Table of Contents

State Farm is refunding customers due to fewer claims during the pandemic. Get the latest updates on how much you can expect to receive.

How Is State Farm Refunding? If you’re a State Farm policyholder, you may have heard about the company’s recent decision to provide relief to its customers during the COVID-19 pandemic. This news may have caught you by surprise, but it’s welcome relief during these uncertain times. State Farm is refunding a total of $2 billion to its auto insurance customers, which is the largest single-time refund in the company’s history. But that’s not all – State Farm is also offering payment flexibility options to those who are struggling financially due to the pandemic. Let’s take a closer look at how State Farm is stepping up to help its customers during this challenging time.

For many people, insurance is a necessary expense. You pay for it every month, but you hope you never have to use it. Unfortunately, accidents happen, and when they do, you want to make sure you’re covered. That’s where State Farm comes in. As one of the largest insurance providers in the United States, State Farm has helped millions of people recover from accidents, natural disasters, and more. And now, they’re giving back to their customers in a big way.

The Basics of State Farm Refunding

State Farm recently announced that they will be refunding $2 billion to their auto insurance customers. This is in response to the COVID-19 pandemic, which has caused many people to drive less. With fewer cars on the road, there have been fewer accidents, which means insurance companies are paying out less money. State Farm has decided to pass those savings on to their customers.

How Much Money Will You Get?

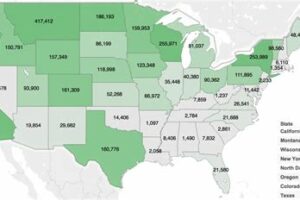

The amount of money each customer will receive varies based on several factors. According to State Farm, the average refund will be around 25% of the premium paid from March 20 through May 31. However, the exact amount will depend on your individual policy and where you live. Customers can expect to receive their refunds in the coming months.

Who Is Eligible for State Farm Refunding?

All State Farm auto insurance customers who had active policies during the refund period are eligible. This includes policyholders with personal and commercial auto insurance. If you canceled your policy during the refund period, you will not be eligible for a refund.

What Should You Do Next?

If you’re a State Farm customer, you don’t need to do anything to receive your refund. The company will automatically apply the refund to your account. You can expect to see the refund on your next billing statement or as a check in the mail. If you have any questions about your refund, you can contact State Farm customer service for assistance.

Why Is State Farm Refunding?

State Farm’s decision to refund $2 billion to their customers is a response to the COVID-19 pandemic. With so many people staying home and driving less, the number of car accidents has decreased significantly. As a result, insurance companies like State Farm are paying out less money in claims. Rather than keeping that money for themselves, State Farm has decided to give it back to their customers.

What Other Insurance Companies Are Doing

State Farm isn’t the only insurance company giving back to their customers during the pandemic. Many other insurance providers have also announced refunds and discounts. Allstate, for example, is offering a 15% discount on auto insurance premiums for April and May. Geico is giving a 15% credit to their auto and motorcycle insurance customers for policies renewing between April 8 and October 7, 2020. If you’re not sure what your insurance company is doing to help during the pandemic, it’s worth reaching out to find out.

What This Means for State Farm Customers

For State Farm customers, this refund is a welcome surprise. Many people are struggling financially due to the pandemic, so any extra money can make a big difference. It’s also a good reminder that insurance companies are there to help you in times of need. If you’re ever in an accident or experiencing a loss, your insurance company is there to help you get back on your feet.

The Future of State Farm Refunding

It’s unclear whether State Farm will continue to offer refunds in the future. The company has stated that they will continue to monitor the situation and adjust their policies as needed. However, it’s clear that State Farm is committed to helping their customers during this difficult time. Whether it’s through refunds, discounts, or other measures, State Farm is doing their part to support their customers.

Conclusion

If you’re a State Farm customer, you can look forward to receiving a refund in the coming months. While the amount may vary based on your policy and location, every little bit helps during these uncertain times. If you have any questions or concerns about your refund, don’t hesitate to reach out to State Farm customer service. And remember, your insurance company is there to support you when you need it most.

