Table of Contents

Wondering if State Farm will cover your rental car expenses? Find out if you’re eligible for reimbursement and what the process entails.

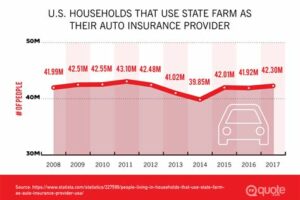

Are you in a bind and need a rental car while your vehicle is being repaired after an accident? The last thing you want to worry about is how you’re going to pay for it. That’s where State Farm comes in. As one of the largest insurance providers in the country, State Farm understands the importance of getting you back on the road quickly and safely. But, does State Farm reimburse for rental cars? The answer is yes, but there are a few things you should know before you hit the rental car lot.

Does State Farm Reimburse for Rental Car?

When you get into an accident and your car is being repaired, you may need a rental car to get around. The cost of renting a car can add up quickly, but your insurance policy may cover the expense. If you have State Farm insurance, you may be wondering if they reimburse for rental cars. In this article, we will explore whether State Farm provides rental car reimbursement and what you need to know about it.

What is Rental Car Reimbursement?

Rental car reimbursement is an optional coverage that you can add to your car insurance policy. This coverage will pay for a rental car while your vehicle is being repaired or replaced after an accident. Rental car reimbursement coverage is not automatically included in your policy, so you will need to add it if you want to be covered.

Does State Farm Provide Rental Car Reimbursement?

Yes, State Farm does provide rental car reimbursement as an optional coverage. If you have rental car reimbursement coverage on your policy, State Farm will pay for a rental car while your vehicle is being repaired or replaced after an accident.

What Does State Farm Rental Car Reimbursement Cover?

The amount of rental car reimbursement coverage you have will depend on your policy. Typically, State Farm will reimburse you for the cost of a rental car up to a certain amount per day or a total amount for the rental period. The coverage may also include expenses such as fuel and insurance for the rental car.

How Do You Get Rental Car Reimbursement from State Farm?

If you have rental car reimbursement coverage on your policy, you can get reimbursed for the cost of your rental car by filing a claim with State Farm. To file a claim, you will need to provide documentation of the rental car expenses, such as a rental car agreement and receipts for fuel and insurance.

What Should You Know Before Adding Rental Car Reimbursement to Your Policy?

Before adding rental car reimbursement to your State Farm policy, there are a few things you should know:

- Rental car reimbursement coverage is optional and will increase your insurance premium.

- You will need to choose a daily rental amount and a maximum total rental amount when you add the coverage to your policy.

- If you have another car that you can use while your vehicle is being repaired, you may not need rental car reimbursement coverage.

What Other Options Do You Have for Rental Cars?

If you don’t have rental car reimbursement coverage on your policy or if you have reached your policy’s limit, there are other options for getting a rental car:

- You can rent a car from a rental car company and pay for it out of pocket.

- You may be able to get a rental car covered by the at-fault driver’s insurance policy if they were responsible for the accident.

- You may be able to get a rental car covered by your credit card company if you used the card to pay for your car insurance.

In Conclusion

If you have State Farm insurance, you can add rental car reimbursement coverage to your policy to have the cost of a rental car covered while your car is being repaired or replaced after an accident. However, it’s important to understand that this coverage is optional and will increase your insurance premium. If you don’t have rental car reimbursement coverage, there are other options available for getting a rental car while your vehicle is being repaired or replaced.

If you’ve ever been in a car accident, you know how stressful it can be to not have access to transportation while your vehicle is being repaired. That’s where rental car coverage comes in. It’s important to have this type of coverage because it provides you with a rental car while your car is out of commission. State Farm offers rental reimbursement coverage to its policyholders, but it’s important to understand their policy before filing a claim.

Understanding State Farm’s Rental Reimbursement Policy is crucial if you want to take advantage of this coverage. State Farm will reimburse you for the cost of renting a car while your vehicle is being repaired, up to the limit specified in your policy. This coverage is optional, so you’ll need to add it to your policy if you want to take advantage of it. Keep in mind that State Farm will only cover the cost of a rental car if the repairs are covered by your policy.

Can You Get Rental Reimbursement Without a Title? The answer is no. State Farm requires that you have a title to your vehicle in order to receive rental reimbursement. This is because the title serves as proof of ownership and helps prevent fraud. If you don’t have a title, you won’t be able to get rental reimbursement from State Farm.

Exceptions to State Farm’s Rental Reimbursement Policy are important to note. State Farm won’t reimburse you for a rental car if your car is stolen or totaled. They also won’t cover the cost of a rental car if you’re on vacation or if your car is being serviced for routine maintenance.

Filing a Rental Reimbursement Claim with State Farm is a straightforward process. You’ll need to provide proof of the rental car expenses, such as receipts or invoices. Make sure you keep all of your receipts, as State Farm will require them in order to process your claim. Once you’ve submitted your claim, State Farm will review it and determine if the rental car expenses are covered under your policy.

Alternatives to State Farm’s Rental Reimbursement Coverage may be worth considering if you’re looking to save money on your insurance premiums. Some credit cards offer rental car coverage as a perk, so you may already have this coverage without realizing it. Additionally, some rental car companies offer their own insurance coverage, which can be more affordable than purchasing rental car coverage through your insurance provider.

