Table of Contents

Find out if State Farm sells surety bonds. Learn about their bond offerings and compare rates from other providers to get the best deal.

Are you in need of a surety bond, but not sure where to turn? Look no further than State Farm! With their reputation for excellent customer service and reliable insurance products, it may come as a surprise that they also offer surety bonds. Whether you’re a contractor bidding on a construction project or need a bond for your business license, State Farm has options to meet your needs. But what exactly are surety bonds, and how do they work? Let’s dive in and explore the world of surety bonds with State Farm.

When it comes to surety bonds, State Farm is a well-known and trusted name in the insurance industry. But many people wonder, does State Farm sell surety bonds? The answer is yes, they do! In this article, we will explore what surety bonds are, how they work, and how State Farm can help you get the bond you need.

What are Surety Bonds?

Surety bonds are contracts between three parties: the principal (the person or company that needs the bond), the obligee (the party that requires the bond), and the surety (the insurance company that issues the bond). They are often required by government agencies or other entities as a way to ensure that the principal will fulfill its obligations under the terms of a contract or agreement.

How Do Surety Bonds Work?

When a surety bond is issued, the surety company is essentially guaranteeing that the principal will fulfill its obligations. If the principal fails to do so, the obligee can make a claim on the bond to recover any damages or losses incurred as a result of the principal’s failure to perform. The surety company will then investigate the claim, and if it is found to be valid, will pay out the amount of the bond up to its limit.

Why Might You Need a Surety Bond?

There are many situations where you might need a surety bond. For example, if you are a contractor bidding on a government project, you may be required to provide a performance bond to ensure that you will complete the project according to the contract. If you are starting a business, you may need a license and permit bond to ensure that you will comply with all applicable laws and regulations. And if you are involved in a lawsuit, you may need a court bond to guarantee payment if you lose the case.

Does State Farm Sell Surety Bonds?

Yes, State Farm does sell surety bonds. In fact, they offer a wide range of bond types to meet the needs of their customers. Whether you need a performance bond, a license and permit bond, or any other type of bond, State Farm can help you get the coverage you need.

How Can You Get a Surety Bond from State Farm?

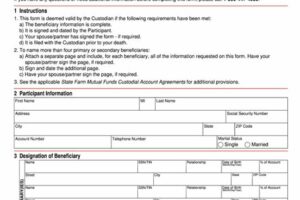

If you need a surety bond, the first step is to contact a State Farm agent. They will be able to walk you through the process and help you choose the right type of bond for your needs. The agent will then help you fill out the necessary application paperwork and submit it to the underwriting department for approval. Once the bond is approved, you will need to pay the premium, which is typically a percentage of the bond amount.

What Are the Benefits of Getting a Surety Bond from State Farm?

There are several benefits to getting a surety bond from State Farm. First and foremost, you can trust that you are getting coverage from a reputable and reliable insurance company. Additionally, State Farm offers competitive rates and flexible payment options, making it easy for you to get the coverage you need at a price you can afford. And if you ever need to make a claim on the bond, State Farm’s claims department is available 24/7 to assist you.

What Factors Affect the Cost of a Surety Bond?

The cost of a surety bond can vary depending on several factors. These may include the type of bond, the bond amount, the creditworthiness of the principal, and the length of the bond term. In general, the more risky the bond is, the higher the premium will be.

Final Thoughts

Surety bonds can be a valuable tool for protecting yourself and your business. And with State Farm, you can trust that you are getting coverage from a reliable and reputable insurance company. Whether you need a performance bond, a license and permit bond, or any other type of bond, State Farm can help you get the coverage you need at a price you can afford.

Understanding Surety Bonds: An Overview

Surety bonds are contracts that guarantee the completion of a project or the fulfillment of an obligation. They provide assurance to the party requiring the bond that if the bonded party fails to meet its obligations, the surety company will step in and fulfill them. Surety bonds are commonly used in industries such as construction, finance, and licensing to ensure compliance with laws and regulations.

What Are the Different Types of Surety Bonds Available?

There are several types of surety bonds available, each designed to serve a specific purpose. Contract bonds are used in construction to guarantee that a contractor will complete a project according to the terms of a contract. Commercial bonds are used for businesses to ensure compliance with regulations and laws. Court bonds are required in legal proceedings to protect against financial losses. License and permit bonds are necessary for obtaining certain licenses and permits, such as those needed for selling alcohol or operating a business.

Does State Farm Offer Surety Bonds?

Yes, State Farm offers surety bonds to its customers. As a trusted insurance provider, State Farm understands the importance of financial security and risk management. They offer a variety of surety bonds to meet the needs of individuals and businesses in various industries.

The Benefits of Working with State Farm for Surety Bonds

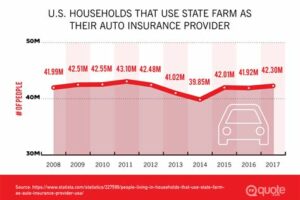

State Farm is a reputable and experienced insurance provider, with a long history of satisfying customers’ needs. Their surety bond program offers reliable protection and peace of mind to their clients, ensuring they comply with legal and contractual obligations. State Farm has a team of knowledgeable agents who can guide clients through the process of obtaining a surety bond, from application to approval. Additionally, State Farm offers competitive rates for their surety bond products.