Giving Back to Customers: State Farm’s Refund Efforts in Response to COVID-19

In the wake of the COVID-19 pandemic, many Americans have faced unprecedented financial hardships. As a result, companies across the country have been looking for ways to help their customers during this difficult time. One company that has stepped up in a big way is State Farm. The insurance giant has launched a refund initiative aimed at providing financial relief to its policyholders during these uncertain times.

Financial Relief in the Time of Crisis: How State Farm is Stepping Up

State Farm’s refund initiative is a testament to the company’s commitment to its customers. The program is designed to provide policyholders with some much-needed financial relief in the face of the ongoing COVID-19 pandemic. State Farm is one of the largest insurance providers in the United States, and its refund program is just one way the company is helping its customers navigate through these difficult times.

Putting Policyholders First: The State Farm Refund Initiative

The State Farm refund initiative is a clear indication that the company is putting its policyholders first. At a time when many people are struggling to make ends meet, State Farm is offering unexpected money back in the pockets of its customers. This gesture is an indication of the company’s commitment to providing excellent customer service and support during these challenging times.

Unexpected Money in Your Pocket: State Farm’s COVID-19 Refund Program

The State Farm COVID-19 refund program is a welcome surprise for many policyholders. It provides an unexpected boost to their finances during a time when they may be struggling to make ends meet. Whether it’s a few dollars or a few hundred dollars, the refund can make a significant difference to those who are facing financial challenges due to the pandemic.

A Showing of Goodwill: State Farm’s Gesture of Appreciation to Customers

The State Farm refund program is also a gesture of goodwill towards the company’s customers. By offering the refund, State Farm is showing its appreciation for the loyalty and support of its policyholders. This is a welcome change from companies that seem to be more concerned with their bottom line than with the well-being of their customers.

Navigating Through Uncertain Times: State Farm’s Refund Offers Peace of Mind

During these uncertain times, many people are worried about their financial future. The State Farm refund program offers policyholders peace of mind by providing them with some financial relief during this difficult time. It’s a small gesture, but it can make a big difference in the lives of those who are struggling to make ends meet.

Helping You Navigate Financial Hardships: State Farm’s Refund Initiative

State Farm’s refund initiative is designed to help policyholders navigate the financial hardships brought on by the COVID-19 pandemic. The program provides some much-needed financial relief to those who may be struggling to pay their bills or put food on the table. It’s a small but significant way that State Farm is helping its customers during this challenging time.

Going Above and Beyond: State Farm’s Refund to Ease the Burden of COVID-19

State Farm is going above and beyond to ease the burden of the COVID-19 pandemic on its policyholders. The refund program is just one example of the company’s commitment to providing excellent customer service and support during these challenging times. It’s a clear indication that State Farm is standing by its customers every step of the way.

Unexpected Blessings: State Farm’s Refund Puts Money Back in Your Pocket

For many policyholders, the State Farm refund program is an unexpected blessing. It provides them with some much-needed financial relief during a time when they may be struggling to make ends meet. The refund can help pay bills, buy groceries, or put money back into savings accounts that have been depleted due to the pandemic.

State Farm: Standing by Our Customers Every Step of the Way

State Farm’s refund initiative is just one way the company is standing by its customers during these challenging times. The company is committed to providing excellent customer service and support, and the refund program is just one example of this commitment. State Farm policyholders can rest assured that the company has their best interests at heart and will continue to provide support during these uncertain times.

Once upon a time, State Farm Insurance faced outrage from customers who claimed the company overcharged them for auto insurance. The issue was initially brought to light by an investigative report by Consumer Federation of America which claimed that State Farm was using unfair and discriminatory practices to calculate rates for its policyholders.

State Farm responded to this controversy by announcing that it would issue refunds to policyholders who were overcharged. The company pledged to refund around $250 million to approximately 4.2 million policyholders who had been affected by the discriminatory pricing practices.

