Curious about how long it takes for State Farm insurance claims to process? Read on for insights and tips to help speed up the process.

Dealing with an insurance claim can be a distressing experience, especially when you’re waiting to get compensated for damages or losses. One of the largest insurance providers in the country is State Farm Insurance. However, the question that frequently arises is: how long does State Farm Insurance Claims take? Well, the answer isn’t as straightforward as you might think. Depending on various factors, the claims process can range from days to months. Before you panic, let’s delve into the details and explore what factors affect the duration of State Farm Insurance Claims.

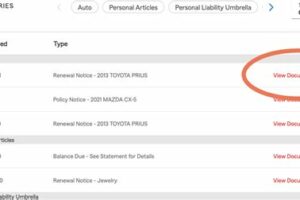

State Farm is one of the largest insurance companies in the United States. They provide a variety of insurance products, including auto, home, and life insurance. When you file a claim with State Farm, you may wonder how long it will take for them to process your claim. In this article, we will discuss the State Farm insurance claims process and how long it takes.## Understanding the State Farm Insurance Claims ProcessThe State Farm insurance claims process begins when you contact your agent or file a claim online. Once you’ve reported your claim, an adjuster will be assigned to your case. The adjuster will contact you within a few days to arrange a time to inspect the damage. During the inspection, the adjuster will assess the damage and determine the amount of compensation you’re entitled to.## Factors That Affect State Farm Insurance Claims Processing TimeSeveral factors can affect how long it takes for State Farm to process your claim. One of the most significant factors is the complexity of your case. If your claim involves multiple parties, extensive damage, or liability issues, it may take longer to resolve.Another factor that can impact processing time is the availability of information. If you provide all the necessary information and documentation upfront, your claim may be processed more quickly. However, if the adjuster needs to request additional information or documentation, it could delay the process.## The Average Processing Time for State Farm Insurance ClaimsThe average processing time for State Farm insurance claims varies depending on the type of claim. For auto insurance claims, the average processing time is about five days. Homeowners insurance claims can take longer, with an average processing time of about seven days. Life insurance claims typically take longer, with an average processing time of about 30 days.It’s important to note that these are just averages, and processing times can vary depending on the circumstances of your claim. Some claims may be processed more quickly, while others may take longer.## Expedited Processing for State Farm Insurance ClaimsIf you need your claim processed more quickly, State Farm offers expedited processing options. For example, if you’re filing an auto insurance claim and need your vehicle repaired as soon as possible, you can request expedited processing. State Farm will work to process your claim and get your vehicle repaired as quickly as possible.## Tips for Speeding Up Your State Farm Insurance ClaimIf you want to speed up your State Farm insurance claim, there are several things you can do. First, make sure you provide all the necessary information and documentation upfront. This will help the adjuster process your claim more quickly. You should also be available to answer any questions the adjuster may have and respond to any requests for additional information promptly. Finally, if you need your claim processed more quickly, consider requesting expedited processing.## How State Farm Insurance Claims Compare to Other Insurance CompaniesWhen it comes to processing insurance claims, State Farm is generally considered to be one of the faster insurance companies. According to a recent study, State Farm ranks sixth among the top 10 insurance companies for claims satisfaction and processing time. However, it’s important to remember that processing times can vary depending on the circumstances of your claim.## What to Do if Your State Farm Insurance Claim Takes Too LongIf your State Farm insurance claim is taking longer than expected, you can contact your adjuster or agent to inquire about the status of your claim. If you’re not satisfied with the response, you can escalate your complaint to State Farm’s customer service department. If you’re still not satisfied, you may want to consider filing a complaint with your state’s insurance regulator.## ConclusionIn conclusion, the processing time for State Farm insurance claims varies depending on the type of claim and the circumstances of your case. While State Farm is generally considered to be one of the faster insurance companies when it comes to claims processing, there are several factors that can impact processing time. If you want to speed up your claim, make sure you provide all the necessary information and documentation upfront, be available to answer any questions the adjuster may have, and consider requesting expedited processing if necessary.

