Wondering if State Farm Insurance covers Uber drivers? Read on to learn about their policies and what coverage options are available.

Are you an Uber driver wondering if State Farm Insurance has got your back? Well, the answer is not as straightforward as you might think. While State Farm does offer insurance policies for ride-sharing drivers, not all policies cover Uber drivers. So, before you hit the road, it’s essential to understand what coverage you have and what you might need. Let’s take a closer look at State Farm’s policies to see just how much protection they offer to Uber drivers.

Once upon a time, there was a young man named John who had just become an Uber driver. He was thrilled to start earning some extra cash, but he was also worried about what would happen if he got into an accident while driving for Uber. He wondered, Does State Farm Insurance cover Uber drivers?

John decided to do some research to find out whether his State Farm Insurance policy would protect him while he was driving for Uber. He discovered that State Farm does offer rideshare insurance to Uber drivers, but there are some limitations and requirements to be aware of.

Here are some key points to keep in mind if you’re an Uber driver who is covered by State Farm Insurance:

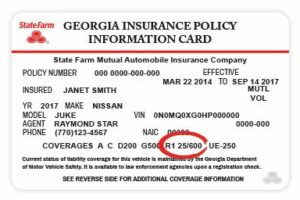

- State Farm’s rideshare coverage is only available in certain states. Be sure to check with your local State Farm agent to see if this coverage is available in your area.

- You must have a personal auto insurance policy with State Farm in order to be eligible for rideshare coverage.

- Rideshare coverage only applies when you are logged into the Uber app and waiting for a ride request or transporting a passenger. It does not cover you during personal use of your vehicle.

- Rideshare coverage has different deductible options, so be sure to choose the one that best fits your needs and budget.

Overall, John was relieved to learn that State Farm Insurance does cover Uber drivers, as long as they have the proper coverage and meet the requirements. He felt much better knowing that he could drive for Uber with peace of mind, knowing that he was protected in case of an accident.

In conclusion, if you’re an Uber driver who is insured by State Farm, it’s important to understand the details of your coverage and any limitations that may apply. Always be sure to talk to your local State Farm agent if you have any questions or concerns about your policy.

Hello and thank you for taking the time to read this article about State Farm insurance and its coverage for Uber drivers. We hope that this information has been helpful and informative for you, and has provided some clarity on a topic that can often be confusing and overwhelming.

As we have discussed throughout this article, State Farm does offer coverage for Uber drivers, but there are some important caveats to keep in mind. Specifically, drivers must have their own personal auto insurance policy with State Farm in order to qualify for coverage while driving for Uber. Additionally, coverage may vary depending on the specific circumstances of the accident or incident, so it is important to speak with your insurance agent to fully understand your policy.

At the end of the day, we believe that it is always best to err on the side of caution when it comes to insurance coverage and protection. If you are an Uber driver or thinking of becoming one, we highly recommend speaking with your State Farm agent to discuss your options and ensure that you have the right coverage in place. By doing so, you can have peace of mind knowing that you are protected in the event of an accident or other unforeseen circumstance.

Thank you again for visiting our blog and reading this article. We hope that you have found the information helpful, and please feel free to leave a comment or question below if you have any further thoughts or concerns. As always, drive safely and stay protected!

Video Does State Farm Insurance Cover Uber Drivers

When it comes to using your personal vehicle for ride-sharing services like Uber, you may wonder if your auto insurance coverage will still apply. Here are some common questions that people ask about whether State Farm insurance covers Uber drivers:

-

Does State Farm insurance cover Uber drivers?

Yes, State Farm does offer a Rideshare Driver Coverage endorsement that can be added to your personal auto policy. This endorsement provides additional coverage when you are driving for a transportation network company (TNC) like Uber or Lyft. It can help fill gaps in your personal auto insurance coverage that may not apply while you are working as a ride-share driver.

-

What does State Farm’s Rideshare Driver Coverage endorsement include?

The Rideshare Driver Coverage endorsement from State Farm includes:

- Contingent liability coverage: This covers damages or injuries you may cause to others while you are logged into the TNC app but have not accepted a ride request yet.

- Primary liability coverage: This covers damages or injuries you may cause to others while you are transporting passengers or on your way to pick up a passenger.

- Uninsured/underinsured motorist coverage: This covers you and your passengers if you are involved in an accident with an uninsured or underinsured driver who is at fault.

-

How much does State Farm’s Rideshare Driver Coverage endorsement cost?

The cost of adding the Rideshare Driver Coverage endorsement to your State Farm auto insurance policy may vary based on several factors, such as your location, driving record, and the level of coverage you choose. Contact your local State Farm agent to get a quote.

-

Is it necessary to have additional coverage if I am an Uber driver?

While Uber does offer some liability coverage for its drivers, it may not be enough to fully protect you in the event of an accident. Adding the Rideshare Driver Coverage endorsement from State Farm can help ensure that you have the coverage you need while you are driving for Uber or other ride-sharing services.

-

Can I still use my personal auto insurance for non-ride-share driving?

Yes, your personal auto insurance policy will still apply when you are using your vehicle for personal use or other types of driving that do not involve ride-sharing. The Rideshare Driver Coverage endorsement from State Farm is designed to supplement your existing coverage when you are working as a ride-share driver.

By adding the Rideshare Driver Coverage endorsement to your State Farm auto insurance policy, you can enjoy peace of mind knowing that you have the coverage you need as an Uber driver. Contact your local State Farm agent today to learn more about this option and get a personalized quote.