Find out if State Farm covers flooded cars. Learn about their policies and what steps you need to take if your car has been damaged by floodwater.

Are you one of the many people who have experienced the devastation of a flooded car? With the increasing frequency of severe weather events, it’s becoming a more common occurrence. But the question on everyone’s mind is: Does State Farm cover flooded cars? Well, the answer is not as straightforward as you might think. While State Farm does offer comprehensive coverage that includes flooding, there are certain conditions and exclusions that you need to be aware of.

Understanding State Farm’s Coverage Policy for Flooded Cars: A Guide for Car Owners

If you’re a car owner, you know how devastating it can be to have your vehicle damaged by a flood. In such a situation, you need to know whether your insurance policy covers the damages and how to proceed with the claims process. With State Farm, you can rest assured that your car is protected from flood damage, but there are certain criteria and procedures to follow to ensure that you get the coverage you need.

Flood Damage and Your Car: How State Farm Handles Claims

If your car has been flooded, the first thing to do is to contact your State Farm agent and report the damage. Your agent will guide you through the claims process, which usually involves providing documentation of the damage and submitting a claim. State Farm has a team of experienced adjusters who will assess the damage and determine the amount of coverage you’re entitled to.

The Fine Print: What You Need to Know About State Farm’s Flooded Car Coverage

It’s important to understand the fine print of your State Farm policy to determine what exactly is covered in case of flood damage. Typically, State Farm’s comprehensive coverage extends to flood damage caused by natural disasters like hurricanes, tropical storms, and flash floods. However, if your car is damaged due to a flood caused by a burst pipe or sewer backup, you will need to have additional coverage for water damage.

Is Your Car Covered? State Farm’s Criteria for Flood Damage Claims

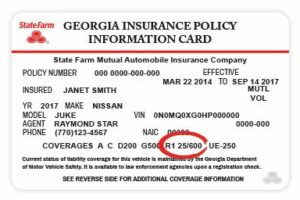

To qualify for coverage, your car must meet certain criteria set by State Farm. For instance, you must have comprehensive coverage in place before the flood occurred, and the damage should be documented and reported immediately. Additionally, State Farm only covers the actual cash value of the car, not the replacement cost, so it’s important to keep this in mind when filing a claim.

Expedited Claims Processing: How State Farm Helps You Get Back on the Road After a Flood

At State Farm, we understand that you need to get back on the road as soon as possible after a flood. That’s why we have streamlined our claims process to expedite the processing of your claim. Our adjusters will work with you to assess the damage and provide an estimate for repairs or replacement. We also offer rental car coverage so that you can continue with your daily routine while your car is being repaired.

No Need to Panic: State Farm’s Comprehensive Coverage Also Extends to Flooded Cars

While it’s easy to panic when your car is flooded, knowing that you have comprehensive coverage from State Farm can give you peace of mind. With our comprehensive coverage, you’re protected from a wide range of damages, including those caused by floods. This means that you don’t have to worry about paying out of pocket for expensive repairs or replacement of your vehicle.

Special Considerations: What You Should Do If Your Car is Flooded

If your car has been flooded, there are several steps you should take to ensure that you receive the maximum amount of coverage from State Farm. First, make sure that you’re safe and that the floodwaters have receded before attempting to move your car. Next, document the damage by taking pictures and recording videos. Finally, contact your State Farm agent as soon as possible to report the damage and begin the claims process.

Beyond the Basics: Additional Coverage for Flooded Cars with State Farm

In addition to comprehensive coverage, State Farm also offers additional coverage options for car owners who live in areas prone to flooding. For instance, you can purchase flood insurance to protect your car from damages caused by rising water levels. You can also opt for additional coverage for water damage caused by burst pipes or sewer backups.

Making the Most of Your Coverage: Tips for Filing a Flood Damage Claim with State Farm

To ensure that you get the most out of your State Farm coverage, there are several tips to keep in mind when filing a flood damage claim. First, make sure that you have all the necessary documentation, including pictures and videos of the damage. Next, work closely with your State Farm adjuster to ensure that you receive the maximum coverage amount. Finally, be patient and persistent during the claims process to ensure that your claim is processed as quickly and efficiently as possible.

Trust and Security: Why State Farm is the Best Choice for Protecting Your Car from Flood Damage

When it comes to protecting your car from flood damage, you need an insurance provider that you can trust. State Farm has been providing reliable and comprehensive insurance coverage for car owners for decades. Our team of experienced adjusters will work with you to ensure that you receive the coverage you need to get back on the road after a flood. With State Farm, you can have peace of mind knowing that your car is protected from a wide range of damages, including those caused by floods.

