John felt confident that they had made the right decision in choosing State Farm as their lender.

Thanks to State Farm’s competitive interest rates and personalized service, Sarah and John were able to secure a home loan that fit within their budget. They were thrilled to finally move into their dream home and knew that they had made the right choice by choosing State Farm.

Point of View

If you are in the market for a home loan, State Farm is definitely worth considering. Here are some reasons why:

- State Farm offers both conventional and jumbo home loans, giving customers a wide range of options to choose from.

- Their loan officers provide personalized service and will work with you every step of the way to ensure that you understand the process and are comfortable with your loan.

- State Farm’s interest rates are competitive with other lenders, which can save you money in the long run.

- State Farm has a strong reputation for excellent customer service, so you can feel confident that you are in good hands.

Overall, State Farm is a great option for anyone looking to secure a home loan. Whether you are a first-time homebuyer or a seasoned homeowner, their personalized service and wide range of options make them a top choice.

Well, folks, we hope you found this article informative and helpful in answering your question, “Does State Farm offer home loans without title?” As you now know, the answer is no, State Farm does not offer home loans that do not require a title. However, they do offer a variety of other loan options for homeowners and homebuyers alike.

If you’re in the market for a home loan, it’s important to do your research and shop around to find the best option for you. While State Farm may not offer the particular type of loan you’re looking for, there are many other lenders out there who do. Take the time to compare rates and terms from different lenders to ensure you’re getting the best deal possible.

Remember, buying a home is a big decision, and choosing the right loan can have a significant impact on your financial future. So don’t rush into anything – take your time, do your due diligence, and make an informed decision that’s right for you and your family.

Thank you for reading, and good luck on your homebuying journey!

.

People also ask if State Farm offer home loans, and here are some answers:

- Does State Farm offer mortgages? Yes, State Farm offers mortgages for purchasing or refinancing a home. They have a variety of loan options, including fixed-rate and adjustable-rate mortgages, FHA and VA loans, and jumbo loans.

- How do I apply for a State Farm mortgage? You can apply for a State Farm mortgage online, over the phone, or in person at a State Farm agent’s office. The application process typically involves providing personal and financial information, such as your income, assets, credit score, and employment history.

- What are the requirements for getting a State Farm mortgage? The requirements for getting a State Farm mortgage may vary depending on the type of loan you’re applying for and your individual circumstances. Generally, you’ll need to have a good credit score, a stable income, and enough savings for a down payment and closing costs.

- What are the benefits of getting a State Farm mortgage? Some potential benefits of getting a State Farm mortgage include competitive interest rates, flexible repayment terms, access to online tools and resources, and personalized customer service from a State Farm agent.

- Is State Farm a good choice for a mortgage? Whether or not State Farm is a good choice for a mortgage will depend on your specific needs and preferences. It’s always a good idea to compare mortgage offers from multiple lenders to find the best deal for you.

Overall, State Farm does offer home loans in the form of mortgages, and they have a range of loan options and application methods available. To determine if State Farm is the right choice for your mortgage needs, it’s important to do your research and compare offers from multiple lenders.