Table of Contents

Wondering if your State Farm homeowners insurance covers your storage unit? Read on to find out what is and isn’t covered.

Are you planning to rent a storage unit for your valuable possessions? You may be wondering if your State Farm homeowners insurance will cover any damages or losses that occur while your items are stored away from home. Well, the answer is not a straightforward one. While some policies do offer coverage for personal property in storage units, there are certain limitations and exclusions to keep in mind. So, before you sign on the dotted line with your storage unit provider, let’s take a closer look at what exactly State Farm’s homeowners insurance covers when it comes to off-premises storage.

What Are Storage Units?

Storage units are rented spaces where individuals or businesses can store their belongings. These units are typically located in commercial buildings or outdoor facilities and come in various sizes to accommodate different needs. People rent storage units for a variety of reasons, such as moving, renovations, or lack of space in their homes or offices. They provide a secure and convenient way to keep items safe and organized.

Why Would You Need Coverage for a Storage Unit?

While storage units offer a level of protection for your belongings, they are not immune to accidents or incidents. Some common issues that can occur include theft, damage from fires or floods, or even pest infestations. If any of these incidents happen, you could be faced with significant financial losses. That’s why it’s essential to have insurance coverage for your storage unit.

Does State Farm Cover Storage Units?

The short answer is yes, State Farm homeowners’ insurance policies do provide coverage for items stored in a storage unit. However, there are some limitations and conditions to be aware of.

What Type of Coverage is Included?

State Farm’s standard homeowners’ insurance policies include coverage for personal property, which extends to items stored in a storage unit. This means that if your belongings are stolen or damaged while in storage, you can file a claim with your insurance company to receive compensation.

Are There Any Limitations?

While State Farm does cover items in storage units, there are some limitations to be aware of. Firstly, the coverage is typically limited to a percentage of the total coverage amount for personal property. This means that if you have a $100,000 policy, the coverage for items in storage may only be up to $10,000. Additionally, certain types of items may not be covered, such as jewelry, antiques, or artwork. If you have valuable items that you plan to store, it’s important to check with your insurance company to ensure they are covered.

What About Liability Coverage?

In addition to coverage for personal property, State Farm homeowners’ insurance policies also include liability coverage. This means that if someone is injured while on the storage unit property, you could be held liable for their medical expenses or other damages. However, it’s important to note that this coverage only applies if the injury was caused by your negligence. If the storage unit facility is found to be at fault, their liability insurance would be responsible for covering the damages.

What Should You Do Before Renting a Storage Unit?

If you plan to rent a storage unit, there are a few things you should do beforehand to ensure you have adequate insurance coverage. Firstly, check with your insurance company to see what type of coverage is included in your homeowners’ insurance policy. Make sure you understand the limitations and conditions of the coverage, so you know what items are covered and how much compensation you could receive if something happens. Secondly, talk to the storage unit facility about their insurance options. Many facilities offer their own insurance policies that can provide additional coverage for your belongings. Finally, make an inventory of all the items you plan to store in the unit and take photos or videos of them. This documentation will be useful if you need to file a claim later on.

Conclusion

In summary, State Farm homeowners’ insurance policies do provide coverage for items stored in a storage unit, but there are limitations and conditions to be aware of. It’s important to understand what type of coverage is included in your policy and to talk to the storage unit facility about their insurance options. By taking these steps, you can ensure that your belongings are protected and that you have peace of mind while they are in storage.

Protecting Your Belongings: Will State Farm Homeowners Insurance Cover Your Storage Unit?

When it comes to protecting your possessions, homeowners insurance is a must-have. But what about items that are stored off-site in a storage unit? Many people assume their homeowners insurance policy will cover their belongings in storage, but this isn’t always the case. If you’re a State Farm customer, you’ll be pleased to know that the company does offer coverage for storage units, but it’s important to understand the specifics of this coverage before relying on it.

