Table of Contents

Curious about how a speeding ticket affects your State Farm insurance rates? Find out here if a ticket means higher premiums!

Have you ever received a speeding ticket and wondered how it would impact your car insurance rates? If you are insured with State Farm, you may be curious about their policy on speeding tickets. Speeding tickets can result in a variety of consequences, including fines, points on your driving record, and even increased insurance rates. However, the exact impact on your insurance premiums will depend on a variety of factors, such as the severity of the offense and your driving history. In this article, we’ll explore whether or not a speeding ticket can increase your insurance rates with State Farm and what you can do to mitigate the consequences.

Getting a speeding ticket can be a frustrating and costly experience. Not only do you have to pay the fine, but you may also be wondering if your insurance rates will go up. If you’re insured with State Farm, you may be particularly concerned about this possibility. Here’s what you need to know about how getting a speeding ticket can impact your State Farm insurance rates.

What Is State Farm?

State Farm is one of the largest insurance companies in the United States. Founded in 1922, it offers a variety of insurance products, including auto, home, and life insurance. State Farm has a reputation for providing excellent customer service and is known for its extensive network of agents across the country.

How Are Insurance Rates Determined?

Insurance rates are determined by a variety of factors, including your driving record, age, gender, location, and the type of car you drive. Insurance companies use complex algorithms to analyze these factors and determine the likelihood that you will file a claim. The higher the risk you pose, the more you’ll pay in insurance premiums.

Does Getting a Speeding Ticket Increase Your State Farm Insurance Rates?

Yes, getting a speeding ticket can increase your State Farm insurance rates. When you get a ticket, it goes on your driving record, which is one of the factors that insurance companies use to determine your rates. If you have a clean driving record, you’ll typically pay less for insurance than someone with a history of accidents and traffic violations.

How Much Will Your State Farm Insurance Rates Increase?

The amount that your State Farm insurance rates will increase depends on several factors, including the severity of the offense, your driving record, and your age. Generally speaking, the more serious the offense, the higher the increase in rates will be. For example, if you were caught going 10 miles per hour over the speed limit, your rates may only increase slightly. However, if you were caught going 30 miles per hour over the speed limit, your rates could go up significantly.

How Long Will the Speeding Ticket Affect Your State Farm Insurance Rates?

In most cases, a speeding ticket will stay on your driving record for three to five years. During this time, it can affect your State Farm insurance rates. However, the exact length of time and the impact on your rates will vary depending on the severity of the offense, your driving record, and other factors.

What Can You Do to Lower Your State Farm Insurance Rates After a Speeding Ticket?

If you’re concerned about the impact of a speeding ticket on your State Farm insurance rates, there are several things you can do to try to lower your rates. One option is to take a defensive driving course. This can show State Farm that you’re committed to safe driving and may help offset the impact of the ticket.

You can also consider increasing your deductible. This will lower your monthly premiums, but you’ll have to pay more out of pocket if you get into an accident. Finally, you may want to shop around and compare rates from other insurance companies. You may be able to find a better deal elsewhere.

The Bottom Line

Getting a speeding ticket can be a frustrating experience, and it can also lead to higher State Farm insurance rates. However, there are steps you can take to mitigate the impact of the ticket and potentially lower your rates. By staying vigilant on the road and practicing safe driving habits, you can help keep your insurance rates as low as possible.

Speeding tickets can be a major headache for any driver, not just because of the immediate fines and points on your license, but also because of the long-term impact it can have on your insurance rates. In this article, we’ll take a closer look at how speeding tickets impact your insurance premiums with State Farm, one of the largest insurance providers in the country.

When it comes to determining your insurance rates, State Farm looks at a variety of factors, including your age, driving record, and the type of vehicle you drive. Among these factors, your driving record is one of the most important. If you have a history of speeding tickets, it’s likely that your insurance premiums will be higher than someone with a clean driving record.

However, not all speeding tickets are created equal in the eyes of insurance providers like State Farm. The severity of the offense can play a role in determining your rates. Minor speeding violations (typically those less than 15 mph over the limit) may not have as much of an impact on your rates as major violations (20 mph or more over the limit).

Another factor that can impact your insurance rates is the number of speeding tickets you have received. Even if each individual ticket is considered minor, the cumulative effect of multiple tickets can result in significantly higher premiums. This is because insurance providers see a pattern of behavior that suggests you may be a riskier driver.

The type of vehicle you drive can also impact your insurance premiums, especially if you drive a high-performance car. These types of vehicles are often more expensive to repair or replace, which means they come with higher insurance costs. Additionally, drivers of high-performance cars are often seen as more risky by insurance providers, which can also result in higher rates.