How Long Can You Use a Rental Car with State Farm’s Coverage? The amount of time you can use a rental car with State Farm’s coverage varies depending on your policy. Generally, you’ll be able to use the rental car for up to 30 days. If your car is still being repaired after 30 days, you’ll need to pay for the rental car out of pocket.

Tips for Choosing the Right Rental Car for Your Needs include considering the size of the car, the type of driving you’ll be doing, and the features you’ll need. If you’re traveling with a large group or need extra cargo space, you’ll want to choose a larger vehicle. If you’ll be doing a lot of highway driving, you may want to choose a car with good gas mileage. And if you’ll be driving in inclement weather, you’ll want to choose a car with all-wheel drive or four-wheel drive.

How to Save Money on Rental Car Expenses involves shopping around for the best rates, avoiding renting from the airport, and considering using public transportation instead of renting a car. You can also save money by choosing a smaller car or by renting for a shorter period of time.

When Should You Consider Declining Rental Reimbursement Coverage? If you have access to another vehicle or if you can easily use public transportation while your car is being repaired, you may want to consider declining rental reimbursement coverage. Additionally, if you’re able to cover the cost of a rental car out of pocket, you may not need this coverage.

Overall, rental car coverage is an important part of your insurance policy. Understanding State Farm’s Rental Reimbursement Policy can help you make an informed decision when it comes to choosing this type of coverage. By considering the alternatives and following the tips provided, you can save money on rental car expenses while still having access to transportation when you need it most.

Have you ever been in a car accident and wondered if State Farm would reimburse you for a rental car while your vehicle is being repaired? Well, wonder no more! Here’s the story:

After a car accident, Emily was relieved that she and the other driver involved were both okay. However, her car needed extensive repairs and she was left without transportation. Emily had heard that some insurance companies provided rental car reimbursement, but she wasn’t sure if State Farm did. She decided to call her agent to find out.

- Emily’s agent confirmed that her policy did include rental car reimbursement coverage.

- He explained that State Farm would reimburse her up to a certain amount per day for a rental car while her car was being repaired.

- Emily was thrilled to hear this news and began looking for a rental car right away.

- She found a rental car company that worked with State Farm and made sure to provide all necessary documentation to ensure her reimbursement.

- After her car was repaired and returned to her, Emily submitted her rental car receipts to State Farm for reimbursement.

- Within a few weeks, she received a check in the mail for the full amount of her rental car expenses.

Emily was so grateful for State Farm’s rental car reimbursement coverage. It made a difficult situation much easier to handle. She was also impressed with her agent’s knowledge and helpfulness throughout the process.

If you’re a State Farm policyholder and have been in a car accident, make sure to ask your agent about rental car reimbursement coverage. It could save you a lot of stress and money in the long run.

Hello there, dear readers!

As we come to the end of this informative blog post about whether State Farm reimburses for rental car without title, we hope that you have found it helpful and engaging. We understand that dealing with car accidents can be a stressful and overwhelming experience, which is why we wanted to provide you with all the necessary information regarding rental car reimbursement.

Now, to answer the question at hand: Does State Farm reimburse for rental car without title? The answer is yes! State Farm understands that not all policyholders will have the title to their vehicle readily available, especially in situations where the car has been totaled or stolen. In such cases, State Farm may still offer rental car reimbursement as long as you provide some form of proof of vehicle ownership, such as registration documents or a bill of sale.

We hope that this blog post has helped clear up any confusion you may have had about rental car reimbursement with State Farm. Remember, it’s important to always review your insurance policy and speak with your agent to ensure that you have the right coverage for your needs. Thank you for taking the time to read our blog, and we wish you safe and happy travels!

.

People often wonder if State Farm reimburses for rental car expenses. Below are some of the top questions people ask about this topic, along with answers to help clarify any confusion.

-

Does State Farm cover rental cars?

Yes, State Farm provides rental car coverage as part of their auto insurance policies. This coverage may be optional or included, depending on your specific policy. If your car is damaged due to an accident, theft, or other covered event, State Farm will typically cover the cost of a rental car while your car is being repaired.

-

How much does State Farm cover for rental cars?

The amount of rental car coverage provided by State Farm will vary based on your policy. Some policies may have a daily limit, while others may have a total cap on rental car expenses. It’s important to review your policy details to understand exactly how much coverage you have for rental cars.

-

What types of rental cars does State Farm cover?

State Farm typically covers the cost of a rental car that is similar in size and features to your own car. For example, if you drive a mid-size sedan, State Farm will likely cover the cost of a rental car that is also a mid-size sedan. If you need a larger or more expensive rental car, you may need to pay the difference out of pocket.

-

Do I need to get approval from State Farm before renting a car?

It’s always a good idea to contact State Farm before renting a car to ensure that you have coverage and to understand any restrictions or limitations. However, in most cases, you do not need to get prior approval from State Farm to rent a car.

-

How long can I rent a car for with State Farm coverage?

The length of time you can rent a car with State Farm coverage will depend on the specifics of your policy. Some policies may have a daily or weekly limit, while others may allow you to rent a car for as long as it takes to repair your own car. Again, it’s important to review your policy details to understand exactly how much rental car coverage you have.

In summary, State Farm does provide coverage for rental cars in most cases. However, the amount and type of coverage will vary depending on your specific policy. If you have questions about your coverage or need to file a claim for a rental car, it’s best to contact State Farm directly to get the most accurate information.