Storage Solutions: Understanding State Farm’s Coverage for Off-Site Storage Units

If you have a State Farm homeowners insurance policy, you can add coverage for your storage unit by purchasing an endorsement. This endorsement provides protection for personal property that’s stored off-premises, including in a storage unit. The amount of coverage you receive will depend on the value of the items you’re storing and the limits of your policy. Keep in mind that there may be exclusions and limitations on certain types of items, such as jewelry or collectibles, so it’s important to review your policy carefully and speak with your agent to ensure you have adequate coverage.

Safe and Sound: Ensuring Your Stored Items are Covered with State Farm Insurance

When you purchase an endorsement for off-site storage coverage from State Farm, you’ll have peace of mind knowing that your stored items are protected. This coverage extends to damage or loss caused by covered perils, such as fire, theft, or vandalism. However, it’s important to note that damage caused by flooding or earthquakes may not be covered under your policy, so it’s important to review the specifics of your coverage with your agent.

From Furniture to Furs: What State Farm Homeowners Insurance Covers in Your Storage Unit

State Farm’s off-site storage coverage extends to a wide range of personal property, including furniture, clothing, electronics, and even fine art. However, as mentioned earlier, there may be exclusions or limitations on certain types of items, so it’s important to review your policy carefully. For example, if you have expensive jewelry or furs stored in your unit, you may need to purchase additional coverage to ensure these items are fully protected.

Don’t Get Caught Unprotected: The Importance of Adding Storage Unit Coverage to Your State Farm Policy

If you’re currently storing items in a storage unit, it’s important to make sure you have adequate insurance coverage in place. While some storage facilities offer their own insurance policies, these may not always provide sufficient protection for your belongings. By adding an endorsement for off-site storage coverage to your State Farm homeowners insurance policy, you can rest easy knowing that your possessions are fully protected.

Storage Unit Mishaps: How State Farm Insurance Can Help Mitigate the Damage

Even with the best precautions in place, accidents can happen. If your stored items are damaged or lost due to a covered peril, State Farm’s off-site storage coverage can help mitigate the financial impact. This coverage can help pay for repairs or replacement of your damaged or lost items, up to the limits of your policy.

Exploring Your Options: Comparing State Farm’s Coverage for Different Storage Units

Not all storage units are created equal, and this can impact the cost and coverage of your insurance policy. For example, if you’re storing items in a climate-controlled unit, you may need to purchase additional coverage to account for the higher value of these items. On the other hand, if you’re storing items in a unit with no climate control, your insurance costs may be lower due to the increased risk of damage or loss. Be sure to speak with your State Farm agent to understand the options available for your specific storage unit.

Peace of Mind While You Keep Your Treasures: State Farm’s Promise to Keep Your Stored Belongings Safe

When you choose State Farm for your off-site storage coverage, you can trust that your stored belongings are in good hands. With a long history of protecting homeowners and their possessions, State Farm is committed to providing comprehensive coverage and exceptional customer service. Whether you’re storing furniture, electronics, or priceless family heirlooms, State Farm has the coverage you need to keep your treasures safe and secure.

Ask and You Shall Receive: Understanding the Claims Process for State Farm Storage Unit Coverage

If you do experience damage or loss to your stored items, it’s important to understand the claims process for your State Farm off-site storage coverage. To file a claim, simply contact your agent or call the State Farm claims center. Your agent will guide you through the process and help ensure you receive the full benefit of your policy. Keep in mind that there may be deductibles and other fees associated with your claim, so it’s important to review your policy carefully and ask any questions you may have.

Secure Your Stored Items: How State Farm Homeowners Insurance Can Help You Rest Easy

When it comes to protecting your personal property, State Farm has you covered. By purchasing an endorsement for off-site storage coverage, you can ensure your stored belongings are fully protected against a range of perils. Whether you’re storing furniture, clothing, electronics, or even fine art, State Farm has the coverage you need to rest easy knowing your treasures are safe and secure.