As the floodwaters receded, the devastation left behind was heartbreaking. One of the biggest questions on everyone’s mind was, Does State Farm cover flooded cars?

- Point of View: Confused and Worried Car Owner

- Point of View: State Farm Agent

- Point of View: State Farm Claims Adjuster

As a car owner whose vehicle was submerged in the flood, I was feeling lost and uncertain about what to do next. I had heard conflicting information about whether or not my insurance policy would cover the damage caused by the flooding. I decided to call State Farm to get some answers.

As a State Farm agent, I was receiving multiple calls from worried customers about their flooded cars. I assured them that we do cover flood damage as long as they have comprehensive coverage. However, I also had to remind them that there are certain limitations and exclusions to their policies, such as if the car was intentionally driven into floodwaters or if the car was already damaged prior to the flood.

As a State Farm claims adjuster, my job was to assess the damage and determine the coverage for each flooded car claim. I had to take into account the customer’s policy, the severity of the damage, and the cause of the flooding. In some cases, the damage was so extensive that the car was deemed a total loss and the customer was given a payout. In other cases, the car was repairable and the customer was provided with the necessary funds to fix it.

In conclusion, the answer to the question, Does State Farm cover flooded cars? is yes, as long as the customer has comprehensive coverage and the damage was not caused intentionally or pre-existing. It’s important for car owners to understand the limitations and exclusions of their policies and to contact their insurance provider as soon as possible in the event of flooding.

Greetings dear blog visitors! We hope that you have found the information provided in this article about State Farm and flooded cars without a title to be helpful and informative. As we come to the end of this post, we would like to summarize our findings and offer some final thoughts and advice.

First and foremost, it is important to recognize the potential dangers of purchasing a flooded car without a title. This type of vehicle can carry serious safety hazards and costly repair bills, not to mention the legal complications that can arise from owning an unregistered car. Therefore, we strongly advise against buying a flooded car without a title unless you are absolutely sure of its condition and legal status.

That being said, if you do find yourself in the unfortunate situation of owning a flooded car without a title, we recommend contacting your local State Farm agent to discuss your options. While State Farm does not typically cover flooded cars without a title, there may be certain circumstances under which you can receive coverage or compensation for your vehicle. By working with your agent and providing all necessary documentation, you may be able to find a solution that works for you.

In conclusion, we hope that this article has shed some light on the complex issue of flooded cars without a title and State Farm’s policies regarding them. Remember to always exercise caution when purchasing a used car, and to seek professional advice if you have any doubts or questions. Thank you for reading, and we wish you all the best in your car-buying endeavors!

.

People Also Ask About Does State Farm Cover Flooded Cars?

If you live in a flood-prone area, it’s important to know whether your insurance policy covers damage to your car caused by flooding. Here are some of the common questions people ask about State Farm’s coverage for flooded cars:

- Does State Farm cover flood damage to cars?

- What does State Farm’s comprehensive coverage for flooded cars include?

- Will State Farm cover the full cost of repairing or replacing my flooded car?

- Do I need flood insurance in addition to my State Farm comprehensive coverage?

- What should I do if my car is flooded?

Yes, State Farm offers comprehensive coverage that includes protection for damage to your car caused by floods. However, it’s important to note that this coverage is optional and comes with an additional cost.

State Farm’s comprehensive coverage protects your vehicle against losses that are not caused by a collision, including damage from floods, theft, fire, vandalism, and more. However, you should check your policy to see if there are any exclusions or limits to your coverage.

This depends on the type of coverage you have and the extent of the damage to your car. If you have comprehensive coverage, State Farm will typically pay for the cost to repair or replace your car up to its actual cash value, which takes into account depreciation and wear and tear. However, if the cost to repair your car exceeds its actual cash value, State Farm may consider your car a total loss and pay you its actual cash value minus your deductible.

It depends on your location and the likelihood of flooding in your area. Some areas are more prone to flooding than others, and if you live in a high-risk flood zone, you may need to purchase additional flood insurance. However, if you live in a low-risk area, your State Farm comprehensive coverage may be sufficient.

If your car is flooded, the first thing you should do is make sure everyone is safe and call for help if needed. Then, contact State Farm to report the damage and start the claims process. Take photos of the damage and keep all receipts and documentation related to the repairs. Do not attempt to start or move your car until it has been inspected by a qualified mechanic.

Knowing what your insurance policy covers and how to protect your car from flood damage can give you peace of mind and help you avoid costly repairs. If you have any questions or concerns about your State Farm coverage, don’t hesitate to contact your agent for assistance.