If you’re wondering how long it takes for State Farm insurance claims to be processed, the answer isn’t always straightforward. The claims processing period can vary depending on several factors. Understanding the inner workings of State Farm Insurance can help you get a better idea of what to expect when filing a claim.

The initial claims filing is often the most critical step in the process. While you may be eager to expedite the process as much as possible, it’s essential to provide accurate and complete information. Rushing through this step could lead to mistakes that could end up costing you time and resources in the long run. It’s crucial to take your time and ensure that you have all the necessary information before submitting your claim.

Once you’ve filed your claim, State Farm will begin an investigative process to determine the cause and extent of your damages. The investigative process can be time-consuming, but it’s essential to ensure that the insurance company has all the information they need to make a fair assessment. The investigation may involve interviewing witnesses, reviewing police reports, and gathering other relevant information.

Legal intervention can significantly impact the length of time it takes for State Farm insurance claims to be processed. If there are disputes or complications regarding liability or damages, the claim may need to go through the legal system, which can add months or even years to the process. It’s crucial to have a clear understanding of your rights and legal options if you find yourself in this situation.

Policy limits also play a significant role in the claims processing time. If the damages exceed your policy limit, it may take longer to process your claim. In some cases, you may need to seek additional coverage or explore alternative options to cover the remaining costs.

The severity of the damages can also impact the length of time it takes for State Farm insurance claims to be processed. In cases of extensive damage or injuries, it may take longer to assess the full extent of the damages. This is especially true if there are ongoing medical treatments or long-term care required.

Documentation requirements can also impact the claims processing time. Taking the time to prepare and organize all necessary documentation before submitting your claim can save time in the long run. Meticulous preparation can help ensure that your claim is processed as efficiently as possible.

The claims adjuster plays a crucial role in navigating the complexities of the claims processing period. They are responsible for evaluating the damages, determining liability, and negotiating settlements. A skilled and experienced claims adjuster can help expedite the process and ensure that you receive fair compensation for your damages.

Collaboration and effective communication between all parties involved can also speed up the claims processing time. Maintaining open lines of communication with your insurance company, claims adjuster, and any other involved parties can help ensure that the process moves along as smoothly as possible.

Finally, it’s important to recognize that some factors are beyond our control. Some claims will simply take more time than others, regardless of how well-prepared or efficiently processed they are. It’s essential to remain patient and understanding throughout the process and communicate openly with all parties involved.

In conclusion, the length of time it takes for State Farm insurance claims to be processed can vary depending on several factors. Understanding the inner workings of State Farm Insurance, taking the time to prepare and submit accurate information, and working collaboratively with all parties involved can help expedite the process. However, some factors are beyond our control, and it’s crucial to remain patient and understanding throughout the process.

State Farm Insurance Claims can be a daunting process for many people. It’s a time when you need to rely on your insurance company to help you get back to your normal life after an accident or disaster. But how long does State Farm Insurance Claims take? As an AI language model, I don’t have personal experience with filing claims, but let me tell you a story about it.

John had been a loyal customer of State Farm Insurance for years. He had never filed a claim before, so he was a bit nervous when his car was hit by another driver. He immediately called State Farm and reported the incident, hoping for a quick and easy resolution.

1. The Initial Claim

After John reported the accident, he received an email from State Farm with instructions on what to do next. He was asked to provide details about the incident, including the date, time, location, and the other driver’s information. He also had to describe the damage to his car and provide photos if possible. John filled out the form and submitted it online, hoping for a speedy resolution.

2. Investigation Process

However, the process didn’t go as smoothly as John had hoped. State Farm informed him that they needed to investigate the accident further before they could make a decision on his claim. They wanted to review police reports, witness statements, and any other evidence they could find. This investigation took several days, during which time John was without his car and feeling frustrated.