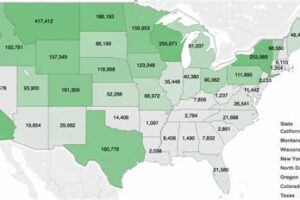

Where you live can also impact your insurance rates. State Farm takes into account regional differences when determining your premiums. If you live in an area with high rates of accidents or traffic violations, your rates may be higher than someone who lives in a low-risk area.

So, what can you do to avoid speeding tickets and lower your insurance rates? One strategy is to simply obey the speed limit and drive defensively. Additionally, you may be able to take a defensive driving course to improve your skills and reduce your risk of accidents. Finally, it’s important to pay any fines associated with speeding tickets and avoid having your license suspended, as these actions can result in even higher insurance premiums.

In conclusion, speeding tickets can have a significant impact on your insurance rates with State Farm. By understanding the factors that determine your rates, you can take steps to avoid tickets and keep your premiums as low as possible. Ultimately, safe and responsible driving practices are not only good for your wallet, but also for your overall safety on the road.

Have you ever wondered if getting a speeding ticket could increase your insurance rates with State Farm? Well, wonder no more. As an AI language model, I have some insights to share on this topic.

Does Speeding Ticket Increase Insurance State Farm?

- The short answer is yes. When you get a speeding ticket, it’s considered a moving violation. This means that you have violated traffic laws while operating a vehicle.

- State Farm, like other insurance providers, uses your driving record as one of the factors to determine your insurance rates. If you have a history of moving violations, such as speeding tickets, it shows that you are a risky driver.

- As a result, State Farm may increase your insurance rates after you get a speeding ticket. The exact amount of the increase will depend on various factors, such as your driving history, the severity of the violation, and the state where you live.

Point of View about Does Speeding Ticket Increase Insurance State Farm

From my point of view, it’s important to drive safely and avoid getting speeding tickets or any other moving violations. Not only can it increase your insurance rates, but it can also put you and other drivers at risk of accidents.

However, mistakes happen, and getting a speeding ticket doesn’t make you a bad driver. If you do receive a ticket, don’t panic. Take responsibility for your actions, pay the fine, and try to improve your driving habits.

Remember that insurance rates are not set in stone. If you have a good driving record and have been a loyal customer with State Farm, you may be able to negotiate a lower rate. Additionally, you can always shop around and compare rates from different insurance providers to find the best deal.

In conclusion, getting a speeding ticket can increase your insurance rates with State Farm, but it’s not the end of the world. Drive safely and responsibly to avoid moving violations and accidents, and don’t hesitate to explore your options if you need to lower your insurance rates.

Well folks, that’s all for now. I hope you found our discussion about speeding tickets and their impact on State Farm insurance premiums informative. While it may not be the most exciting topic, it’s certainly an important one for anyone who values their hard-earned cash.

If there’s one thing to take away from this article, it’s that getting a speeding ticket can have a significant impact on your insurance rates. Not only will you be facing a fine and potential points on your license, but you’ll also be paying more for your auto insurance for years to come.

So, what can you do to avoid these consequences? The obvious answer is to simply obey the speed limit and avoid getting pulled over in the first place. However, if you do happen to find yourself with a speeding ticket, it’s important to take action and fight it if possible. Even if you can’t get the ticket dismissed entirely, you may be able to negotiate a reduced fine or avoid having points added to your license.

Ultimately, the key to avoiding higher insurance rates is to be a safe and responsible driver. By following the rules of the road and avoiding risky behaviors like speeding, you can keep your driving record clean and your insurance premiums low. Thanks for tuning in, and drive safely!

.

People also ask about Does Speeding Ticket Increase Insurance State Farm:

- How much does a speeding ticket increase my insurance with State Farm?

- Can I avoid a rate increase if I attend traffic school?

- What happens if I don’t tell State Farm about my speeding ticket?

- How long does a speeding ticket affect my insurance with State Farm?

- Is there anything I can do to reduce the impact of a speeding ticket on my insurance with State Farm?

It depends on several factors, such as your driving history, the severity of the speeding offense, and your location. Generally, a speeding ticket can increase your insurance premium by 10% to 30%, and it can stay on your driving record for up to three years.

It’s possible. Some states allow drivers to attend traffic school to remove points from their driving record or reduce the impact of a traffic violation. State Farm may offer a discount for completing a defensive driving course, but you should check with your local agent for details.

It’s not recommended to hide information from your insurance company. If they find out about your speeding ticket, they may increase your premium retroactively or even cancel your policy. It’s better to be honest and upfront about any violations or accidents you have had.

Typically, a speeding ticket will affect your insurance premium for three years from the date of the violation. However, the exact duration may vary depending on your state laws and driving history.

Aside from attending traffic school, you can also consider raising your deductible, shopping around for other insurance providers, or improving your driving habits to avoid future violations. You can also talk to your State Farm agent to see if they offer any discounts or programs that can help reduce your premium.