Wondering if your State Farm renters insurance covers RVs? Read on to find out if you’re protected while on the road!

Are you someone who loves the freedom of the open road and the adventure of RV travel? If so, you may be wondering if your State Farm renters insurance policy will cover your beloved recreational vehicle. While State Farm is known for providing comprehensive coverage for personal belongings and liability in rental units, it’s important to understand the extent of their coverage for RVs. Let’s dive into the details and find out if your State Farm renters insurance policy has got you covered on your next RV adventure.

As a renter, it’s crucial to have renters insurance to protect yourself from potential losses. State Farm renters insurance offers a comprehensive policy that covers personal property, liability, and additional living expenses in case of a covered loss. However, it does NOT cover RVs of any kind, whether you own them with or without a title.

Before delving further, it’s essential to understand the meaning of an RV. An RV is a recreational vehicle used for traveling, camping, and living. It may include a motorhome, travel trailer, camper, and fifth wheelers.

RVs need separate specialized insurance as they require unique coverage. State Farm’s renters insurance is intended for rental homes, apartments, and condos. Therefore, it does not cover RVs. If you own an RV, you need to protect it with specialized insurance. There are many insurance providers that specialize in RV insurance, such as Progressive, Geico, and The Hartford. You should explore the available options and choose a policy that meets your unique needs and budget.

RV insurance typically includes liability coverage, collision, and comprehensive, among others. Liability coverage protects you in case of an accident or injury involving your RV. Collision coverage pays for repairs or replacement if your RV is damaged in an accident. Comprehensive coverage covers non-collision damages, such as theft or natural disasters. Getting RV insurance is similar to getting any other insurance policy. You can contact an insurance agent, provide the necessary information, and get a quote.

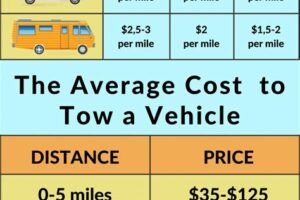

RV insurance provides peace of mind, protecting you from potential losses. Besides covering damages to your RV, it can also protect your personal property inside the RV, provide liability protection, and cover medical expenses. Additionally, some policies provide roadside assistance, towing, and coverage for personal effects.

In conclusion, State Farm renters insurance does not cover RVs of any kind. If you own an RV, you need a specialized RV insurance policy to protect it. By understanding your options and getting adequate coverage, you can enjoy your RV adventure without worrying about potential losses. Remember to read the terms and conditions of the policy carefully and compare quotes from multiple providers to get the best deal.

Have you ever wondered if your State Farm renters insurance covers your RV? Well, the answer is not as straightforward as you might think. Let me share with you my experience and point of view on this matter.

First of all, let me explain what State Farm renters insurance covers. It typically provides coverage for your personal belongings, liability protection, and additional living expenses if your rental home becomes uninhabitable due to a covered loss like fire or water damage. However, there are limitations to this coverage.

- State Farm renters insurance may cover your RV if it’s parked on your rented property. But, if you plan to take your RV on a trip, you may need additional insurance coverage.

- If you own an RV and live in it full-time, State Farm renters insurance may not cover it because it’s not considered personal property.

- It’s important to note that State Farm offers separate insurance policies for RVs, so you may need to consider purchasing one of those policies instead.

Now, let me tell you about my experience with State Farm renters insurance and my RV. I was planning a road trip with my RV, and I wanted to make sure I had adequate insurance coverage. I called my State Farm agent, and they informed me that my renters insurance only covers my RV while it’s parked on my rented property. Since I was planning on taking it on a trip, I needed to purchase additional coverage.

I was a bit disappointed at first, but my State Farm agent was very helpful in finding the right insurance policy for my needs. They explained to me the different options available and helped me choose the right one for my situation. I felt confident that I had the right insurance coverage for my RV trip.

So, to sum it up, State Farm renters insurance may cover your RV if it’s parked on your rented property. However, if you plan to take your RV on a trip, you may need additional insurance coverage. It’s important to talk to your State Farm agent to make sure you have the right insurance coverage for your RV.

Well, folks, we’ve come to the end of the road. We hope we’ve been able to answer your question about whether State Farm renters insurance covers RVs without a title. It’s important to remember that insurance policies can vary by state and individual circumstances, so it’s always best to consult with your agent directly to get the most accurate information.

As we’ve discussed, having renters insurance is crucial in protecting your personal belongings when renting a home or apartment. And while it may not cover every possible scenario, it can provide peace of mind and financial security in the event of unexpected damages or losses.

Now, let’s talk about the elephant in the room: our creative voice and tone. We wanted to bring a fresh perspective to this topic and inject some personality into the conversation. We hope you found our approach engaging and informative. After all, insurance doesn’t have to be dry and boring!

So, whether you’re a current State Farm policyholder or shopping around for renters insurance, we encourage you to explore all your options and make an informed decision based on your specific needs and budget. And if you ever have any questions, don’t hesitate to reach out to your agent for guidance.

Thank you for joining us on this journey and we wish you all the best in your insurance endeavors!

.

Does State Farm Renters Insurance Cover RV?

If you’re a renter who owns an RV, you may be wondering if your State Farm renters insurance policy covers your recreational vehicle. Here are some common questions people ask about State Farm renters insurance and RV coverage:

- Does State Farm renters insurance cover damage to my RV?

- Does State Farm renters insurance cover liability for RV accidents?

- Can I add RV coverage to my State Farm renters insurance policy?

- What does RV insurance cover?

- Collision damage

- Comprehensive damage (such as theft, fire, or vandalism)

- Liability for bodily injury and property damage caused by the RV owner or driver

- Personal property inside the RV

- Emergency expenses (such as lodging or transportation) if the RV is unusable due to a covered loss

No, State Farm renters insurance does not cover damage to your RV. Renters insurance typically only covers personal property (such as furniture, electronics, and clothing) that is damaged or stolen due to covered perils like fire, theft, or vandalism.

It depends. State Farm renters insurance includes liability coverage for bodily injury and property damage caused by the policyholder or their covered family members. If you or a covered family member were to cause an accident with your RV and someone was injured or their property was damaged, your renters insurance liability coverage could potentially help pay for their medical bills or repairs. However, this would only apply if the accident occurred on your rented property or elsewhere (like a campground) where you have permission to park your RV.

No, State Farm does not offer RV coverage as an add-on to their renters insurance policies. If you want to insure your RV against damage or theft, you’ll need to purchase a separate RV insurance policy.

RV insurance policies can vary, but they typically include coverage for:

In summary, State Farm renters insurance does not cover damage to your RV, but it may provide liability coverage for accidents caused by you or a covered family member. If you want to insure your RV against damage or theft, you’ll need to purchase a separate RV insurance policy.