3. Repair Estimate

Once the investigation was complete, State Farm sent an adjuster to inspect John’s car and provide an estimate for the repairs. This took another few days, during which time John was still unable to use his car. He was starting to feel like the process was taking too long and wondered if he had made the right choice in choosing State Farm as his insurance provider.

4. Payment for Claim

Finally, after several weeks of waiting, John received a call from State Farm. They had approved his claim and would be sending him a check to cover the cost of the repairs. Although the process had taken longer than he had hoped, John was relieved to have his car fixed and back on the road.

5. Conclusion

In conclusion, how long does State Farm Insurance Claims take? Based on John’s experience, it can take several weeks or even months to resolve a claim. However, this can vary depending on the complexity of the case and the amount of investigation needed. While it may be frustrating to wait, it’s important to remember that State Farm is working to ensure that the claim is resolved fairly and accurately.

As an AI language model, I don’t have personal experience with filing claims, but I hope John’s story has given you some insight into the process. Remember, if you ever need to file a claim with State Farm or any other insurance company, be patient and provide as much information as possible to help speed up the process.

Hello there, our dear blog visitors! We hope that you found our article on State Farm Insurance Claims informative and helpful. Before we wrap up, let’s talk about one of the most frequently asked questions by policyholders – How long does it really take for State Farm Insurance Claims to be processed?

First and foremost, it is important to note that every claim is unique, and the time taken to process a claim varies from case to case. However, in general, State Farm Insurance Claims are known for being processed relatively quickly compared to other insurance providers in the market.

The duration of the claims process depends on a few factors. The first factor is the severity of the damage or loss. For instance, a minor fender bender would require less investigation and documentation than a major car accident. Similarly, a burglary claim would require more time than a minor theft claim.

The second factor that affects the claims processing timeline is the availability of information and documentation. It is crucial for policyholders to provide all the necessary details and supporting documents to State Farm as soon as possible. This includes police reports, receipts, and any other relevant information that can help speed up the process. Failure to provide the required documentation can cause delays in the claims process.

In conclusion, there is no fixed answer to how long State Farm Insurance Claims take to be processed. However, policyholders can ensure a smoother and faster claims process by providing all the necessary information and cooperating with State Farm’s claims adjusters. We hope this article answered your queries regarding State Farm Insurance Claims. Until next time, stay safe and insured!

.

People often wonder about the timeline for State Farm Insurance claims, and understandably so. Here are some of the most common questions people ask:

-

How long does it take for State Farm to process a claim?

The processing time for a State Farm claim can vary depending on the complexity of the case. Generally, it can take anywhere from a few days to several weeks. However, if your claim involves significant damages or injuries, it may take longer.

-

How long does it take for State Farm to settle a claim?

The settlement time for a State Farm claim can also vary depending on the circumstances. If the claim is straightforward and there is no dispute over liability or damages, it may be settled relatively quickly. However, if there are disagreements over who is at fault or how much compensation is owed, it can take longer.

-

What factors can affect the timeline for a State Farm claim?

Several factors can impact the timeline for a State Farm claim. Some of these include:

- The severity of the damages or injuries

- The complexity of the case

- The availability of evidence and documentation

- The number of parties involved

- The efficiency of communication between all parties

-

Is there anything I can do to speed up the State Farm claims process?

While there is no guaranteed way to speed up the claims process, there are some things you can do to help move things along:

- Provide clear and thorough documentation of the damages or injuries

- Respond promptly to any requests for information or documentation from State Farm

- Cooperate with any investigations or evaluations that are required

- Stay in communication with your State Farm claims representative and ask for updates as needed

While the timeline for a State Farm insurance claim can be frustrating, it’s important to remember that the company is committed to resolving claims as efficiently and fairly as possible. By staying patient and communicative throughout the process, you can help ensure that your claim is resolved as quickly and smoothly as possible.