As a State Farm policyholder, you may wonder if your homeowners insurance covers storage units. After all, you want to make sure that your belongings are protected no matter where they are stored.

Here’s what you need to know:

- State Farm homeowners insurance policies typically cover personal property even when it’s in a storage unit.

- However, there may be some limitations and exclusions, so it’s important to review your policy and talk to your agent if you have any questions.

- Some policies may have a limit on the amount of coverage for items stored off-premises, so you’ll want to check your limits to make sure you have enough coverage for your belongings.

It’s also important to note that not all storage units are created equal. Some storage facilities may offer additional security features, such as video surveillance and gated access, which can help reduce the risk of theft or damage.

So, if you’re considering renting a storage unit, be sure to do your research and choose a reputable facility that offers adequate security measures.

Ultimately, it’s up to you to make sure your belongings are protected, whether they’re in your home or in a storage unit. By reviewing your State Farm homeowners insurance policy and taking steps to secure your storage unit, you can have peace of mind knowing that your personal property is covered.

Well folks, it’s been a pleasure having you here with us today as we explored the ins and outs of State Farm homeowners insurance and answered the burning question: does it cover storage units? While we may have started off uncertain, our investigation has shed some light on the subject.

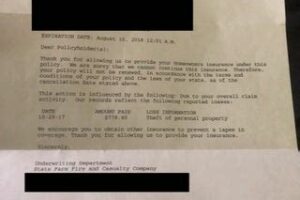

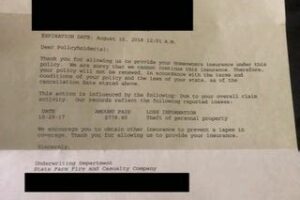

Firstly, we learned that State Farm does indeed offer coverage for your personal property while it’s stored away in a storage unit. However, there are certain limitations to this coverage that you should be aware of. For example, your coverage may only extend to a certain dollar amount, or it may exclude certain types of items altogether. It’s important to review your policy and speak with your agent to fully understand what is and isn’t covered.

At the end of the day, it’s always better to be safe than sorry. If you’re considering storing your belongings in a unit, make sure to do your research and invest in adequate coverage. With State Farm homeowners insurance, you can rest easy knowing that your personal property is protected – even when it’s not under your roof.

Thank you for joining us on this journey of discovery. We hope that you’ve found the information provided helpful and informative. And remember, if you have any further questions or concerns about your homeowners insurance policy, don’t hesitate to reach out to your State Farm agent. They’re always here to help!

.

When it comes to storing your belongings, you might be wondering if your State Farm homeowners insurance policy covers the items you keep in a storage unit. Here are some of the most common questions people ask about State Farm homeowners insurance and storage units, along with the answers:

-

Does State Farm homeowners insurance cover items stored in a storage unit?

Yes, State Farm homeowners insurance typically covers personal property that is stored elsewhere, including in a storage unit. However, the coverage may be limited based on the type of policy you have and the specific circumstances of the loss.

-

What types of losses are covered for items in a storage unit?

State Farm homeowners insurance typically covers losses due to theft, fire, vandalism, and certain natural disasters like wind and hail. However, coverage may vary depending on your policy and location.

-

Do I need to purchase additional insurance for my items in a storage unit?

It depends on the value of your belongings and the level of coverage provided by your State Farm homeowners insurance policy. If the total value of your stored items exceeds the coverage limit listed in your policy, you may need to purchase additional insurance to protect them.

-

What should I do if I need to file a claim for loss or damage of items in a storage unit?

If you experience a loss or damage to items stored in a storage unit, you should contact State Farm as soon as possible to file a claim. Be sure to provide detailed information about the items lost or damaged and any supporting documentation you have, such as receipts or photos.

By understanding the specifics of your State Farm homeowners insurance policy and taking steps to protect your stored items, you can have peace of mind knowing that your belongings are covered even when they’re not in your home.