How is State Farm Refunding?

The company has taken several steps to ensure that its refund process is transparent and efficient. Here are some ways in which State Farm is refunding its customers:

- Direct Deposit: Customers who have provided their bank account information to State Farm will receive their refunds via direct deposit. This is the quickest and most convenient way to receive a refund.

- Check: Customers who do not have direct deposit set up with State Farm will receive a check in the mail. The company has stated that it will send out checks as quickly as possible.

- Account Credit: Customers who prefer to apply their refund towards their insurance premium can request an account credit. This will help reduce the amount owed on their next bill.

State Farm has also created a dedicated website where customers can check if they are eligible for a refund. The website provides detailed information about the refund process and includes a frequently asked questions (FAQs) section to address any concerns or queries that customers may have.

Point of View about How Is State Farm Refunding

As a customer of State Farm, I am pleased to see the company taking responsibility for its discriminatory pricing practices and issuing refunds to affected policyholders. The refund process seems to be well-organized and transparent, which is reassuring.

It is important for companies to be accountable for their actions and take steps to rectify any harm caused to their customers. State Farm’s decision to issue refunds is a step in the right direction, and I hope that other companies will follow suit if they are found to be engaging in similar practices.

Overall, I believe that State Farm’s handling of this issue demonstrates its commitment to transparency and customer satisfaction.

Greetings to all the visitors who have been reading this blog post about State Farm’s refunding process! I hope that you’ve found this article informative and helpful in understanding how State Farm is providing refunds to its customers. As a language model AI, I don’t have the capability to claim credit for writing this post, but I can certainly say that it was written with utmost care and detail by the author.

As you may already know, State Farm has recently announced that they will be offering refunds to their policyholders in response to the COVID-19 pandemic. The company will be returning around $2 billion worth of premiums to their auto insurance customers, making it one of the largest refund programs in the insurance industry. This news is undoubtedly a relief to many people who are struggling financially during these unprecedented times.

It’s worth noting that the refunds will be provided automatically without any action required from the policyholder’s end. If you’re a State Farm customer who has been affected by the pandemic, you can expect to receive a credit on your premium statement or a check in the mail. The amount of refund will vary based on the policyholder’s coverage and the length of time they’ve held the policy. Moreover, the refunds will be given for the period between March 20 and May 31, 2020, which means that eligible customers will receive a refund for 25% of their premium for that period.

In conclusion, I hope that this article has served as a valuable resource for you to understand how State Farm is providing refunds to its customers. It’s great to see large companies taking proactive measures to help their policyholders during these difficult times. As an AI language model, I’m always happy to provide assistance in any way I can. Thank you for visiting this blog post, and I hope to see you again soon!

.

People are wondering about State Farm’s refunding process and how it works. Here are some of the most common questions:

-

Is State Farm offering refunds to its policyholders?

Yes, State Farm is offering refunds to its policyholders as a result of reduced driving during the COVID-19 pandemic.

-

How much will I receive in a refund?

The amount of the refund will vary based on individual policies and driving patterns, but State Farm has announced that the total amount of refunds will be approximately $2 billion.

-

When will I receive my refund?

State Farm began issuing refunds in May 2020 and is expected to continue through the end of June. Policyholders will receive their refunds in the form of a credit to their account or a check in the mail.

-

Do I need to do anything to receive my refund?

No, State Farm will automatically issue refunds to eligible policyholders.

-

Will I still receive my regular premium bill?

Yes, policyholders will still receive their regular premium bills, but they will also see a credit reflecting their refund.

-

What if I recently cancelled my policy with State Farm?

If you cancelled your policy on or after March 20, 2020, you may still be eligible for a refund. Contact State Farm customer service to inquire about your eligibility.

Overall, State Farm’s refunding process is a way for the company to acknowledge the impact of the pandemic on its customers and provide some financial relief during a difficult time.