How to Secure a Surety Bond through State Farm

The process of securing a surety bond through State Farm is straightforward. First, determine what type of surety bond you need and the amount required. Then, contact a State Farm agent who specializes in surety bonds. They will guide you through the application process, which typically involves providing information about your business or personal finances, along with any required documentation. Once approved, you will be issued a surety bond that meets your needs.

Key Requirements for Qualifying for a Surety Bond

To qualify for a surety bond, you must have good credit and financial standing, as the surety company will review your credit history and financial statements. Your industry experience, reputation, and ability to complete projects on time and within budget are also factors that may influence your eligibility. Additionally, you must be able to demonstrate your ability to meet the terms of the bond contract.

Factors that Influence Surety Bond Premiums

Surety bond premiums are determined based on several factors, including the type of bond required, the amount of coverage needed, and the risk associated with the bond. Individuals or businesses with poor credit or a history of financial problems may be charged higher premiums due to the increased risk. However, working with an experienced and reputable surety provider like State Farm can help ensure competitive rates.

Choosing the Right Surety Bond for Your Needs

Choosing the right surety bond requires careful consideration of your specific situation and needs. A knowledgeable insurance agent can help you identify the type of bond that best fits your requirements, as well as the amount of coverage needed. It’s essential to read and understand the bond contract carefully before signing to avoid any misunderstandings or disputes later on.

What to Consider Before Purchasing a Surety Bond

Before purchasing a surety bond, it’s important to consider the cost, the terms of the bond contract, and the reputation of the surety provider. You should also assess your ability to meet the requirements of the bond contract, including any financial or performance obligations. Additionally, you should ensure that the bond meets the specific legal or contractual requirements for your industry or situation.

Wrapping Up: Making an Informed Decision about Surety Bonds with State Farm

Surety bonds provide essential protection and assurance to individuals and businesses in various industries. Working with a reputable and experienced provider like State Farm can help ensure reliable coverage and peace of mind. By understanding the different types of surety bonds available, the key requirements for qualifying, and the factors that influence premiums, you can make an informed decision about purchasing a surety bond that meets your specific needs.

Once upon a time, there was a businessman named John who needed a surety bond for his upcoming project. He had heard about State Farm’s reliable insurance and wondered if they also sold surety bonds.

- John decided to do some research and visited State Farm’s website.

- He was pleasantly surprised to find that State Farm did indeed sell surety bonds.

- Excitedly, he clicked on the Surety Bonds tab and started browsing through the various types of bonds available.

- He found that State Farm sold a wide range of surety bonds including contract bonds, commercial surety bonds, court bonds, and fidelity bonds.

- Impressed with the variety, John decided to call State Farm’s customer service to learn more about the bonding process.

- He was connected with a knowledgeable agent who patiently answered all of his questions and explained the entire process in detail.

- After the call, John felt confident in State Farm’s ability to meet his surety bond needs and decided to purchase a bond from them.

From John’s point of view, State Farm’s customer service was exceptional and their surety bond options were comprehensive. He was grateful to have found a reliable insurance company that could also fulfill his bonding requirements.

So, if you are like John and in need of a surety bond, look no further than State Farm. Their commitment to meeting customer needs and providing excellent service will leave you feeling confident and secure.

Hello there, dear blog visitors! We hope you’ve enjoyed reading our article about whether State Farm sells surety bonds without a title. As you’ve learned from our post, State Farm does indeed offer surety bonds for various purposes, including construction, business, and court-related needs.

We understand that obtaining a surety bond can be a confusing and overwhelming process, especially if you’re not familiar with the legal jargon or the specific requirements of your state. That’s why we recommend reaching out to a licensed State Farm agent who can guide you through the process and help you find the right surety bond for your needs.

Whether you’re a contractor bidding on a construction project, a business owner seeking to comply with licensing regulations, or an individual involved in a legal dispute, a surety bond can provide the financial guarantee you need to protect yourself and others. With State Farm’s reputation for reliability and customer service, you can trust that you’re in good hands when it comes to securing a surety bond.

Thank you for visiting our blog and taking the time to learn more about State Farm’s surety bond offerings. We hope this article has been informative and helpful in your search for the right insurance and financial products. If you have any more questions or would like to speak with a State Farm agent, don’t hesitate to reach out. We’re here to help!

.

People also ask about whether State Farm sells surety bonds, and we’re here to answer those questions for you.

- What are surety bonds?

- Does State Farm sell surety bonds?

- What types of surety bonds does State Farm offer?

- Contract surety bonds for construction projects

- Commercial surety bonds for businesses

- Fidelity bonds to protect against employee theft and fraud

- How do I get a surety bond from State Farm?

- Are State Farm’s surety bonds competitive?

Surety bonds are a guarantee that a job or project will be completed by a contractor or company. They protect the obligee, or the party who requires the bond, from financial loss if the contractor fails to fulfill their obligations. Surety bonds are common in construction and other industries where large projects are involved.

Yes, State Farm is one of many insurance companies that offer surety bonds. They have a variety of options for contractors and businesses, including contract surety bonds, commercial surety bonds, and fidelity bonds.

State Farm offers a range of surety bonds, including:

You can contact your local State Farm agent to inquire about obtaining a surety bond. They will be able to provide you with information on the types of bonds available and the application process.

State Farm’s rates for surety bonds are competitive with other insurance companies that offer similar products. However, it’s always a good idea to shop around and compare rates from multiple providers to ensure that you’re getting the best deal.

Overall, State Farm is a reputable provider of surety bonds for contractors and businesses. If you’re in need of a surety bond, it’s worth considering them as an option.